We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Global Overview

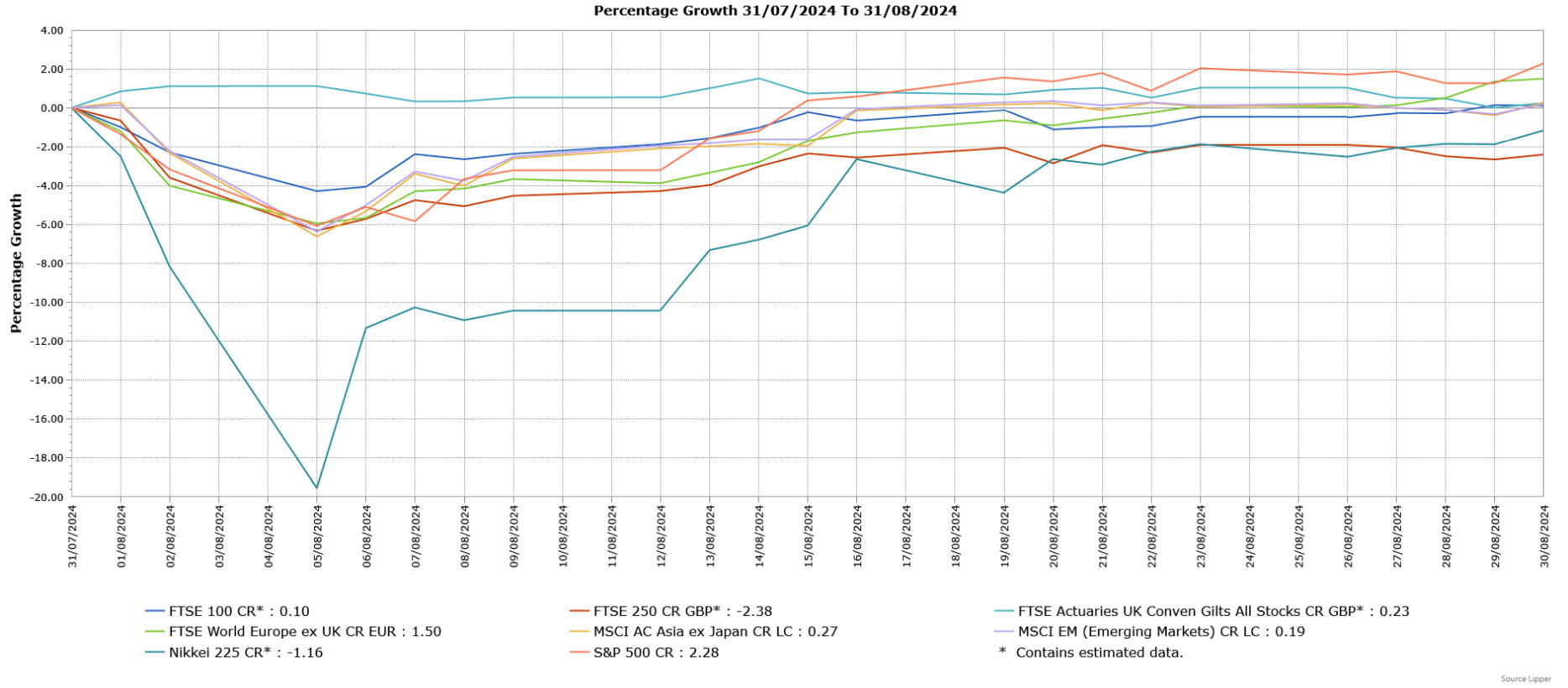

The start of August saw significant volatility that resulted in some sharp market falls amid concerns over weak US economic data and the unwinding of the yen carry trade. However, more positive economic data resulted in markets rebounding, leading most global indices to end the month higher. Fixed income markets posted modest gains in August.

UK Economic Overview

Interest Rates

The Bank of England reduced interest rates by 0.25% to 5%, marking the first cut since March 2020. Policymakers were split 5-4 on whether inflation had eased enough, whilst following the announcement the BoE Governor Andrew Bailey said the Monetary Policy Committee would move cautiously forward, stating that care would be taken to not cut interest rates too quickly or by too much.

