We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

Global equity markets saw good gains in December as easing inflation led to investors turning increasingly optimistic of interest rates having peaked with rising expectations over central banks cutting rates in the first half of 2024. Developed markets outperformed Emerging Markets, as ongoing concerns over China weighed on the latter. Fixed income markets also saw strong performance amid the hopes of a shift in monetary policy direction from ‘higher for longer’ to potential rate cuts.

Economic Overview

UK

Bank of England and Interest Rates

As expected, the Bank of England held its interest rate at 5.25% whilst stating that the rate needed to stay high for “an extended period”. As with the previous meeting, it wasn’t a unanimous decision with the Monetary Policy Committee (MPC) voting 6-3 to leave the base rate unchanged, with the three dissenters again preferring to raise the rate by 0.25%, whilst for most of the others the hold decision had been “finely balanced”. The BoE Governor Andrew Bailey highlighted that successive rate rises have helped bring inflation down from over 10% in January to 4.6% in October, whilst noting there was “still some way to go” in the fight against inflation and to bring it back to its 2% target. Furthermore, Mr Bailey said it was “really too early” to speculate about cutting rates.

Economic Growth

The Office for National Statistics (ONS) said Britain’s economy unexpectedly contracted in October, thereby increasing the risk of recession. The ONS said the economy shrank by 0.3% in October, below the 0.2% growth in September and the forecasted no change reading, as well as the first time there had been a monthly contraction since July. The ONS said that exceptionally wet weather may have impacted activity in October, particularly in retail and tourism, as Storm Babet hit the UK. The dominant service sector shrank by 0.2% in October, whilst manufacturing and construction contracted by 1.1% and 0.5% respectively. For the three months to October, the ONS said there was zero growth in the economy.

The ONS also lowered its estimate for the third quarter from no growth to a 0.1% contraction, compared with the forecasted unchanged reading, which suggests the UK was at risk of recession. In addition, growth in the second quarter was revised lower from a 0.2% expansion to a flat reading. The ONS suggested that rising interest rates were weighing on consumer spending, which slowed in the third quarter. Furthermore, the ONS also said the lower estimate was impacted by additional data showing businesses in film production, engineering and design as well as telecommunications were “all performing a little worse than we thought”. There were also weaker performances from smaller companies, particularly those in the hospitality and IT sectors.

Unemployment & Labour Market Statistics

The ONS said unemployment in the three months to September was unchanged at 4.2%, whilst employment rose by 50,000 people. The ONS said this data may not prove reliable due to the changes it has made to measure the jobs market. The estimated number of job vacancies fell for the 17th consecutive time by 45,000 in the three months to November and are now nearly 30% below their peak, although at 949,000, they remain above their pre-pandemic level.

The pace of wage growth eased in the three months to October, but remained ahead of inflation. Annual growth in regular pay excluding bonuses fell from 7.8% to 7.3%, the sharpest slowdown in nearly two years although the pace remains strong. Annual average regular earnings growth for the public sector was 6.9%, among the highest ever rates since comparable records began in 2001, whilst for the private sector it was 7.3%. When adjusted for inflation, annual regular pay growth was 1.4%. Annual growth in employee’s total pay, which includes bonuses, slowed from 8% to 7.2% and in real terms, it increased by 1.3%.

Inflation

The headline annual rate of UK inflation, as measured by the Consumer Price Index (CPI), saw a bigger fall than expected in November amid falling petrol prices. The ONS said CPI fell from 4.6% in October to 3.9% in November, the lowest level since September 2021 and below the forecasted smaller decline to 4.4%. The ONS said the fall was driven by transport and in particular cheaper petrol prices, with fuel 10.6% cheaper than last year. In addition, there was a much smaller increase in food and drink prices compared with the previous year, but they do remain 27% higher than two years ago and have increased by over 9% in the past 12 months. In particular, the pace of price increases for milk, cheese and eggs slowed, whilst the costs for a variety of baked goods fell, having increased a year ago. However, the prices for olive oil, sugar and onions remained much higher.

