We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

November was a good month for both equity and fixed income markets as slowing inflation in the US and other countries increased hopes that interest rates have reached their peaks. There were particularly strong performances across many regions, but the FTSE 100 saw a smaller gain due to sterling out-performance and weakness in commodities which weighed on areas such as the energy sector.

Economic Overview

UK

Bank of England and Interest Rates

The Bank of England (BoE) held interest rates unchanged at their 15-year peak of 5.25%, whilst ruling out cuts any time soon as the central bank fights to “squeeze out of the system” the highest inflation of the world’s big rich economies. Nonetheless, it wasn’t a unanimous decision as the Monetary Policy Committee (MPC) voted 6-3 to maintain the interest rate at 5.25%, with the three dissenters preferring to raise the rate by 0.25%. The BoE said the “MPC’s latest projections indicate that monetary policy is likely to need to be restrictive for an extended period of time”. The BoE Governor Andrew Bailey also warned against complacency, as he stated that inflation was still too high, and the bank was determined to get it all the way back to its 2% target. Mr Bailey also added that the BoE will be watching closely to see if further increases in interest rates are needed, but reiterated that even if this isn’t the case, it was much too early to be thinking about cuts. In particular, the BoE highlighted it was keeping a close eye on strong wage growth, which is thought could maintain inflationary pressures.

The BoE also released its latest Monetary Policy Report, containing its updated economic projections. The BoE is not predicting a recession, but does not expect any growth in Britain’s economy in the third quarter of this year, before a nominal expansion of 0.1% in the final three months of 2023. The forecast is for zero growth in 2024, followed by an expansion of just 0.25% in 2025. Despite forecasting barely any economic growth, inflation is now not expected to return to its 2% target until the end of 2025, around six months later than previously projected, although it should continue to fall throughout next year as energy and food price rises ease.

Economic Growth

The Office for National Statistics (ONS) said the British economy stalled in the third quarter, the weakest performance in four quarters. The preliminary estimate showed the economy failed to grow in the July to September period, but this was slightly above the forecasted 0.1% contraction. The ONS said the latest figures showed a subdued picture across all areas of the economy, with the dominant services sector contracting by 0.1%, whilst construction grew by 0.1% with industrial production broadly flat. Looking at expenditure, an increase in the volume of net trade was offset by falls in business investment, household spending and government consumption. Britain’s economy was 1.8% above its level in late-2019, making its post-Covid recovery stronger than that of Germany and broadly matching France, but a long way below the US.

For the month of September alone, the ONS said the British economy grew by 0.2%, ahead of the forecasted flat reading, whilst August’s reading was revised lower from a gain of 0.2% to 0.1%. The main contributor to growth was the 0.2% expansion in the service sector, driven by growth in professional, scientific and technical activities, as well as human health and social work. The construction sector grew 0.4%, rebounding from its 0.8% contraction in August. However, consumer-facing services output fell 0.2%, although this was an improvement on the bigger decline in August, whilst production output showed no growth.

Unemployment & Labour Market Statistics

Based on the experimental figures the ONS is using to offset a fall in response rates to its usual Labour Force Survey of households, British unemployment remained steady at 4.2% in the three months to September. Employment rose by 54,000 in the three months to September, with forecasts having been for a sharp fall. The estimated number of job vacancies fell for the 16th consecutive month to 957,000, the lowest level since the second quarter of 2021 but still around 15% higher than before the pandemic.

The pace of wage growth eased in the three months to September, but rose faster than inflation by the most for two years. Annual growth in regular pay excluding bonuses, was 7.7%, slightly lower than in previous months but still among the highest annual growth rates since comparable records began in 2001. When adjusted for inflation, annual regular pay was 1.3% higher. Annual growth in employee’s total pay, which includes bonuses was 7.9% and continues to be impacted by the Civil Service one-off payments made in July and August. In real terms, total pay increased by 1.4%.

Inflation

The headline annual rate of UK inflation, as measured by the Consumer Price Index (CPI), fell by more than expected in October as household energy prices were lower than a year ago amid a wider softening of price pressures. The ONS said CPI fell from 6.7% in September to 4.6%, the smallest increase in two years and lower than the forecasted decline to 4.8%. The ONS also said the fall in the annual CPI rate was the biggest from one month to the next since April 1992. However, despite the sharp fall in CPI, inflation in the UK remains the highest among Group of Seven nations, although at the time it was only narrowly above France’s 4.5%. The ONS said the fall came as last year’s steep rise in energy costs had been followed by a small reduction in the energy price cap in October this year. Food prices were little changed, although they did ease to their lowest since June 2022, whilst there was a fall in hotel prices.

Core inflation, which excludes food, energy, alcohol and tobacco prices, fell from 6.1% in September to 5.7% in October, the lowest since March 2022. Services price inflation fell by more than expected by the Bank of England as it declined from 6.9% to 6.6%.

