We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

Following gains in the previous month, global equity markets ended December lower as the major global central banks confirmed they remained committed to raising interest rates until inflation is under control. Widespread concerns over recession also weighed on investor sentiment. Overall, emerging markets were more resilient than developed markets, boosted by China’s earlier than expected reversal of its zero-Covid policies. UK fixed income assets also finished lower, amid a further increase in interest rates.

Economic Overview

UK

Bank of England and interest rates

The Bank of England (BoE) raised its interest rate by 0.5% to 3.5%, the highest level since 2008, whilst indicating that more increases were likely. It was not a unanimous vote with six of the nine Monetary Policy Committee (MPC) members voting for the 0.5% rise, but one policymaker opted for a larger 0.75% hike whilst two voted to not increase rates at all. The two MPC members preferring not to raise rates believe that the tightening of monetary policy to date was “more than sufficient” to get inflation back to target. The BoE said “The labour market remains tight and there has been evidence of inflationary pressures in domestic prices and wages that could indicate greater persistence and thus justifies a further forceful monetary policy response”. The BoE Governor Andrew Bailey, in a letter to the Chancellor Jeremy Hunt accompanying this interest rate decision, said that the bank’s forecasts suggested British inflation had reached its peak. Mr Bailey also told reporters that inflation data gave “the first glimmer” that prices would fall sharply next year, but that labour market pressures meant it was too soon for the BoE to let down its guard.

Economic Growth

The ONS said the economy expanded by 0.5% in October, which was better than the expected 0.4% growth and well above the 0.6% contraction in September which was affected by the public holiday for the funeral of Queen Elizabeth II. The services sector grew 0.6% following its 0.8% decline in September, with the largest contributions from wholesale and retail trade and repair of motor vehicles. Construction rose for the fourth consecutive month. For the three months to October, the economy contracted by 0.3%, still the biggest drop since early 2021 when there were strict Covid restrictions in place.

The ONS said the economy fell by 0.3% in the third quarter, slightly worse than the preliminary estimate of -0.2%, putting Britain bottom of the Group of Seven (G7) in terms of quarterly growth. Business investment fell by 2.5% in quarterly terms, lower than the first estimate of a 0.5% fall. Although the dominant services sector expanded 0.1%, this was more than offset by declines in manufacturing and construction. The ONS also said that British economic output in the third quarter was 0.8% lower than its level of late-2019, compared with a previous estimate of 0.4% below and in contrast to other G7 countries that have recovered.

Unemployment & Labour Market Statistics

British unemployment rose for a second consecutive month, increasing from 3.6% to 3.7% in the three months to October. Job vacancies in the three months to November fell by 65,000 to 1,187,000, but despite five consecutive quarterly falls it remains at historically high levels. The economic inactivity rate, which is the share of people not in work and not looking for it fell in the three months to October from 21.7% to 21.5%, driven mostly by more older people who had retired.

The ONS said growth in regular pay excluding bonuses was stronger than expected in the three months to October as it rose by 6.1%, the strongest growth rate seen outside of the pandemic period. However, taking into account inflation wages fell by 2.7%, which remains among the largest declines since comparable records began in 2001.

Inflation

The annual rate of UK inflation, as measured by the Consumer Price Index (CPI), fell by more than expected in November, amid a slowdown in the pace of motor fuel price increases. The ONS said CPI rose 10.7% in November, lower than both the 41-year high of 11.1% in October and the forecasted smaller fall to 10.9%. The fall in the pace of inflation was broadly due to petrol and diesel prices easing from their record highs, although the ONS said average fuel prices remained well above what they were last year. Food prices continued to rise, with annual food inflation reaching 16.5%, the highest rate for 45 years and just above October’s increase of 16.4%. There was also a large upward contribution from housing and household services, principally from electricity, gas and other fuels. Core CPI, which excludes volatile food and energy prices, fell from 6.5% in October to 6.3% in November.

US

Interest Rates

The US Federal Reserve (Fed) increased its interest rate by 0.5% to a new range of 4.25% to 4.5%, the highest since late-2007. This represented an easing in the pace of increases from the 0.75% rises at the previous four meetings. However, the Fed projected at least an additional 0.75% of further increases by the end of 2023, as well as a rise in unemployment and a near stalling of economic growth. The accompanying statement was little changed from the November meeting and still emphasised that ongoing increases in the interest rate would be appropriate in order to ensure monetary policy is sufficiently restrictive to return inflation to 2% over time. In the press conference following the meeting, the Fed Chair Jerome Powell said the speed of rate rises was less critical now, whilst adding he wasn’t ready to confirm the recent good news on inflation points to a peak in price pressures. Mr Powell said that whilst recent data showed a welcome reduction in pressures, it will take substantially more evidence to give confidence inflation is on a sustained downward path.

The Fed now sees inflation, using the bank’s preferred measure, as remaining above the 2% target at least until the end of 2025 and will still be above 3% by the end of 2023. In addition, the median projection for unemployment is to rise from its current level of 3.7% to 4.6% over the next year, an increase that exceeds the level historically associated with a recession. Economic growth is forecasted to be just 0.5% in 2023, the same as estimated for 2022, before rising to 1.6% in 2024.

