We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

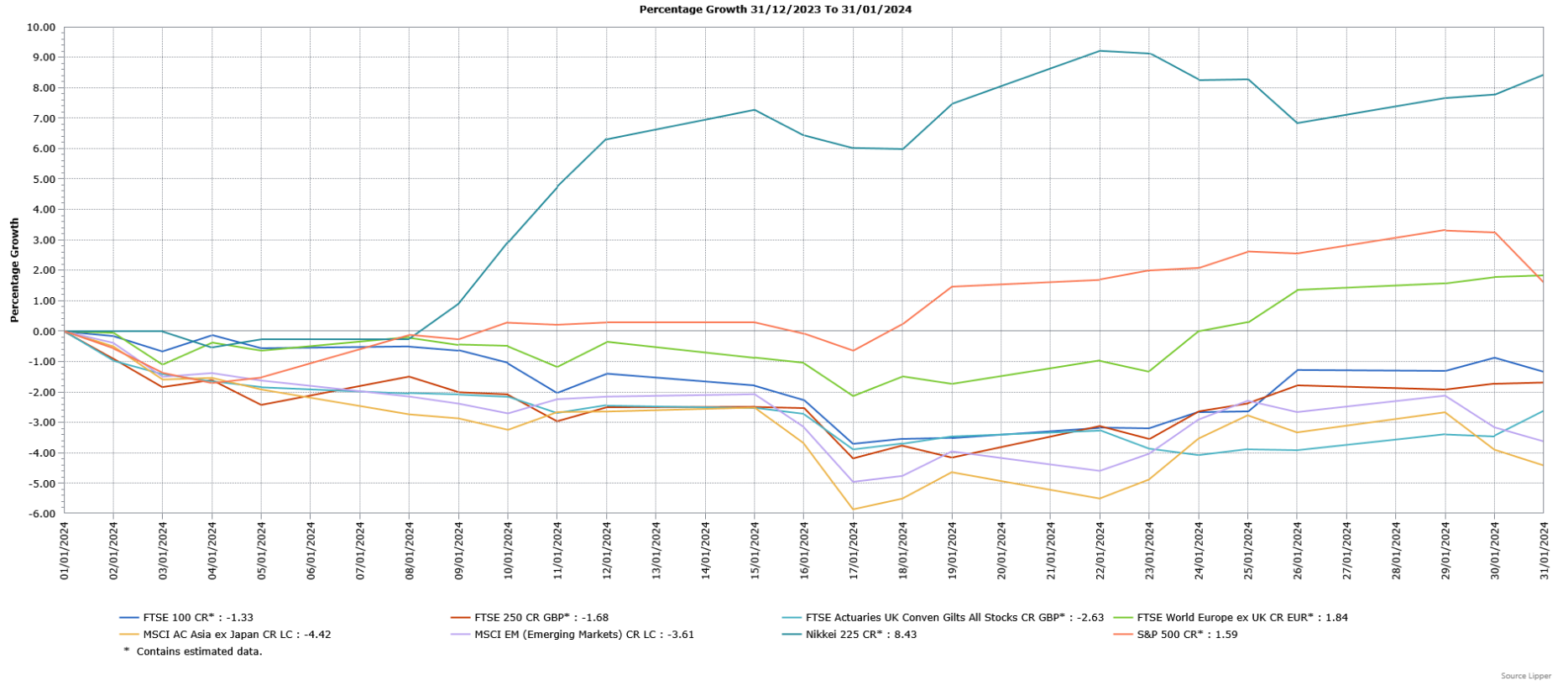

January saw mixed performance from global equity markets amid signs that central banks would not be cutting interest rates as quickly as hoped for at the end of 2023. Most developed markets finished the month higher, with the UK the notable exception, whilst Asian and Emerging Markets underperformed due to ongoing concerns over China. The repricing of the timing of interest rate cuts contributed to losses for fixed income markets, as they reversed some of the gains from the end of last year.

UK

Economic Growth

The Office for National Statistics (ONS) said Britain’s economy grew by more than expected in November, supported by stronger retail sales. The ONS said the economy expanded by 0.3% in November, rebounding from the 0.3% contraction in October and ahead of the forecasted smaller 0.2% growth. The ONS said the recovery was led by services, with retail, which was boosted by Black Friday sales, car leasing and computer games companies enjoying a buoyant month. There was also further support from fewer strikes taking place than seen in previous months. The ONS also said the economy contracted by 0.2% in the three months to November. Despite the improved growth reading, the ONS said “the longer-term picture remains one of an economy that has shown little growth over the last year”.

Unemployment & Labour Market Statistics

The ONS said unemployment in the three months to November was broadly unchanged at 4.2%, whilst employment rose by 73,000 people. The ONS said this data may not prove reliable due to the changes it has made to measure the jobs market. The estimated number of job vacancies fell for the 18th consecutive period by 49,000 in the three months to December to 934,000, although this is still above pre-pandemic levels.

