We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

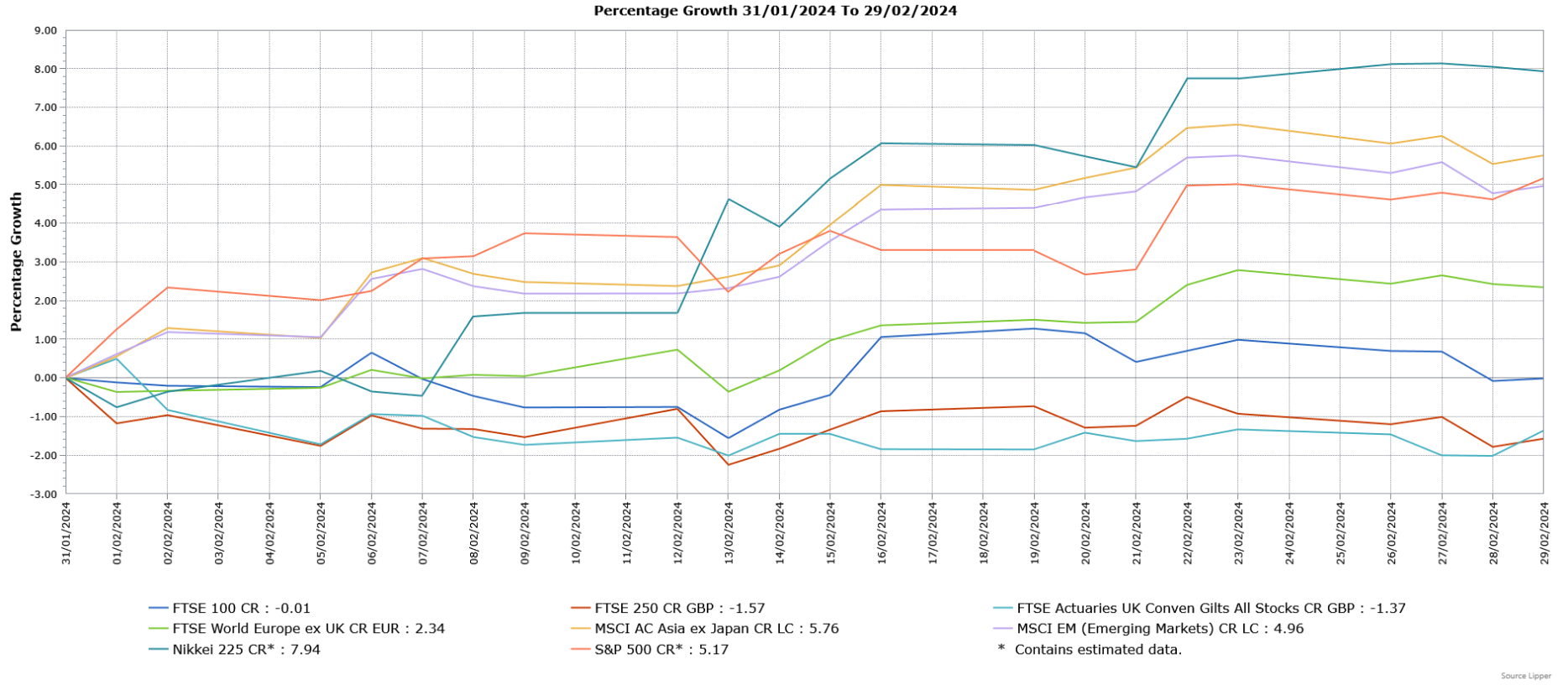

Most global equity markets rose in February, with notable strong performance from Asia and Global Emerging Markets as China rebounded, whilst there were also good gains from the US and Japan. The UK market was an outlier as it finished broadly unchanged amid some challenging economic data. Fixed income markets finished lower, as investors pushed back the timing of interest rate cuts.

Economic Overview

UK

Bank of England and Interest Rates

The Bank of England (BoE) left its interest rate unchanged at 5.25%, but suggested there was the possibility of cuts as inflation falls. Whilst there was no change to the interest rate, there was a three-way split in the vote with six members preferring to leave it unchanged, but two opted for a 0.25% increase whilst one chose a 0.25% cut. This was the first time since 2008 that the Monetary Policy Committee had members voting for both an increase and a reduction at the same time, with forecasts being for only one to vote for a rate rise with the other eight opting to keep the rate unchanged.

The BoE Governor Andrew Bailey stated it was too soon to declare victory and that getting inflation to its 2% target would not be “job done” as prices were then expected to rise again. However, Mr Bailey did say there was a shift in the BoE’s thinking from how restrictive monetary policy needs to be to “how long do we need to maintain this position for”. Furthermore, the BoE removed its warning that further tightening would be required if more persistent inflation pressure emerged, although it was reiterated that policy would need to stay “restrictive for sufficiently long”. The BoE also stated in its latest forecasts that inflation was now likely to return to 2% in the second quarter of this year, well ahead of its November forecast of this happening at the end of 2025. However, the BoE is also projecting inflation to rise again in the third quarter of this year and to not return to target until late-2026. The BoE also maintained its view the British economy will struggle to generate much growth in the coming years, although there was a small upgrade to its forecasts.

