We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

Global equity markets broadly rose in June, as they recovered from their losses in May. Investor sentiment was helped by falls in inflation in the US and Eurozone, with the Federal Reserve opting to pause its interest rate hiking cycle at its June meeting. However, the UK continued to see stubbornly high prices as the Bank of England surprised markets with a larger than expected interest rate rise. There were gains across developed markets, whilst despite concerns over the economic recovery in China, Asian and Global Emerging Markets also finished June higher. UK fixed income markets were under pressure in June, as they ended the month with losses due to the increased likelihood of further interest rate rises.

Economic Overview

UK

Bank of England and Interest Rates

The Bank of England (BoE) surprised markets as it raised its interest rate by 0.5% to 5%, the highest level since 2008 and ahead of the smaller forecasted 0.25% increase. The BoE also stated that there had been “significant” news suggesting persistently high inflation would take even longer to fall. The BoE’s Monetary Policy Committee (MPC) voted 7-2 to raise the interest rate by 0.5%, the largest increase since February, with the two outliers preferring to leave rates unchanged as they believed much of the impact of previous tightening was yet to be felt.

The BoE Governor Andrew Bailey said “The economy is doing better than expected but inflation is still too high and we’ve got to deal with it”, whilst adding “if we don’t raise rates now, it could be worse later”. The MPC stated “There has been significant upside news in recent data that indicates more persistence in the inflation process”. The MPC added “second-round effects in domestic price and wage developments generated by external cost shocks are likely to take longer to unwind than they did to emerge”. Additionally, Mr Bailey highlighted the rise was imperative to control inflation, but a recession is not expected or desired and the necessary action will be taken to bring prices down to target. Mr Bailey also reiterated his view that current wage growth was unsustainable and that businesses could not continue to keep raising prices at their current pace.

Economic Growth

The Office for National Statistics (ONS) said the British economy grew by 0.2% in April, which was in line with expectations and despite contractions in manufacturing and construction. The ONS said the health sector was the largest negative contributor to growth, primarily due to four days of junior doctor strikes. Services output rose 0.3%, with the main drivers being wholesale and retail trade, followed by information and communications, where the film and TV industry was a notable contributor. Manufacturing output contracted 0.3%, whilst construction unexpectedly contracted by 0.6% amid rising interest rates and mortgage costs. The ONS said the economy in April was 0.3% above its pre-pandemic level of February 2020.

For the first quarter of this year, the ONS confirmed Britain’s economy grew by just 0.1%, unchanged from its preliminary estimate. This meant output was 0.5% lower than it was in the final quarter of 2019, just before the pandemic. In annual terms, the economy grew by only 0.2% in the first quarter, again in line with the earlier estimate. The sluggish growth was supported by a solid increase in gross fixed capital formation (also known as investment), which was driven by higher business spending. However, household consumption remained unchanged amid the cost of living crisis. Government spending declined, primarily due to lower spending on public administration and defence, as well as education and health. Net external demand also had a negative impact as imports fell at a slower rate than exports.

Unemployment & Labour Market Statistics

British unemployment unexpectedly declined in the three months to April, falling from 3.9% to 3.8% compared with the forecasted small rise to 4%. For the three months to May, job vacancies fell by 79,000 to 1.051 million, the 11th consecutive fall with survey respondents continuing to note economic pressures as a factor in holding back on recruitment. The economic inactivity rate, which is the share of people not in work and not looking for it, fell to 21% in the three months to April, which the ONS said was largely driven by those inactive for other reasons and those looking after family or home. The number of people inactive due to long-term sickness rose to another record high.

Wage growth was stronger than expected, with regular pay excluding bonuses increasing to an annual 7.2% in the three months to April, which was higher than the 6.8% rise in the previous period and above the forecasted 6.9% gain. This was also the largest gain in regular pay outside of the pandemic. When adjusted for inflation, regular pay declined by 1.3%. Employee’s total pay, which includes bonuses, increased by an annual 6.5%, but in real terms fell by 2%.

