We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

Global equity markets recorded good gains in November, with Asian and Global Emerging Markets outperforming developed markets. The start of November saw large interest rate increases in the UK and the US that were in line with expectations, whilst investor sentiment was boosted by a bigger than expected fall in US inflation and hopes over a slowdown in the aggressive pace of rate rises. There was further support from an easing in China’s strict zero-Covid measures. UK fixed income assets also finished higher as bond yields fell.

Economic Overview

UK

Bank of England and interest rates

The Bank of England (BoE) raised interest rates by 0.75% to 3%, the biggest single increase since 1989, whilst warning that the British economy might not grow for another two years, which would be the longest downturn since the 1920s. It was not a unanimous vote to raise rates by 0.75%, with one of the nine members preferring a 0.5% increase whilst one opted for a much smaller 0.25% rise. The BoE Governor Andrew Bailey said that “We can’t make promises about future interest rates but based on where we stand today, we think Bank Rate will have to go up by less than currently priced in financial markets”.

The BoE also released its latest Monetary Policy Report, which allows the Monetary Policy Committee (MPC) to share its thinking and explain the rationale underpinning its decisions. The BoE is now forecasting inflation to reach a 40-year high of around 11% in the fourth quarter of this year, but this will then fall below its 2% target by mid-2024, even if interest rates don’t increase any further. The BoE also believes the economy has already entered a recession that may last through 2023 and 2024, shrinking by 2.9% in total. Whilst this would be the UK’s longest downturn since records began in the 1920s, it would not be the deepest recession. Unemployment is forecast to rise to 6.4% by late-2025. However, these forecasts are based on market expectations in late October that interest rates would peak at 5.2%, which is a level the BoE said it did not expect to reach. Nonetheless, Mr Bailey said inflation risks were heavily skewed to the upside and that it was too risky to rule out further rate rises, with the MPC reiterating it would respond forcefully if needed.

Autumn Statement

In the Autumn Statement, the Chancellor Jeremy Hunt announced spending cuts and tax rises, although most of these are scheduled to come into effect after an expected General Election in 2024. Mr Hunt also said the economy was already in a recession.

The Autumn Statement also included updated projections from The Office for Budget Responsibility (OBR), which said that household disposable incomes would fall by 4.3% in the current financial year and by 2.8% in 2023/24, the sharpest declines in records dating back to the 1950s. The falls would also erase all the growth in living standards over the eight years to 2022. The OBR also said that Britain was already in a recession, with its expectation being for the economy to contract by 1.4% in 2023, sharply lower than its forecast of 1.8% growth in March. The OBR forecasts a return to growth in 2024, with the economy to expand by 1.3%.

Economic Growth

The UK economy fell into contraction in the third quarter and although it was by less than expected, it was still the first fall since the start of 2021 when there were strict Covid restrictions in place. The UK economy contracted by 0.2% in the third quarter, which was better than the forecasted 0.5% loss. The contraction means the British economy is now further below its pre-pandemic size, the only one of the Group of Seven yet to fully recover. The Office for National Statistics (ONS) said a decline in manufacturing across most industries drove the fall, whilst adding that customer-facing businesses also “fared badly” with shops hit hard by the cost-of-living crisis.

In September alone, the ONS said the economy shrank by 0.6%, a bigger fall than the forecasted 0.4% contraction and the largest since January 2021. Part of this fall was due to the funeral of Queen Elizabeth II, where the one-off public holiday saw many businesses close. However, the 0.3% contraction in August was revised higher to a smaller loss of 0.1%, whilst July’s 0.1% growth was increased to 0.3%. The ONS said the upwards revision to both July and August’s data broadly reflected new quarterly figures on health and education output, together with some stronger readings from the professional and scientific and wholesale and retail sectors.

Private Sector Survey Data

In more timely data on the UK economy, a closely watched survey showed that cost of living pressures continued to weigh on activity in Britain’s private sector in November. The S&P Global flash composite Purchasing Managers’ Index (PMI) measures activity in the services sector and manufacturing and is an estimate for the full month as it is provided before the end of the period and as such, is not based on the entire range of survey responses. The flash composite PMI rose slightly in November, from its final reading of 48.2 in October to 48.3, a two-month high. The survey reading has now been below the 50-mark separating expansion from contraction for four consecutive months.

