We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

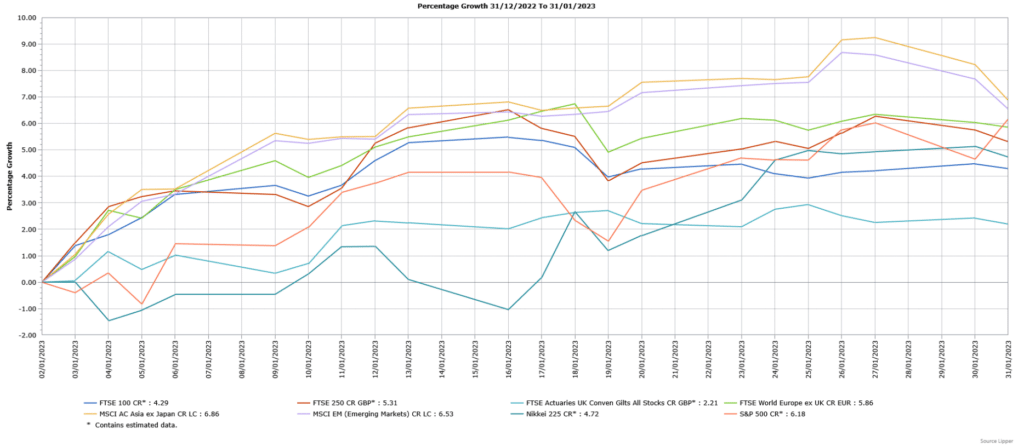

Global equity markets enjoyed a positive start to 2023, with investor sentiment helped by China’s reopening following the removal of its zero-Covid policy in December. There was further support from signs that inflation was easing from its highs in several major economies, amid hopes that the current cycle of interest rate increases might be nearing the end. All major equity markets ended the month higher, whilst the hopes over interest rates also contributed to UK fixed income assets enjoying positive returns in January.

Economic Overview

UK

International Monetary Fund (IMF) Forecast

The IMF forecasted that the UK economy will contract in 2023 and underperform other advanced economies, including sanctions-hit Russia. The IMF said the UK economy will shrink by 0.6% in 2023, instead of its previous prediction of slight growth. The downgrade was due to the high energy prices (the UK has a high dependence on expensive liquid natural gas), rising mortgage costs, increasing taxes and persistent labour shortages, but the report didn’t mention Brexit as a factor. As a result of the downgrade, the UK economy is expected to be the only country to contract this year across all advanced and emerging economies. However, the IMF did also state that it thinks the UK is now “on the right track” following the announcement of its spending plans in the Autumn Statement. In addition, the IMF also revised its growth forecast for 2024 upwards, from a 0.6% expansion to 0.9%.

Economic Growth

The Office for National Statistics (ONS) said Britain’s economy unexpectedly grew in November, with the men’s football World Cup providing a boost to the pubs and restaurants sector. The ONS said the economy expanded 0.1% in November which was above the forecasted 0.2% decline, although it was below October’s gain of 0.5%. Britain’s dominant services sector was the strongest performer, with output rising 0.2% despite widespread strikes, driven by people going out to the pub to watch the football. As well as strong growth in food and beverage services, the ONS said early pre-Christmas spending on video games also boosted output. However, manufacturing output fell by 0.5%, driven by a fall in often volatile pharmaceuticals production. A seasonal drop in Covid-19 vaccinations also weighed on growth. For the three months to November, the economy contracted by 0.3%.

Unemployment and Labour Market Statistics

In line with expectations, British unemployment remained steady at 3.7% in the three months to November. Job vacancies fell by 85,000 in the three months to December, the sixth consecutive decline, but they remain a lot higher than before the pandemic. The economic inactivity rate, which is the share of people not in work and not looking for it, fell in the three months to November to 21.5%, but it was still slightly higher than immediately before the pandemic.

The ONS said regular pay excluding bonuses grew by an annual 6.4% in three months to November, the strongest increase since records began in 2001 (not including the jumps during the pandemic which were distorted by lockdowns and government support measures). However when considering inflation, wages fell by 2.6%, which remains among the fastest drops in regular earnings since records began. Total employee pay, which includes bonuses, also rose by 6.4%, but in real terms after allowing for inflation it also fell by 2.6%. Private sector wage growth of 7.2% was sharply higher than the 3.3% increase in the public sector.

Inflation

The annual rate of UK inflation, as measured by the Consumer Price Index (CPI), fell in line with forecasts from 10.7% in November to 10.5% in December, further below the 41-year high of 11.1% in October. Lower prices for petrol and diesel and clothing drove the headline rate lower, but the cost of food and non-alcoholic beverages was 16.8% higher than a year earlier, the biggest increase since September 1977. The rise in food prices was led by eggs, milk and cheese. Restaurants and hotel prices also rose in December, whilst there was a sharp increase in air fares.

Core CPI, which excludes volatile food and energy prices, was unchanged at 6.3% in December, slightly above the forecasted small fall to 6.2%. Inflation in services prices, which some Bank of England officials view as indicating more persistent inflation pressures and the secondary impact of higher energy and wage costs, rose by 6.8%, its highest rate since March 1992.

US

Economic Growth

US economic growth in the fourth quarter was stronger than expected, although this was driven by a sharp rise in business inventories, some of which may be unwanted. The Commerce Department said the US economy grew at an annualised 2.9% in the fourth quarter, slower than the 3.2% gain in the previous three-month period but above the forecasted 2.6% expansion. Consumer spending, which is a key driver of economic activity, rose by 2.1% (2.3% in the previous quarter), driven by a rebound in goods spending at the start of the quarter, mostly on motor vehicles. Spending on services slowed, with the main contributors being healthcare, housing, utilities and personal care. With demand for long-lasting manufactured goods fading, inventories surged higher and added nearly 1.5% to growth, having fallen in the previous two periods, whilst there were smaller contributions from government spending and a smaller trade deficit. Excluding inventories, government spending and trade, domestic demand only rose by 0.2%, the smallest increase since the second quarter of 2020 and much lower than the 1.1% rate in the previous period.

