Introduction

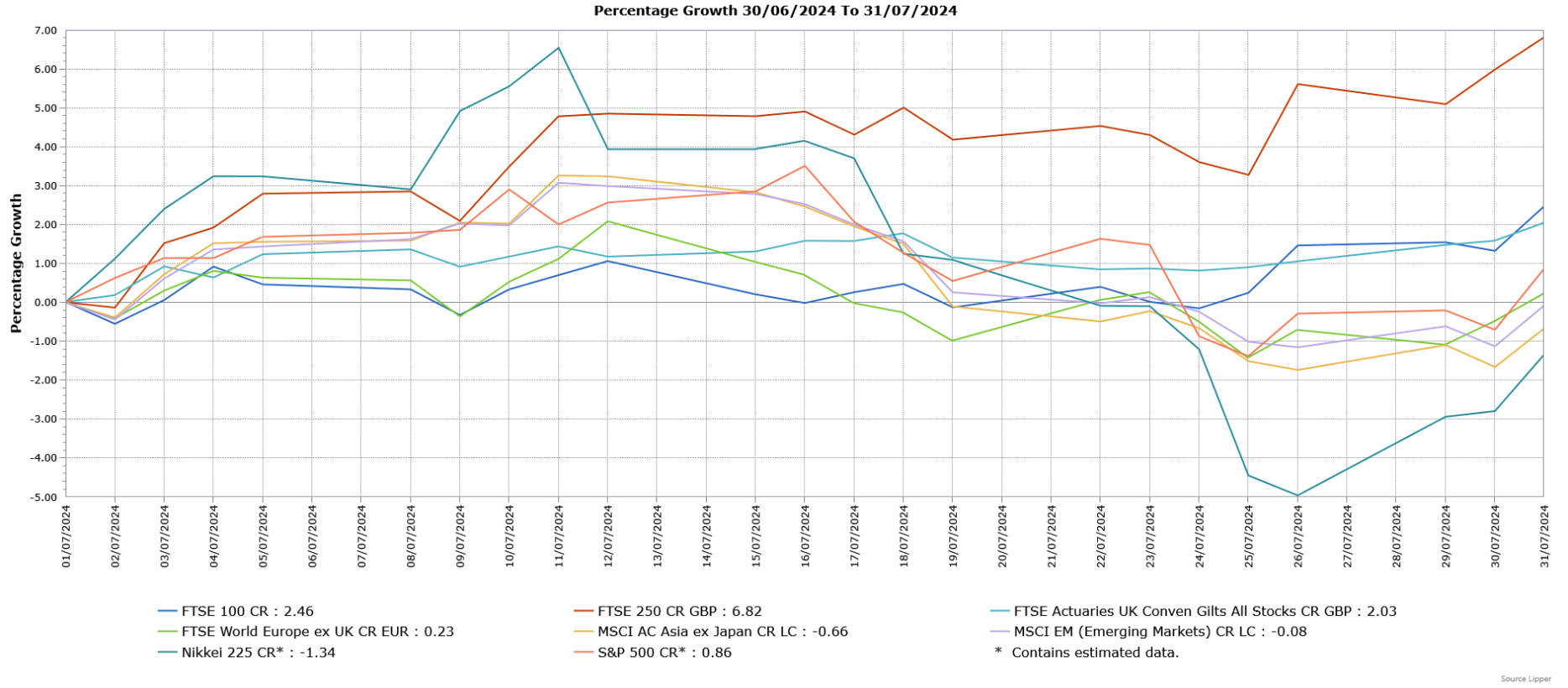

There was mixed performance from global equity markets in July, with developed markets broadly rising as they outperformed Global Emerging Markets. In particular, positive economic data and Labour’s return to power contributed to outperformance from UK indices. Fixed income markets performed well in July, driven by expected interest rate cuts amid easing inflationary pressures.

UK Economic Overview

- The UK economy exceeded expectations in May 2024, with GDP growth of 0.4% compared with the forecasted 0.2%, driven primarily by strong performances in the construction and retail sectors. The construction sector, particularly house-building, saw its fastest growth in nearly a year. The services sector also contributed positively to overall economic performance. Over the three months to May, the economy grew by 0.9, the fastest pace since the three months to January 2022.