Inflation

The annual rate of UK inflation, as measured by the Consumer Price Index (CPI), unexpectedly remained unchanged in May. The ONS said CPI matched April’s 8.7%, despite being forecasted to fall to 8.4%. The ONS said the cost of airfares rose by more than a year ago and is at a higher level than usual for May, whilst rising prices for second-hand cars, as well as recreational and cultural goods and services, also contributed to inflation remaining stubbornly high. Food and drink price inflation eased slightly from 19% in April to 18.3% in May. The largest downward contribution came from falling prices for motor fuel.

Core CPI, which excludes volatile components such as food and energy prices, also surprised as it rose from 6.8% in April to 7.1%, the highest level since March 1992. Services price inflation, which is heavily influenced by wage growth, rose to 7.4%, also the highest since 1992, with the ONS noting rising prices in cafes, restaurants and hotels. However, producer price inflation slowed by more than expected, falling from an increase of 5.2% in April to 2.9% in the 12 months to May, the smallest rise since March 2021.

US

Federal Reserve and Interest Rates

The Federal Reserve (Fed) left interest rates unchanged in the 5%-5.25% range at its June meeting, but new projections indicated that there may be further increases by the end of this year. In a press conference following the meeting, the Fed Chair Jerome Powell said US growth and the job market were more robust than expected despite the aggressive monetary policy tightening over the last year. Mr Powell said the pause at this meeting was out of caution, which will allow the Fed to gather more information before determining if rates do need to rise again, with the pace of moves now less important than finding the correct level that slows inflation while minimising any rise in unemployment.

Mr Powell said the Fed’s latest quarterly projections showed that “growth estimates moved up a bit, unemployment estimates moved down a bit, inflation estimates moved up”. When all projections were taken together, Mr Powell said the data suggested “more restraint will be necessary than we thought”. This was demonstrated by the uniform shift higher in policymaker’s interest rate outlook for the year, with nine of 18 officials seeing the rate moving 0.5% higher, whilst a further three thought it could need to go even further. However, Mr Powell did also suggest the conditions needed to see inflation coming towards target were coming into place, but it will take some time. Mr Powell also stated that the July meeting will be “live”, with officials not yet decided on what they will do with rates.

Economic Growth

In its third estimate, the Commerce Department said the US economy grew by more than previously thought in the first quarter of this year. The previous reading was revised higher from 1.3% annualised growth to 2%, well above the forecasted smaller increase to 1.4%, but it was still slower than the 2.6% expansion in the fourth quarter of last year. Consumer spending was stronger than expected, notably on durable goods. Net trade contributed positively, as exports rose at a faster pace than imports. The main negative contributions came from private inventory investment and residential fixed investment.

Inflation

Headline US consumer prices barely rose in May, whilst the annual increase was the smallest in two years, although underlying price pressures remained elevated. The Labor Department said the Consumer Price Index (CPI) rose 0.1% in May, well below the 0.4% gain in April as well as the forecasted 0.2% increase. Gasoline prices dropped 5.6%, whilst electricity costs fell for a third consecutive month and utility gas also cost less. However, food prices rose 0.2% having been unchanged in the previous two months, with fruits and vegetables, non-alcoholic beverages and other food products all costing more. It was also more expensive to eat out. Meat and fish were cheaper, whilst egg prices declined sharply by 13.8%, the most since January 1951. For the twelve months through May, CPI rose 4%, the smallest year-on-year increase since March 2021, as well as below the forecasted 4.1% rise and well beneath the 4.9% gain in April.

