We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

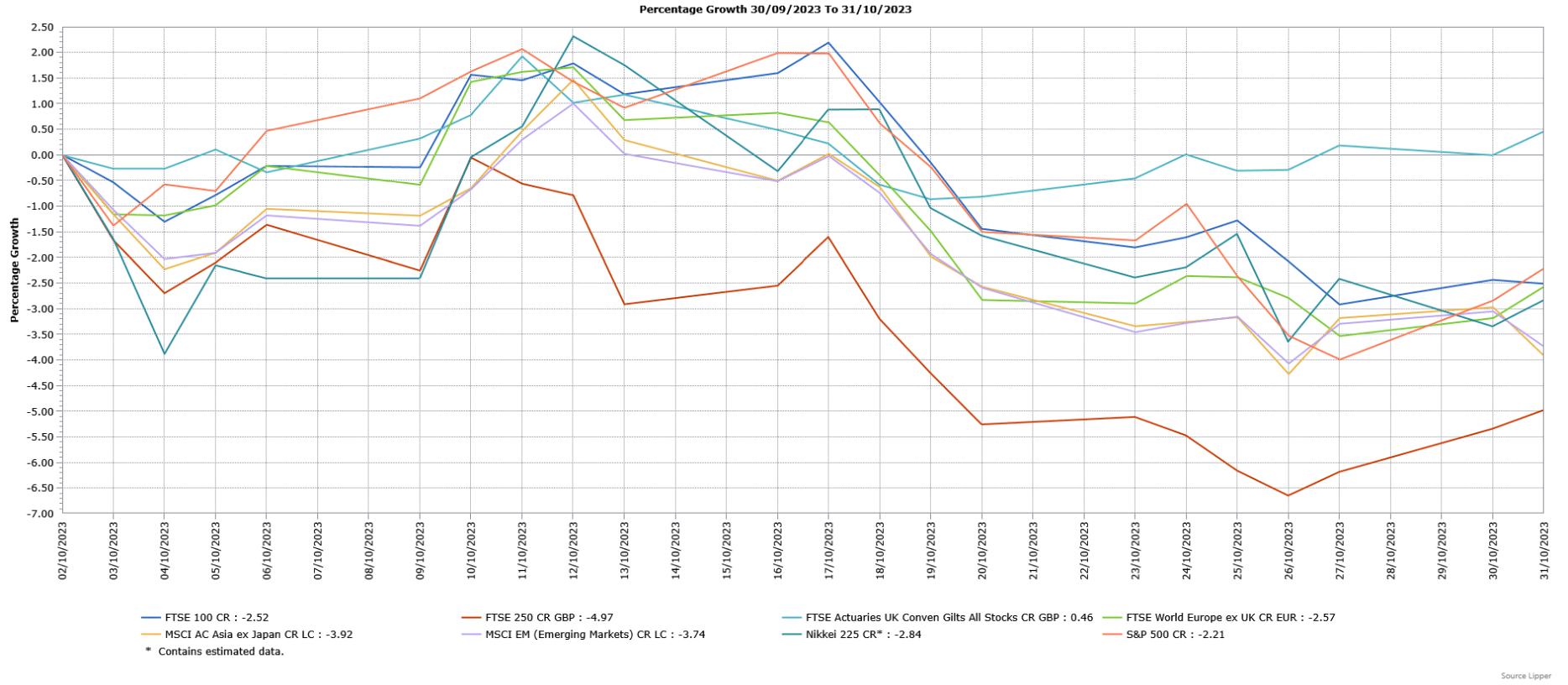

October was a difficult month for global equity markets as they suffered widespread declines, with weakening economic data weighing on investor sentiment, as did the conflict in the Middle East. Global Emerging Markets underperformed developed markets amid falling oil prices, whilst concerns over interest rates remaining higher for longer also hit sentiment. UK fixed income markets proved more resilient in October as they finished slightly higher, driven by declines in short-term yields.

Economic Overview

UK

Economic Growth

The Office for National Statistics (ONS) said the British economy partially rebounded in August from its bigger than expected contraction in July. In line with expectations, the economy was reported to have grown by 0.2% in August, but July’s contraction, which was exacerbated by the rainy weather and various strikes, was revised slightly lower from a 0.5% decline to 0.6%. As a result of August’s growth, the ONS said the economy needs to expand by 0.2% in September to avoid a contraction in the third quarter as a whole, excluding other factors. Whilst July’s data was revised lower, June’s monthly growth was increased by 0.2% to 0.7%. The monthly expansion in August was driven by slightly stronger than expected growth of 0.4% in the dominant services sector, whilst manufacturing and construction contracted by 0.8% and 0.5% respectively. Over the three months to August, the economy grew by 0.3%, described by the ONS as a “modest” performance that was supported by car manufacturing and sales in addition to construction. On a monthly GDP basis, Britain’s economy was 2.1% bigger than in February 2020, just before the start of the pandemic.