Whilst in absolute terms growth in earnings remained strong, wages rose at their weakest pace in nearly a year. In the three months to November, annual growth in regular pay excluding bonuses fell for the third consecutive period from 7.2% to 6.6%. The ONS said annual public sector pay growth, which at 6.6%, overtook the private sector, where the increase was 6.5%, for the first time since March 2021. When adjusted for inflation, annual regular pay growth was 1.4%. Annual growth in employee’s total pay, which includes bonuses and can be volatile, slowed from 7.2% to 6.5% and, in real terms, increased by 1.3%.

Inflation

The headline annual rate of UK inflation, as measured by the Consumer Price Index (CPI), unexpectedly rose in December, the first increase in ten months. The ONS said CPI rose from 3.9% in November to 4% in December, compared with the forecasted small fall to 3.8%. The ONS said the higher CPI reading was driven by a sharp rise in tobacco duty that took effect in late November, which pushed prices higher by the most since 1992. There was also a bigger impact from seasonal air fare increases, as the ONS increased their weighting in the inflation basket. Higher clothing and entertainment prices also contributed to the increase in CPI. A fall in the annual rate of inflation for food and non-alcoholic drinks from 9.2 to 8%, the lowest level since April 2022, partially offset the upwards pressures on CPI.

Core inflation, which excludes food, energy, alcohol and tobacco prices, was unchanged at 5.1% in December, above the forecasted fall to 4.9% and the first time since July it has not declined. Services price inflation, which the Bank of England views as a key measure of domestically-generated inflation, edged higher from 6.3% to 6.4%.

US

US Federal Reserve & Interest Rates

As expected, the Federal Reserve (Fed) left its interest rate unchanged in the 5.25%-5.5% range, whilst the Fed Chair Jerome Powell said rates had peaked and would move lower in coming months. However, Mr Powell didn’t declare victory in either the inflation fight, or having achieved the “soft landing” for the economy, whilst he also didn’t promise that there would be a cut as soon as the March meeting. Instead, Mr Powell said rate cuts would come once the Fed is more secure about inflation continuing to decline from a level the central bank still characterises as “elevated”, at least on a one-year basis, but he did suggest this was just a matter of time before there is that conviction. Otherwise, Mr Powell spoke positively about economic growth, stating that it is solid to strong, whilst unemployment of 3.7% indicated the labour market is strong, adding “Let’s be honest, this is a good economy”. In addition, the Fed’s policy statement said the risks to the dual employment and inflation targets “are moving into better balance”, adding that any changes to the interest rate will be based on careful assessment of income data, the evolving outlook and the balance of risks. The previous statement had excluded any consideration of rate cuts.

Economic Growth

The Commerce Department’s advance estimate of economic growth in the fourth quarter of last year was higher than expected, with key support coming from robust consumer spending. The US economy grew by an annualised 3.3% in the fourth quarter, ahead of the forecasted 2% pace and followed a 4.9% expansion in the third quarter. As well as consumer spending, which rose 2.8%, growth was also boosted by rising exports and increased government spending and business investment. For the whole year 2023, the economy grew 2.5%, a faster pace than the 1.9% expansion in 2022 as well as the quickest rate in two years.

Inflation

US consumer prices rose by more than expected in December, with shelter responsible for more than half the rise in inflation. The Labor Department said the Consumer Price Index (CPI) rose 0.3% in December, above the forecasted 0.2% increase and follows a 0.1% rise in November. Gasoline prices rose 0.2%, having dropped 6% in November, whilst food prices were 0.2% higher for a second consecutive month. Grocery food prices rose by 0.1%, matching November’s gain, with egg prices jumping by nearly 9% due to disruption caused by the spread of avian flu. Meat and dairy product prices were slightly higher, but breakfast cereals fell 2.4%, the largest decline since January 2007. For the twelve months through December, CPI rose 3.4%, above November’s 3.1% increase and the forecasted 3.2% rise.

The so-called core CPI, which excludes volatile food and energy components, rose 0.3% in December, matching November’s increase. Core CPI was driven higher by rising shelter costs, which rose 0.5% having increased by 0.4% in the previous month. Owners’ equivalent rent, which is what a homeowner would receive from renting a home, also rose 0.5%, in line with the gain seen in November. Services inflation continued to be sticky, rising 0.5% amid increases in healthcare costs and airline fares. Excluding rents, services inflation matched November’s 0.6% increase. Goods price deflation stalled, as the cost of used cars and trucks rose for a second consecutive month, offsetting falls in household furnishings and apparel. Goods prices were 0.1% higher, having declined 0.7% in November, whilst core goods prices were unchanged following their 0.3% decline in the previous month. For the twelve months through December, core CPI rose 3.9%, slightly below the 4% pace in November and the lowest reading since May 2021.