Economic Growth

The Office for National Statistics (ONS) said the economy shrank in the fourth quarter of last year, which following the fall in the third quarter meant the UK had slipped into a technical recession, which is defined as two successive quarterly contractions. The ONS said Britain’s economy fell by 0.3% in the fourth quarter, which was worse than the forecasted smaller decline of 0.1% and follows a 0.1% contraction in the third quarter. The fall was also the largest since the first three months of 2021 when new Covid restrictions were put in place. There was a broad-based decline in output, with a small contraction in services and larger falls in industrial production and construction. There were also falls in household spending, exports, imports and government expenditure. However, these falls were partially offset by an increase in gross capital formation. On a year-on-year basis, the economy fell by 0.2%, the first contraction since 2021 and below the forecasted 0.1% rise, whilst it follows downwardly revised growth of 0.2% in the third quarter. For the calendar year 2023, the economy edged higher by 0.1%.

For the month of December alone, the ONS said the economy shrank by 0.1%, lower than the 0.2% expansion in November but ahead of the forecasted slightly bigger fall of 0.2%. Services output declined by 0.1%, broadly due to a fall in wholesale and retail trade as well as the repairs of motor vehicles and motorcycles. Construction fell by 0.5% amid a sharp decline in new work. However, industrial production grew 0.6%, driven by growth in the manufacture of transport equipment and basic pharmaceutical products and pharmaceutical preparations.

Unemployment & Labour Market Statistics

The ONS said unemployment in the three months to December fell to 3.8%, the lowest level since the November 2022 to January 2023 period, whilst employment rose by 72,000 people. The ONS has reweighted these data sets to account for changes in population estimates, but a full overhaul of its Labour Force Survey will only take place in September and until such time, the reliability of the jobs market data cannot be guaranteed. The estimated number of job vacancies declined for the 19th consecutive month by 26,000 to 932,000 in the three months to January, although this remains above pre-pandemic levels.

The pace of wage growth eased again, although it was still stronger than expected. In the three months to December, annual growth in regular pay excluding bonuses fell from 6.7% to 6.2%, ahead of the forecasted 6%. When adjusted for inflation, annual regular pay growth was 1.8%, the biggest increase since the three months to September 2021. Annual growth in employee’s total pay, which includes bonuses and can be volatile, slowed from 6.7% to 5.8%, the smallest increase since the three months to July 2022 but above the forecasted 5.6%, whilst in real terms there was a rise of 1.4%.

Inflation

The headline annual rate of UK inflation, as measured by the Consumer Price Index (CPI), was unexpectedly unchanged at 4% in January compared with the forecasted rise to 4.2%. The ONS said the biggest upward contribution came from housing and household services, which includes gas and electricity charges that rose as a result of the new higher energy price cap. The price for second-hand cars also rose for the first time since May 2023. However, food and non-alcoholic beverages prices fell for the first time in monthly terms since September 2021, dropping 0.4% from December with bread and cereals part of the reason for the fall. Food prices are still relatively high though after the sharp rises seen in the past two years. The main downward pressure on CPI came from furniture and household goods, amid big discounts being offered by retailers to clear their shelves after disappointing sales prior to Christmas.

Core inflation, which excludes food, energy, alcohol and tobacco prices, was also unchanged at 5.1% in January, although this was also below the forecasted small increase to 5.2%. Services price inflation, which the Bank of England views as a key measure of domestically-generated inflation, rose from 6.4% in December to 6.5% in January, although this was below the level expected by the central bank.

US

Economic Growth

US economic growth in the fourth quarter of last year was revised slightly lower from the preliminary estimate of an annualised 3.3% pace to 3.2%, remaining slower than the 4.9% expansion in the third quarter. The Commerce Department’s small downward revision reflected a downgrade to inventory investment, which provided a negative contribution of 0.3% instead of the previous 0.1% addition. However, there was an upgrade to consumer spending, which increased at a 3% rate, instead of the previous estimate of 2.8% and was responsible for 2% of overall growth, whilst there were positive contributions from state and local government investment, together with residential and business expenditure. Both exports and imports also rose by more than initially estimated.

Inflation

US consumer prices were higher than expected in January, with the increase driven by a jump in the cost of rental housing. The Labor Department said the Consumer Price Index (CPI) rose 0.3% in January, ahead of the 0.2% increase in December and the forecasted 0.2% rise. Shelter, which includes rents, was responsible for over two-thirds of the rise in CPI. Food prices were 0.4% higher, the biggest rise in a year, although this was partly blamed on winter storms. Grocery goods inflation was also 0.4% higher, the largest gain since January 2023 amid more expensive sugar and sweets as well as fats and oils, fruits and vegetables. Non-alcoholic beverages prices were 1.2% higher. However, prices for cereals and bakery products fell, whilst they were unchanged for meat, eggs and fish. Gasoline prices were 3.3% lower. For the twelve months through January, CPI rose 3.1%, below December’s 3.4% increase but above the forecasted 2.9% increase.