Unemployment & Labour Market Statistics

British unemployment was unchanged at 4.2% in the three months to August compared with the previous period, but this data was based on a new calculation that accounts for dwindling survey responses from households. The experimental figures include new data sources to compensate for this falling response rate to the Labour Force Survey (LFS), which usually forms the basis of job market statistics. The new calculation included using jobs data collected by Britain’s tax office over a three month period and changes to welfare claims as a proxy for measuring unemployment, as well as the LFS results. Using the previous methodology, the unemployment rate for the previous three month period to July would have been 4.2%. In addition, the ONS announced separately that the estimated number of job vacancies fell for a 15th consecutive period in the three months to September to a two-year low of 988,000.

The pace of wage growth eased in the three months to August, with regular pay excluding bonuses 7.8% higher than a year earlier, slightly lower than the 7.9% seen in the three months to July, which had been revised higher from 7.8%. This was the first fall in wage growth since January, but still one of the highest regular annual growth rates since comparable records began in 2001. The public sector saw annual average regular pay growth of 6.8% in the three months to August, the highest rate since comparable records began in 2001, whilst there was growth of 8% in the private sector, which is among the largest seen outside of the pandemic period. When adjusted for inflation, annual regular pay was 1.1% higher. Annual growth in employee’s total pay, which includes bonuses, was 8.1%, which was again affected by the one-off payments by the NHS and civil service in June, July and August. In real terms, total pay increased by 1.3%.

Inflation

The headline annual rate of UK inflation, as measured by the Consumer Price Index (CPI), unexpectedly remained unchanged in September amid an increase in petrol prices, whilst services inflation rose resulting in core CPI also being above forecast. The ONS said CPI held at 6.7% in September, matching August’s reading and above the forecasted small fall to 6.6%. The ONS said the rise in petrol prices prevented a lower reading in annual CPI. The largest downward contributions came from food and non-alcoholic beverages and furniture and household goods. Although food prices were 12.1% higher in September than a year earlier, this was slower than the 13.6% pace seen in August and the first monthly fall in two years. In particular, the prices of milk, cheese and eggs were all lower. Furniture and household good prices also rose by less than a year ago.

Core inflation, which excludes food, energy, alcohol and tobacco prices, fell by less than expected as it declined from 6.2% in August to 6.1% in September, compared with the forecasted slightly bigger fall to 6%. Services price inflation rose from 6.8% to 6.9%, driven by more expensive hotel rooms. Prices charged by manufacturers eased 0.1% in September, which followed a 0.5% annual fall in August.

US

Economic Growth

The Commerce Department’s advance estimate showed US economic growth in the third quarter was stronger than expected, amid increased consumer spending and businesses restocking to meet the strong demand. US GDP rose by an annualised 4.9% in the third quarter, well above the 2.1% pace in the previous quarter as well as the forecasted 4.3% gain. Consumer spending rose by 4% having only increased by 0.8% in the second quarter, adding almost 2.7% to GDP growth, driven by expenditure on both goods and services. Inventory restocking added just over 1.3% to economic growth, but reliance on imports to restock resulted in a small trade deficit that imposed a small negative contribution. Excluding inventories and trade, the economy grew by 3.5%. Government spending increased, but business investment fell for the first time in two years as expenditure on equipment such as computers declined and the boost faded from the construction of factories relating to a campaign to encourage more semiconductor manufacturing in the US.

Inflation

US consumer prices rose in September, driven by a surprise jump in rental costs, but there was a steady moderation in underlying inflationary pressures. The Labor Department said the Consumer Price Index (CPI) increased 0.4% in September, below the 0.6% pace seen in August but above the forecasted 0.3% gain. A 0.6% surge in the cost of shelter was responsible for over half the rise in CPI. Gasoline prices gained 2.1%, although this was sharply slower than the 10.6% jump in August. Food prices overall rose 0.2% for the third consecutive month. Grocery food prices were 0.1% higher, with consumers paying more for meat, fish and eggs, but the prices of cereals and bakery products fell for the first time since June 2021. For the twelve months through September, CPI matched August’s 3.7% increase, just above the forecasted 3.6% rise.

The so-called core CPI, which excludes volatile food and energy components, rose 0.3% in September, matching the increase seen in August. Owners’ equivalent rent, which is what a homeowner would receive from renting a home, jumped 0.6%, the largest increase since February and follows a 0.4% rise in August, although other independent measures suggest rents are on a downward trend with the CPI data tending to lag these gauges by several months. The 3.7% increase in the cost of staying away from home also lifted core CPI, thereby ending three consecutive monthly declines, whilst prices for motor vehicle insurance, recreation, personal care, new vehicles, household furnishings and operations were also higher. However, prices for used cars and trucks fell 2.5%, whilst apparel costs declined 0.8%. The increase in rents led to services inflation excluding energy rising 0.6%, whilst the fall in used cars and truck prices extended core goods deflation as they fell by 0.4%. For the twelve months through September, core CPI rose 4.1%, the lowest year-on-year increase since September 2021 and follows the 4.3% gain in August.

