We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

Investor sentiment in November was shaped by the US Presidential election, which contributed to developed markets broadly outperforming global emerging markets, with the UK and US leading the gains. Trade tariff concerns negatively impacted Asian markets, especially China. Fixed income markets rose, supported by interest rate cuts in the UK and US.

Economic Overview

UK

- Bank of England (BoE) & Interest Rates: The BoE cut rates by 0.25% to 5%, with the Monetary Policy Committee (MPC) voting 8-1 in favour of the reduction. Governor Andrew Bailey emphasised gradual rate reductions to ensure inflation stays close to target. The BoE forecasted that the Autumn Budget would boost the UK economy by around 0.75% in 2025, but will barely have any impact on growth in two or three years’ time. In addition, the BoE projected that the Budget could add just under 0.5% to the inflation rate at its peak in just over two years’ time, meaning it will take a year longer to return sustainably to its 2% target.

- Economic Growth: UK Q3 GDP growth slowed to 0.1%, with the dominant services sector seeing a slight gain, although construction expanded 0.8%. However, production declined. Within expenditure, business investment rose 1.2%, whilst household and government spending both rose. On a year-on-year basis, growth was 1%. In September, GDP contracted by 0.1%, reflecting stagnation in services a slower pace of growth in construction, as well as decline in production.

- Labour Market: Unemployment rose from 4% to 4.3% in the three months to September, the highest in four months. Vacancies continued to decline but remained above pre-pandemic levels. Regular wage growth slowed to 4.8%, the weakest in over two years, although still just stronger than the forecasted 4.7%, whilst adjusted for inflation, it rose by 2.7%.

- Inflation: CPI inflation increased from 1.7% to 2.3% in October, primarily due to higher energy costs following the rise in regulated domestic energy tariffs. Core inflation, which excludes volatile components, rose slightly from 3.2% to 3.3%. Services inflation, a key measure of domestic inflation, increased from 4.9% to 5%.

US

- Federal Reserve (Fed) & Interest Rates: The Fed reduced rates by 0.25% to the 4.5%-4.75% range. Fed Chair Jerome Powell said data would continue to be assessed to determine the future path of interest rates. Mr Powell also said the result of the US Presidential election would have no “near-term” impact on US monetary policy, but as usual would begin assessing the impact of new policies under the incoming administration as they take shape.

- Economic Growth: Q3 GDP was confirmed to have grown at 2.8% annually. There were small downgrades to consumer spending, although this remained at a robust pace, government expenditure and exports, which were offset by upgrades to private inventory accumulation, business investment and state and local government spending.

- Inflation: CPI rose 2.6% year-on-year in October, with shelter costs, including rents and hotel prices, responsible for over half the increase. Core inflation held steady at 3.3%, continuing to be driven by shelter costs and more broadly, overall services price rises. Overall goods costs were unchanged.

Europe

- Economic Growth: The Eurozone economy expanded by 0.4% in Q3, the fastest pace in two years. Growth was supported by Germany surprisingly avoiding recession, stronger-than-expected gains in France, and robust performance in Spain. Italy’s growth stalled, highlighting regional variations. Year-on-year, GDP grew 0.9%.

- Inflation: Headline inflation rose to 2% in October, driven by base effects, with the previous year’s sharp decline in energy prices no longer being factored into the annual rate. Energy costs fell at a slower pace, whilst prices rose faster for food, alcohol and tobacco, as well as non-energy industrial goods. Core inflation remained steady at 2.7%, with services prices increasing from 3.9% to 4%.

Asia and Emerging Markets

- Japan: Q3 GDP growth slowed to from 2.2% to 0.9% annually, although this was ahead of the forecasted 0.7%. Private consumption, which accounts for over half of economic output, unexpectedly improved to 0.9%, whilst government spending increased. However, net external demand negatively affected growth, whilst capital spending declined. Quarter-on-quarter GDP matched forecasts at 0.2%.