US

US Federal Reserve & Interest Rates

The Federal Reserve (Fed) opted to keep its interest rate unchanged in the 5.25%-5.5% range, as policymakers struggled to determine whether financial condition are already tight enough to control inflation, or whether an economy that continues to outperform may need more restraint. The Fed Chair Jerome Powell said the current situation remained something of a riddle, with officials ready to raise rates again if progress on bringing inflation lower stalls, but also wary of the damage this could cause to the economy whilst trying not to disrupt, any more than necessary, the ongoing dynamic of steady job and wage growth. The Fed also acknowledged that economic activity had expanded at a strong pace in the third quarter. As a result, Mr Powell said the better course of action for now, given the uncertainties, was to leave the interest rate unchanged and see how job and price data evolves over the period to the next meeting in December.

Economic Growth

The Commerce Department reported that US economic growth was stronger than previously thought in the third quarter amid increased business investment. US GDP growth was revised higher from an annualised 4.9% in the third quarter to 5.2%, the fastest pace since the fourth quarter of 2021 and ahead of the forecasted 5% expansion. It was also quicker than the 2.1% growth in the second quarter, as well as above the Federal Reserve’s view of non-inflationary growth of around 1.8%. The upward revision reflected upgrades to business investment in structures (mostly warehouses) and healthcare facilities. State and local government spending was also revised higher. Residential investment was also increased, driven by the construction of more single-family homes, whilst private inventory investment was also higher than previously estimated. Overall, inventory investment added 1.4% to growth. However, growth in consumer spending, which accounts for more than two-thirds of GDP, was lowered from 4% to 3.6%, although this is still a solid pace. The downgrade was due to cuts in spending on financial services and insurance as well as used light trucks.

Inflation

US consumer prices were unchanged in October amid lower gasoline prices, whilst the annual rise in underlying inflation was the lowest in two years. The Labor Department said there was an unchanged reading in the Consumer Price Index (CPI), below the forecasted 0.1% rise and follows a 0.4% increase in September. Gasoline prices fell 5%, having risen 2.1% in September, offsetting the continued rise in the cost of rental accommodation. Food prices rose 0.3% having increased 0.2%, in each of the three previous months. Grocery food prices were 0.3% higher, driven by increases for meat, fish and eggs. Cereals and bakery products also cost more, but fruit and vegetables were unchanged. For the twelve months through October, CPI rose 3.2%, below both September’s 3.7% increase and the forecasted 3.3%.

The so-called core CPI, which excludes volatile food and energy components, rose 0.2% in October having risen 0.3% in each of the two previous months. Owners’ equivalent rent, which is what a homeowner would receive from renting a home, increased 0.4%, having jumped 0.6% in September. There were also higher costs for recreation, personal care and apparel, whilst prices were higher for motor vehicle insurance. Healthcare costs were higher, although doctor visits cost less. However, the cost of motel and hotel rooms declined 2.5%, whilst there were cheaper airline fares, household furnishings and operations. New motor vehicles also cost slightly less, as did communication services. Prices for used cars and trucks declined for a fifth consecutive month, although the pace of decrease eased. Overall, goods prices fell 0.4% and declined 0.1%, excluding food and energy. Services inflation rose 0.3%, although this was lower than the 0.6% jump in September, whilst core services were also 0.3% higher. For the twelve months through October, core CPI rose 4%, the lowest year-on-year increase since September 2021 and follows a 4.1% gain in September.

Europe

Economic Growth

Eurostat confirmed the Eurozone economy contracted by 0.1% quarter-on-quarter in the third quarter, in line with its preliminary estimate. The data showed that among the large Eurozone economies, France and Spain grew by 0.1% and 0.3% respectively, but Germany contracted by 0.1% and there was no growth in Italy. There were also contractions in some of the smaller Eurozone countries. On a year-on-year basis, Eurostat said the economy grew by just 0.1%, also matching its preliminary estimate.

Inflation

Preliminary estimates showed another large fall in headline annual inflation in the Eurozone in November. Eurostat said headline consumer price growth fell from 2.9% in October to 2.4% in November, a bigger decline than the forecasted fall to 2.7% and the lowest level since July 2021. Nearly all items contributed to the slower pace of price growth, except for unprocessed food prices. In particular, the energy cost dropped by 11.5%, whilst the rates of inflation eased for food, alcohol and tobacco and non-energy industrial goods. Core inflation, which excludes prices for energy, food, alcohol and tobacco, fell from 4.2% to 3.6%, its lowest level since April 2022, and was driven by a big drop in services prices.

