We generally recommend that you hold investments for the medium to long term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

Most global equity markets rose in July as inflation appeared to be moderating in the UK, US and Europe, where economic growth data also remained resilient. Whilst inflation continued to ease, there were further interest rate rises in the US and Europe. Emerging markets outperformed the developed markets amid strong performance from China as the government announced its determination to provide support to the flagging economy. UK fixed income markets also finished higher, with corporate bonds outperforming government bonds.

Economic Overview

UK

Economic Growth

The Office for National Statistics (ONS) said the British economy contracted by 0.1% in May, which was better than the forecasted 0.3% fall but followed growth of 0.2% in April. Manufacturing, energy and construction all contracted in May, as did sales at pubs and bars, but services overall showed no growth as the health sector recovered whilst the IT industry had a “strong month”. Whilst the extra bank holiday to mark King Charles’ coronation likely weighed on activity due to one less working day than normal, some companies in the arts, entertainment and recreation sector said they benefited, as did hotels and restaurants. However, there were signs that strikes in the health, rail and education sectors also weighed on output, albeit to a lesser extent than in April. The ONS said anything better than a 0.1% drop in June would put the economy on track to avoid a contraction in the second quarter as a whole.

Unemployment & Labour Market Statistics

British unemployment unexpectedly rose from 3.8% to 4% in the three months to May, driven by people who have been unemployed for up to 12 months. Job vacancies fell for the 12th consecutive time in the three months ending June, falling by 85,000 to 1.034 million. The economic inactivity rate, which is the share of people not in work and not looking for it, fell to 20.8% in the quarter to May, with the ONS stating this continues to be largely driven by those inactive for other reasons and those looking after family or home.

Wage growth was stronger than expected, with regular pay excluding bonuses increasing to an annual 7.3% in the three months to May, the joint highest alongside the previous quarter, which was revised higher from an initial 7.2%. Regular pay growth had been forecasted to grow by 7.1%. In the private sector, regular pay growth was 7.7%, the highest outside of the pandemic period, whilst the 5.8% rise in the public sector was a level not seen since late-2001. However, when adjusted for inflation, regular pay declined by 0.8%. Employee’s total pay, which includes bonuses, increased by an annual 6.9%, but in real terms fell by 1.2%.

Inflation

The annual rate of UK inflation, as measured by the Consumer Price Index (CPI), fell in June to its slowest pace in over a year. The ONS said CPI rose by 7.9%, the lowest rate since March 2022 and below the forecasted fall to 8.2% and much lower than the 8.7% pace seen in April and May. The largest downward contribution came from petrol and diesel prices, which were a record 23% lower than a year ago. However, there were still large increases for other goods and services, with sugar prices 54% higher whilst transport insurance costs jumped 48%. Food prices overall rose less quickly.

Core inflation, which excludes food, energy, alcohol and tobacco prices, fell from 7.1% to 6.9%, which was better than the forecasted unchanged reading. Services prices rose by 7.2% in annual terms, easing from 7.4% in May, whilst factory gate prices increased by just 0.1% in the 12 months to June, the lowest reading since December 2020.

US

Federal Reserve and Interest Rates

The Federal Reserve (Fed) raised its interest rate by 0.25% to a range of 5.25%-5.5%, a level last seen prior to the 2007 housing market crash as well as representing the 11th increase in its last 12 meetings. The Fed said in its accompanying statement that “The Federal Open Market Committee will continue to assess additional information and its implications for monetary policy”, which was little changed from its previous June statement and left future policy options open. The Fed Chair Jerome Powell made no promises either way in respect of future decisions, with a September meeting eight weeks away being considered “live” for another rate increase, though a continued easing of inflation and weaker economic data may also prompt policymakers to pause.

In the press conference following the meeting, Mr Powell said the central bank was very much looking at “the totality” of incoming data and studying it in particular for signs that the economy is heading for a period of “below trend” growth that is thought to be needed for inflation to decline. The Fed described the economy as growing at a “moderate” pace, a slight upgrade from the “modest” pace seen at the June meeting. Mr Powell did acknowledge that inflation falling from its highs without causing serious damage to the economy was a positive development. Mr Powell also warned against expecting any near-term easing rates, highlighting these will take place when Fed is comfortable doing so and that it will not be this year.

Economic Growth

The Commerce Department’s preliminary estimate showed the US economy grew by more than expected in the second quarter of this year, with labour market strength supporting consumer spending whilst businesses increased investment in equipment. The economy is estimated to have expanded at a 2.4% annualised rate, which was ahead of the 2% gain in the first three months of the year as well as the forecasted 1.8% increase. Consumer spending, which accounts for more than two-thirds of the economy, rose by 1.6%, which, although slower than the 4.2% pace in the previous period, was still sufficient to add over 1% to growth. Spending has been supported by excess savings accumulated during the pandemic, as well as strong wage growth from the tight labour market. Business investment rose, having almost stalled in the first quarter, driven by an increase in spending on equipment like aircraft and motor vehicles. Factory construction is also being boosted by government efforts to bring semiconductor manufacturing back to the US. Government spending also provided a positive contribution, as did inventory investment, but trade weighed on activity. Residential investment, which includes homebuilding, contracted for the ninth consecutive quarter.