- Unemployment remained unchanged at 4.4% in the three months to May., Regular pay growth excluding bonuses slowed from 6% to 5.7% in the three months to May, although this remained a robust pace. When adjusted for inflation, annual regular pay growth was 2.5%.

- Inflation held steady at 2% in June, above the forecasted fall to 1.9%. There were certain unusual factors, like increased hotel prices potentially linked to the Taylor Swift tour, adding upward pressure, as well as a smaller fall in the cost of second-hand cars. Clothing and footwear prices fell amid poor weather. Core inflation remained at 3.5%, whilst services inflation, a key measure of domestically-generated inflation, was stronger than expected, as it remained unchanged at 5.7% compared with the forecasted small fall to 5.6%.

US Economic Overview

- The Federal Reserve (Fed) maintained interest rates in 5.25% to 5.5% range in July, but signalled policymakers may be ready to reduce borrowing costs in September, provided inflation continues its downward trend. The Fed Chair said no decisions were made regarding future meetings, with all policy decisions being taken on a meeting-by-meeting basis.

- Preliminary data showed the US economy rebounded strongly in the second quarter of 2024, with GDP growing at an annualized rate of 2.8%, surpassing the 2% forecast and the 1.4% in the previous period. Growth was boosted by robust consumer spending and business investment, particularly on equipment (mostly aircraft).

- In June, consumer prices fell for the first time in four years, largely due to lower gasoline prices and a moderation in rent increases. The Consumer Price Index (CPI) fell by 0.1% in June, whilst over 12 months it rose 3%, the smallest gain since June 2023. Core CPI rose 0.1% in June, whilst over 12 months the increase of 3.3% was the lowest since April 2021.

European Economic Overview

- As expected, the European Central Bank kept its interest rate unchanged at 3.75%, but said September’s meeting was “wide open” as it lowered its view of the Eurozone’s economic prospects and predicted inflation would keep on falling.

- The Eurozone experienced modest growth in the second quarter of 2024, with GDP increasing by 0.3%, slightly above expectations. Strong performances in France and Spain helped offset an unexpected contraction in Germany, the region’s largest economy. On a year-on-year basis, the economy grew 0.6%, ahead of the forecasted 0.5%.

- Inflation in the Eurozone eased slightly, with consumer prices rising by 2.5% in June, down from 2.6% in May, amid slower increases in the prices of energy and food, alcohol and tobacco. Core inflation was unchanged at 2.9%, broadly driven by services inflation remaining at 4.1%.

Asia and Emerging Markets

- Japan: The Bank of Japan (BOJ) raised its interest rate to a level not seen since 2008. The BOJ voted 7-2 to increase its interest rate from 0-0.1% to 0.25%. The BOJ Governor Kazuo Ueda also didn’t rule out another increase this year. The BOJ also announced plans to reduce its bond-buying program, indicating a move towards a more neutral policy stance.

- China: China’s economy showed further signs of strain, with growth slowing to 4.7% year-on-year in the second quarter, below the expected 5.3%. Bad weather was partly responsible for the slowdown, as well as weak domestic demand and ongoing difficulties in the property sector.

Market Overview

- UK Equities: UK indices performed particularly well, with the mid cap FTSE 250 producing a particularly strong return as it outperformed the FTSE 100. There was support from the landslide victory for Labour in the general election, which increased hopes of a sustained economic recovery, whilst optimism rose over a cut in interest rates as inflation remained at 2%. The more domestically focused FTSE 250 also benefited in particular from positive economic data, whilst the stronger sterling was a headwind to the overseas earners in the FTSE 100.

- Global Equities: The US S&P 500 rose, though there was a noticeable rotation from growth stocks to value-oriented sectors. European equities showed modest gains, with significant sectoral divergence, while the Japanese market experienced volatility, ending the month lower despite early gains, with a rebound in the yen partly responsible.

- Asia and Emerging Markets: Asian markets finished slightly lower, although this masked different regional performances. Emerging markets underperformed developed markets, amid weakness in China and Taiwan. India and Brazil were among the strongest performers, whilst the weaker US dollar was also supportive.

- Fixed Income: Fixed income markets performed well, driven by expectations of interest rate cuts amid easing inflationary pressures. Whilst both finished higher, UK government bonds outperformed corporate bonds, ahead of the Bank of England interest rate decision on 1 August.