Core inflation, which excludes food, energy, alcohol and tobacco prices, also saw a bigger than expected decline as it fell from 5.7% in October to 5.1% in November. Services price inflation, which the Bank of England views as a key measure of domestically-generated inflation, fell from 6.6% to 6.3%.

US

US Federal Reserve & Interest Rates

The Federal Reserve (Fed) left its interest rate unchanged in the 5.25%-5.5% range, but Fed Chair Jerome Powell said the historic tightening of monetary policy is likely over as inflation falls faster than expected, with rate increases “not the base case anymore”. There was also a shift in the policy outlook, with 17 of 19 Fed policymakers now seeing rates lower by the end of 2024 with no one seeing them higher. In addition, a measure of policymakers’ perceptions of risks facing the economy also moved closer to balance, which Mr Powell alluded to when stating the Fed was now at the point where “both mandates are important”, suggesting sensitivity to the risk of “overdoing it” and pushing the economy into a faster than necessary slowdown. Mr Powell also highlighted that the strong growth appears to be moderating, whilst the labour market is coming back to balance and inflation is making real progress. Mr Powell added that whilst declaring victory would be premature, the question is “when will it become appropriate to begin dialling back”. The Fed’s updated projections showed interest rates at 4.5% to 4.75% at the end of 2024, whilst inflation ends 2023 at 2.8%, before reaching 2.4% by the end of 2024, close to the 2% target. In addition, the unemployment rate is forecast to rise from 3.7% to 4.1%, whilst economic growth is seen slowing from 2.6% in 2023 to 1.4% over 2024.

Economic Growth

The Commerce Department lowered its previous estimate of an annualised 5.2% growth in the third quarter to an increase of 4.9%, which although lower than the forecasted unchanged reading, was still the fastest pace since the fourth quarter of 2021 and above the 2.1% expansion in the second quarter. The downward revision reflected downgrades to consumer spending and inventory investment. Consumer spending, which accounts for more than two-thirds of US economic activity, was reduced from 3.6% to a still strong 3.1% rate, broadly due to a downward revision to spending on international travel. The lower inventory investment reading was broadly due to downgrades to stocks at general merchandise and other retail stores.

Inflation

US consumer prices unexpectedly rose in November, as falls in the cost of gasoline were more than offset by increases in rents. The Labor Department said the Consumer Price Index (CPI) rose 0.1% in November, having been unchanged in October, whilst forecasts had been for another unchanged reading. Gasoline prices dropped 6% having fallen 5% in October, but natural gas cost more, as did electricity. Food prices were 0.2% higher following their 0.3% gain in October. Grocery food prices rose 0.1% with higher costs for cereals and bakery products as well as fruits and vegetables, but meat, fish and eggs prices were lower. For the twelve months through November, CPI rose 3.1%, just below October’s 3.2% increase although in line with forecasts.

The so-called core CPI, which excludes volatile food and energy components, rose 0.3% in November having risen 0.2% in October. Owners’ equivalent rent, which is what a homeowner would receive from renting a home, lifted core CPI as it increased 0.5%, just above the 0.4% reading in October. Services prices rose 0.5%, beating the 0.3% gain in the previous month. Excluding rents, services inflation jumped 0.6%, well above October’s 0.3% rise. There was also a 1.6% jump in the cost of used cars and trucks, though this is viewed as likely to be temporary due to the impact of the now-ended strikes. Healthcare costs rose, as did health insurance prices. However, apparel prices declined 1.3% amid deep discounting, whilst the costs for household furnishings and operations also fell, as did those for new motor vehicles. These latter falls contributed to the continuation of goods price deflation, with goods prices slumping 0.7% having fallen 0.4% in October. Core goods prices fell 0.3%, a bigger decline than the 0.1% fall in the previous month. For the twelve months through November, core CPI rose 4%, matching the pace seen in October. Shelter costs, which were 6.5% higher, accounted for nearly 70% of the year-on-year increase in core CPI.