Manufacturing continued to see activity decline at a faster pace than the services sector, although the pace in the fall in output eased in November. It was noted by a number of firms that fewer instances of supply shortages had supported production volumes. Companies that reported a downturn in business typically referenced cutbacks in non-essential client spending, due to rising costs and weaker economic conditions. Overall, new work volumes fell for the fourth consecutive month with the rate of decline the sharpest since January 2021, with lower orders from abroad contributing to the fall, especially in the manufacturing sector. There continued to be strong input cost pressures, with the overall rate of inflation only easing slightly from October. Surging energy bills and higher wages remained the main drivers of inflation, whilst sterling weakness resulted in rising import prices. Service sector businesses indicated a much steeper rate of input cost inflation than manufacturing businesses. Prices charged increased at their slowest pace since August 2021, which was attributed by some respondents to weaker demand and greater competitive pressures. Business optimism for the year ahead recovered most of its losses seen during October, but the reading was still the second-lowest since May 2020.

The flash services PMI was unchanged at 48.8 in November, whilst the flash manufacturing PMI also matched its final reading of 46.2 from October. Manufacturing output rose, but is still showing a sharp decline in production despite increasing from 45.0 to 45.4, a four-month high.

Government Borrowing

British government borrowing, which is the difference between spending and tax income, was less than expected in October although it is expected to rise sharply over the coming months due to the impact of the energy cost support measures and a slowing economy. The ONS said public sector borrowing excluding state-owned banks was £13.5 billion, well below the forecasted £22 billion reading, which was higher due to the expectation that the figure would include large first payments under the energy bill support scheme. However, borrowing was £4.4 billion more than in October 2021 and the fourth highest for this month since records began in 1993. The data did include £3.4 billion of “other” subsidies, which is an initial indicative estimate of the energy bill support measures, with the ONS stating that this excluded the scheme for businesses as estimates were not yet available. In October, debt interest payments remained high at £6.1 billion, primarily due to the surge in inflation.

Unemployment & Labour Market Statistics

British unemployment unexpectedly rose in the three months to September, increasing from 3.5% to 3.6%, instead of the forecasted unchanged figure. The ONS said the number of people in employment fell by 52,000, a larger drop than the forecasted decline of 25,000. Job vacancies dropped to 1.23 million, the lowest reading since late-2021. The ONS said job vacancies continued to fall from their peak, with increasing numbers of employers noting that economic pressures are a factor in holding back on recruitment. The biggest falls in vacancies were in hospitality, followed by retailing and wholesaling. Nonetheless, the absolute level of vacancies remains historically high.

The ONS said growth in regular pay excluding bonuses rose by 5.7%, the highest annual rate since 2000 excluding the pandemic period, but taking into account inflation wages fell by 2.7%, which although lower than the record fall it remains among the largest declines since comparable records began in 2001. Employees’ total pay, which includes bonuses, increased by 6% but in real terms after allowing for inflation fell by 2.6%. The ONS also said the difference between public and private sector wage growth was the largest it had seen outside of the pandemic.

Inflation

The annual rate of UK inflation, as measured by the Consumer Price Index (CPI), rose in October to its highest level since 1981. The ONS said that CPI rose 11.1% in the 12 months to October, the most since October 1981 and above both the 10.1% increase in September and the forecasted 10.7%. The ONS said that inflation would have reached 13.8% if the government had not implemented the energy price cap.

Prices of food and non-alcoholic beverages rose at their fastest rate since 1977, with the cost of milk increasing by almost 50% in the past year. There have also been significant rises in the prices of pasta, margarine, butter, cereals and cheese. Energy and fuel costs also rose sharply and remain a key driver of inflation. Core CPI, which excludes volatile food and energy prices, was unchanged at its 30-year high of 6.5%. Producer price data showed there were still inflationary pressures to come, but suggested a possible slowdown as manufacturers’ costs for raw materials and energy rose at their slowest pace since March, although the increase was still huge by historical standards.

Retail Sales

British retail sales recorded a partial recovery from their decline in September, where shops had been closed for the funeral of Queen Elizabeth, but they remained below their pre-pandemic level. Retail sales volumes rose 0.6% in October, ahead of both the forecasted 0.3% gain and the 1.5% fall in September. The ONS said volumes remained 0.6% lower than their pre-pandemic level. October saw a rebound in petrol and diesel sales, whilst volumes at non-food stores also rose, though both were still well below February 2020 levels. However, the recovery didn’t extend to food stores, which saw sales fall. Non-store shops, which are mostly online retailers, saw sales increase 1.8% whilst they remain around a fifth higher than pre-pandemic levels. The ONS also highlighted the downward trend for retail sales, adding that volumes in the three months ending October were 2.4% lower than the previous three months.

