Introduction

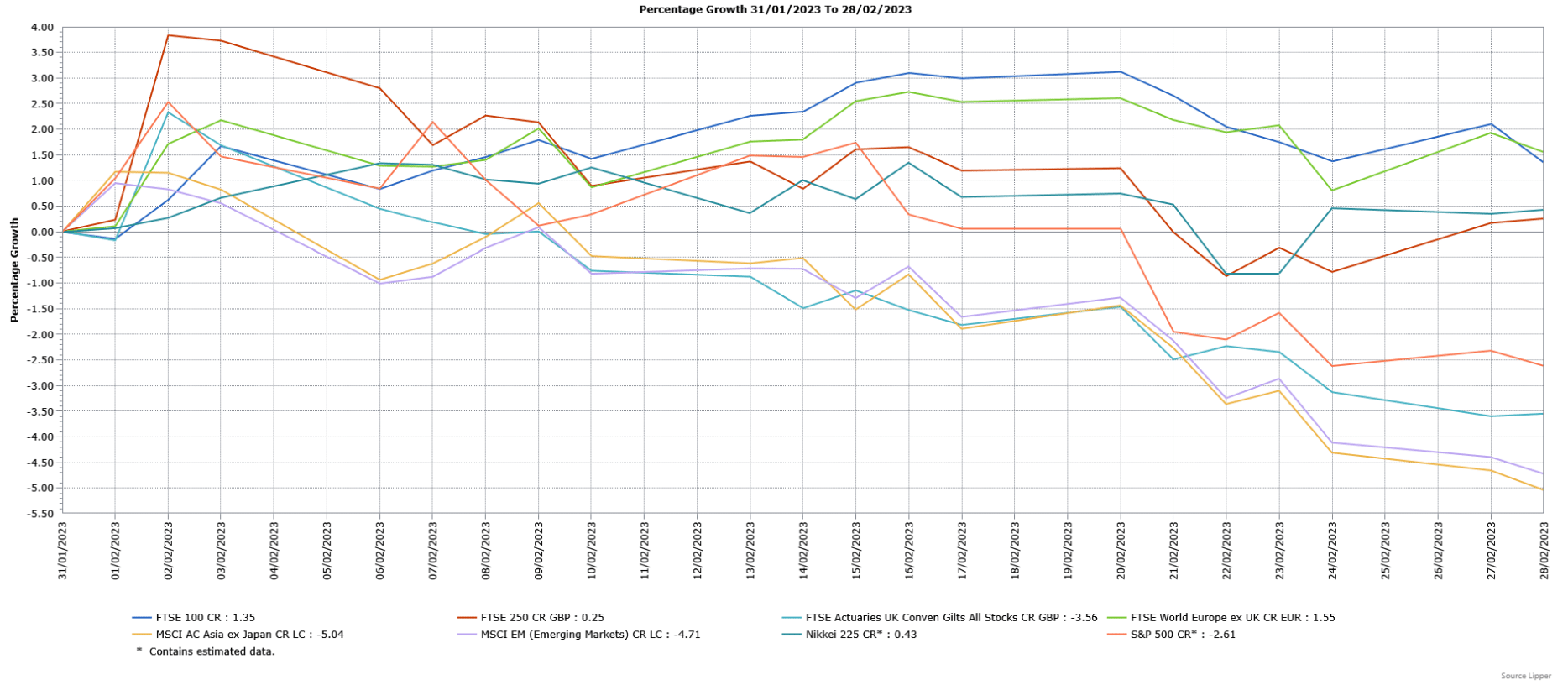

There was mixed performance from global equity markets in February, with UK and European indices finishing the month with gains, supported by improving company earnings. However, the US finished lower as inflation appeared more persistent than expected, whilst Asian and Global Emerging Markets suffered the biggest losses, partly due to increased tensions between the US and China. UK fixed income assets endured a difficult month, with sentiment hit by expectations of further interest rate rises, notably in the US.

Economic Overview

UK

Bank of England and Interest Rates

The Bank of England’s (BoE) Monetary Policy Committee (MPC) voted 7-2 to increase the interest rate by 0.5% to 4%, in line with most expectations and the highest level since 2008. The two outliers preferred to keep the interest rate unchanged. However, the BoE Governor Andrew Bailey indicated that the tide was turning in the efforts to combat surging inflation, stating that “We’ve seen the first signs that inflation has turned the corner”, although he added “But it’s too soon to declare victory just yet, inflationary pressures are still there”. Mr Bailey said the MPC would need to be “absolutely sure” that inflation was receding. The MPC said further interest rate increases would be dependent on evidence of more persistent price pressures.

