We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

March was a difficult month for developed global equity markets as they broadly suffered losses, with the US underperforming again in a similar pattern to the previous month. Investor sentiment was negatively affected by concerns over trade tensions ahead of the announcement of broader tariffs on 2 April, dubbed “Liberation Day” by President Trump. There was though outperformance by Global Emerging Markets, supported by gains in China and Latin America. Fixed income markets fell slightly amid worries over the impact of tariffs on inflation.

Economic Overview

UK

Bank of England & Interest Rates

As expected, the Bank of England kept interest rates steady at 4.5%. However, the vote was more comprehensive than forecast, with eight members of the Monetary Policy Committee (MPC) voting in favour versus just one who supported a cut compared with the projected 7-2 split. Governor Andrew Bailey emphasised the need for caution, citing inflation risks and global uncertainty linked to trade tariffs. He stressed that any future rate cuts would depend on clear evidence that inflation is falling.

Economic Growth

The UK economy grew by 0.1% in the fourth quarter, consistent with the preliminary estimate. Services, the largest part of the economy, grew more slowly than first thought, while construction rose. A drop in production was not as bad as previously estimated. Household and government spending both rose slightly. On a year-on-year basis, the economy grew 1.5%, the strongest annual rate in two years. For the month of January, there was a small surprise contraction of 0.1%, mainly due to a decline in production and notably in manufacturing. Construction activity also fell, although services continued to grow for the third straight month.

Unemployment & Labour Market Statistics

Unemployment remained at 4.4% in the three months to January. Labour market data showed little change in wage growth, but job vacancies rose slightly—marking the first increase since mid-2022. Regular pay grew by 5.9% annually, with private sector pay growth just slightly slowing. Adjusted for inflation, real pay increased 3.2%. However, total pay growth, including bonuses, dipped slightly from 6.1% to 5.8%, whilst in real terms it was 3.1%.

Inflation

UK headline inflation dropped to 2.8% in February from 3% in January, coming in below forecasts. The decline was largely due to falling prices in clothing and footwear, driven by widespread discounting. Core inflation, which strips out food and energy prices, also eased slightly from 3.7% to 3.5%. However, services inflation—a key concern for the Bank of England—remained unchanged at 5%, suggesting that domestic price pressures persist.

US

US Federal Reserve & Interest Rates

The Federal Reserve (Fed) left interest rates unchanged at 4.25%–4.50%, as widely expected. Fed Chair Jerome Powell noted that economic uncertainty remains high, and that the impact of new trade tariffs could push inflation higher. While the Fed still expects to cut rates twice this year, Powell emphasised that there’s no urgency, and decisions will depend on how the economy evolves. He acknowledged that while growth remains solid, risks have shifted toward weaker growth and higher inflation.

Economic Growth

The US economy expanded at an annualised rate of 2.4% in the fourth quarter, slightly better than the previous estimate. Growth was driven mainly by strong consumer spending, which rose 4%—its best pace in nearly two years. Trade also helped, as exports fell less than expected while imports declined more. Investment dropped less than originally thought, and government spending was revised upward, all contributing to economic growth.

Inflation

Consumer prices in the US rose more slowly in February, with the CPI increasing just 0.2%, the smallest monthly gain since October. Lower prices for airline tickets and gasoline helped ease overall inflation, while shelter (which includes hotel and motel rooms) accounted for nearly half the rise in CPI. Over the past year, inflation stood at 2.8%, down from 3% in January. Core inflation, which excludes food and energy, also slowed, rising 3.1% year-on-year—the smallest gain since April 2021.

Europe

European Central Bank & Interest Rates

The European Central Bank (ECB) cut its main interest rate by 0.25% to 2.5%, reflecting falling inflation. However, the bank warned that risks remain high due to global trade tensions and rising government spending in some countries. ECB President Christine Lagarde noted that the path for future rate changes isn’t clear, and any decision to cut or pause would be more dependent on new economic data. Inflation is now expected to reach the ECB’s 2% target only in early 2026, with the rate now seen at 2.3% this year instead of 2.1%.

Economic Growth

The Eurozone economy grew by 0.2% in the final quarter of last year, slightly above earlier estimates. However, this improvement was mainly due to strong growth in Ireland, which often sees big swings due to its large multinational sector. Overall, annual growth for the region was 1.2%. Among major economies, Spain performed best with 3.5% growth, while Germany, the region’s largest economy, contracted slightly.

Inflation

Eurozone inflation slowed February, dropping to 2.3% from 2.5%. This was better than expected, partly due to lower inflation in Germany. While food prices rose, energy inflation slowed significantly. Core inflation also eased slightly to 2.6%, marking the lowest rate in over two years. Inflation in services, which makes up a large part of the consumer basket, also moderated from 3.9% to 3.7%.

Asia and Emerging Markets

Japan

The Bank of Japan kept its interest rate at 0.5%, as expected, while expressing concerns over global economic uncertainty. Governor Kazuo Ueda noted that rising food prices and strong wage growth could keep inflation elevated. External risks like US trade policies were noted, but few hints were given over the timing of the next rate increase. Japan’s Q4 growth was unexpectedly revised down from 2.8% to 2.2%. Business investment and exports were supportive, but private consumption, a key part of the economy,. remained unchanged at 0.1%. On a quarter-on-quarter basis, the economy grew 0.6%, just below the earlier estimate of 0.7%.

Market Overview

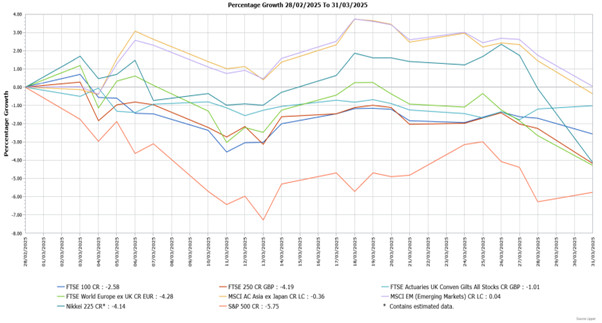

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK equities fell in March, with the mid cap FTSE 250 suffering a bigger loss than the FTSE 100. The falls were driven by a fall in investor confidence amid worries over fresh US trade tariffs, with the FTSE 100 proving more resilient to these fears although it still finished the month lower.

US equities, as shown by the S&P 500, underperformed in March as they suffered a sharp decline as investor sentiment was hit by concerns over the severity of new trade tariffs from the White House, with the previously strong performing technology sector among the worst hit. European markets, as demonstrated by the FTSE World Europe ex UK Index, also declined amid the tariff uncertainty, although Germany suffered a smaller loss as it benefited from the news around increased fiscal spending. The Japanese Nikkei 225 Index also ended the month lower, with the tariffs expected to impact key Japanese export sectors.

Asian markets finished March slightly lower, as shown by the small loss in the MSCI Asia ex Japan Index. Asian markets were supported by gains in China, where economic data showed signs of recovery, whilst Beijing pledged further fiscal and monetary support for the economy as well as prioritising boosting consumption. There was outperformance from emerging markets, as demonstrated by the nominal increase in the broad MSCI Emerging Markets Index. Gains in China were again supportive, as was strong performance in Brazil.

UK fixed income assets ended March with losses, despite inflation falling as the economy continued to stagnate. UK government bonds bonds (FTSE Actuaries UK Conventional Gilts Index) outperformed as they suffered a smaller loss than corporate bonds. There was also a notable sell-off in Europe, particularly in Germany after announcing it would overhaul its borrowing rules to fund increased defence and infrastructure spending.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629. CA12817 Exp 04/2026