Asia and Emerging Markets

Japan

Japan’s economy contracted in the third quarter, amid soft consumption and exports. Government data showed the world’s third-largest economy shrunk by 2.1% year-on-year in the third quarter, a worse performance than the forecasted 0.6% contraction and follows an expansion of 4.5% in the second quarter. The weak performance reflected lacklustre consumption, which was flat in the third quarter, having fallen 0.9% in the previous period and below the forecasted 0.2% growth. Capital expenditure also weighed as it declined 0.6%, which although better than the 1% drop in the previous period, was well below the expected 0.3% gain. External demand also reduced GDP by 0.1% as an increase in service imports offset rises in auto exports.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

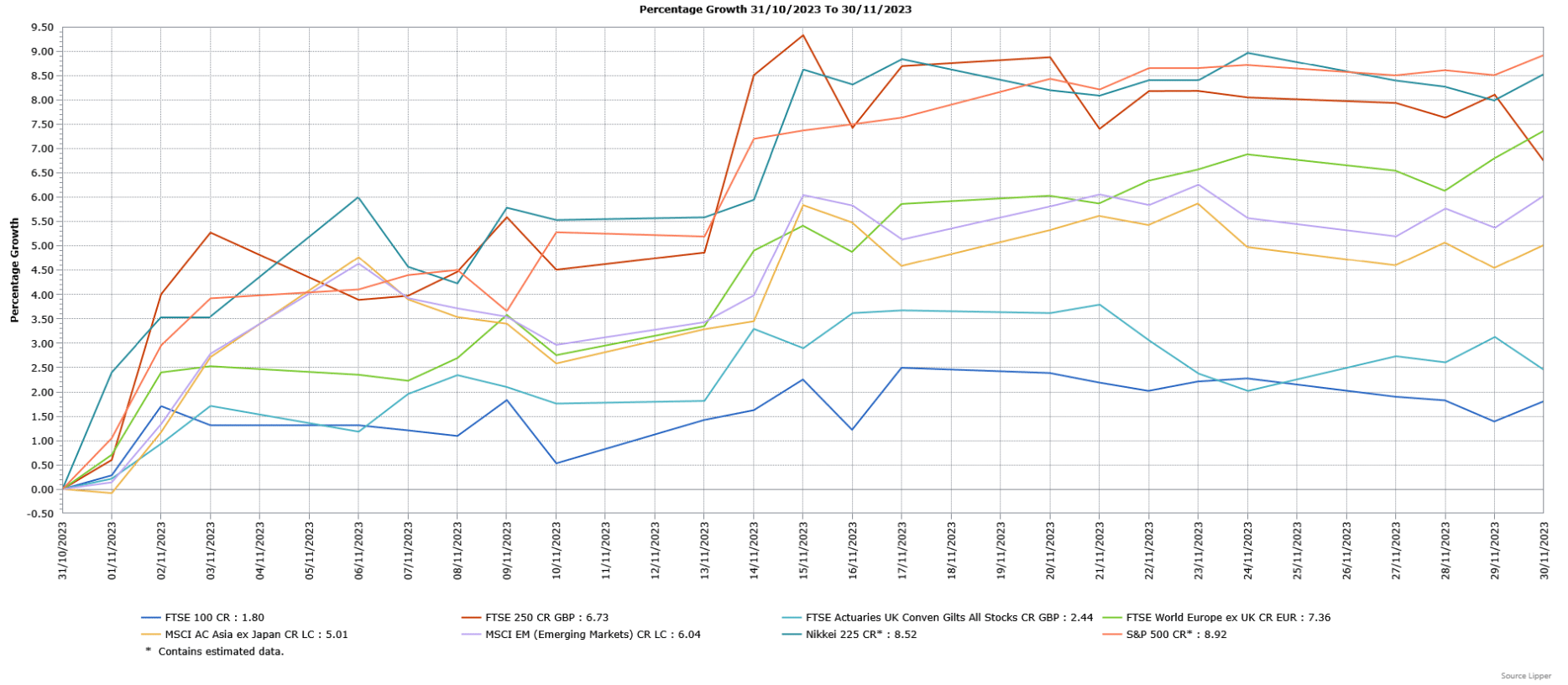

UK equities rose in November, with the mid-cap FTSE 250 sharply outperforming the FTSE 100. The FTSE 100 finished the month with a gain despite the strong performance of sterling weighing on the internationally exposed larger companies, as well as weakness in the energy sector. The more domestically focussed FTSE 250 posted a strong gain amid hopes that interest rates may have peaked.

The US S&P 500 recorded a very strong gain in November following a further fall in inflation and hopes that further interest rate rises may no longer be needed, boosting in particular rate-sensitive sectors. European markets, as demonstrated by the FTSE World Europe ex UK Index, also posted very good returns with falling Eurozone inflation a driver. The Japanese Nikkei 225 finished the month sharply higher, with large cap growth stocks performing particularly well in the first half of November.

The hopes that US interest rates may have peaked also boosted the performance of the broad MSCI Asia ex Japan Index, which ended the month higher with most markets in the region finishing with gains. The Chinese market under-performed due to ongoing concerns over weaker economic growth. Although Global Emerging Markets broadly under-performed developed markets, the broad MSCI Emerging Markets Index still posted a strong gain, supported by hopes of cuts in US interest rates in 2024.

It was a positive month for UK fixed income assets, with gilts participating in the wider global bond rally on hopes interest rates have peaked, further helped by the Bank of England keeping its base rate unchanged. Investment grade corporate bonds outperformed Government bonds (FTSE Actuaries UK Conventional Gilts Index), with both benefiting from falling yields (fixed income prices and yields have an inverse relationship).

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA10761 Exp 12/2024