We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

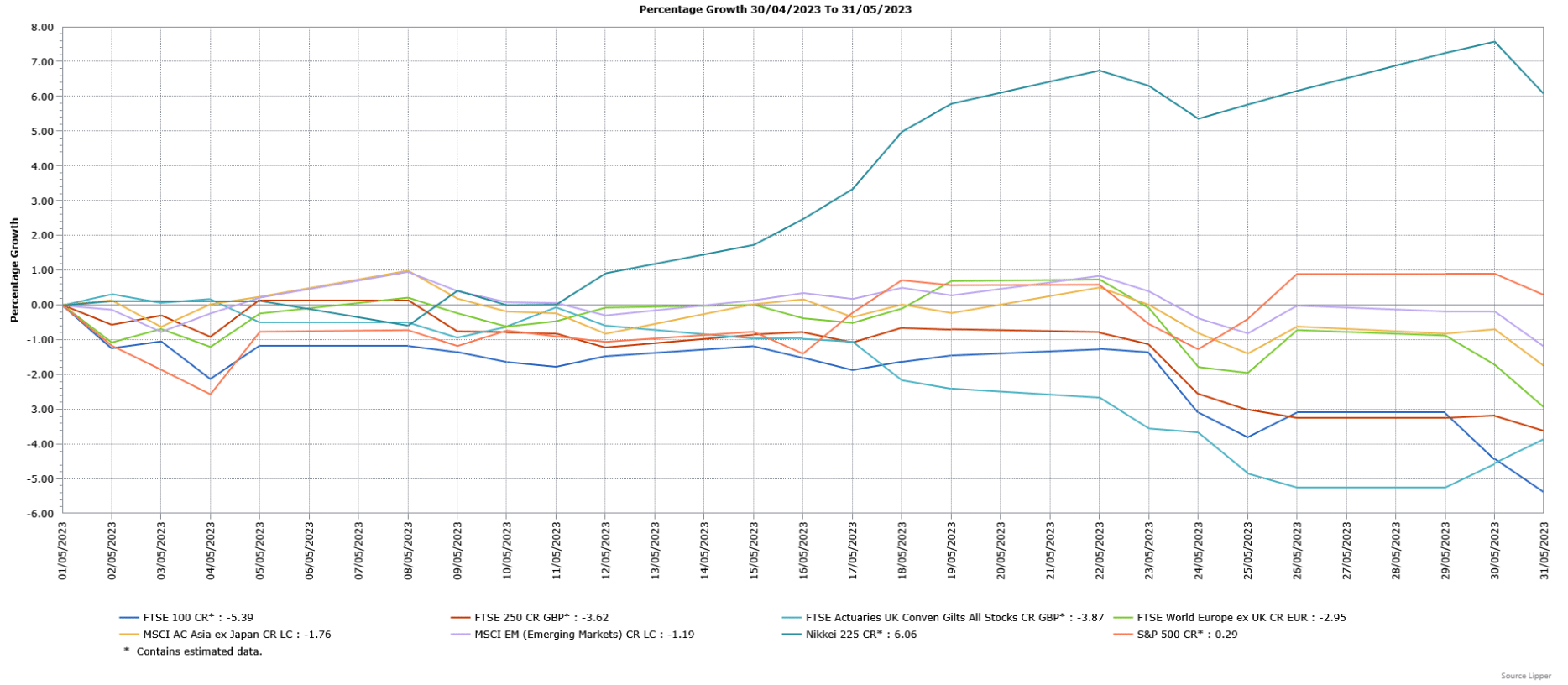

Global equity markets broadly fell in May, where concerns over the ongoing discussions regarding the US debt ceiling were a key driver of the difficult conditions. However, there were some outliers, with notably the US S&P 500 finishing nominally higher, but this was driven by a small number of large cap tech stocks. Asian markets were also impacted by weakness in China, amid disappointing economic data. UK fixed income assets fell, with gilts underperforming due to persistent inflation and increased expectations of further interest rate rises.