The BoE also released its latest Monetary Policy Report, containing its updated economic projections. The BoE’s central projection is now for inflation to fall sharply from the 10.5% level in December, largely due to past increases in energy and other goods prices falling out of the calculation of the annual rate. Annual inflation is now projected to fall to around 4% towards the end of 2023. It was noted that there are considerable uncertainties around the medium-term outlook, with the MPC continuing to judge that the risks to inflation are skewed significantly to the upside, reflecting in particular the possibility of greater persistence in domestic wage and price setting. The UK is still expected to enter recession this year, but it will be shorter and less severe than previously projected, mostly due to lower energy prices and weaker market interest rate expectations. The downturn is now expected to last five quarters rather than around two years and as a result, fewer people are likely to lose their jobs.

Economic Growth

The Office for National Statistics (ONS) said Britain’s economy just avoided going into recession in the fourth quarter of last year. Having contracted by 0.2% (revised up from a decline of 0.3%) in the third quarter, the economy showed zero growth in the final three months of the year. The economy in the fourth quarter was still 0.8% below its pre-pandemic level, unlike other major advanced economies that are now above their pre-pandemic size. However, business investment in the fourth quarter was 13.2% higher than a year earlier and is now back at the same level pre-pandemic three years earlier. For the calendar year 2022, the economy grew 4%, which was the biggest increase among G7 countries.

For the month of December, the economy contracted by 0.5%, which was worse than the forecasted 0.3% decline. Widespread strikes in the public sector, rail and postal services weighed on economic growth in the final month of 2022. The contraction in December was driven by a fall in services output, including fewer medical operations, doctors’ visits and lower school attendance, partly due to the strikes. There was also a negative impact from sporting activities, particularly football, due to the World Cup. The ONS said the decline would have been larger had it not been for the very cold snap that led to increased energy generation.

Unemployment & Labour Market Statistics

In line with forecasts, British unemployment remained steady at 3.7% in the three months to December. However, job vacancies fell by 76,000 to 1.134 million in the three months to January, the seventh consecutive decline. The economic inactivity rate, which is the share of people not in work and not looking for it, fell in the three months to December to 21.4%. The ONS said there was a record flow of people moving out of economic inactivity during the fourth quarter of last year as increasing numbers returned to work.

The ONS said regular pay excluding bonuses grew by an annual 6.7% in the three months to December, the strongest growth since records began in 2001 (bar during the pandemic). However, when considering inflation regular wages fell by 2.5%. Employee’s total pay, which includes bonuses, rose by annual 5.9%, the slowest increase since the three months to July 2022, but the ONS said this largely reflected unusually high bonuses in late-2021. In real terms, total pay fell by 3.1%. Private sector regular wage growth was 7.3%, which continues to be sharply higher than the public sector, where the increase was 4.2%.

Inflation

The annual rate of UK inflation, as measured by the Consumer Price Index (CPI), fell by more than expected as it declined from 10.5% in December to 10.1% in January, the lowest reading since September and below the forecasted smaller drop to 10.3%. The ONS said the decline was driven by falls in fuel prices, as well as a dip in the costs of restaurant, café and takeaway prices. Air and coach travel prices dropped back after seeing a “steep rise” in December. The cost of food and non-alcoholic beverages eased only slightly, but the increase of 16.7% remained very close to the 45-year record of 16.8% in December and remains a key driver of overall inflation alongside energy bills. Core CPI, which excludes volatile components such as food and energy prices, fell from 6.3% in December to 5.8% in January. The pace of services price inflation eased in January, as it fell from 6.8% in December to 6%.

US

US Federal Reserve and Interest Rates

The US Federal Reserve (Fed) further scaled back the pace of interest rate rises as it said it had turned a key corner in the fight against high inflation, but that “victory” would still require its benchmark rate to be increased further and to remain elevated at least through 2023. The Fed increased its interest rate by 0.25% to a range between 4.5% and 4.75%, the highest since 2007. In the news conference following the announcement, the Fed Chair Jerome Powell said “It’s going to take some time” for disinflation to spread through the economy, whilst adding he expects there to be a couple more rate hikes still to go and “given our outlook, I just I don’t see us cutting rates this year”. It was also highlighted that whilst the disinflationary process has started with goods prices slowing and supply chains getting back to normal, important segments of the economy including large parts of the service sector were yet to see inflation slow. This includes the labour market, where the high level of job openings and still-strong wage increases showed the labour market was “extremely tight”.

Economic Growth

US economic growth in the fourth quarter was revised slightly lower from an annualised gain of 2.9% to 2.7%. The downward revision reflected the impact of high inflation on consumer spending, which was lowered from the original estimate of a 2.1% increase to 1.4%, as well as lower exports compared with the preliminary figure. Economic growth in the fourth quarter was driven by a sharp rise in business inventories, which may impact on future growth. Excluding trade, government and inventories, domestic demand increased at only a 0.1% rate instead of the previously reported 0.2% pace, which likely reflected an easing in demand in the last two months of 2022, although data suggested a rebound earlier this year.

