We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Market Commentary – January 2025

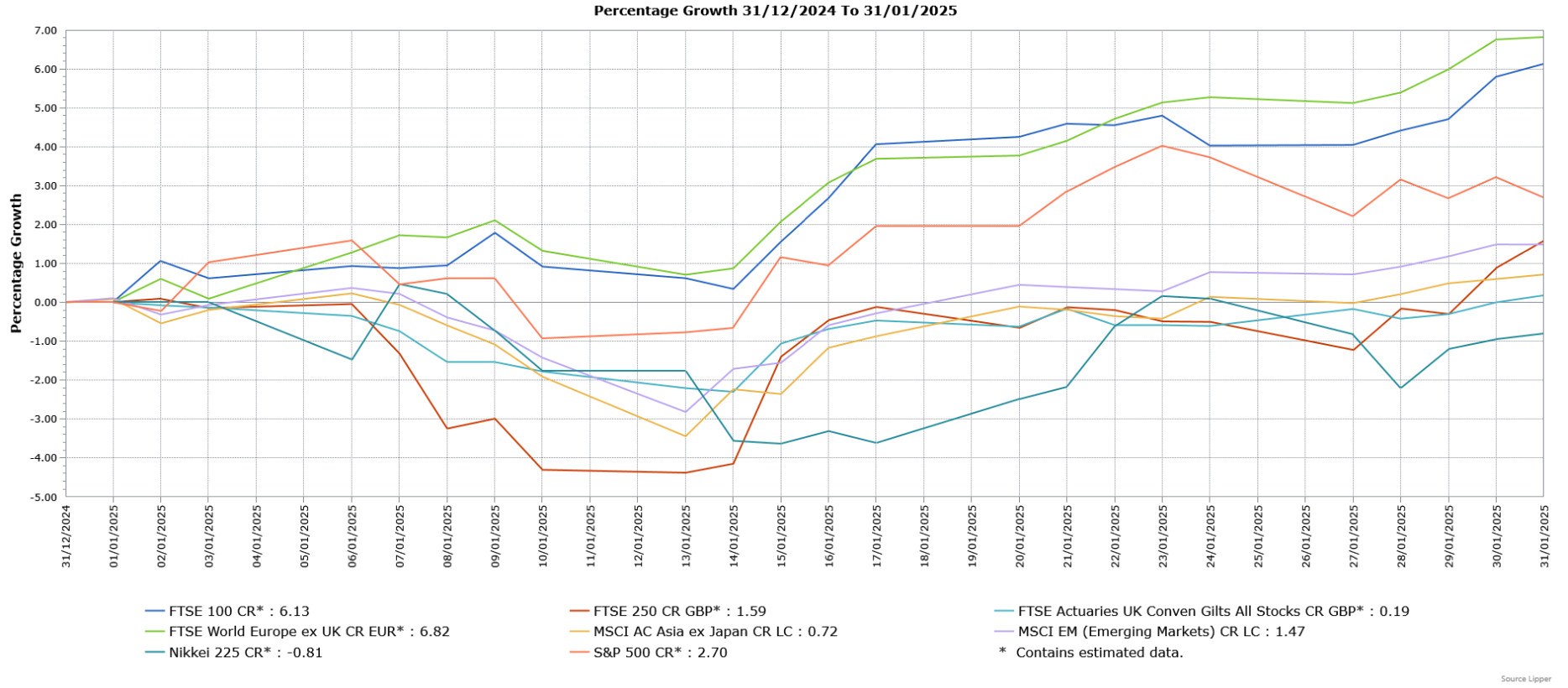

Global equity markets produced positive returns in January, although in a change from 2024 performance was led by Europe, whilst the UK also outperformed the US, where there was additional volatility as the Chinese AI company DeepSeek challenged the US leadership in AI. Asian and Global Emerging Markets also recorded gains. Fixed income markets finished slightly higher.

UK Economy

- Growth: The UK economy expanded by 0.1% in November, missing forecasts but improving from 0.1% contractions in September and October. Growth was led by the services sector, while construction also rose. However, the production sector declined, dragged down by manufacturing. Over the three months to November, the economy showed no overall growth compared to the prior period.

- Labour Market: Growth in regular pay excluding bonuses remained strong, rising from 5.2% to 5.6%, whilst unemployment rose slightly from 4.3% to 4.4% in the three months to November, the highest since May. The number of job vacancies declined for the 30th consecutive month but remained above pre-pandemic levels. Pay growth also outpaced inflation at its strongest rate in more than three years, providing a boost to real earnings.