Consumer Confidence

Research firm GfK said British consumer confidence edged higher in November, but remained near its record low level. GfK’s Consumer Confidence Index rose from -47 in October to -44 in November, having fallen to a record low of -49 in September. GfK said the improvement likely reflected relief among British consumers over the stabilising of the country’s financial outlook following Prime Minister Liz Truss’ resignation. All five of GfK’s household economic and financial confidence surveys improved in November, but the research firm said the concerns over the cost-of-living crisis and weak economy were unchanged.

US

Interest Rates

In line with expectations, the Federal Reserve (Fed) raised interest rates by 0.75% to a new range of 3.75% to 4%, the highest level since early-2008, but signalled that future increases could be made in smaller steps to account for the “cumulative tightening of monetary policy” it has already implemented. The Fed Chair Jerome Powell said at a news conference following the latest policy meeting that he wanted no confusion over the point around the direction of interest rates, stating that they were still undecided about just how high rates would need to rise to curb inflation and there was determination to “stay the course until the job’s done”. Mr Powell added that “there’s some ground to cover” for the interest rate to reach a “sufficiently restrictive” level that will slow inflation, with the final destination “very uncertain…We’re going to find it over time”. Mr Powell also said the question of when to ease the pace of increases was much less important than the question of how high they need to go and then for how to keep monetary policy restrictive. Mr Powell said it was “very premature” to discuss when the Fed might pause the current cycle of rate rises.

Economic Growth

US economic growth in the third quarter was revised higher from an annualised rate of 2.6% to 2.9%, which was ahead of the forecasted smaller increase to 2.7% and follows the 0.6% contraction in the second quarter. The upward revision was driven by upgrades to growth in consumer and business spending as well as lower imports, which offset the impact from a slower pace of inventory accumulation. Within consumer spending, growth in healthcare and “other” services offset a fall in expenditure on goods, primarily motor vehicles and food and beverages. Non-residential investment was higher, but there was a larger fall in residential investment.

Private Sector Survey Data

S&P Global said that weakness in demand weighed on private sector business activity in November, with lower output across both manufacturing and the services sector. The flash composite PMI fell from 48.2 in October to 46.3 in November, a three-month low and among the quickest seen since 2009. New orders across the private sector fell at their fastest pace since the first Covid-19 wave in May 2020, with both manufacturers and services businesses recording sharp declines. Firms noted the impact of inflation and higher interest rates had led to greater hesitancy and postponements by customers in placing orders. Inflationary pressures eased further in November, with input cost inflation weakening for the sixth consecutive month, although prices were still rising at a pace well above the series average. Businesses highlighted falls in the prices of some key components, as well as reduced freight costs. In line with the slower growth in input costs, selling prices increased at their weakest pace in just over two years, with some firms noting that concessions and discounts were made to entice customers to place orders. The flash services PMI fell from 47.8 in October to 46.1 in November, a three-month low, whilst the flash manufacturing PMI declined from 50.4 to 47.6, a 30-month low. Manufacturing output fell from 50.7 to 47.2, a 30-month low.

Employment

US employment growth was stronger than expected in October, although the pace is slowing whilst unemployment has risen. The Labor Department’s closely watched employment report showed nonfarm payrolls added 261,000 jobs, above the forecasted increase of 200,000, whilst September’s reading was revised higher from a gain of 263,000 to 315,000. There was broad-based hiring in October, which was led by healthcare which added 53,000 jobs. Professional and technical services payrolls added 43,000 jobs, whilst there were increases of 32,000 and 35,000 in manufacturing and leisure and hospitality respectively. However, the leisure and hospitality sector remains 1.1 million jobs below its pre-pandemic level, whilst it also has the most openings. Government payrolls rose by 28,000 jobs and there were moderate gains in interest-rate sensitive sectors such as financial activities and retail trade. Construction payrolls barely rose and there was a small gain for transportation and warehousing.

The unemployment rate, which is obtained from the household survey, rose from 3.5% in September to 3.7% in October, reflecting a 328,000 decline in household employment. Wage growth remained robust, with average hourly earnings increasing 0.4% in October following the 0.3% gain in September, but the year-on-year increase eased from 5% to 4.7%, a smaller rise since August 2021 as last year’s large rises fall out of the calculation.

Inflation

US consumer prices rose by less than expected in October, with the annual increase falling below 8% for the first time in eight months. The Labor Department said the Consumer Price Index (CPI) rose 0.4% in October, matching the increase in September and below the forecasted 0.6% rise. Higher rents were responsible for more than half the increase, whilst gasoline prices rebounded having fallen for three consecutive months. Food prices rose 0.6%, but this was a slower pace relative to recent months. The price of food consumed at home gained 0.4%, the slowest rise since December 2021. For the twelve months through October, CPI rose by 7.7% having increased by 8.2% in September, the smallest gain since January.

