We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

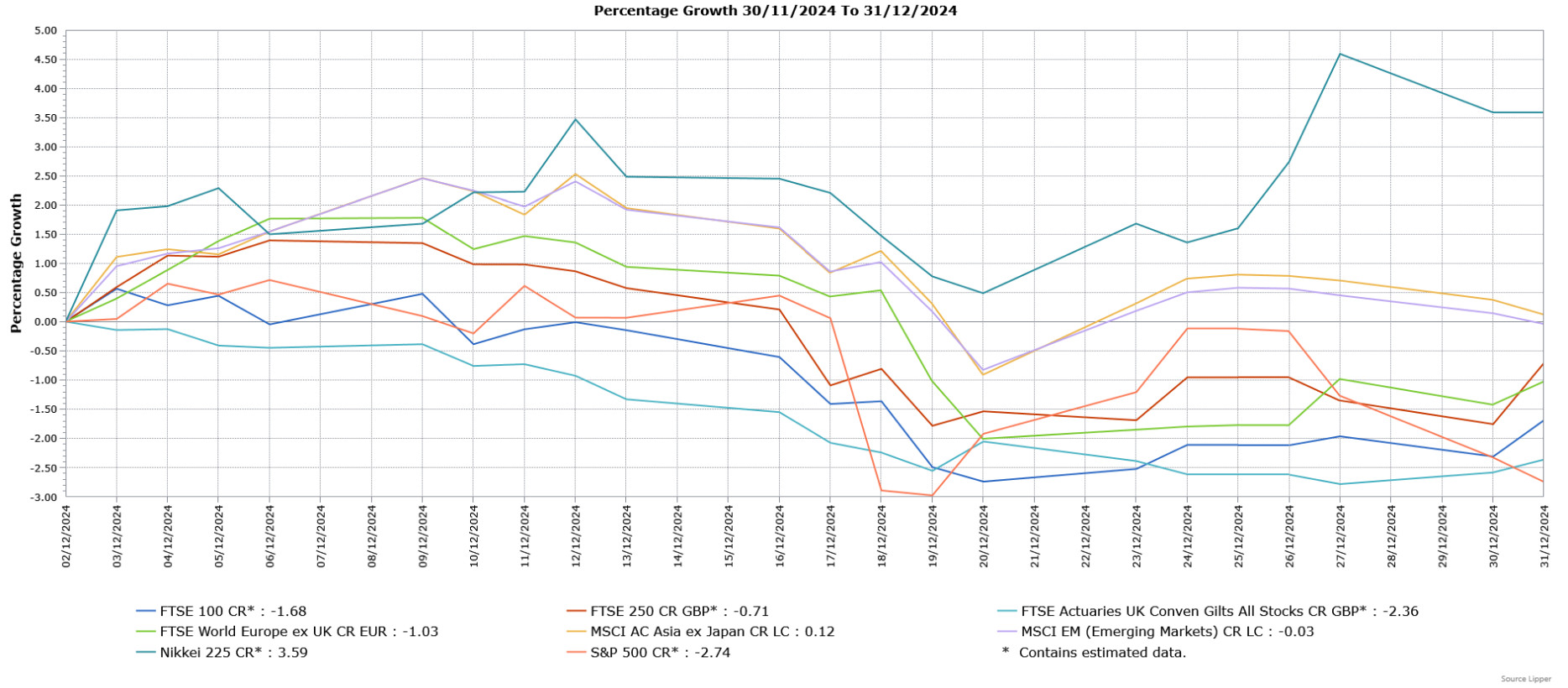

Most developed equity markets declined in December despite further interest rate cuts, with disappointing economic data weighing on the UK whilst both the Bank of England and US Federal Reserve signalled fewer rate reductions in 2025. Asian and global emerging markets were more resilient as they ended the month broadly unchanged. Concerns over the pace of future interest rate cuts contributed to losses in fixed income.

UK Economic Overview

- Interest Rates: The Bank of England kept its interest rate steady at 4.75%, as expected. However, the Monetary Policy Committee (MPC) vote revealed unexpected division, with six members voting to hold rates and three dissenting. The dissenters argued that the current “very restrictive” policy risked pushing inflation too low and creating economic slack. Governor Andrew Bailey emphasised the need for a cautious, gradual approach to future rate cuts, citing uncertainty in the economic outlook and potential impacts of US trade policies under President Trump.

- Growth: Revised data from the ONS showed no economic growth in Q3 2024, down from the preliminary estimate of 0.1%. The service sector saw growth of 0.1% downgraded to 0%, whilst production saw a worse decline. Construction improved, but still fell 0.7%. Business investment saw an uptick, but household spending and government expenditure were flat or weaker. The economy also contracted by 0.1% in October, marking consecutive monthly declines for the first time since the pandemic, missing forecasts for growth of 0.1%.

