We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

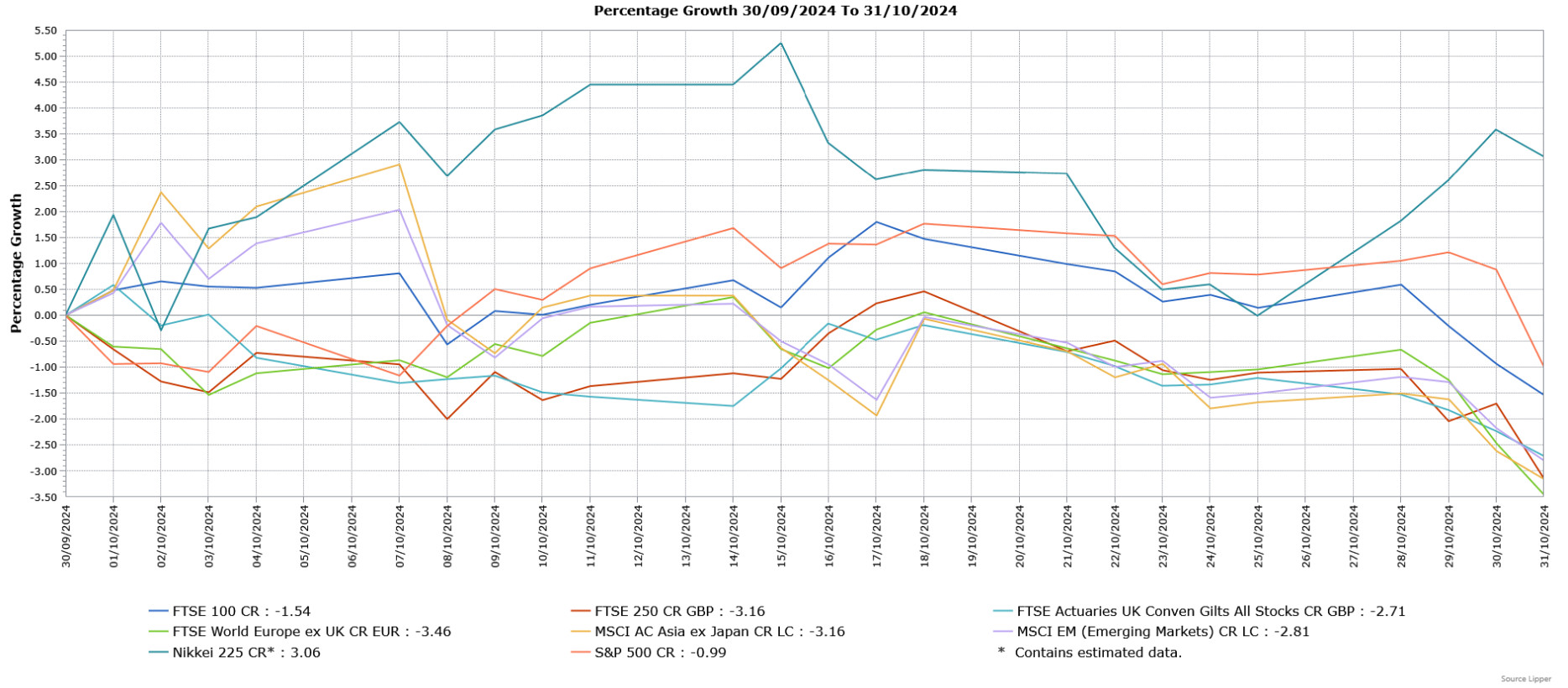

Global equity markets were under pressure in October, with most indices ending the month lower amid uncertainty over the UK Budget, the outcome of the US Presidential election and the ongoing conflict in the Middle East. The Japanese market was a notable outlier as it finished higher, with the weaker yen supporting large cap exporters. Fixed income markets also fell in October as investors looked towards more inflationary policies being implemented under a Republican victory in the US election.

