We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

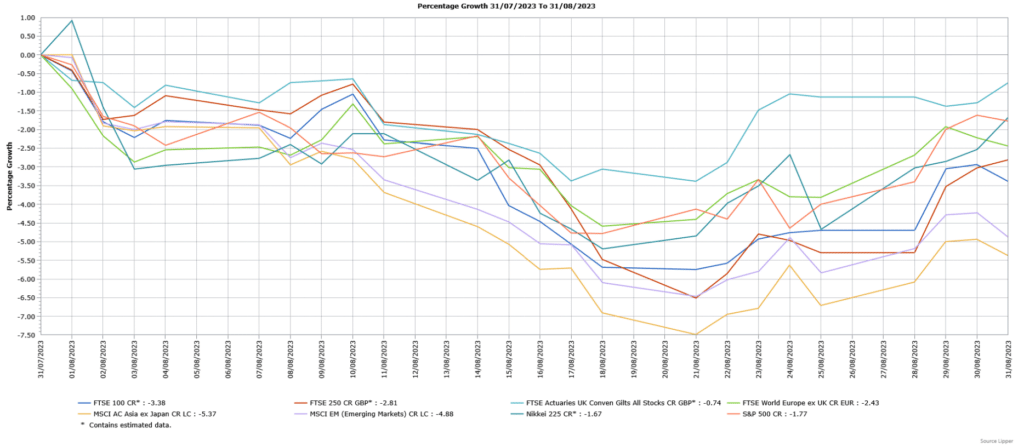

August was a difficult month for global equity markets, with investor sentiment hit by concerns over China’s economy, notably its struggling real estate sector. The concerns over China contributed to emerging markets underperforming developed markets. Whilst inflation continued to ease, the increases in interest rates may not yet be over and may remain higher for longer, leading to small losses for UK fixed-income assets.

Economic Overview

UK

Bank of England and interest rates

In line with most expectations, the Bank of England (BoE) raised its key interest rate by 0.25% to 5.25%, the 14th consecutive increase and the highest level since February 2008. There was a three-way split in the voting, with six of the nine Monetary Policy Committee (MPC) members opting for the 0.25% increase. Still, two members preferred a bigger 0.5% rise, whilst one person elected for no change as they warned of the risk of smothering the economy. In its new guidance, the BoE said, “the MPC will ensure that Bank Rate is sufficiently restrictive for sufficiently long to return inflation to the 2% target”. The BoE Governor Andrew Bailey told the press conference following the announcement that “I don’t think it is time to declare it’s all over”, adding it was “far too soon” to speculate about the timing of any rate cuts. Mr Bailey also said, “we might need to raise interest rates again, but that’s not certain”.

The BoE also released its latest Monetary Policy Report, containing its updated economic projections. The BoE now predicts that inflation will not reach its 2% target until the second quarter of 2025, three months later than May’s forecast. The BoE also stated that services prices inflation, which is believed to offer a longer-term price signal, is projected to stay high. The projection for wage growth at the end of this year was increased from 5% to 6%, as pay demands have not fallen in line with lower prospects for inflation, with Mr Bailey stating the pace of pay growth was “materially above” previous forecasts. The BoE noted the economy’s recent “surprising resilience”, but the growth forecasts barely changed from May to 0.5% in 2023 and 2024, and just 0.25% in 2025. The unemployment rate is now expected to rise more than previously projected, reaching 4.8% in late 2025.

Economic growth

The Office for National Statistics (ONS) said the British economy unexpectedly grew in the second quarter of this year. However, it remains the only big-advanced economy yet to regain its pre-Covid late-2019 level. The ONS said the economy grew 0.2% in the second quarter, above the forecasted flat reading and the BoE’s projected 0.1% expansion. Manufacturing had its best quarter since early 2019 as output rose 1.6%, whilst business investment jumped 3.4%. Services rose 0.1%, with some sectors supported by the good weather and an increase in live events. Construction rose, but mining fell amid crude petroleum and natural gas extraction declines. There was strong growth in household consumption as well as a jump in government spending.