- Labour Market: The unemployment rate held steady at 4.3% for the three months to October. Despite this, vacancies continued to decline, falling for the 29th consecutive period, though they remained above pre-pandemic levels. The ONS continued to caution that labour market data could be volatile due to sampling issues. Wage growth accelerated, with regular pay increasing 5.2% annually, surpassing forecasts, whilst when adjusting for inflation there was real growth of 3%.

- Inflation: UK inflation rose in November, with the Consumer Price Index (CPI) climbing to 2.6%, its highest level in eight months. The increase was driven by higher fuel and clothing costs, while airfares saw a larger than normal seasonal decline. Core inflation, which excludes volatile items, edged up to 3.5%, slightly below expectations. Services inflation remained elevated, reflecting persistent domestic cost pressures.

US Economic Overview

- Interest Rates: The Federal Reserve reduced its benchmark rate by 0.25% to a range of 4.25%-4.5%. Chair Jerome Powell signalled a cautious approach to future rate cuts, emphasising the need for further progress in reducing inflation. The Fed’s latest projections suggest inflation will decline but remain above the 2% target through 2025, with only two additional rate cuts of 0.2% each expected next year, 0.5% overall less than expected in September.

- Growth: The Commerce Department revised Q3 economic growth upward to an annualised 3.1%, reflecting stronger consumer spending and export activity. However, private inventory investment was revised down, whilst imports were higher. Consumer spending, accounting for over two-thirds of US economic activity, was particularly robust, growing 3.7% instead of 3.5%.

- Inflation: US CPI rose by 0.3% in November, the largest monthly increase in seven months. Housing costs, food prices, and energy expenses were key contributors. However, rents, a significant inflation driver, grew at their slowest pace since mid-2021. Core CPI, which excludes volatile items, remained stable at 3.3% year-on-year.

Europe

- Interest Rates: The European Central Bank (ECB) reduced its deposit rate by 0.25% to 3%, marking the fourth rate cut of 2024. While policymakers were initially divided on the size of the cut, the decision was ultimately unanimous. ECB President Christine Lagarde highlighted the ongoing disinflation process but noted downside risks to growth, including potential trade tensions with the US. The ECB signalled further rate reductions may be needed in 2025 but provided limited guidance on timing.

- Growth and Inflation: Eurozone Q3 economic growth was confirmed at 0.4% quarter-on-quarter and 0.9% year-on-year. Inflation increased to 2.2% in November, driven by energy costs falling at a slower pace and higher prices for non-energy industrial goods. Core inflation held steady at 2.7%, reflecting persistent underlying price pressures.

Asia and Emerging Markets

- Japan: The Bank of Japan (BOJ) left its interest rate unchanged at 0.25%, maintaining its accommodative stance. While most board members preferred stability, one dissenter advocated a rate hike, citing inflationary risks. BOJ Governor Kazuo Ueda emphasised the importance of monitoring wage trends and economic data before making further moves. Q3 growth was revised upward to an annualised 1.2%, supported by upward revisions to capital investment and exports. However, private consumption growth slowed compared to earlier estimates, although it remained at a solid pace.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

- UK equities: both the FTSE 100 and mid cap FTSE 250 posted losses in December. Investor sentiment was impacted by disappointing economic data, notably higher inflation and an unexpected decline in growth, as well as the Bank of England indicating fewer interest rate cuts in 2025.

- Overseas equities: US equities, as shown by the S&P 500, ended December lower as the Federal Reserve suggested few interest rate cuts in 2025 amid persistent inflation. Most sectors declined, although some tech-related areas finished higher. European markets, as demonstrated by the FTSE World Europe ex UK Index, recorded a small loss, driven by a sharp decline in Novo-Nordisk due to weaker obesity drug data. However, there were some regional differences, with France notably finishing the month higher. The Japanese Nikkei 225 Index was a relative outlier as it recorded a decent gain, supported by a weaker yen that boosted exporters.

- Asian & Global Emerging Markets: Asian markets ended December with a nominal gain, as shown by the small increase in the MSCI Asia ex Japan Index. There was mixed regional performances, with China seeing gains on hopes of increased public borrowing and spending in 2025, but South Korea declined amid political turmoil. The broad MSCI Emerging Markets Index finished broadly unchanged, with emerging Asia posting gains but Latin American indices suffered losses.

- UK fixed income: Fixed income suffered losses in December as the Bank of England voted to leave interest rates unchanged, whilst suggesting a slower pace of cuts in 2025. Corporate bonds declined, but spreads (the difference in yields when compared with government bonds) continued to narrow as government bonds (FTSE Actuaries UK Conventional Gilts Index) endured a bigger fall.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629. CA12604 Exp 01/2026