Europe

European Central Bank and Interest Rates

In line with expectations, the European Central Bank (ECB) kept its deposit rate at its record high of 4% whilst reiterating its commitment to fighting inflation. The ECB President Christine Lagarde said “the consensus around the table was that it was premature to discuss rate cuts”, whilst highlighting that future decisions would depend on incoming data. Ms Lagarde added “we need to be further along the disinflation process to be confident that inflation will be at target – sustainably so”. However, there was an indication that the tone was starting to change as a reference in previous statements to elevated domestic price pressures and strong labour cost growth was removed at this meeting, although Ms Lagarde warned against over-interpreting such omissions and urged to focus instead on the content still in the statement.

Economic Growth

In its preliminary estimate, Eurostat said the Eurozone economy registered 0% growth in the fourth quarter of last year, slightly above the forecasted 0.1% contraction and follows a 0.1% fall in the third quarter. This meant the Eurozone avoided falling into a technical recession, broadly due to better than expected growth in Spain and Italy of 0.6% and 0.2% respectively. The French economy registered no growth, whilst the largest region, Germany, suffered a 0.3% contraction. On a year-on-year basis, the Eurozone economy grew 0.1% in the fourth quarter, ahead of the flat reading in the third quarter and the forecasted 0%. For the calendar year 2023, the Eurozone economy grew 0.5%.

Inflation

Eurostat said inflation rose in December to 2.9% from 2.4% in November, the first increase since April, although it was just below the forecasted 3% reading. The rise in inflation was driven by energy-related base effects, with energy prices falling 6.7% in December compared with the 11.5% fall in November. There was an easing in the pace of price rises for food, alcohol & tobacco and non-energy industrial goods. In line with expectations, core inflation, which excludes prices for energy, food, alcohol and tobacco, fell from 3.6% to 3.4%, its lowest level since March 2022. Services price inflation was unchanged at 4%.

Asia and Emerging Markets

Japan

In line with expectations, the Bank of Japan (BOJ) maintained its ultra-loose monetary policy stance, with the short-term interest rate unchanged at -0.1% and the target for the 10-year government bond around 0%. The BOJ did signal its growing conviction that conditions for phasing out this significant amount of stimulus were falling into place, suggesting that the end to negative interest rates could be getting closer. However, the BOJ Governor Kazuo Ueda gave no hints whether there could be a change to the negative interest rate policy at its forthcoming meetings in either March or April. Mr Ueda did state though that the likelihood of Japan sustainably achieving the BOJ’s 2% inflation target was gradually increasing, whilst highlighting the recent steady rises in services prices. He also said “If we get further evidence that a positive wage-inflation cycle will heighten, we will examine the feasibility of continuing with the various steps we are taking under our massive stimulus programme”. The BOJ did add a new comment to its quarterly outlook report that highlighted the chances of reaching the inflation target were gradually rising, but there remained high uncertainties over future developments. The report showed the BOJ had reduced its core consumer inflation projection for the fiscal year beginning in April from 2.8% to 2.4%, although the forecast for 2025 was increased slightly from 1.7% to 1.8%.

China

The National Bureau of Statistics (NBS) said China’s economy grew by an annualised 5.2% in the fourth quarter of last year, ahead of the 4.9% expansion in the third quarter but just below the forecasted 5.3% gain. On a quarter-on-quarter basis, the economy grew 1%, lower than the revised 1.5% expansion in the previous quarter. For the full calendar year 2023, the economy also grew 5.2%, above the official target of around 5% and a quicker pace than the 3% expansion in 2022. However, excluding the pandemic-affected years, it was the slowest pace of annual rise since 1990. The year-on-year comparisons have benefited from a low base comparison in the prior period.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK equities finished January lower, with the FTSE 100 seeing a slightly smaller loss than the mid-cap FTSE 250. Investor sentiment was hit by the pushing back of the start of interest rate cuts, which impacted to a greater extent on the more domestically focused FTSE 250, as did the slightly higher than expected UK inflation reading for December. The FTSE 100 suffered from underperformance by the large diversified energy, basic materials and financials stocks.

Strong corporate earnings and economic data provided support to the US S&P 500, which ended January higher. Positive announcements from the mega-cap tech-related companies contributed to outperformance by the communication services and information technology sectors. European markets, as demonstrated by the FTSE World Europe ex UK Index, also rose with the gains again led by the information technology and communication services sectors. The Japanese Nikkei 225 Index posted particularly strong gains on the back of an outperformance by large cap stocks amid expectations of structural changes in Japan, with the weaker yen also supporting exporters.

Reduced expectations for early interest rate cuts and ongoing concerns over weaker Chinese economic growth weighed on Asian markets, with the broad MSCI Asia ex Japan Index suffering a loss in January, with the sell-off in China also a key contributor. Global Emerging Markets underperformed Developed markets, with the broad MSCI Emerging Markets Index finishing January lower with China again a key reason for the underperformance as well as reduced optimism over interest rate cuts in the US.

UK fixed income markets fell in January as yields rose (fixed income prices and yields have an inverse relationship), with bonds giving up some of their gains from the end of 2023 due to reduced expectations of early interest rate cuts. Government bonds (FTSE Actuaries UK Conventional Gilts Index) underperformed investment grade bonds, with long-duration bonds suffering the bigger losses.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA11168 Exp 03/2025