The so-called core CPI, which excludes volatile food and energy components, rose 0.3% in October, lower than the 0.6% gain in September. Owners’ equivalent rent, which is what a homeowner would receive from renting a home, rose 0.6%, a slower pace than the 0.8% increase in September. Core services prices rose 0.5%, but there were signs of goods disinflation broadening. Prices of used cars and trucks fell 2.4%, whilst the cost of apparel declined for the second consecutive month with retailers offering discounts to sell unwanted inventory. Prices of furniture and bedding, as well as appliances, also fell meaning core goods prices dropped 0.4% having been unchanged in the previous month. For the 12 months through October, core CPI rose 6.3%, a slower pace than the 6.6% gain in September.

Retail Sales

US retail sales were stronger than expected in October, suggesting consumer spending had picked up early in the fourth quarter. Retail sales, which are mostly goods, rose 1.3% compared with the forecasted 1% increase and followed the unchanged reading in September. On a year-on-year basis, retail sales rose 8.3% in October. It is thought that one-time tax refunds in California may have provided support to retail sales, along with Amazon’s second Prime Day promotion. Overall, there was a broad increase in sales that was led by motor vehicles, with receipts at auto dealers rebounding 1.3% amid improved supply. Higher gasoline prices contributed to a 4.1% increase in receipts at service stations, whilst furniture store sales rose 1.1%. Online retail sales rose 1.2%. However, sales at electronics and appliance stores fell, whilst there were lower receipts at general merchandise stores and sporting goods, hobby, musical instrument and book stores. Clothing stores sales were flat. Receipts at bars and restaurants, the only services category in the retail sales report, rose 1.6% in October. The so-called core retail sales, which exclude automobiles, gasoline, building materials and food services and correspond most closely with the consumer spending component of GDP, rose 0.7% in October, whilst September’s reading was revised higher from a gain of 0.4% to 0.6%.

Consumer Spending

The Commerce Department reported at the beginning of December that US consumer spending, which accounts for more than two-thirds of the US economy, increased solidly in October. Consumer spending rose 0.8% in October, which was in line with expectations and above the unrevised gain of 0.6% in September. Consumers purchased motor vehicles and in particular light trucks, as well as furniture and recreational goods. There was also increased expenditure on dining out and on housing and utilities.

Europe

Economic Growth

In line with the flash estimate, the EU’s Statistics Office, Eurostat, said the Eurozone economy grew by 0.2% in the third quarter compared with the previous three-month period. On a year-on-year basis, growth of 2.1% was also in line with the previous estimate. The European Commission expects the Eurozone economy to contract in the fourth quarter of this year and the first three months of 2023, with surging energy prices and rising interest rates negatively impacting on spending, borrowing power and confidence.

Inflation

Eurostat’s preliminary estimate of inflation in the Eurozone showed prices falling in November for the first time in 17 months. Consumer price growth in the 19 countries sharing the euro fell from 10.6% to 10%, well below the forecasted smaller fall to 10.4%. An easing in the pace of energy price increases was the main driver of the slowdown in inflation, but prices for food, alcohol and tobacco continued to rise at a faster rate. Inflation excluding volatile energy and food prices increased from 6.4% to 6.6%, whilst an even narrower measure that also excludes alcohol and tobacco was unchanged at 5%.

Germany

The German economy grew by more than initially estimated in the third quarter, supported by consumer spending. Europe’s largest economy grew 0.4% quarter-on-quarter in the third quarter, ahead of the preliminary estimate of 0.3%, which was also the forecasted gain. Household spending was the main driver of the higher figure, with consumers travelling and going out more after almost all Covid-19 restrictions had been lifted and despite rising inflation and the energy crisis. Government spending was flat, whilst investment in construction fell. However, investment in machinery and equipment saw strong growth. Trade with foreign countries rose, helped by continuing orders and improved supply chains, with both exports and imports rising. Most service sectors saw growth, whilst manufacturing was the key driver within production. On an annual basis, the German economy grew 1.3% in the third quarter, ahead of the forecasted 1.2% expansion that matched the preliminary estimate.

Preliminary survey data showed the German private sector remained in contraction in November, although the rate of decline eased compared with recent months. The S&P Global flash composite PMI rose from to 45.1 in October to 46.4 in November, a three-month high. The services sector suffered a similar downturn to the previous month and whilst manufacturing output continued to decline, the pace eased from October with goods producers noting improved material availability. New business inflows continued to fall at a sharp rate, with a combination of high inflation and uncertainty weighing on demand for goods and services. Manufacturers saw a steeper decline in new orders, although less marked than in October, whilst the fall in the service sector gathered pace as it reached the fastest rate since May 2020. Inflationary pressures remain at historically high levels, but there were further signs of easing in pipeline price pressures, with businesses reporting the weakest rise in input costs since May 2021, notably in the manufacturing sector. Average prices charged for goods and services continued to rise sharply as businesses looked to pass on higher costs to their customers. Whilst the rate of output price inflation eased to its second slowest in the past nine months, it remained quicker prior to this period than at any time in the series history dating back to 2002.