The so-called core CPI, which excludes volatile food and energy components, rose 0.4% in January, the biggest increase since May 2023 and above December’s 0.3% gain. The rise in Core CPI was boosted by a 0.6% jump in shelter costs, which had gained 0.4% in December. Owners’ equivalent rent, which is what a homeowner would receive from renting a home, surged 0.6%, the biggest increase in nine months and follows a 0.4% rise in the previous month. New weights for the CPI increased housing’s share, whilst reducing that of new and used cars, and these were used to calculate January’s CPI data, together with updated seasonal factors. Prices for hotel and motel rooms rebounded in January, whilst airline fares rose. There were also increases in the cost of motor vehicle insurance, medical care services and health insurance. However, prescription medication prices recorded their largest fall since February 2021. Services inflation registered its biggest rise in a year of 0.7%, comfortably above the 0.4% increase in December. Excluding rents, services rose 0.6%, also the largest gain in a year. Goods prices fell 0.3% having been unchanged in December, with used car and truck prices suffering a 3.4% drop, their largest decline since May 1969. For the twelve months through January, core CPI matched December’s 3.9% increase.

Europe

Economic Growth

In line with its preliminary estimate, Eurostat confirmed economic growth in the Eurozone was flat in the fourth quarter of last year, which followed a 0.1% contraction in the third quarter. Among the largest Eurozone countries, the biggest economy, Germany, still suffered a 0.3% contraction, whilst the second largest, France, registered no growth. The third biggest, Italy, expanded by 0.2% whilst there was 0.6% growth in the next largest, Spain. On a year-on-year basis, Eurostat’s preliminary estimate of 0.1% growth was also unchanged and follows a no growth reading in the third quarter.

Inflation

Eurostat said inflation eased in line with expectations in January, although underlying price pressures didn’t weaken as much as forecast. Inflation fell from 2.9% in December to 2.8% in January, with the pace easing for food, alcohol and tobacco as well as non-energy industrial goods, but energy prices declined at a slower pace. Core inflation, which excludes prices for energy, food, alcohol and tobacco, fell from 3.4% to 3.3%, slightly above the forecasted fall to 3.2% although still the lowest level since March 2022. Services price inflation was unchanged at 4%, indicating some continued price pressures and notably from wages.

Asia and Emerging Markets

Japan

Japan’s economy unexpectedly fell into recession for the first time in five years in the fourth quarter of last year, as a decline in private consumption weighed on activity. The economy declined by an annualised 0.4% in the fourth quarter, sharply lower than the forecasted 1.4% gain although above the 3.3% drop in the third quarter. The second consecutive quarter of contraction meets the definition of a technical recession. Private consumption, which makes up over half the Japanese economy, fell 0.2%, below the forecasted 0.1% gain, amid rising cost pressures and lingering global headwinds. Another important part of the economy, capital expenditure, declined 0.1% versus the forecasted 0.3% increase. Both consumption and capital expenditure have now contracted for three consecutive quarters. Public investment fell again, whilst government spending was slightly lower, having risen in the third quarter. Net trade provided a positive contribution of 0.2%, driven by a 2.6% increase in exports which grew faster than imports. On a quarter-on-quarter basis, the economy contracted 0.1% and followed a revised 0.8% drop in the third quarter. As a result of falling into recession, Japan’s economy lost its place as the world’s third biggest economy to Germany.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK equities were mixed in February, with the FTSE 100 ending the month unchanged, but there was a loss for the mid cap FTSE 250. The more domestically focussed FTSE 250 suffered to a greater extent from the domestic economic challenges, but the FTSE 100 showed greater resilience. The best performing sectors included industrials and financials, whereas consumer staples, real estate and basic materials were among the biggest detractors.

There was strong performance from the US S&P 500, which reached a record high during the month. US equities were supported by good corporate results, particularly from the so-called “Magnificent 7” companies, a group of large high-performing and influential technology-related stocks that are believed to be key beneficiaries of the current optimism over AI. European markets, as demonstrated by the FTSE World Europe ex UK Index, also recorded gains with AI-related technology stocks, consumer discretionary and industrials among the top performers. The Japanese Nikkei 225 Index recorded a very strong gain as it passed its previous record high set back in December 1989, driven by large cap stocks and positive inflows from overseas investors.

Asian markets rebounded in February, as shown by the positive performance from the broad MSCI Asia ex Japan Index. Performance was boosted by a rebound in China, amid cautious optimism that the gloom may be starting to lift with activity data better than expected at the start of the Lunar New Year. Global Emerging Markets, as demonstrated by the broad MSCI Emerging Markets Index, also performed well as they similarly benefited from China’s positive performance, as well as hopes of a US interest rate cut in the middle of the year.

UK fixed income markets finished February lower as investors pushed back expectations over the start of interest rate cuts, particularly labour markets remaining strong and some inflation data higher than expected. Government bonds (FTSE Actuaries UK Conventional Gilts Index) slightly underperformed investment grade bonds.

This update is intended to be for information only and should not be taken as financial advice.