We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

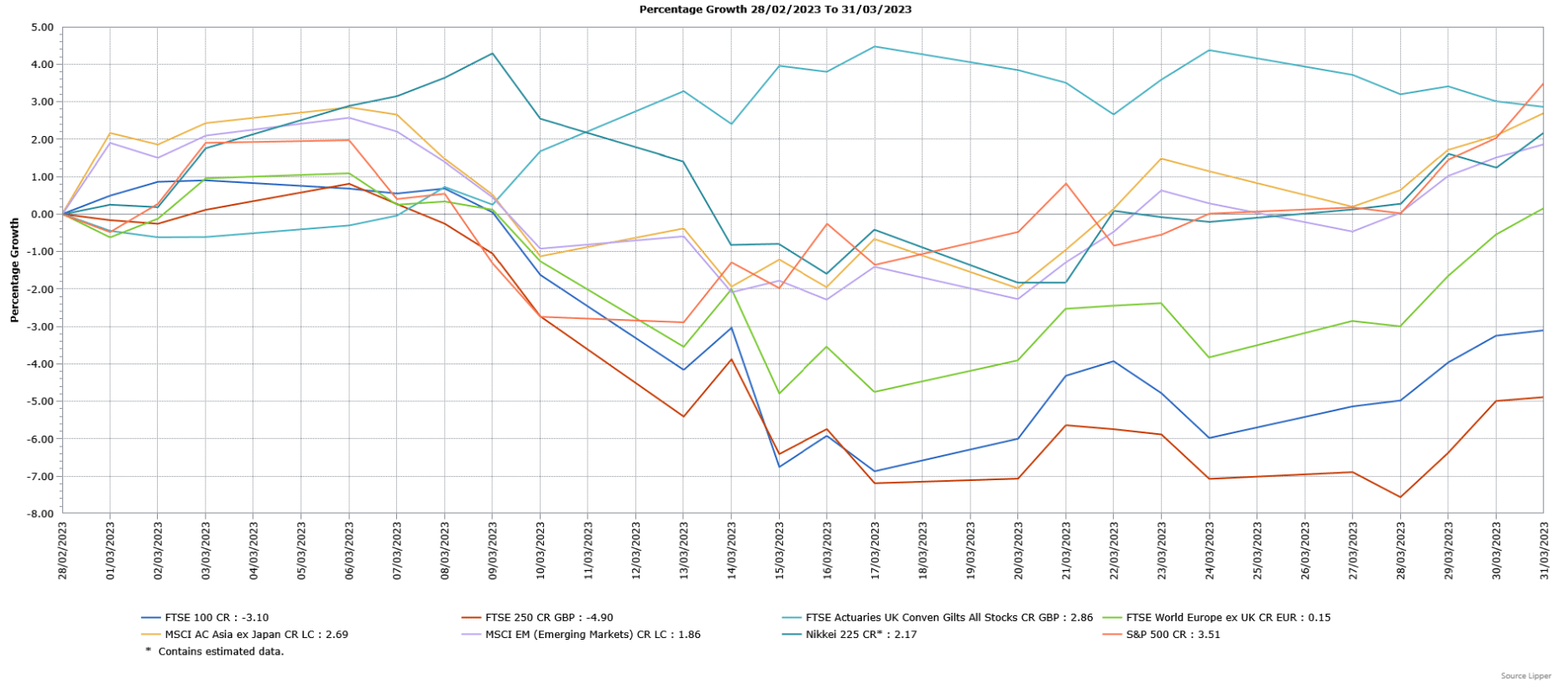

There was significant volatility in global equity markets during March due to concerns over the banking sector, following the collapse of two US banks and UBS’s forced take-over of Credit Suisse. However, despite the initial negative impact on investor sentiment, most global equity markets still ended March higher, with the main outlier being UK indices which suffered from persistently high inflation and the sell-off in banking shares. Fixed income markets were also volatile, though they too finished March higher.