Economic Overview

UK

Bank of England and Interest Rates

In line with expectations, the Bank of England (BoE) raised its interest rate by 0.25% to 4.5%, the twelfth consecutive increase. The Monetary Policy Committee (MPC) voted by a majority 7-2 to increase the rate by 0.25%, with two members again preferring to keep the rate at 4.25%. At the press conference following the announcement, the BoE Governor Andrew Bailey said “We have to stay the course to make sure inflation falls all the way back to the 2% target”, before stressing that the BoE was not sending any signals about its next moves, which will be data-dependent. The BoE maintained its message from earlier in the year, stating “If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required”.

The BoE also released its latest Monetary Policy Report, containing its updated economic projections. The BoE now expects inflation to fall more slowly than it previously hoped, mostly due to big and persistent rises in food prices. In addition, the BoE also sees stronger wage growth than previously projected. The BoE now expects inflation to fall to 5.1% by the end of this year, which represents a smaller decline than its previous projection of a fall to 3.9%. The BoE predicts inflation will not return to its 2% target until early- -2025. However, the BoE no longer expects the British economy to fall into recession as it made the biggest upgrade to its growth projections since it first published forecasts in 1997. The BoE revised its February forecast of a 0.5% contraction for 2023 upwards to growth of 0.25%, although the pace remains extremely modest.

Economic Growth

The Office for National Statistics (ONS) said Britain’s economy grew sluggishly in the opening three months of this year, with an unexpectedly sharp fall in March weighing on the overall figure. In line with expectations, the ONS said the economy expanded 0.1% in the first quarter, the same as the fourth quarter of last year. The ONS also said that output was 0.2% higher than a year earlier, but was 0.5% lower than the fourth quarter of 2019 – before the pandemic – a weaker rebound than any major advanced economy. Widespread strikes weighed on overall economic activity in the first quarter. The dominant services sector grew 0.1%, but there were stronger increases in the smaller construction sector (0.7%) and manufacturing (0.5%). However, there were falls elsewhere, including in education, health and transport and storage. Household consumption showed no growth amid high inflation, but there was a positive contribution from business and government investment.

For the month of March, the ONS said there was a contraction of 0.3%, below the forecasted unchanged reading. Whilst there was growth in industrial output and construction, the much larger services sector declined 0.4%, reflecting disappointing car sales and weakness in the retail sector, amid unusually rainy weather and high inflation.

Unemployment & Labour Market Statistics

British unemployment rose from 3.8% to 3.9% in the three- -months to March, slightly above the forecasted unchanged reading though still low by historical standards. The ONS said the increase was linked to more people, mainly men, seeking to return to work and therefore being counted as part of the jobs market. Job vacancies declined for the tenth consecutive month, falling by 55,000 to 1.083 million in the three months to April. The economic inactivity rate, which is the share of people not in work and not looking for it, fell to 21% in the three months to March. The ONS also said those inactive due to long-term sickness rose to a record high.

The pace of wage growth eased, though pay continued to increase. The ONS said regular pay excluding bonuses rose by an annual 6.7% in the three- -months to March, only a 0.1% increase on the previous period and below the forecasted rise to 6.8%. Average regular pay growth for the private sector was 7%, whilst the public sector saw an increase of 5.6%, the highest since the three- -months to October 2003. When adjusted for inflation, regular pay fell by 2%. In line with expectations, employee’s total pay, which includes bonuses, increased by an annual 5.8%, but in real terms declined by 3%.

Inflation

The annual rate of UK inflation, as measured by the Consumer Price Index (CPI), fell in April, but by less than expected as the rate remained stubbornly high. The ONS said CPI rose by 8.7% in annual terms in April, which was lower than the 10.1% rise in March but below the forecasted bigger fall to 8.2%. The smaller than expected fall means Britain still has the joint highest rate of inflation among the Group of Seven advanced economies alongside Italy. The fall in inflation was driven by slower electricity and gas price rises compared with the previous extreme jumps. However, annual food and drink price inflation eased only slightly from March, when it hit its highest rate since 1977, falling from 19.2% to 19.1%. The ONS said some vegetables were more expensive than a year ago, including potatoes, but the price of staples such as bread, cereal, fish, milk and eggs had fallen compared with March.