The flash services PMI fell slightly from 46.5 in October to 46.4 in November, a two-month low, but the flash manufacturing PMI rose from 45.1 to 46.7, a two-month high. Manufacturing output jumped from 42.3 to 46.4, also a two-month high.

France

The INSEE official statistics agency said the French economy expanded by 0.2% in the third quarter, in line with its preliminary estimate and consensus forecasts. Household consumption declined, driven by lower goods expenditure, but government spending jumped higher having declined in the previous period. Gross fixed capital formation (also called investment) was higher, whilst there was a positive contribution from net foreign demand as both exports and imports rose. On an annual basis, the economy grew 1% in the third quarter, also in line with the preliminary estimate.

The latest private sector survey data indicated that the French economy contracted in November, the first monthly decline since February 2021. The S&P Global flash composite PMI fell from 50.2 in October to 48.8 in November, a 21-month low. Whilst manufacturing production fell for the sixth consecutive month, a decline in service sector activity was the main driver of the overall contraction. Companies reported that falling client demand was a key reason for lower output levels across both manufacturing and the services sector, whilst some businesses also noted the negative economic impact of the uncertain outlook. New business orders declined, with respondents linking higher prices to weaker demand conditions, as well as high energy costs on the purchasing power of customers. An easing in input cost inflation was helped by falling supply chain disruptions, most notable in the manufacturing sector. Prices charged for goods and services continued to rise sharply, although the overall pace was the slowest since August.

The flash services PMI fell from 51.7 in October to 49.4 in November, a 20-month low, but the flash manufacturing PMI rose from 47.2 to 49.1, a three-month high but still in contraction. Manufacturing output also rose, increasing from 43.5 to 46.0, a three-month high, but again the reading remained in contractionary territory.

Asia and Emerging Markets

Japan

Japan’s economy unexpectedly contracted for the first time in a year in the third quarter. Whilst the recent lifting of Covid curbs should have been beneficial, the economy has come under pressure from surging global inflation, rising worldwide interest rates and the war in Ukraine. The economy contracted by an annualised 1.2% in the third quarter, sharply below the forecasted 1.1% expansion and the revised gain of 4.6% in the second quarter. On a quarter-on-quarter basis, the economy fell by 0.3% compared with the forecasted 0.3% gain. The contraction was driven by a slowdown in private consumption, which makes up more than half the Japanese economy. Although private consumption rose 0.3%, above the forecasted 0.2% gain, this was well below the 1.2% rise in the previous quarter. In addition, large gains in imports offset growth in exports, meaning external demand produced a negative contribution of 0.7%. Weakness in the yen also made imports more expensive, impacting on consumer spending growth.

China

The National Bureau of Statistics (NBS) said that China’s manufacturing and services activities fell further into contraction in November, amid ongoing strict Covid restrictions and weakening global demand. The official manufacturing PMI fell from 49.2 in October to 48.0 in November, further below the 50-mark separating expansion from contraction but slightly above the forecasted drop to 49.0. The data showed that the sub-indexes for the manufacturing PMI, including output, employment and suppliers’ delivery times, all contracted in November at a faster pace than the previous month. In addition, new orders and new export orders fell further, broadly due to weakening domestic and foreign demand. The official non-manufacturing PMI fell from 48.7 in October to 46.7 in November, whilst the official composite PMI, which includes both manufacturing and services activity, fell from 49.0 to 47.1. The official PMI surveys focus on the largest sample of companies, although the majority are big and state-owned enterprises.

Both China’s exports and imports unexpectedly contracted in October, the first simultaneous fall since May 2020. Exports declined by 0.3% in October compared with a year earlier, which was much lower than the 5.7% gain in September and the forecasted 4.3% increase. Surging inflation in major economics has weighed on external demand. In addition, it was the worst performance since May 2020. Imports fell by 0.7% in October, below the 0.3% gain in September and the forecasted 0.1% increase. Domestic demand continues to be affected by ongoing Covid restrictions and the slump in the property market, which has hit importers.