Economic Overview

UK

Bank of England and Interest Rates

In line with expectations, the Bank of England’s (BoE) Monetary Policy Committee (MPC) voted 7-2 to increase the interest rate by 0.25% to 4.25%. Although there had initially been mixed views on whether the turmoil in the banking sector could result in the interest rate remaining unchanged, the higher than expected inflation reading for February resulted in the increase being expected. Following the meeting, the BoE Governor Andrew Bailey was non-committal about possible future rate rises, stating that “We don’t know whether it’s going to be the peak”. Mr Bailey added “What I can tell you is that we’ve seen signs of inflation really peaking now. But of course, it’s far too high…. We need to see it starting to come down progressively and get back to target”.

The BoE repeated its message from the previous meeting that suggested raising the interest rate was less urgent, whilst also highlighting that it will be closely monitoring indications of persistent inflationary pressures. The BoE said it expected inflation in the second quarter to be lower than its forecast in February, helped by the extension of the energy bill subsidies and a fall in global energy prices. The BoE also said it believed the UK was no longer heading into an immediate recession, although the economy is projected to only grow slightly in the coming months. Following the issues in the banking sector, the BoE noted the “large and volatile moves” in global financial markets, but said its Financial Policy Committee judged that Britain’s banking system was resilient.

Economic Growth

The Office for National Statistics (ONS) said the British economy performed better than expected in January with a one-off boost from children returning to school, after December had seen unusually high levels of widespread illness. The ONS said the economy expanded 0.3% month-on-month, which was ahead of the forecasted 0.1% gain and the 0.5% contraction in December. The expansion was driven solely by services, with a large contribution from the education sector, whilst the return of the men’s football Premier League after the end of the World Cup was also positive for growth. However, there were contractions in both manufacturing and construction. The ONS said economic output in January was 0.2% below its pre-pandemic level of February 2020, which is in contrast to other advanced economies.

It was confirmed that the British economy avoided a recession last year, with the previous estimate of no growth in the fourth quarter of 2022 being revised slightly higher to an expansion of 0.1%. In addition, the reading for the third quarter of last year was also revised higher to show a contraction of 0.1% instead of a fall of 0.2%.

Unemployment & Labour Market Statistics

British unemployment remained unchanged at 3.7% in the three-months to January, remaining close to its lowest level in almost five decades and slightly below the forecasted small increase to 3.8%. Job vacancies fell for the eighth consecutive period, falling by 51,000 to 1.1 million in the three months to February. The economic inactivity rate, which is the share of people not in work and not looking for it, fell slightly to 21.3% in the three-months to January 2023.

The ONS said regular pay excluding bonuses rose by an annual 6.5% in the three months to January, slightly lower than the 6.7% in the preceding three-months and the first slowdown in this measure since late-2021. However, when considering inflation, regular wages fell by 2.4%. Average regular pay growth for the private sector was 7%, whilst the public sector saw an increase of 4.8%, the largest since the three-months to February 2006 (excluding the pandemic period). Employees’ total pay, which includes bonuses, rose by annual 5.7%, also slowing from the previous three-months where growth was 6% as well as the weakest pace since the three-months to July 2022. In real terms, total pay fell by 3.2%, the biggest drop since early-2009. Furthermore, the growth in regular and total pay was below expectations of 6.6% and 5.7% respectively.

Inflation

The annual rate of UK inflation, as measured by the Consumer Price Index (CPI), unexpectedly rose in February, driven by higher food prices and more expensive drinks in pubs and restaurants. The ONS said CPI rose 10.4% in February, above the forecasted fall to 9.9% and ahead of the 10.1% rate in January. The ONS said an end to January drinks promotions in pubs and restaurants was the biggest factor in pushing inflation higher. Food and non-alcoholic drink prices were also key contributors to the increase in CPI, as they rose at their fastest pace in over 45 years, with notable increases for some salad and vegetable items as high energy costs and bad weather across parts of Europe led to shortages and rationing. Clothing costs, particularly for children and women, rose, but fuel prices continued to fall.

Core CPI, which excludes volatile components such as food and energy prices, rose from 5.8% in January to 6.2% in February, above the forecasted small fall to 5.7%. The annual rate of inflation in the services sector increased from 6% to 6.6%. There were some signs of an easing in price pressures, with prices paid by factories increasing by 12.7% over the 12-months to February, a large increase by historical standards but the weakest pace since September 2021. Furthermore, prices charged by manufacturers rose 12.1%, their slowest pace in a year.