Core CPI, which excludes volatile components such as food and energy prices, rose from 6.2% in March to 6.8%, the highest since March 1992 and well ahead of the expected unchanged reading. Goods inflation eased from 12.8% to 10%, but service prices rose from 6.6% to 6.9%, also the highest level since March 1992.

US

Federal Reserve and Interest Rates

In line with expectations, the Federal Reserve (Fed) raised its interest rate by 0.25% to a 5%-5.25% range, whilst amending its policy statement language by dropping a reference stating that it “anticipates” further increases would be needed. Whilst the change in language doesn’t mean that there will not be another increase at its June meeting, the Fed Chair Jerome Powell said it was now an open question whether further hikes will be warranted in an economy still facing high inflation, but also showing signs of a slowdown as well as the risk of tighter bank credit conditions. The Fed said that “in determining the extent to which additional policy firming may be appropriate”, officials would consider how the impact of monetary policy was accumulating in the economy. However, Mr Powell said at a press conference following the announcement that inflation remains the chief concern and that it is therefore too soon to say with certainty that the rate-hike cycle has finished. Mr Powell also said “We are prepared to do more”, with policy decisions at future meetings to be made on a “meeting-by-meeting” basis. Mr Powell also said a move to cut rates later this year was unlikely, especially with the committee’s view that inflation is not going to come down so quickly and will take some time, meaning a reduction this year would not be appropriate.

Economic Growth

In its second estimate, the Commerce Department confirmed US economic growth slowed in the first quarter. Whilst the reading was revised higher from 1.1% annualised growth to 1.3%, it was still slower than the 2.6% pace seen in the final three months of last year. It was though ahead of the forecasted unchanged reading. The upward revision reflected upgrades to inventory investment, state and local government spending, non-residential fixed investment and exports. However, residential fixed investment was revised lower.

Inflation

Headline US consumer prices fell below 5% in April for the first time in two years. The Labor Department said the Consumer Price Index (CPI) rose 0.4% in April, which was in line with expectations and follows the 0.1% gain in March. High rental costs continued to be the main driver of the increase in inflation. Food prices were unchanged for the second consecutive month, with grocery store prices declining 0.2% having fallen 0.3% in March, the first back-to-back falls since July 2019. Fruit and vegetables, meat, fish and eggs were also all cheaper compared with the previous month, whilst milk prices fell 2%, the biggest decline since February 2015. Natural gas prices dropped 4.9%, whilst the cost of electricity fell for a second consecutive month. However, gasoline prices rebounded 3%, having fallen 4.6% in March. For the twelve months through April, CPI rose 4.9%, the smallest year-on-year rise since April 2021 and just below the 5% gain in March.

The so-called core CPI, which excludes volatile food and energy components, rose 0.4% in April, matching March’s gain. The first gain in used cars and trucks prices since June lifted monthly core CPI, whilst also boosting broad core goods prices, which rose 0.6%, the most since mid-2022. Owners’ equivalent rent, which is what a homeowner would receive from renting a home, rose 0.5% for a second consecutive month. The cost of airline fares fell 2.6%, whilst hotel and motel room prices dropped 3%, but there was a jump in the cost of recreation and personal services. Overall services inflation excluding shelter edged 0.1% higher, having been unchanged in March. For the 12 months through April, core CPI rose 5.5%, slightly lower than the 5.6% gain in March.

Europe

European Central Bank and Interest Rates

The European Central Bank (ECB) slowed the pace of its interest rate increases from the series of 0.75% and 0.5% hikes, but indicated more tightening was to come at future meetings. All the ECB policymakers bar one agreed with the 0.25% increase in the main interest rate to 3.25%, which was also in line with expectations. The ECB President Christine Lagarde told a press conference “We are not pausing – that is very clear”, adding “We know that we have more ground to cover”. Ms Lagarde also said that interest rates were not yet “sufficiently restrictive” to get inflation to fall to the ECB’s 2% target, whilst referencing future “policy decisions”, suggesting more than one additional increase could be needed. Ms Lagarde said there were still big upside risks to inflation, notably from recent wage deals and high corporate profit margins, and that financial conditions were still not sufficiently tight. The ECB also said it would stop reinvesting cash from maturing debt in its €3.2 trillion Asset Purchase Programme from July.