Inflation

US consumer prices fell for the first time in more than two and a half years in December, driven by lower gasoline and motor vehicle prices. The Labor Department said the Consumer Price Index (CPI) fell 0.1% in December, the first fall since May 2020 and follows a 0.1% increase in November. Forecasts were for an unchanged reading, meaning this was the third consecutive month that CPI was below expectations. Gasoline prices slumped 9.4% having fallen 2% in November, however natural gas costs rose 3% whilst electricity gained 1%. Food prices were 0.3% higher, the smallest gain in nearly two years and follows a 0.5% rise in November. The cost of food consumed at home gained 0.2%, the lowest rise since March 2021. Fruit and vegetable prices fell along with dairy products, but meat, poultry and fish cost more, whilst egg prices surged by over 11% due to avian flu. For the twelve months through December, CPI rose by 6.5% having increased by 7.1% in November, the smallest gain since October 2021.

The so-called core CPI, which excludes volatile food and energy components, rose 0.3% in December, slightly quicker than the 0.2% increase in November. Prices for used cars and trucks declined 2.5%, their sixth consecutive monthly fall, whilst the cost of new motor vehicles fell 0.1%, the first drop since January 2021. Core goods prices fell by 0.3%, the third consecutive decline. However, apparel prices rose despite retailers offering discounts to clear excess inventory.

Services prices, the largest component of the CPI basket, jumped 0.6% following their 0.3% increase in November. Services costs were driven higher by rents, with owners’ equivalent rent, which is what a homeowner would receive from renting a home, surging 0.8%, having risen 0.7% in November. Healthcare costs rose following two consecutive monthly declines, whilst excluding rental shelter, services inflation was 0.4% higher having been unchanged in November. For the 12 months through December, core CPI rose 5.7%, a slower pace than the 6% gain in November.

Europe

Economic Growth

The EU’s Statistics Office, Eurostat, said the Eurozone economy unexpectedly expanded in the fourth quarter of last year, despite the impact of high energy costs and rising interest rates. The Eurozone economy saw slight growth of 0.1% which was above the forecasted 0.1% contraction, although slower than the 0.3% expansion in the third quarter. Among the bigger Eurozone countries, both Germany and Italy suffered contractions in the fourth quarter, but France and Spain expanded. On a yearly basis, the economy expanded 1.9% in the fourth quarter, just ahead of the forecasted 1.8% growth.

Inflation

The preliminary estimate released at the beginning of February saw headline inflation in the Eurozone slow in January to its lowest level since May 2022 on the back of falling energy costs. Eurostat said prices in the 20 countries sharing the euro (this expanded from 19 on 1 January 2023 when Croatia joined) fell from a year-on-year rise of 9.2% in December to 8.5% in January, well below the forecasted smaller drop to 9%. The decline was driven by lower energy costs, despite food and industrial goods maintaining upward pressure on prices. However, inflation excluding volatile energy and food prices increased from 6.9% to 7%, whilst an even narrower measure that also excludes alcohol and tobacco remained unchanged at 5.2%, above the forecasted small fall to 5.1%.

Asia and Emerging Markets

China

The National Bureau of Statistics (NBS) said China’s economy grew by 2.9% year-on-year in the fourth quarter of last year, which was above the forecasted smaller expansion of 1.8% but below the 3.9% gain in the previous quarter. On a quarter-on-quarter basis, growth was flat in the fourth quarter, which was better than the forecasted 0.8% decline but worse than the 3.9% expansion in the previous quarter.

For 2022, economic growth was 3%, well below the official target of around 5.5% and excluding the period after Covid first hit in 2020, the worst performance in nearly half a century. China’s economy was severely hit last year by the zero-Covid policy, which saw major industrial centres being closed or placed under strict curbs for long periods. Whilst Beijing removed the Covid restrictions in December, this led to many businesses struggling with surging infections.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK indices rose in January, with the mid cap FTSE 250 outperforming the FTSE 100, despite the large cap index enjoying its biggest percentage gain for this month since 2013. The FTSE 250 benefited from good performance in domestically focused consumer stocks, amid signs that the UK economy was holding up better than expected.

US indices produced strong gains, with the S&P 500 recording its first January increase since 2019, whilst the tech-heavy Nasdaq was over 10% higher. Sentiment was boosted by optimism over an easing in interest rate increases amid falling inflation. European markets, as demonstrated by the broad FTSE World Europe ex UK Index, also performed well on signs of resilient economic data and hopes of better than expected corporate earnings. The Japanese Nikkei 225 Index also posted a gain, with support from China’s reopening and expectations of slower US interest rate rises.

The broad MSCI Asia ex Japan Index recorded a strong gain, with China’s faster than expected reopening boosting performance in the region. Hong Kong performed strongly, whilst there were also notable gains in China, Taiwan and South Korea. Global Emerging Markets also produced a large positive return, as shown by the broad MSCI Emerging Markets Index, with sentiment helped by the end of China’s zero-Covid policy as well as a weakening US dollar.

Fixed income markets had a positive start to 2023, with sentiment boosted by increased hopes over the current cycle of interest rate increases nearing its end. This optimism provided support to both government and corporate bond markets, with the latter outperforming amid signs that inflation had peaked and some better than expected economic data that reduced some of the worse recession fears.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA9147 Exp:02/2024