US

US Federal Reserve and Interest Rates

Despite the turmoil in the banking sector, the US Federal Reserve (Fed) raised interest rates by 0.25% to a range between 4.75% and 5%, whilst updated projections showed 10 of 18 Fed policymakers still expect a further rise of 0.25% by the end of 2023. However, the sudden failures of two US banks, Silicon Valley Bank and Signature Bank, led to the latest policy statement no longer saying that “ongoing increases” in rates will likely be appropriate, which had been used every time since the decision in March 2022 to start the rate hiking cycle. The policy-setting Federal Open Market Committee said only that “some additional policy firming may be appropriate”, suggesting there was a chance of one more 0.25% increase, may be at the next meeting, and that this would represent an initial stopping point in this cycle. The Fed also dropped language saying that inflation “has eased”, instead declaring that inflation “remains elevated”.

The Fed Chair Jerome Powell opened his post-meeting news conference with comments relating to the recent banking crisis, as he sought to reassure depositors, consumers and businesses that the system was sound after the actions the central bank and other regulators have taken in the previous two weeks. Mr Powell also said the turmoil will probably take a toll on growth and the economic outlook, with the events likely resulting in tighter credit conditions for households and businesses. Nonetheless, with it being too soon to determine the impact of these events, Mr Powell said it was appropriate to proceed with this increase in the interest rate, but also to no longer say that “ongoing” rate rises were appropriate.

Economic Growth

The Commerce Department confirmed the US economy expanded at a solid pace in the fourth quarter of last year, although its third estimate saw growth revised marginally lower from 2.7% annualised to 2.6%. The small downward revision reflected downgrades to exports and consumer spending on services. However, there were upwards revisions to non-residential investment, residential and state and local government spending. Good-producing industries recorded a 4% growth rate, ahead of the 2.3% expansion in the services-producing sector.

Inflation

US consumer price growth remained solid in February, with continued pressure from higher costs for rental housing. The Labor Department said the Consumer Price Index (CPI) rose 0.4% in February, which was in line with expectations and follows the 0.5% increase in the previous month. Shelter, which includes rents as well as hotel and motel accommodation, was responsible for more than 70% of the increase in CPI. Although food prices rose 0.4%, the cost of food consumed at home gained 0.3%, which was the smallest increase since May 2021. The cost of non-alcoholic drinks increased 1%, whilst there were modest gains in the prices for fruits and vegetables. However, meat cost less whilst egg prices were 6.7% lower. Gasoline prices rose 1%, but the cost of natural gas dropped 8%, the biggest decline since October 2006. For the twelve months through February, CPI rose by 6%, the smallest year-on-year increase since September 2021 as well as lower than the 6.4% rise in January.

The so-called core CPI, which excludes volatile food and energy components, rose 0.5% in February, the largest gain since September and follows a 0.4% increase in January. The main driver of the rise was owners’ equivalent rent, which is what a homeowner would receive from renting a home, which increased 0.7% and matched January’s advance. Services prices rose 0.5%, also boosted by higher costs of hotel and motel rooms and airline fares, although excluding rents there was a much smaller gain of 0.1%. There was an eighth consecutive monthly decline in the prices of used cars and trucks, but apparel prices rose as did household furnishings and operations. Overall core goods prices were unchanged in February having risen in January for the first time since August. For the 12 months through February, core CPI rose 5.5%, a slightly slower pace than the 5.6% gain in December as well as the smallest gain since December 2021.

Europe

European Central Bank and Interest Rates

Despite the turmoil in the banking sector, the European Central Bank (ECB) raised its interest rate by 0.5% to 3%, the highest level since late-2008 and in line with its promise following the bank’s previous meeting. Although the ECB said it was too early to predict future interest rate moves, it rejected suggestions that its campaign to combat inflation was a threat to financial stability whilst stating that Eurozone banks were resilient and that if anything, higher interest rates should support their margins. The ECB President Christine Lagarde told a news conference “I think that the banking sector is currently in a much, much stronger position than where it was back in 2008”, highlighting the improved capital and liquidity positions since the Global Financial Crisis. An ECB Governing Council statement said it was monitoring market tensions and would respond as necessary to preserve price stability and financial stability in the Eurozone. However, the statement offered no commitment for future rate decisions, although Ms Lagarde said “We know that if our baseline were to persist when the uncertainty reduces, then we have a lot more ground to cover”, whilst noting it was impossible to determine the future path amid the “completely elevated” uncertainty in markets.