Industrial production and consumer data also suggested China’s economy lost some momentum, with demand easing both at home and abroad. The NBS said industrial production rose 5% year-on-year in October, below the forecasted 5.2% gain and slower than the 6.3% increase in September. Retail sales declined for the first time since May, with the year-on-year fall of 0.5% below the forecasted 1% gain and the 2.5% increase in September. A week-long National Day holiday was unlikely to have helped consumption in October, which is traditionally a popular month for domestic travel. Further Covid-19 outbreaks disrupted pandemic-sensitive sectors, including the restaurant industry. The NBS said domestic Covid containment measures were placing a “huge” pressure on the economy, adding that downside risks from the global economy were increasing. In addition, property investment declined 16% year-on-year in October, its largest fall since January-February 2020.

Malaysia

In line with expectations, Malaysia’s central bank raised its interest rate by 0.25% to 2.75%, the highest level since February 2020 and the fourth consecutive increase. The bank is looking to contain persistent inflation amid a positive growth outlook, noting that the increase would “pre-emptively manage the risk of excessive demand on price pressures” and came against the backdrop of “positive growth prospects”. The bank also said that headline inflation likely peaked in the third quarter, but was expected to remain elevated heading into 2023. The bank reiterated that it was not on any pre-set course, with any adjustment to monetary policy going forward dependent on evolving conditions and their implication on the outlook for growth and inflation.

The Malaysian economy expanded at its fastest pace in over a year in the third quarter, although the central bank highlighted that the outlook was uncertain due to the risk of a global slowdown. The economy expanded 14.2% in the third quarter from a low base a year earlier, when activity was impacted by Covid-19 restrictions, with the pace ahead of the forecasted 11.7% gain and the 8.9% increase in the previous period. The stronger than expected expansion was driven by a continued increase in domestic demand, a recovery in the labour market, solid exports and ongoing policy support. On a quarter-on-quarter basis, the economy expanded by a seasonally-adjusted 1.9%, which was slower than the 3.5% in the previous period.

Indonesia

The Indonesian economy expanded at its fastest pace in more than a year in the third quarter, supported by improved investment and government spending. Southeast Asia’s largest economy grew 5.72% year-on-year in the third quarter, ahead of the 5.44% increase in the previous three-month period but below the forecasted growth of 5.89%. Unadjusted for seasonal factors, on a quarter-on-quarter basis the economy expanded by 1.81% compared with the previous three months, above the forecasted 1.62% gain. Investment rose at its fastest pace in over a year, whilst private consumption remained robust and government spending fell more slowly compared with the previous quarter. Although exports rose strongly, their net contribution fell as imports also rose.

As expected, Indonesia’s central bank raised interest rates by 0.5% for a third consecutive month to 5.25%. The Governor Perry Warjiyo said that the “front-loaded” and “pre-emptive” increase was aimed at anchoring inflation expectations and providing further support for the rupiah. The Governor also highlighted that whilst the global economy was slowing and some countries were facing the risk of recession, activity in Indonesia was improving and the central bank maintained its forecast that growth will beat the upper end of its 4.5% to 5.3% range in 2022, whilst it will be “high” next year. Mr Warjiyo also said that “Bank Indonesia will strengthen monetary policy response to lower inflation expectations that are currently too high”, whilst adding the increases were more “measured” and not as “aggressive” as in other countries.

Hong Kong

Government data confirmed Hong Kong’s economy contracted by 4.5% in the third quarter compared with a year earlier, the third consecutive quarter of year-on-year contraction and in line with the advance estimate. The government further lowered its full-year growth forecast from between 0.5% and -0.5% to a contraction of 3.2%. Weak performance in external trade was the main negative contributor, with exports of goods falling sharply whilst services also fell. Private consumption remained broadly flat, whilst government spending eased compared with the previous quarter. Gross fixed investment also fell at a much quicker pace than the second quarter.

Thailand

Thailand’s economy expanded 1.2% quarter-on-quarter in the third quarter, ahead of both the forecasted 0.9% gain and the 0.7% increase in the previous three-month period. Economic growth was boosted by a fourth consecutive quarterly increase in household consumption, which remained resilient despite growing cost pressures. Fixed investment rebounded strongly from its decline in the second quarter, whilst government spending fell at a slower pace than the previous period. Net trade was a negative contributor, with exports falling and imports rising in the third quarter. A rebound in industrial output led an improvement in the non-agricultural sector, whilst services sector activity grew for the fifth consecutive quarter, but there was a contraction in agricultural output. On a year-on-year basis, Thailand’s economy expanded 4.5%, in line with expectations and the most in five quarters.

In line with expectations, Thailand’s central bank raised interest rates by 0.25% to 1.25%. The third consecutive 0.25% increase comes as the central bank tries to contain above target inflation, as well as supporting an economic recovery amid increasing global headwinds. The Bank of Thailand’s forecasts for economic growth this year and in 2023 were reduced slightly, whilst its inflation projection for next year was increased from 2.6% to 3%.