Europe

European Central Bank and Interest Rates

In line with expectations, the European Central Bank (ECB) held the deposit rate at its record high of 4%, whilst pushing back against any imminent cuts. The ECB President Christine Lagarde said that inflation would soon rebound and prices pressures remain strong, whilst stating that “We don’t think it’s time to lower our guard”, adding “there is still work to be done…that can very much take the form of holding (rates)”. Ms Lagarde added that policymakers “did not discuss rate cuts at all”. In addition, the ECB’s updated economic projections showed headline inflation averaging 5.4% in 2023, 2.7% in 2024 and 2.1% in 2025, suggesting it could reach its 2% target then.

Economic Growth

In its third estimate, Eurostat confirmed the Eurozone economy contracted 0.1% quarter-on-quarter in the third quarter, matching the previous estimate. It was the first decline since the fourth quarter of 2022, driven by a negative contribution from changes in inventory. Fixed investment was unchanged, whilst net trade made a neutral contribution as a fall in exports was offset by a decline in imports. Household consumption increased, improving in three consecutive periods of either contraction or no growth, whilst public spending also rose. Among the largest Eurozone economies, there were contractions of 0.1% in Germany and France and a fall of 0.2% in the Netherlands, whilst Spain and Italy grew 0.3% and 0.1% respectively. On a year-on-year basis, the Eurozone economy registered no growth in the third quarter, below the previous estimate of a 0.1% expansion and the weakest performance since the contractions in 2020.

Asia and Emerging Markets

Japan

As expected, the Bank of Japan (BOJ) maintained its ultra-loose monetary policy stance, with its short-term interest rate target remaining at -0.1% and that for the 10-year government bond around 0%. The BOJ also left unchanged its pledge to increase stimulus “without hesitation” if needed. In addition, the BOJ made no change to its dovish guidance, with the bank awaiting further evidence on whether wages and prices would rise enough to justify a change in policy stance. The BOJ Governor Kazuo Ueda said prices and wages appear to be moving in the right direction, but warned that conditions remained uncertain, stating that the bank “still needs to scrutinise whether a positive wage-inflation cycle will fall in place”. The Governor also gave no clear signal as to how soon the BOJ could exit negative rates, whilst also saying the BOJ wouldn’t rush into raising rates just because the Federal Reserve could start cutting them soon.

The initial estimate of a 2.1% year-on-year contraction in the economy in the third quarter was revised lower to a fall of 2.9%, below the forecasted small increase to a 2% decline. Both consumer and business spending contracted and weighed on the Japanese economy in the third quarter. Consumer spending, which makes up more than half of the economy, fell 0.2% compared with the forecasted broadly flat reading, whilst capital expenditure declined 0.4%, although this was an improvement on the previous estimate of a 0.6% drop and market expectations of a slight upgrade to a fall of 0.5%. In line with the preliminary reading, external demand reduced GDP by 0.1% as service imports grew faster than auto exports.