Inflation

US consumer prices rose by less than expected for a second consecutive month in November, whilst underlying core inflation increased by the least in 15 months. The Labor Department said the Consumer Price Index (CPI) rose 0.1% in November, below both the 0.4% increase in October and the forecasted 0.3% gain. Gasoline prices fell 2%, whilst the cost of natural gas was lower as was electricity prices. Although food prices rose 0.5%, this was the smallest gain since December 2021 and slightly lower than October’s 0.6% increase. The cost of food consumed at home rose 0.5%, driven by fruits and vegetables, cereals and non-alcoholic beverages, but prices for meat, fish and eggs were lower. For the twelve months through November, CPI rose by 7.1% having increased by 7.7% in October, the smallest gain since December 2021.

The so-called core CPI, which excludes volatile food and energy components, rose 0.2% in November, slightly lower than the 0.3% gain in October and the lowest increase since August 2021. A fifth consecutive monthly fall in the prices for used cars and trucks held back core CPI, whilst the costs for new motor vehicles and household furnishings were unchanged. Goods deflation was more evident, with core goods prices falling 0.5%, the most since April 2020. Spending has been shifting to services, the largest component of CPI, gaining 0.3% although there were mixed results. Healthcare costs fell, as did airline ticket prices and hotel and motel accommodation costs. However, other prices rose, driven by education, communication, personal and recreation services. Rents continued to apply upward pressure, with owners’ equivalent rent, which is what a homeowner would receive from renting a home, rising 0.7% having increased 0.6% in the previous month. Core services were 0.4% higher, but excluding rents were unchanged. For the 12 months through November, core CPI rose 6%, a slower pace than the 6.3% gain in October.

Europe

Interest Rates

In line with expectations, the European Central Bank (ECB) raised its interest rate by 0.5% to 2%, the highest level in 14-years. This represented an easing in the ECB’s pace of increases, but the central bank stressed significant tightening remained ahead. The ECB President Christine Lagarde told a news conference following the announcement that “Based on the information that we have available today, that predicates another 0.5% rise at our next meeting and possibly at the one after that, and possibly thereafter”. In addition, the ECB’s new projections showed inflation still above the 2% target through 2025, whilst Ms Lagarde said prices may still come in higher than that, citing the possibility of a period of stronger than expected wage growth and a boost to demand from government support measures. The ECB also said that it currently expected any recession to be “relatively short-lived and shallow”, with Ms Lagarde noting that unemployment levels were at “rock-bottom”. The ECB also outlined plans to stop replacing maturing bonds from its €5 trillion portfolio, which will see monthly reinvestments reduced starting from March 2023, with the pace of balance sheet reduction being revised from July.

Market Overview

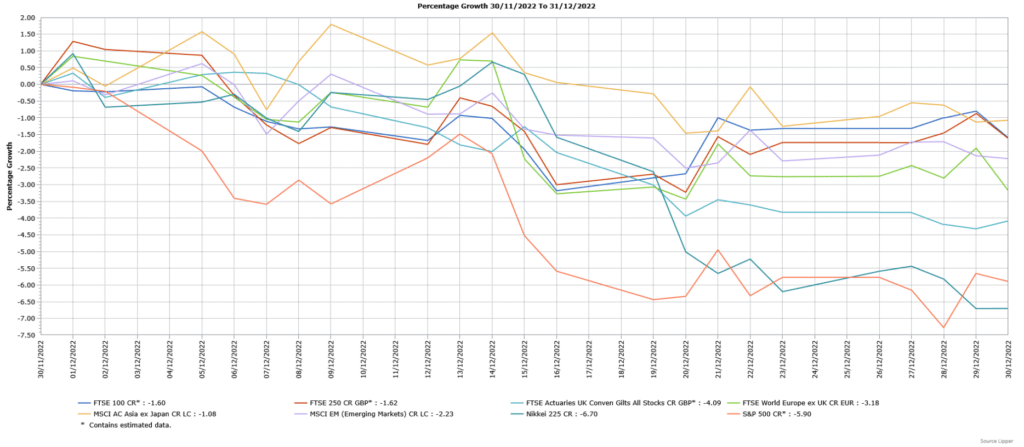

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK markets fell in December, with the FTSE 100 and FTSE 250 suffering similar losses. Investor sentiment was hit by rising interest rates, together with fears over recession.

US indices suffered sharp falls in December, as shown by the S&P 500, whilst the tech-heavy Nasdaq was the biggest decliner after the Federal Reserve reiterated its firm stance on combatting inflation. European markets, as demonstrated by the broad FTSE World Europe ex UK Index, also fell as they were similarly impacted by the further increases in interest rates, as well as weak economic data. The Japanese Nikkei 225 Index endured a large loss, with the market being additionally hit by the Bank of Japan’s unexpected revision to its yield curve control policy.

Outperformance from China and Hong Kong following the earlier than expected reopening of the Chinese economy helped limit the losses from the broad MSCI Asia ex Japan Index, with other regional markets suffering from concerns over US interest rates going higher and for staying there for longer. Global Emerging Markets, as shown by the broad MSCI Emerging Market Index, also benefited from the removal of the Chinese Covid-restrictions, although there was weakness in some Emerging Asia indices, whilst Latin America was the weakest performer.

Fixed income markets fell in December as yields moved higher (fixed income prices and yields have an inverse relationship),as the major central banks announced further increases in interest rates. Sterling corporate bonds fell, but suffered small losses than government bonds (FTSE Actuaries UK Conventional Gilts Index).

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA9025 Exp 06/2023