Inflation

Headline US consumer prices rose modestly in June, whilst the annual increase was the smallest in over two years. The Labor Department said the Consumer Price Index (CPI) rose 0.2% in June, slightly higher than the 0.1% gain in May but lower than the forecasted 0.3% increase. Shelter, which includes rents, was responsible for 70% of the rise in CPI in June, whilst there were also increases in motor vehicle insurance and gasoline prices. These gains offset a fall in the prices of used cars and trucks. Food prices edged up by just 0.1%. Grocery prices were unchanged, with a fall in the cost of eggs as well as cheaper meat and fish offsetting an 0.8% increase in fruits and vegetables. However, it cost more to eat out. For the 12 months through June, CPI rose 3%, the smallest year-on-year increase since March 2021, as well as just below the forecasted 3.1% rise and well beneath the 4% gain in May. Part of the reason for the fall in the year-on-year CPI is last year’s large increases dropping out of the calculation.

The so-called core CPI, which excludes volatile food and energy components, rose 0.2% in June, which followed a 0.4% rise in May and was the smallest gain since August 2021, as well as the first time in six months that the monthly gain wasn’t at least 0.4%. Core CPI was boosted by a 0.4% rise in shelter costs, with owners’ equivalent rent, which is what a homeowner would receive from renting a home, increasing by 0.4%, although this was the smallest rise since December 2021. Prices for hotel and motel rooms declined by 2.3%. Motor vehicle insurance jumped 1.7%, whilst prices for apparel rose 0.3%. However, prices for used cars and trucks were 0.5% lower and unchanged for new cars. As a result, core goods prices fell 0.1% having risen 0.6% in May. Airline tickets declined 8.1%, the largest drop in nearly a year, whilst there were also falls in the prices of communication services and household furnishings and operations. Healthcare costs were unchanged, as were the prices of prescription medicine. Services prices gained 0.3%, with the rise being 0.2% when excluding rents. For the 12 months through June, core CPI rose 4.8%, the smallest increase since October 2021 and follows a 5.3% increase in May.

Europe

European Central Bank and Interest Rates

In line with expectations, the European Central Bank (ECB) raised its main refinancing interest rate by 0.25% to 4.25%, the highest level since October 2008. In addition, the key deposit facility rate increased by the same amount to 3.75%, the highest since 2000 before euro banknotes and coins were even in circulation. The ECB President Christine Lagarde said what happens next was in the balance, although there was a determination to “break the back” of inflation. Ms Lagarde stressed at the press conference, following the announcement, that all options remained on the table but there was a suggestion of a pause at its next meeting after stating, “Do we have more ground to cover? At this point in time, I wouldn’t say so”. The ECB’s full policy statement said interest rates would be set at “sufficiently restrictive levels for as long as necessary” for a timely return of inflation to its 2% target, but it dropped a reference to rates having to be “brought” to a level that cuts inflation quickly enough.

Economic Growth

A preliminary estimate showed the Eurozone economy returned to growth in the second quarter of this year, whilst it is now reported to have narrowly avoided a technical recession at the start of 2023. The EU’s statistics office said the economy grew 0.3% in the second quarter, slightly above the forecasted 0.2% expansion. This follows zero growth in the opening three months of this year, which was an upwards revision to the previous reading of a 0.1% quarter-on-quarter contraction. Among the Eurozone’s largest countries, France and Spain grew amid stronger exports and tourism, whilst the biggest country Germany registered no growth and Italy suffered a contraction. Eurostat also said the economy grew 0.6% compared with a year earlier, again just above the forecasted 0.5% increase.

Inflation

A flash estimate showed that annual inflation in the Eurozone eased for a third consecutive month in July. Eurostat said headline consumer prices fell from 5.5% year-on-year in June to 5.3% in July, in line with forecasts and the lowest reading since January 2022. The fall in inflation was driven by a further drop in energy prices, together with a slowdown in the cost of food, alcohol and tobacco and non-energy industrial goods. However, services inflation continued to rise, increasing from 5.4% to 5.6%. Core inflation, which excludes prices for energy, food, alcohol and tobacco, was unchanged at 5.5%, which was above the forecasted small fall to 5.4% and is now higher than the headline rate for the first time since 2021.