South Korea

In line with expectations, the Bank of Korea (BoK) raised its interest rate by 0.25% to 3%, the highest level since July 2012. The BoK elected to slow the pace of increases following two 0.5% hikes, with the aim of minimising pressure on the economy whilst looking to keep inflation under control. The BoK said growth in 2022 would be in line with August’s forecast of 2.6%, but for 2023 the projection was reduced from 2.1% to 1.7%. Headline inflation is expected to be 5.1% in 2022 and 3.6% next year.

Central bank data showed the South Korean economy expanded by 0.3% quarter-on-quarter in the third quarter, in line with the advance estimate but below the 0.7% in the previous three-month period. Growth was supported by an increase in private consumption and facilities investment, but construction investment declined as civil engineering fell. Exports rose 1.1%, whilst there was a 6% increase in imports due to higher inflows of crude oil and natural gas. On a year-on-year basis, the economy expanded 3.1% in the third quarter.

Singapore

Singapore’s economy expanded by 4.1% year-on-year in the third quarter, slower than both the flash estimate of 4.4% and the forecasted 4.3% growth. The expansion in the manufacturing sector was weaker than in the previous quarter, amid falls in the electronics, chemicals and biomedical clusters. However, construction activity was the strongest in a year, with both public and private sectors seeing growth. The services sector grew by more than in the second quarter, benefiting from increased output in both wholesale trade and food & beverages, as well as in retail trade, transport, real estate, information and other services. On a quarterly basis, the economy grew by 1.1%, below the forecasted 1.3% gain but ahead of the 0.1% contraction in the second quarter.

Taiwan

Taiwan’s economic growth for the third quarter was revised slightly lower from the preliminary estimate of 4.1% year-on-year to 4.01%, but this was quicker than the downwardly revised 2.95% expansion in the previous quarter. Private consumption rose at a faster rate, led by increased spending on retail, dining out, recreation and transport. However, there was a slowdown in government spending and gross fixed capital formation (also known as investment). On a seasonally-adjusted quarterly basis, the economy expanded 1.83% compared with the 2.37% contraction in the previous period. The statistics office also said Taiwan’s economy was likely to grow more slowly in 2023, due to the impact of global inflation, interest rate rises and China’s zero-Covid policy, with its estimate being reduced from 3.05% to 2.75%.

India

India’s economy expanded by 6.3% year-on-year in the third quarter, slightly above the forecasted 6.2% growth but well below the 13.5% gain in the previous quarter. Government capital spending rose strongly, boosted by increased expenditure on infrastructure such as roads and railways. Private consumption rose albeit at a slower pace than in the second quarter, with support from pent-up demand particularly for services. Among the key sectors, agricultural output rose as did construction, but manufacturing declined. Both imports and exports rose at a slower pace compared with the previous quarter, with the latter impacted by an easing in global demand.

Mexico

As expected, Mexico’s central bank (Banxico) raised its key interest rate by 0.75% to a record 10%. However, it was a split decision to do so with one of the five members preferring a 0.5% rise, indicating that future increases may not be as aggressive. Banxico said that at its “next meetings, the board will assess the magnitude of the upward adjustments to the reference rate based on the prevailing conditions”. The central bank projects inflation to move to its 3% target in the third quarter of 2024, whilst the forecast for average annual inflation for the fourth quarter of this year has been reduced from 8.6% to 8.3%. Banxico did also acknowledge that the balance of risks that might impact on the trajectory of inflation within the forecast horizon remains biased to the upside.

The national statistics agency INEGI said the Mexican economy grew 0.9% in the third quarter, slightly lower than the forecasted 1% expansion that was in line with the preliminary estimate. There was growth across all areas of the economy, with the primary, secondary and tertiary sectors all enjoying expansions in the third quarter. On a year-on-year basis, the economy expanded 4.3%, ahead of the forecasted 4.1% growth.

Turkey

Turkey’s central bank reduced its interest rate by 1.5% to 9%, whilst also stating that it will end its current rate-cutting cycle as signalled at its previous meeting. The interest rate cuts have come despite soaring inflation that hit 85% in October and a plunge in the lira that has fallen around 55% to around record lows. The central bank is to begin the disinflation process, where measures will be implemented to pursue currency and price stability.