The ECB’s new projections released on the same day showed inflation above its 2% target through 2025, which is a key concern for many of its policymakers. Inflation is expected to average 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025, although the ECB noted that these projections were finalised before the current turmoil in the banking sector.

Economic Growth

The EU’s Statistics Office, Eurostat, slightly lowered its earlier estimates for economic growth in the Eurozone from a 0.1% expansion to no growth in the fourth quarter of last year compared with the previous three-month period. Eurostat said government spending rose, whilst net trade contributed positively as exports saw a nominal gain but imports were lower. However, there were negative contributions from household spending and gross fixed capital formation. Amongst the largest countries, there were expansions in France, Spain and the Netherlands, but contractions in Germany and Italy. On a yearly basis, economic growth was also revised slightly lower from the preliminary estimate of 1.9% to 1.8%.

Inflation

Preliminary data showed that headline inflation fell by the most on record, but core prices rose. Headline consumer prices rose by 6.9% in March, below the forecasted smaller fall to 7.1% and sharply lower than the 8.5% increase in the previous month. In addition, this was the largest fall since Eurostat started collecting data in 1991. The fall in headline prices was driven almost solely by lower energy prices compared with the previous year when they had jumped higher due to the war in Ukraine. However, food, alcohol and tobacco saw prices accelerate in March. Core inflation, which excludes volatile food and fuel prices, rose to a new record high of 5.7%, with services prices rising at a faster pace than in February.

Asia and Emerging Markets

Japan

The Japanese economy narrowly avoided falling into recession in the fourth quarter of last year, with weak consumption providing support with the post-pandemic recovery facing the headwinds of high inflation and slowing global growth amid rising interest rates. The preliminary estimate of an annualised 0.6% expansion was revised sharply lower to a weak 0.1%, which was also well below the forecasted 0.8% rise. The small expansion follows a downwardly revised 1.1% contraction in the third quarter. The quarter-on-quarter change was broadly flat, below the forecasts for 0.2% growth. Private consumption, which makes up over half of Japan’s economy, was downgraded from an increase of 0.5% to 0.3%. The data showed spending on services such as restaurants and hotels, as well as goods, were less solid than previously estimated.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK indices finished lower, with the mid cap FTSE 250 suffering a bigger loss than the large cap FTSE 100. The UK’s large banking sector suffered in particular from the global sell-off in bank shares following the collapse of Silicon Valley Bank (SVB) and the issues with Credit Suisse. Inflation was also unexpectedly higher, which further weighed on sentiment.

Following falls in the first half of the month due to persistent inflation and the banking crisis, US markets finished March higher as shown by the S&P 500. The rebound was driven by strong performance from big technology companies, which benefited from easing expectations of higher interest rates. European markets also finished marginally higher, as demonstrated by the FTSE World Europe ex UK Index, which was, despite the sell-off in bank shares, with information technology and consumer staples, among the best performers. In Japan, the Nikkei 225 Index rose, despite its financial sector also being under pressure.

The broad MSCI Asia ex Japan Index produced a gain, with the banking turmoil in the US and Europe having less impact on the region. Sentiment was also helped by an easing in expectations over further US interest rate rises. Global Emerging Markets also rose, as shown by the broad MSCI Emerging Markets Index, led higher by Emerging Asia, followed by Latin America and Europe, Middle East and Africa (EMEA). Emerging Asia benefited from improved sentiment towards China’s internet and gaming sector, as well as the continuation of the reopening recovery.

It was also a volatile month for fixed income markets as initially they focused on the increased likelihood of further US interest rate rises due to the persistence of inflation, as well as being impacted by the collapse of SVB and UBS’s takeover of Credit Suisse. However, the turmoil in the banking sector led some investors to believe that central banks might pause or lower their plans to further increase interest rates, leading to a rebound in fixed income markets. UK government bonds (FTSE Actuaries UK Conventional Gilts Index) benefited in particular, as they outperformed investment grade corporate bonds.

This update is intended to be for information only and should not be taken as financial advice.

CA9996 Exp 04/24