Asia and Emerging Markets

Japan

The Bank of Japan (BOJ) tweaked its yield curve control (YCC) policy to make it more flexible in a move that surprised markets. Whilst the BOJ kept its interest rate at the ultra-low level of -0.1% and stressed the need to maintain monetary support, it said the change to its YCC policy would allow it to respond “nimbly” to risks, including rising inflation. Whilst the target cap of around 0% on the 10-year bond yield was maintained under the YCC policy, as was the guidance allowing the yield to move 0.5% around this rate, the BOJ said these would now be “references” rather than “rigid limits”. The BOJ said it would offer to buy 10-year bonds at 1.0% in fixed-rate operations, instead of the previous rate of 0.5%, signalling that it would now tolerate a rise in the 10-year yield to as much as 1%. The BOJ Governor Kazuo Ueda told a press conference that the tweak was a “pre-emptive” measure and that he did not expect the 10-year yield to hit 1%. In addition, in its quarterly outlook report, the BOJ revised up this year’s consumer inflation forecast from its April projection of 1.8% to 2.5%, although the rate for the fiscal 2024 year was lowered from 2% to 1.9%.

China

The National Bureau of Statistics (NBS) said China’s economy expanded on a seasonally adjusted basis by just 0.8% in the second quarter, which was slower than the 2.2% growth in the first quarter although ahead of the forecasted 0.5% increase. On a year-on-year basis, the economy expanded 6.3% in the second quarter, well below the forecasted 7.3% growth but stronger than the 4.5% increase in the first three months of the year. Whilst the annual figure was the quickest since the second quarter of 2021, it saw a significant boost due to the economic pain being felt last year as a result of the strict zero-Covid restrictions in place in major cities such as Shanghai.

Market Overview

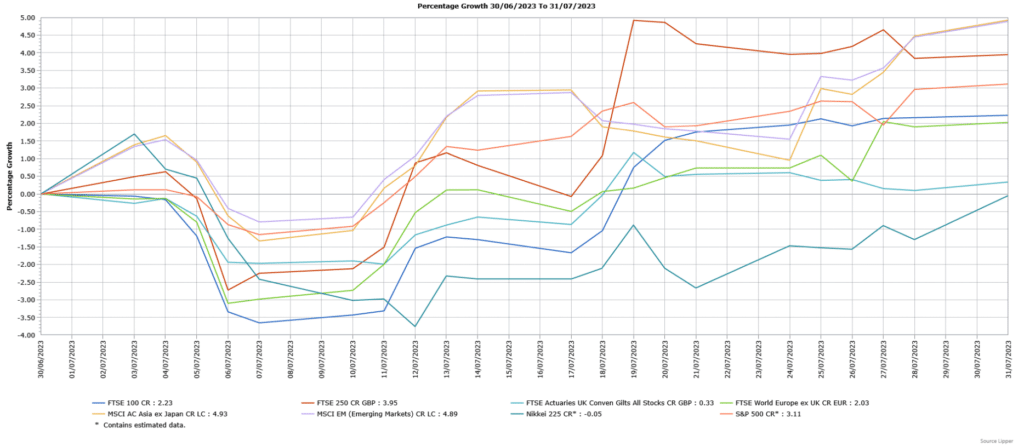

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK equities rose in July, with the mid-cap FTSE 250 outperforming the FTSE 100. The more domestically focused FTSE 250 benefited from the bigger-than-expected fall in inflation, whilst positive corporate earnings updates provided support to the broader UK market. A recovery in commodity prices also helped the basic materials and energy sectors.

The US S&P 500 rose in July amid resilient economic growth data, which helped boost optimism of a soft landing as opposed to a recession, as well as falling inflation. European markets, as demonstrated by the FTSE World Europe ex UK Index, also finished higher as inflation continued to fall and data showed the economy returned to growth. The Japanese Nikkei 225 Index was an outlier as it suffered a small fall, although this does follow a period of positive returns with some pressure from profit-taking, whilst it also didn’t benefit from the stronger performance from mid and small-cap stocks.

The broad MSCI Asia ex Japan Index recorded a strong gain, driven by a rally in China that was supported by government measures such as policy easing as well as optimism over further stimuli aimed at boosting consumption. There were gains across all regional Asian indices. Global Emerging Markets also posted a healthy return, as shown by the broad MSCI Emerging Markets Index, with all regions recording positive returns. Emerging Europe was boosted by Turkey, China drove returns from emerging Asia and the Middle East was led by South Africa. Latin American markets also finished higher.

UK fixed-income assets finished July higher, with the lower inflation reading leading to optimism that the Bank of England would not increase the interest rate by as much as originally thought, leading to government bonds (FTSE Actuaries UK Conventional Gilts Index) ending the month with a gain. Corporate bonds outperformed gilts as credit markets were also supported by lower inflation.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA10423 Exp:08/2024