Turkey’s economy expanded by 3.9% year-on-year in the third quarter, which was slower than the upwardly revised 7.7% in the previous period and marginally below the forecasted 4% growth. This was also the weakest pace since the contraction in the second quarter of 2020. Household spending rose at a slower pace compared with the previous quarter, whilst investment contracted. Exports rose at a softer pace, but imports saw stronger growth. Government consumption was much stronger than in the previous quarter. On a seasonally-adjusted quarter-on-quarter basis, the economy contracted by 0.1%.

Russia

Data from the Rosstat federal statistics office showed the Russian economy contracted by 4% year-on-year in the third quarter, a slight improvement on the 4.1% fall in the second quarter. Russia’s economy remains under pressure from sanctions by Western countries in retaliation to the invasion of Ukraine. The Russian central bank has projected that the economy will contract by 7.1% year-on-year in the fourth quarter, as natural gas exports to Europe have nearly halted and seaborne oil shipments are set to be heavily sanctioned in December.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

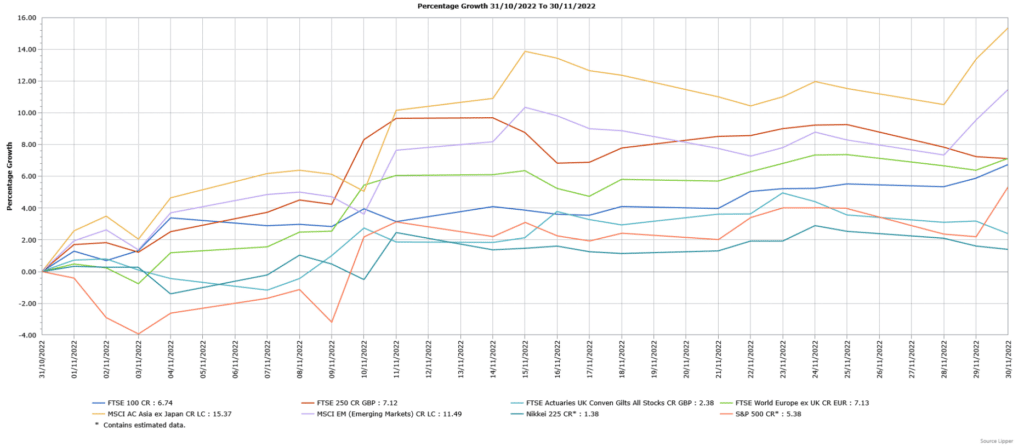

UK markets produced strong gains in November, with the mid cap FTSE 250 outperforming the FTSE 100. Commodity-linked stocks boosted the FTSE 100, as they benefited from hopes of a Chinese demand recovery, whilst energy stocks also performed well. The easing in UK political concerns helped the more domestically focused FTSE 250, as did the better than expected UK economic growth data.

US indices rose in November, as shown by the S&P 500, with the fall in inflation and hopes over an easing in the aggressive pace of interest rate rises boosting investor sentiment. European markets, as demonstrated by the broad FTSE World Europe ex UK Index, enjoyed strong gains after Eurozone inflation fell by more than expected and hopes of an easing in China’s Covid restrictions, which boosted luxury goods stocks in particular. The Japanese Nikkei 225 Index also ended November higher, although its performance lagged other developed markets.

Strong performance from China and Hong Kong in particular boosted the returns from Asian markets, with the broad MSCI Asia ex Japan Index enjoying a very strong gain. Market sentiment was boosted by US and China leaders signalling a desire to improve US-China relations, as well as signs that Beijing was preparing to relax some of its strict Covid-19 restrictions. Global Emerging Markets also benefited from this Chinese newsflow, together with the weaker US dollar, as shown by the double-digit gain in the broad MSCI Emerging Market Index. In a reversal from recent months, Emerging Asia was the strongest performer, followed by Emerging Europe, Middle East and Africa (EMEA) and then Latin America.

Fixed income markets performed well in November, supported by hopes over a peak in US inflation and a potential easing in the pace of interest rate rises. Bond yields fell (fixed income prices and yields have an inverse relationship), as sterling corporate bonds outperformed gilts (FTSE Actuaries UK Conventional Gilts Index).

This update is intended to be for information only and should not be taken as financial advice.

Short-term Key Dates

· 20th December – Bank of Japan Interest Rate Decision

· 21st December – UK Public Sector Finances for November

· 22nd December – UK GDP 3rd Quarter Final Estimate

· 22nd December – US GDP 3rd Quarter Final Estimate

· 6th January – US Non-Farm Payrolls for December

· 12th January – US Inflation for December

· 13th January – UK Monthly GDP for November

· 17th January – China GDP 4th Quarter

· 18th January – UK Labour Market Statistics

· 18th January – Bank of Japan Interest Rate Decision

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA8744 Exp 12/2023