Economic Overview

UK

- Economic Growth:

The UK economy grew by 0.2% in August after stagnating in the previous two months. Growth was driven by a rebound in manufacturing and construction, offsetting weaker than expected performance in the dominant services sector. While the ONS kept earlier growth estimates unchanged for June and July, downgrades for April and May contributed to an annual growth rate of 1%, below the forecasted 1.4%. - Unemployment & Labour Market Statistics:

Data indicated a slowdown in the labour market, with wage growth falling to its lowest level in over two years and vacancies declining for the 27th consecutive period. Despite these trends, unemployment fell to 4%, the lowest level so far in 2024. Regular pay rose 4.9%, whilst adjusted for inflation it grew by 1.9% . Total pay, which includes bonuses and can be more volatile, rose 3.8% and 0.9% in real terms. - Inflation:

The annual UK inflation rate, measured by CPI, fell to 1.7% in September from 2.2% in August, marking the lowest level since April 2021. Lower airfare and petrol prices drove the decline, although food and drink prices rose for the first time since March 2023. Core inflation dropped to 3.2%, with services inflation falling more sharply than expected.

US

- Economic Growth:

The US economy grew at an annualised rate of 2.8% in Q3, slightly below forecasts of 3%. Growth was driven by robust consumer spending, which increased by 3.7%, its fastest pace since early 2023. Business spending on equipment also surged, but a widening trade deficit and reduced inventory accumulation weighed on overall expansion. - Inflation:

US consumer prices rose slightly more than expected in September. Annual inflation rose 2.4%, the smallest increase in 3.5 years, although September’s monthly gain of 0.2% was ahead of the forecasted 0.1%. Food prices rose 0.4%, while gasoline prices fell 4.1%. Core CPI, excluding volatile food and energy components, rose by 0.3%, driven by used car and healthcare cost increases, though housing-related costs moderated. Core CPI rose 3.3% on an annualised basis.

Europe

- European Central Bank & Interest Rates:

The ECB reduced interest rates by 0.25% to 3.25%, marking the first back-to-back rate cuts in 13 years. ECB President Christine Lagarde noted that disinflation was progressing as expected, although she flagged risks from US elections and potential trade tariffs if Donald Trump were elected. - Economic Growth:

The Eurozone economy grew by 0.4% quarter-on-quarter in Q3, its strongest pace in two years and ahead of the forecasted 0.2%. Growth was supported by Germany avoiding recession, stronger growth in France, and robust gains in Spain. On a year-on-year basis, the economy grew 0.9%, exceeding forecasts and prior quarter growth rates. - Inflation:

Headline inflation in the Eurozone fell to 1.7% in September, the lowest since April 2021 and below the forecasted smaller fall to 1.8%. Energy prices fell sharply, but food, alcohol, and tobacco prices rose at a faster pace. Core inflation also declined to 2.7%, with services inflation easing to 3.9%. Major economies such as Germany, France, and Italy all reported lower inflation rates.

Asia and Emerging Markets

- Japan:

The BOJ maintained its interest rate at 0.25% while noting easing risks around the US economy. Inflation hovered near the 2% target, with policymakers signalling potential rate hikes if economic conditions remain supportive. However, the BOJ emphasized a cautious approach amid uncertainties regarding the US election. - China:

China’s economy grew 4.6% year-on-year in Q3, slightly beating forecasts but marking the slowest pace since early 2023. Growth was weighed down by a weak property sector, soft domestic demand, and international trade tensions. Beijing introduced stimulus measures in late September to boost economic activity and rebuild confidence.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

- UK Equities:

UK stocks declined in October, with the domestically focused FTSE 250 underperforming the FTSE 100. Investor sentiment was negatively impacted by the uncertain short-term global economic outlook, which weighed particularly on sectors exposed to external industrial markets. The more domestically focussed FTSE 250 was also affected to a greater extent by the sell-off at the end of the month amid concerns over the UK budget. US Equities:

The S&P 500 fell in October amid uncertainty surrounding the US Presidential election and concerns about the path of interest rates. - European Equities:

European markets, as represented by the FTSE World Europe ex UK Index, declined, with sentiment impacted by concerns over economic growth as well as weak corporate earnings from a number of major companies. - Japanese Equities:

Japan’s Nikkei 225 Index rose in October, benefiting from yen weakness and gains in large-cap stocks. This positive performance occurred despite domestic political challenges. - Asian and Emerging Markets:

Broader Asian markets, represented by the MSCI Asia ex Japan Index, fell amid concerns over an escalation in the Middle East conflict and weaker-than-expected impact from Chinese stimulus measures. Emerging markets also declined, negatively affected by rising US bond yields and dollar strength. - UK Fixed Income:

UK bonds fell in October, with government bonds underperforming corporate bonds. Rising fiscal spending concerns that could lead to inflationary pressures and fears of slower Bank of England rate cuts drove the declines.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629. CA12516 Exp:11/25