Economic Growth

In its second estimate, the EU’s Statistics Office, Eurostat, confirmed its preliminary figure of 0.1% quarter-on-quarter growth in the first three months of this year, which follows a flat fourth quarter of 2022. At the time of the estimate, among the Eurozone’s largest economies, Germany registered no growth, whilst there was a contraction in the Netherlands. However, there were expansions in France, Italy and Spain. Eurostat also confirmed the annual growth rate of 1.3%, again in line with its preliminary estimate.

Inflation

In line with the preliminary estimate, Eurostat confirmed headline inflation was slightly higher in April although there was a slight easing in the pace of core price increases. Headline consumer prices increased 7% in April, just above the 6.9% pace in March, as rising services and energy costs offset a slowdown in food price growth. When excluding volatile food and fuel prices, inflation eased from 7.5% to 7.3%, whilst an even narrower measure, which also excludes alcohol and tobacco, fell from 5.7% to 5.6%, its first decline since June 2022. Service inflation, which is driven primarily by labour costs, increased from 5.1% to 5.2%.

Asia and Emerging Markets

Japan

Japan’s economy came out of recession in the first quarter of this year, as a post-Covid rebound in consumption offset global headwinds. Government data showed the world’s third largest economy grew by an annualised 1.6% in the first quarter, well above the forecasted 0.7% expansion as well as the first growth in three quarters. The expansion followed a 0.1% contraction in the final quarter of 2022, which had been revised lower from a 0.1% gain. Private consumption, which represents over half the economy, rose 0.6% in the first quarter compared with the previous three-month period, ahead of the forecasted 0.4% increase, as Japan’s reopening from the pandemic boosted spending on services. Capital expenditure was also much stronger than expected, rising 0.9% in contrast to the forecasted 0.4% decline. The strength in domestic demand offset weaker exports, which fell 4.2% in the opening three months of this year, the first decline in six quarters. As a result, external demand (net exports) reduced economic growth by 0.3%, highlighting the impact of slowing global growth on Japanese manufacturers.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK indices finished May with losses, with the large cap FTSE 100 suffering a bigger fall than the mid cap FTSE 250. UK markets were hit by a rise in core inflation and the subsequent increase in expectations of further interest rate rises. The FTSE 100 was also impacted by losses in large diversified energy and basic materials companies amid broad-based weakness in commodity prices. The technology sector was the only one to rise, though banks broadly held their value.

Whilst the US S&P 500 just about rose in May, there was a wide variation in sector returns. Overall investor sentiment was significantly impacted by concerns over a possible government default amid the ongoing debt ceiling negotiations, which were finally agreed at the end of the month. Although most sectors struggled to make any headway, the technology sector performed strongly amid increased focus on artificial intelligence. Following a period of good performance, European indices, as demonstrated by the FTSE World Europe ex UK Index, fell in May, impacted by the US debt ceiling uncertainty and concerns over a global economic slowdown. The Japanese Nikkei 225 Index was another outlier as it rose above 31,000 for the first time in 33 years, with support from optimism around the end of deflation, a weaker yen, reforms to the Tokyo Stock Exchange and positive corporate earnings updates.

The broad MSCI Asia ex Japan Index finished lower, driven by sharp declines in Hong Kong and China that offset gains elsewhere in the region, particularly those with large technology sectors such as Taiwan and South Korea. As well as the uncertainty over the US debt ceiling negotiations, Hong Kong and China in particular were impacted by worse than expected Chinese economic data and weakening demand. Global Emerging Markets also declined in May, as shown by the loss for the broad MSCI Emerging Markets Index, with the US debt ceiling and weakness in China again a factor, but all the regions posted negative returns. Europe, Middle East and Africa (EMEA) was the weakest performer, particularly South Africa, followed by Latin America and Emerging Asia.

Government bonds (FTSE Actuaries UK Conventional Gilts Index) underperformed investment grade bonds in May, although both finished lower. Further increases in interest rates during the month weighed on performance, but gilts in particular were negatively affected by disappointing inflation data and the increased expectation that the Bank of England would need to raise interest rates by more than previously estimated.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA10166 Exp 06/24.