Market Overview

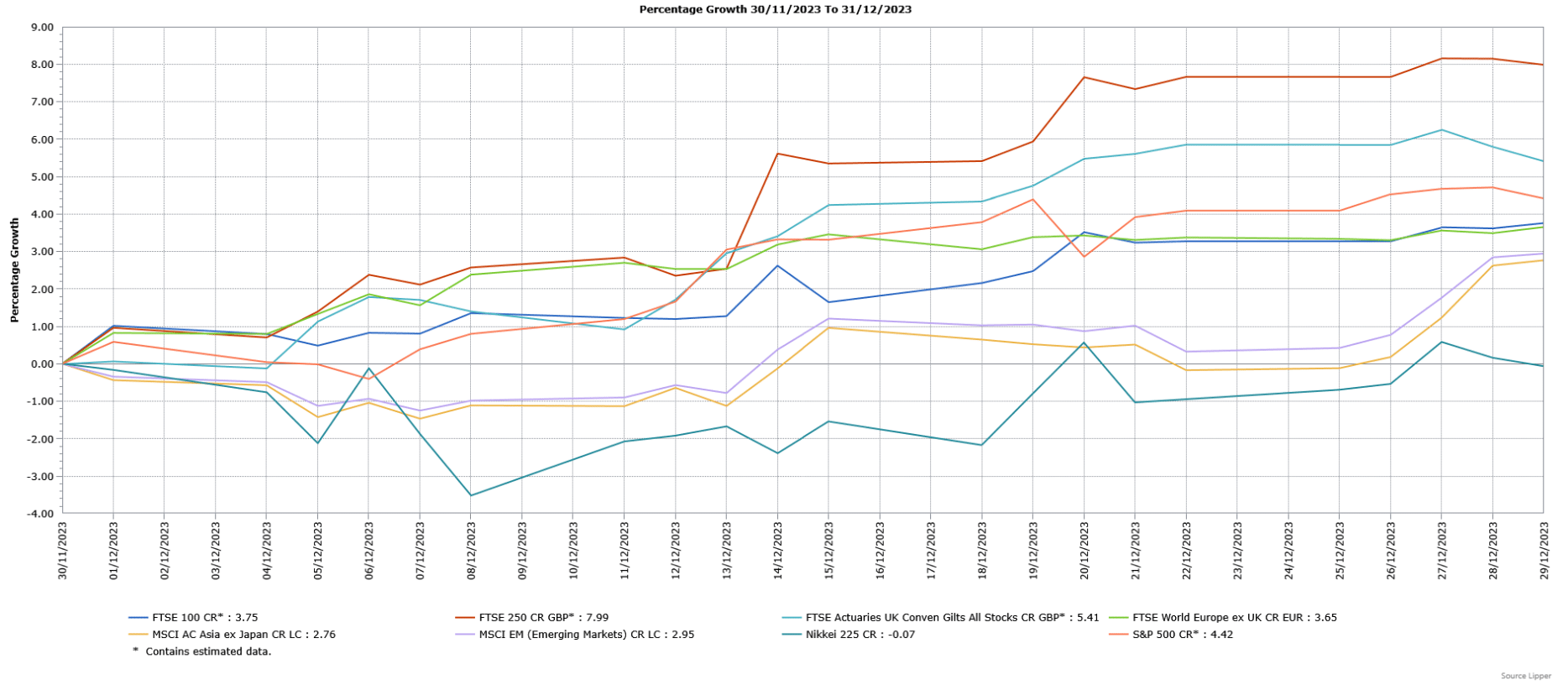

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK equities performed well in December, with the mi- cap FTSE 250 sharply outperforming the FTSE 100 as it posted its strongest monthly gain for three years. Sentiment was boosted by a slowdown in the pace of inflation, raising expectations that the Bank of England would lower interest rates in 2024 and providing support in particular to the FTSE 250 amid strong performance from domestically-focused stocks. Sterling strength weighed on the performance of some of the internationally exposed FTSE 100 companies.

The US S&P 500 rose as the Federal Reserve appeared to call the peak in interest rates and suggested it could start cutting as soon as March, with interest rate sensitive sectors such as IT among the strongest performers. Further falls in US and European inflation readings helped European markets record gains, as demonstrated by the FTSE World Europe ex UK Index, with hopes rising over potential interest rate cuts. The Japanese Nikkei 225 lagged the performance of other developed markets amid concerns over yen strength, ending December broadly unchanged.

Hopes that US interest rates had peaked provided support to the broad MSCI Asia ex Japan Index, which finished December higher with most regions ending with gains. The main outlier was China, amid continued concerns over the weak economy and troubled property sector. Although Global Emerging Markets underperformed developed markets, the broad MSCI Emerging Markets Index still rose despite the underperformance from China, with Brazil among the strongest performers as its interest rate continued to be lowered.

Increased optimism over most major central banks cutting interest rates in 2024 drove strong returns from UK fixed income assets, with yields on both gilts and corporate bonds falling in December (fixed income prices and yields have an inverse relationship). Government bonds (FTSE Actuaries UK Conventional Gilts Index) outperformed investment grade corporate bonds, though both finished the month with strong gains.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA11044 Expiry:01/2025