The so-called core CPI, which excludes volatile food and energy components, rose 0.4% in May, matching the gains in the previous two months. The cost of services increased 0.3%, having risen 0.2% in April. Owners’ equivalent rent, which is what a homeowner would receive from renting a home, rose 0.5% for a third consecutive month. The cost of airline fares fell 3%. Services excluding energy increased 0.4%, matching April’s gain. Used cars and trucks increased 4.4%, which contributed to core goods prices rising 0.6% for a second consecutive month. However, household furnishings fell 0.6%, the first decline in nearly two years and the largest decline since August 2009. For the 12 months through May, core CPI rose 5.3%, which was lower than the 5.5% gain in April, as well as the smallest increase since November 2021.

Europe

European Central Bank and Interest Rates

As expected, the European Central Bank (ECB) raised its main interest rate by 0.25% to 3.5%, a level not seen since 2001. The ECB also stated that it was ending its remaining crisis-era stimulus programmes. The ECB President Christine Lagarde told a press conference that “Barring a material change to our baseline, it is very likely the case that we will continue to increase rates in July”. Ms Lagarde added that the journey wasn’t finished and that there is still ground to cover. The ECB also said it now expected inflation to stay above its 2% target all the way through to the end of 2025, whilst raising its 2023 and 2024 projections for “core” inflation, which excludes volatile energy and food prices. Ms Lagarde also gave her strongest warning yet about wage rises and companies raising prices becoming an increasingly important source of inflation.

Economic Growth

The Eurozone economy unexpectedly fell into a mild recession in the first quarter of this year. The EU’s Statistics Office, Eurostat, lowered its previous estimate of a 0.1% quarter-on-quarter gain in the first quarter to a 0.1% contraction, whilst the flat reading for the final three months of 2022 was revised down also to a fall of 0.1%. Two successive quarters of contraction are commonly described as a technical recession. Household expenditure fell, amid high inflation and borrowing costs, whilst public spending also declined as governments removed stimulus that was meant to partly offset the impact of rising energy costs. However, there was a rebound in gross fixed capital formation, whilst exports declined by less than imports. Among the Eurozone’s largest economies, there were contractions in Germany and the Netherlands, but France, Italy and Spain all saw expansions. Eurostat also said the Eurozone grew 1% compared with a year earlier, which was lower than the previous estimate of a 1.3% expansion as well as the forecasted 1.2% rise.

Inflation

The flash estimate for inflation in June showed a further decline as the cost of fuel fell sharply and offset higher services costs. Eurostat said headline consumer prices fell from 6.1% year-on-year in May to 5.5%, the seventh consecutive monthly decline with Germany the only country to report an increase (from 6.3% to 6.8%), which was partly due to the expiry of a large rail-ticket subsidy. There were further big differences between other Eurozone countries, with inflation in Spain and Belgium falling to 1.6%, but staying in double-digits in Slovakia and close to this level in the Baltics. However, core inflation, which excludes volatile components such as energy and food, only fell slightly from 6.9% to 6.8%. Services was the only category where price growth was stronger, rising from 5% to 5.4%.

Asia and Emerging Markets

Japan

The Bank of Japan (BOJ) maintained its ultra-easy monetary policy despite stronger than expected inflation data, whilst indicating that it will retain this stance as it remains an outlier among most global central banks. In line with expectations, the BOJ maintained its -0.1% interest rate target and a 0% cap on the 10-year bond yield set under its yield curve control policy. The BOJ also reiterated its view that inflation will slow later this year due to falling fuel and commodity prices, as well as its pledge to “patiently” sustain stimulus. The BOJ Governor Kazuo Ueda said “We expect trend inflation to heighten as economic activity strengthens and the labour market tightens. But there’s very high uncertainty about next year’s wage negotiations and the sustainability of wage growth”. However, the Governor also left room to change this stance by adding that if the view on inflation falling should change sharply, then the BOJ will have to review its monetary policy approach.