The better-than-expected quarterly growth was helped by the 0.5% gain in June, which was well above the forecasted 0.2% expansion and the 0.1% contraction in May. It was also the biggest monthly growth since October 2022 and the first time since then that all three sectors contributed positively. The ONS said businesses noted the additional bank holiday in May as a factor in the increased output in June. The warm weather boosted service sectors such as pubs and restaurants, together with the construction industry. In addition, manufacturing and the car industry in particular performed robustly. However, strikes by NHS workers weighed on output.

Unemployment and labour market statistics

British unemployment unexpectedly rose in the three months to June from 4% to 4.2%, the highest level since the three months to October 2021. The increase in unemployment was driven by people unemployed for up to six months. The estimated number of job vacancies fell for the 13th consecutive time in the quarter ending July, declining by 66,000 to 1.02 million. The economic inactivity rate, which is the share of people unemployed and not looking for work, fell to 20.9% in the three months ending in June. This is broadly driven by those inactive for other reasons and those looking after families or homes. In addition, the number of people inactive due to long-term sickness rose to a record high.

Wage growth was stronger than expected, with regular pay (excluding bonuses) rising to an annual 7.8% in the three months to June, the highest regular growth rate since comparable records began in 2001. When adjusted for inflation, annual regular pay growth remained in positive terms, although it was only 0.1%. Employee’s total pay, which includes bonuses, increased by an annual 8.2%, although this was affected by the NHS one-off bonus payments made in June. In real terms, total pay rose by 0.5%. Forecasts had been for smaller increases in both measures of pay growth.

Inflation

In line with expectations, the headline annual rate of UK inflation, as measured by the Consumer Price Index (CPI), fell from 7.9% in June to 6.8% in July. The ONS said falling gas and electricity prices were the biggest driver behind the drop in inflation. In addition, food cost inflation also eased, including staples such as milk, bread and cereal, although the ONS said prices were still nearly 15% higher than a year ago. Petrol and diesel prices were another big drag on inflation, as they fell by a record 25% compared with a year ago. However, other goods and services still saw large increases, with sugar prices 55% higher and transport insurance costs rising by 50%, the biggest increase since records began in the late 1980s.

Whilst headline CPI fell sharply, core inflation, which excludes food, energy, alcohol and tobacco prices, was stronger than expected as it remained unchanged at 6.9% in July compared with the forecasted small fall to 6.8%. Services inflation, which is mostly driven by home-grown pressure from wages, rose from 7.2% to 7.4%, slightly higher than forecast by the BoE. There were signs of weaker inflationary pressures ahead from the manufacturing sector, with factory gate prices falling by 0.8% in the 12 months to July ─ the weakest reading since October 2020.

US

Economic growth

In its second estimate, the Commerce Department said the US economy grew in the second quarter at a slightly slower pace than initially thought as businesses liquidated inventory. The previous estimate of annualised growth of 2.4% was revised down to 2.1%, compared with the forecasted unchanged reading. Inventory investment was revised sharply lower from an increase to a decline, meaning inventories were a small negative rather than adding to growth. There were also downward revisions to business spending on equipment and intellectual products. However, there was a slight upward revision to consumer spending, but trade negatively affected GDP more than initially estimated.

Inflation

The pace of headline US consumer prices rose in July, with higher rents mostly offset by the falling costs of goods such as motor vehicles and furniture. The Labor Department said the Consumer Price Index (CPI) rose 0.2% in July, matching June’s reading, with shelter responsible for more than 90% of the gain as rental costs increased 0.4%. Food prices rose 0.2%, with grocery costs increasing 0.3% having been unchanged in June, boosted by higher prices for eggs, beef, dairy and fruit and vegetables. Grocery prices have eased from their year-on-year peak of 13.5% in August 2022 to 3.6% in July. Restaurant prices were 0.2% higher, whilst the cost of energy products rose 0.1% as gasoline prices saw a slight gain. Whilst there was a jump in prices at the pump in late July, this is expected to be reflected in the August report. For the 12 months through July, CPI rose 3.2% compared with the 3% increase in June, which had been the smallest year-on-year gain since March 2021. The annual CPI reading rose for the first time in 13 months partly because of the lower base following the fall in prices in July last year.