Economic Growth

The UK economy grew by 0.6% in Q2 2024, driven mainly by the services sector, particularly IT, legal services, and scientific research. However, manufacturing and construction output declined. For the month of June, economic growth slowed sharply from 0.4% in May to zero, with heavy rain weighing on retail sales whilst a doctor’s strike contributed to a sharp decline in healthcare activity.

Labour Market

Unemployment unexpectedly fell to 4.2% in the three months to June 2024, despite forecasts of an increase. Annual growth in regular pay excluding bonuses slowed to 5.4%, although real wages after adjusting for inflation was 2.4% the fastest increase in three years. Vacancies continued to decline but remained above pre-pandemic levels.

Inflation

UK headline inflation rose from its 2% target to 2.2% in July, but this was below the forecast of 2.3%. The increase was driven by prices of gas and electricity falling by less than they did a year ago, as well as faster rising prices for clothing and footwear, communication and miscellaneous goods and services. Core inflation fell from 3.5% to 3.3%, slightly below the forecasted 3.4%. Services inflation, a key measure of domestically-driven inflation, dropped from 5.7% to 5.2%, in part reflecting a reversal in June’s increase in the cost of hotels.

US Economic Overview

Economic Growth

The Commerce Department revised economic growth in the second quarter higher from its preliminary estimate of an annualised pace of 2.8% to 3%, well above the 1.4% expansion in the previous period. Consumer spending was the main driver of the increase, as it was revised higher from 2.3% to 2.9% and offset downgrades elsewhere.

Inflation

The US Consumer Price Index (CPI) rose 0.2% in July 2024, while annual inflation dropped below 3% for the first time in over three years to 2.8%. The cost of shelter, which includes rents, was responsible for almost 90% of the increase. Core CPI, which excludes volatile food and energy prices, also increased by 0.2%, driven primarily by higher rents. On an annual basis, core CPI rose 3.2%, the smallest increase since April 2021.

European Economic Overview

Economic Growth

The Eurozone economy grew by 0.3% in Q2 2024, in line with preliminary estimates. Among the large economies, France and Spain saw growth, while Germany contracted slightly by 0.1%. On a year-over-year basis, the Eurozone economy expanded by 0.6%.

Inflation

Eurozone inflation rose unexpectedly from 2.5% to 2.6% in July, driven by higher energy costs and non-energy industrial goods prices. Core inflation remained at 2.9%, unchanged from June, despite a slight slowdown in services inflation.

Asia and Emerging Markets

Japan

Japan’s economy grew at an annualized rate of 3.1% in Q2 2024, surpassing expectations. Growth was driven by private consumption and a rebound in business spending. Government spending remained sluggish, whilst net trade made a negative contribution.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK Equities

UK equities initially suffered in early August due to global market concerns but recovered later in the month. The FTSE 100 posted slight gains, supported by positive economic data, while the FTSE 250 remained down despite a late-month rebound.

Global Equities

Weak jobs data saw US equities suffer sharp falls at the beginning of August, however more positive economic releases, optimism over interest rate cuts and resilient corporate earnings contributed to a rebound that saw the S&P 500 register a positive return for the month. European markets, as demonstrated by the FTSE World Europe ex UK Index, also endured a volatile start, but also finished higher amid expectations of further interest rate cuts. The Japanese Nikkei 225 Index suffered in particular from the unwinding of the yen carry trade, falling over 12% on 5 August in what was the second largest ever daily drop in percentage terms. However, the Japanese market rebounded the next day by just over 10% and ended the month only moderately lower.

Asia and Global Emerging Market Equities

Asian markets finished nominally higher in August, as shown by the performance of the broad MSCI Asia ex Japan Index, with most regions seeing gains with the exception of Korea, which lagged due to a sell-off in its technology stocks following similar falls in their US peers. Global Emerging Markets, as demonstrated by the broad MSCI Emerging Markets Index, similarly suffered falls at the start of the month, before rebounding to end slightly higher, with a weaker US dollar supportive as well as gains in Brazil.

Fixed Income

UK fixed income markets saw modest gains in August, with both government bonds and corporate bonds ending the month higher. Expectations of further interest rate cuts were a key factor driving bond market performance.

CA12392 Exp:09/2025