Revised data showed Japan’s economy grew by more than expected in the first quarter of this year, as increased domestic spending and company restocking offset the impact of slowing global demand on exports. Government data showed the economy expanded an annualised 2.7% in the first quarter, sharply above the preliminary estimate of 1.6% and the forecasted 1.9% growth. Companies’ work-in-progress inventories, particularly among automakers and semiconductor equipment firms, and capital expenditure rose by more than previously estimated, which contributed to the upwards revision to the growth data. Private consumption, which represents over half the economy, was revised lower from a gain of 0.6% to a 0.5% increase, which was driven by new services sector statistics. However, a government official said “the broader picture is unchanged that spending on services such as restaurants and hotels contributed positively”. Domestic demand as a whole provided a larger contribution to economic growth than initially estimated. Net exports reduced economic growth by 0.3%, matching the preliminary estimate. The data for the second half of last year also revised out the technical recession previously reported, as the economy was now shown to have grown 0.4% in the fourth quarter of 2022, having contracted 1.5% in the preceding three months.

Market Overview

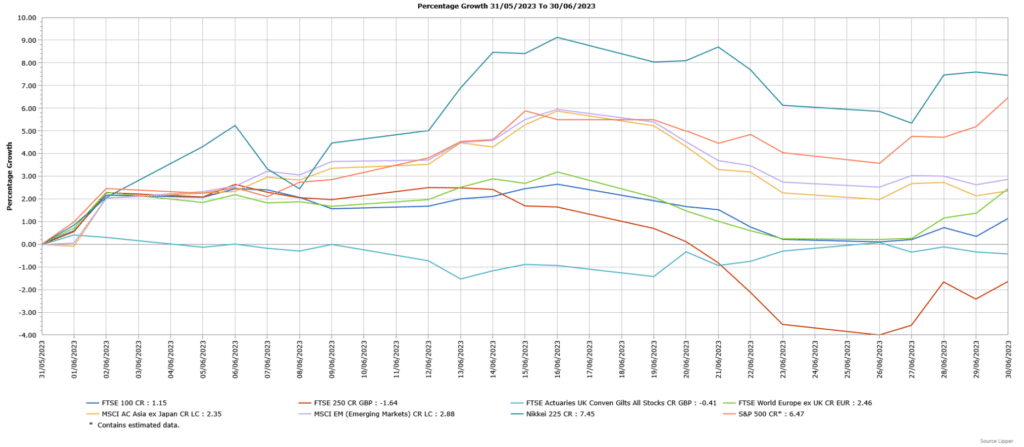

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

There was a mixed performance in the UK, with the FTSE 100 finishing June higher, but there was a loss for the mid-cap FTSE 250. Relatively positive economic data was supportive, though persistently high inflation weighed on the more domestically focused FTSE 250.

The US S&P 500 produced a strong gain in June, with the passing of the debt ceiling bill at the beginning of the month providing initial support. The technology sector was again a key driver of performance, but there were also strong performances from consumer discretionary, industrials and materials stocks. European indices, as demonstrated by the FTSE World Europe ex UK Index, also rose as inflation eased and despite the Eurozone falling into recession. Market performance was led by the consumer discretionary and finance sectors. The Japanese Nikkei 225 Index continued its recent run of positive returns as it finished sharply higher, having reached a 33-year high early in the month amid positive economic data.

The broad MSCI Asia ex Japan Index finished June higher, despite some disappointing Chinese economic data. Nonetheless, Chinese equities still rose whilst there were notable gains in Hong Kong, India, Singapore and Taiwan, but Thailand and Malaysia lagged their regional peers. Global Emerging Markets also rose, as shown by the broad MSCI Emerging Markets Index, with Latin America driving the gains with Brazil a notable strong performer. Emerging Asia also broadly performed well, whilst there were also gains in most of Emerging Europe, where Turkey was an outlier as it finished June lower.

Fixed income assets were under pressure in June due to the increased expectations of further interest rate increases. In the UK, there was a larger than expected interest rate rise, whilst inflation was stronger than expected. Despite the likelihood of further rate rises, government bonds (FTSE Actuaries UK Conventional Gilts Index) outperformed sterling corporate bonds, although both finished June with losses.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA10274 Exp 07/24.