Inflation

US consumer price growth slowed by less than expected in January, with continued pressure from higher costs for rental housing and food. The Labor Department said the Consumer Price Index (CPI) rose 0.5% in January following the gain of 0.1% in December (revised up from a 0.1% decline). A 0.7% increase in the cost of shelter, which mostly reflected rents, was responsible for nearly half of the monthly rise, whilst higher gasoline prices, which had declined for two consecutive months also boosted inflation. Prices for natural gas and electricity also rose. Food prices increased 0.5% having gained 0.4% in December, whilst the cost of food consumed at home rose 0.4%, driven by higher costs for meat, fish and eggs. For the twelve months through January, CPI rose by 6.4%, slightly lower than the 6.5% increase in December, the smallest gain since October 2021.

The so-called core CPI, which excludes volatile food and energy components, rose 0.4% in January, matching its upwardly revised gain in December. In addition to the 0.7% increase in owners’ equivalent rent, which is what a homeowner would receive from renting a home, higher prices for apparel also boosted core CPI as they jumped 0.8%, the largest gain since December 2021. However, healthcare costs fell 0.4%, whilst prices for used cars and trucks were lower. Excluding food, shelter and energy, CPI rose 0.2% having risen 0.1% in December. For the 12 months through January, core CPI rose 5.6%, a slightly slower pace than the 5.7% gain in December.

Europe

European Central Bank and Interest Rates

In line with its December comments, the European Central Bank (ECB) raised its interest rate by 0.5% to 2.5%, whilst stating that there will be a further increase in March of the same size, but the bank will then evaluate the subsequent path of its monetary policy. Financial markets had interpreted this statement as suggesting the rate hiking cycle was nearing its end, but the ECB President Christine Lagarde disputed this view, stating that “No. We know that we have ground to cover, we know that we are not done”. Ms Lagarde also reiterated the central bank’s mantra that it would “stay the course” in the fight to bring inflation back down to its target of around 2%. Ms Lagarde added that “We still have underlying inflation factors that are strong, solid and are not budging, so we need to do our job”, whilst also saying that beyond March the next rate increase in May could be 0.25%, 0.5% or whatever was needed. There was also acknowledgment of the outlook being less concerning for growth and inflation, with the risks for both now “more balanced” than in December. Ms Lagarde said “economic growth in particular has been more resilient than expected and should recover over the coming quarters”.

Inflation

Headline inflation in the Eurozone for January was revised slightly higher from the preliminary estimate of a year-on-year rise of 8.5% to 8.6%, although this was still slower than the 9.2% increase in December. The preliminary data had not included the figures from Germany, the largest economy in the Eurozone. The slowdown from December was driven by lower energy costs, but prices for both non-energy industrial goods and food, alcohol and tobacco rose at quicker pace. The revisions also showed that core inflation, which excludes volatile components such as energy and food prices, rose by 5.3% instead of the previous estimate of 5.2%. Services inflation, which is the biggest component of core inflation, was revised higher from 4.2% to 4.4%, driven by strong wage growth and employee earnings.

Asia and Emerging Markets

Japan

The Japanese economy avoided going into recession, but economic growth in the fourth quarter of last year was much slower than expected. The world’s third largest economy expanded by an annualised 0.6% in the fourth quarter, which represented a rebound from the 1% contraction in the preceding three months but was much lower than the forecasted 2% gain. Although private consumption rose 0.5% and external demand added to growth, capital expenditure was a notable drag on the economy as it declined by a higher than expected 0.5%. Private inventories also provided a negative contribution, with firms seeing declining stocks of automobiles and raw materials. For the full year 2022, the economy expanded 1.1%, slower than the 2.1% gain in 2021.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK indices rose in February, with the large cap FTSE 100 outperforming the mid cap FTSE 250. The FTSE 100 reached a new record high during the month, with the UK market being led higher by the energy, healthcare and telecom sectors. Some domestically-focused areas also performed well, following the release of data showing the UK economy has been more resilient than expected. There was also support from higher company earnings and signs of slowing inflation.

US markets suffered losses, with the S&P 500 underperforming other major developed markets as almost all sectors finished lower. Sentiment was hit by inflation appearing to be more persistent than expected, amid strong economic data, leading to expectations of interest rates remaining higher for longer. European markets, as demonstrated by the broad FTSE World Europe ex UK Index, performed well as they ended February higher, boosted by improved guidance from companies and encouraging forward-looking economic data. The Japanese Nikkei 225 Index posted a small gain, with yen weakness providing support, particularly for exporters.

The broad MSCI Asia ex Japan Index suffered a loss, driven by sharp falls in China and Hong Kong. Rising tensions between the US and China weighed on sentiment, as did the expectation that the US interest rates would remain higher for longer. Global Emerging Markets underperformed developed markets, as shown by the broad MSCI Emerging Markets Index, with the stronger US dollar a headwind. The losses in China contributed to Emerging Asia being the weakest region, followed by Latin America and EMEA (Europe, the Middle East and Africa).

Fixed income markets endured a difficult February, driven by concerns over the persistence of inflation that led to a repricing of expectations of additional interest rate increases. UK government bonds (FTSE Actuaries UK Conventional Gilts Index) underperformed investment grade corporate bonds, although both finished the month lower.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA9241 Exp 03/2024