The so-called core CPI, which excludes volatile food and energy components, rose 0.2% in July, matching June’s reading. Core CPI was boosted by services inflation remaining sticky, gaining 0.3% for a third consecutive month, supported by higher rental costs. Owners’ equivalent rent, which is what a homeowner would receive from renting a home, rose 0.5% in July, having gained 0.4% in June. However, the increase in underlying inflation was curbed by a 0.3% fall in core goods prices, a bigger drop than the 0.1% decline in June. Goods deflation was driven by used cars and trucks, where prices fell 1.3%, whilst there were also falls in the costs of new cars and household furnishings. There were increases in the prices of motor vehicle insurance, education and recreation, but airline fares fell 8.1%, the fourth consecutive decline, with hotel and motel rooms also cheaper. For the 12 months through July, core CPI rose 4.7%, the lowest year-on-year increase since October 2021 and slightly lower than the 4.8% gain in June.

Europe

Economic growth

In line with its preliminary estimate, the EU’s statistics office, Eurostat, said the Eurozone economy grew by 0.3% in the second quarter of this year, which followed zero growth in the first three months of 2023. A moderation in inflationary pressures likely supported a recovery in demand, but higher interest rates and waning confidence are still weighing on the region. Among the Eurozone’s largest economies, France and Spain grew, while Germany stagnated and Italy suffered an unexpected contraction. On a yearly basis, the Eurozone economy expanded by 0.6%, again in line with the preliminary estimate and the weakest pace since the 2020-21 pandemic-related recession.

Inflation

Preliminary estimates showed that annual inflation in the Eurozone remained unchanged in August despite easing price pressures for underlying goods. Eurostat said headline consumer prices proved unexpectedly stubborn as they remained unchanged at 5.3% in August amid a sharp rise in energy costs, having been forecasted to fall to 5.1%. However, core inflation, which excludes prices for energy, food, alcohol and tobacco, fell in line with expectations from 5.5% to 5.3%, despite services inflation barely changing as it edged lower from 5.6% to 5.5%.

Asia and Emerging Markets

Japan

Japan’s economic growth in the second quarter was much stronger than expected, supported by auto exports and tourism. The economy grew by an annualised 6%, which translated to a quarterly increase of 1.5% ─ sharply higher than the forecasted 0.8% gain. It was also the fastest expansion since the final quarter of 2020 and follows a revised 3.7% growth in the first three months of the year. Private consumption, which makes up over half of the economy, declined 0.5% quarter on quarter in the second quarter as price increases weighed on sales of food and household appliances. However, exports grew 3.2% led by car exports and inbound tourism, but capital expenditure was flat. Strong US and European demand supported exports, although the net trade contribution was also flattered by a third consecutive quarterly fall in imports, partly due to yen weakness.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK equities finished August lower, with the FTSE 100 suffering a bigger loss than the mid cap FTSE 250. The more domestically focused FTSE 250 suffered from the signs of a weakening UK economic outlook, but the FTSE 100 was impacted to a greater extent by the concerns over the Chinese economy, which weighed in particular on the basic materials and financials sectors.

The US S&P 500 fell in August, with investor sentiment hit by indications that the Federal Reserve’s tightening cycle may not have ended in July due to signs that policymakers are divided on the next steps. As demonstrated by the FTSE World Europe ex UK Index, European markets ended the month lower with economically sensitive sectors among the worse performing, amid sticky inflation and weaker consumer confidence. The Japanese Nikkei 225 Index also fell on the back of weakness in large cap growth stocks.

The broad MSCI Asia ex Japan Index sharply declined in August, with China and Hong Kong among the biggest fallers. Investor sentiment suffered from concerns over whether Beijing will announce sufficient stimulus to support the economy, while the troubled property sector saw the largest private developer, Country Garden, miss payments on its international bonds. Global Emerging Markets underperformed developed markets, as shown by the fall in the broad MSCI Emerging Markets Index, with Latin America underperforming their peers whilst the concerns over China also weighed on performance.

UK fixed-income assets declined in August, as the Bank of England raised its interest rate by 0.25% with the likelihood of a further increase in September. Both government bonds (FTSE Actuaries UK Conventional Gilts Index) and investment-grade corporate bonds finished the month lower.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA10555 Exp 09/2024