- Inflation: UK inflation slowed from 2.6% to 2.5% in December, below expectations. Cheaper hotel stays, airfares, and clothing contributed to the decline, while services inflation fell sharply from 5% to 4.4%, its lowest level since 2022. The Bank of England closely monitors this trend, as falling core inflation can suggest easing domestic price pressures.

US Economy

- Federal Reserve (Fed) & Interest Rates: The Federal Reserve kept interest rates unchanged at 4.25%-4.5%, awaiting further confirmation of inflation progress. Fed Chair Jerome Powell emphasised patience before further rate cuts, citing concerns over inflation persistence and labour market conditions. The Fed is also awaitinging policy clarity following President Trump’s return to the White House.

- Growth: US GDP expanded by 2.3% in Q4, slowing from 3.1% in Q3. Consumer spending, making up over two-thirds of the economy, rose strongly. However, fixed investment fell for the first time since the first quarter of 2023, partly due to Boeing’s strike, and trade contributed little. For 2024, GDP grew 2.8%, slightly below 2023’s 2.9% growth rate.

- Inflation: US CPI increased 0.4% in December, the highest in nine months, driven by rising energy costs. Gasoline prices surged 4.4%, contributing to over 40% of inflation. CPI rose 2.9% in the 12 months through December. Core CPI, excluding energy and food, rose 3.2% annually, slightly lower than November. Rising service costs, particularly in rents and airline fares, added pressure. For the 12 months through December, core CPI rose 3.2%.

European Economy

- ECB & Interest Rates: The European Central Bank cut interest rates by 0.25% to 2.75%, whilst signalling a further reduction in March. ECB President Christine Lagarde said future decisions will be informed by economic data. The move aimed to support tepid economic growth, which more than offset concerns about inflation risks in the Eurozone.

- Growth: The Eurozone economy stagnated in Q4, missing expectations for 0.1% growth. Germany and France surprisingly contracted, while Italy showed no growth. Spain was an exception among the large economies, expanding by 0.8%. Year-on-year, GDP grew 0.9%, slightly below forecasts. Full-year 2024 GDP rose 0.7%, outperforming 2023’s 0.4% growth.

- Inflation: Eurozone inflation rose to 2.4% in December, marking three consecutive months of acceleration. Base effects drove the increase, with the sharp declines in energy prices seen in 2023 no longer being factored into the annual rate. December saw energy costs rebound slightly, while food and non-energy industrial goods price increases slowed. Core inflation remained at 2.7%. Among major economies, inflation increased in Germany, France, and Spain but slowed in Italy.

Asia & Emerging Markets

- Japan: The Bank of Japan raised interest rates by 0.25% to 0.5%, the highest since 2008. Governor Kazuo Ueda s said the central bank would continue to raise interest rates, given rising wages and inflation. However, he provided no specific timeline. The BOJ also revised its inflation outlook upwards, expecting sustained price growth around its 2% target, with risks skewed to the upside.

- China: China’s economy expanded by 5.4% in Q4, exceeding the 4.6% pace of Q3 and the forecasted 5%. Growth was supported by government stimulus measures introduced since September. For full-year 2024, GDP grew 5%, meeting Beijing’s target but slightly below 2023’s 5.2% growth.

Market Performance

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

- UK Equities: The FTSE 100 outperformed the FTSE 250, benefiting from a rotation away from large US tech stocks as it recorded new highs. Optimism over potential UK interest rate cuts helped boost investor sentiment. Energy, industrial, and financial sectors drove gains in the FTSE 100. However, the FTSE 250’s rise was tempered by concerns over the strength of the domestic economy’.

- US Equities: The S&P 500 hit new record highs but lagged behind European markets due to pressure on tech stocks. NVIDIA and other AI-driven companies saw some sharp declines as Chinese start-up DeepSeek posed competitive threats. Other sectors performed well, but volatility in technology stocks impacted overall US equity market performance.

- European and Japan Markets: European stocks benefited from investors rotating out of US tech, easing immediate tariff concerns, and expectations of ECB rate cuts. Japan’s Nikkei 225 underperformed, affected by losses in large-cap exporters and tech stocks.

- Asian and Emerging Markets: Broader Asian markets saw modest gains, led by South Korea’s rebound from late-2024 losses. The MSCI Emerging Markets Index rose, supported by a weaker US dollar and Latin American gains. However, concerns over US tariffs continued to be a headwind. The IT sector remained volatile due to DeepSeek’s AI developments.

- Fixed Income: UK fixed income assets posted small gains in January despite early falls due to concerns over public financies. However, there was a rebound in the second half of the month amid weaker than expected inflation data which increased expectations of an interest rate cut in February. Corporate bonds slightly outperformed government bonds (FTSE Actuaries UK Conventional Gilts Index).

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA12672 Exp: 03/2026