Europe

European Central Bank and Interest Rates

In line with expectations, the European Central Bank (ECB) left its key interest rate unchanged at 4%, ending a run of 10 consecutive increases. The decision to hold rates was unanimous, amid an easing in price pressures whilst the Eurozone economy has slowed sharply. The ECB President Christine Lagarde repeated the bank’s guidance from the previous meeting, hinting at steady policy ahead but did keep a further rise as a distant possibility. Ms Lagarde said at the news conference “We have to be steady”, adding “the fact we are holding doesn’t mean to say that we will never hike again”. In addition, Ms Lagarde said “even having a discussion on a cut is totally, totally premature”, but it was also stated that the economy was likely to remain weak for the remainder of this year, which adds to the view that this rate-hiking cycle is probably over.

Economic Growth

A flash estimate showed economic growth in the Eurozone in the third quarter was weaker than expected. Eurostat said there was a 0.1% contraction quarter-on-quarter in the third quarter, slightly worse than the forecasted flat reading and the upwardly revised 0.2% gain in the second quarter. This was the first contraction since the pandemic in 2020. Among the largest Eurozone economies, there were modest expansions in France (0.1%) and Spain (0.3%), but Germany saw a 0.1% contraction whilst growth in Italy stalled. On a year-on-year basis, the economy only just grew by 0.1%, below the forecasted 0.2% gain.

Inflation

Preliminary estimates showed annual inflation in the Eurozone fell to its lowest level in over two years in October. Eurostat said headline consumer prices fell from 4.3% in September to 2.9% in October, a bigger fall than the forecasted decline to 3.1%. Energy costs dropped by 11.1%, whilst price growth eased for food, alcohol and tobacco, as well as for non-energy industrial goods. Core inflation, which excludes prices for energy, food, alcohol and tobacco, declined from 4.5% to 4.2%, the lowest reading since July 2022. The more modest decline in core inflation was likely due to a minimal slowdown in services, where prices eased from 4.7% to 4.6%.

Asia and Emerging Markets

Japan

The Bank of Japan (BOJ) maintained its ultra-low interest rate, but did tweak its bond yield control policy. As widely expected, the BOJ kept its -0.1% target for short-term interest rates and that for the 10-year government bond yield around 0% under its yield curve control (YCC) policy. However, the BOJ re-defined 1% as a loose “upper bound” of the YCC rather than a rigid cap with the long-term rate having been capped at 1% in July from its previous level of 0.5%, whilst also scrapping a pledge to guard the level. The BOJ said “Given extremely high uncertainties over the economy and markets, it’s appropriate to increase flexibility in the conduct of YCC”. The BOJ’s nine-member board also revised up its price forecasts to show inflation well above its 2% target this year and in 2024. However, the BOJ Governor Kazuo Ueda said at a press conference after the decision that “We still haven’t seen enough evidence to feel confident that trend inflation will (sustainably hit 2%)”, adding that “As such, we don’t see a big risk of being behind the curve”.

China

Economic growth in the third quarter was stronger than expected, indicating that policy measures may be helping to support a tentative recovery. Data from the National Bureau of Statistics (NBS) showed the economy grew 4.9% in the third quarter compared with the same period last year, which was ahead of the forecasted 4.4% expansion though slower than the 6.3% growth in the second quarter. The higher growth reading was partly due to the low base comparison from 2022 when a number of major cities were under strict lockdowns. On a quarter-on-quarter basis, the Chinese economy expanded 1.3% in the third quarter, which was above both the revised 0.5% growth in the previous three months as well as the forecasted 1% gain.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK equities fell in October, with both the FTSE 100 and mid cap FTSE 250 suffering losses. The more domestically-focused FTSE 250 underperformed the FTSE 100 as it suffered to a greater extent from stagnating growth and concerns over the health of the UK consumer. The FTSE 100 was hit by poor performance from large banks, amid worries over the impact of high interest rates on their lending and mortgage books.

Having risen in the first half of the month, the US S&P 500 ended October lower as investor sentiment was hit by the uncertainty around the future direction of interest rates. European markets, as demonstrated by the FTSE World Europe ex UK Index, also fell amid weakening economic data and falling consumer confidence. The Japanese Nikkei 225 also posted a loss, as it was not immune to the weaker investor sentiment.

The broad MSCI Asia ex Japan Index was weaker in October, with all regional indices posting losses. The broad sell-off was driven by concerns over interest rates remaining higher for longer and geopolitical worries, including the conflict in the Middle East. Global Emerging Markets underperformed developed markets, as shown by the loss in the broad MSCI Emerging Markets Index, as these regions were also impacted by the same concerns.

UK fixed income assets finished slightly higher in October, with a fall in short duration yields offseting an increase in longer-dated yields. Investment grade corporate bonds underperformed Government bonds (FTSE Actuaries UK Conventional Gilts Index) as spreads widened, although they still saw a nominal gain.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA10690 Exp 11/2024.