Market Overview

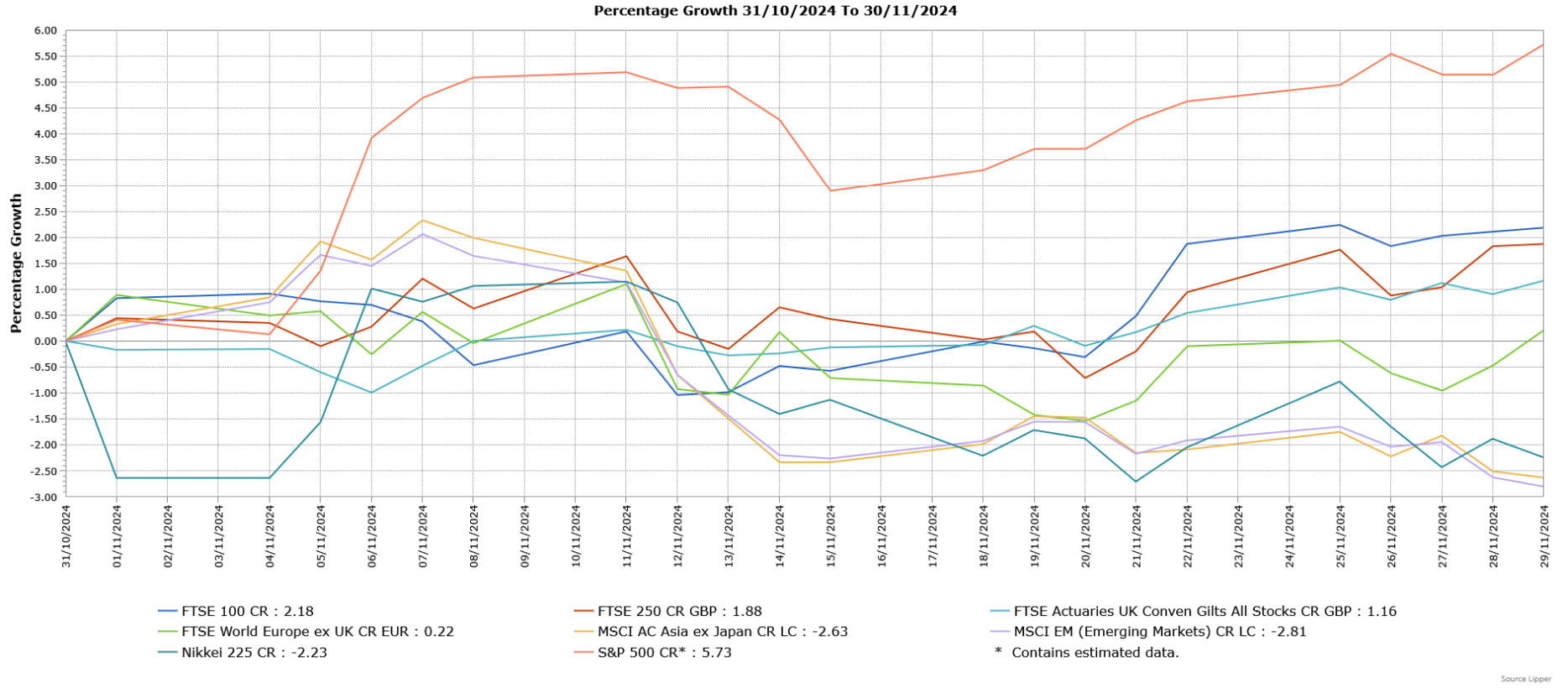

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

- UK Equities: Both the FTSE 100 and mid-cap FTSE 250 rose, supported by a rebound in consumer confidence. Domestically focused companies recovered some of their initial losses post-Autumn Budget, as investors found no immediate surprises in Labour policies.

- US Equities: The S&P 500 posted significant gains, fuelled by optimism about Donald Trump’s pro-growth agenda, including potential tax cuts and deregulation, supported by the Republican party gaining full control of Congress.

- European Markets: The FTSE World Europe ex UK Index finished slightly higher, though there were regional variations as Germany outperformed, despite tariff concerns, while France lagged due to ongoing political uncertainty.

- Japan: The Japanese Nikkei 225 Index ended the month lower, with the losses driven by large cap stocks and in particular exporters, where tariffs were a notable concern.

- Asian Markets: The MSCI Asia ex Japan fell, with most regional indices declining due to tariff fears. China suffered notable losses as threats of very high tariffs on manufactured goods weighed on sentiment.

- Emerging Markets: The MSCI Emerging Markets Index similarly ended November lower, with the threat of tariffs also a headwind alongside the stronger dollar.

- Fixed Income: Both gilts and investment grade corporate bonds rose, supported by global interest rate cuts.

CA12535 Exp 12/25.