We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

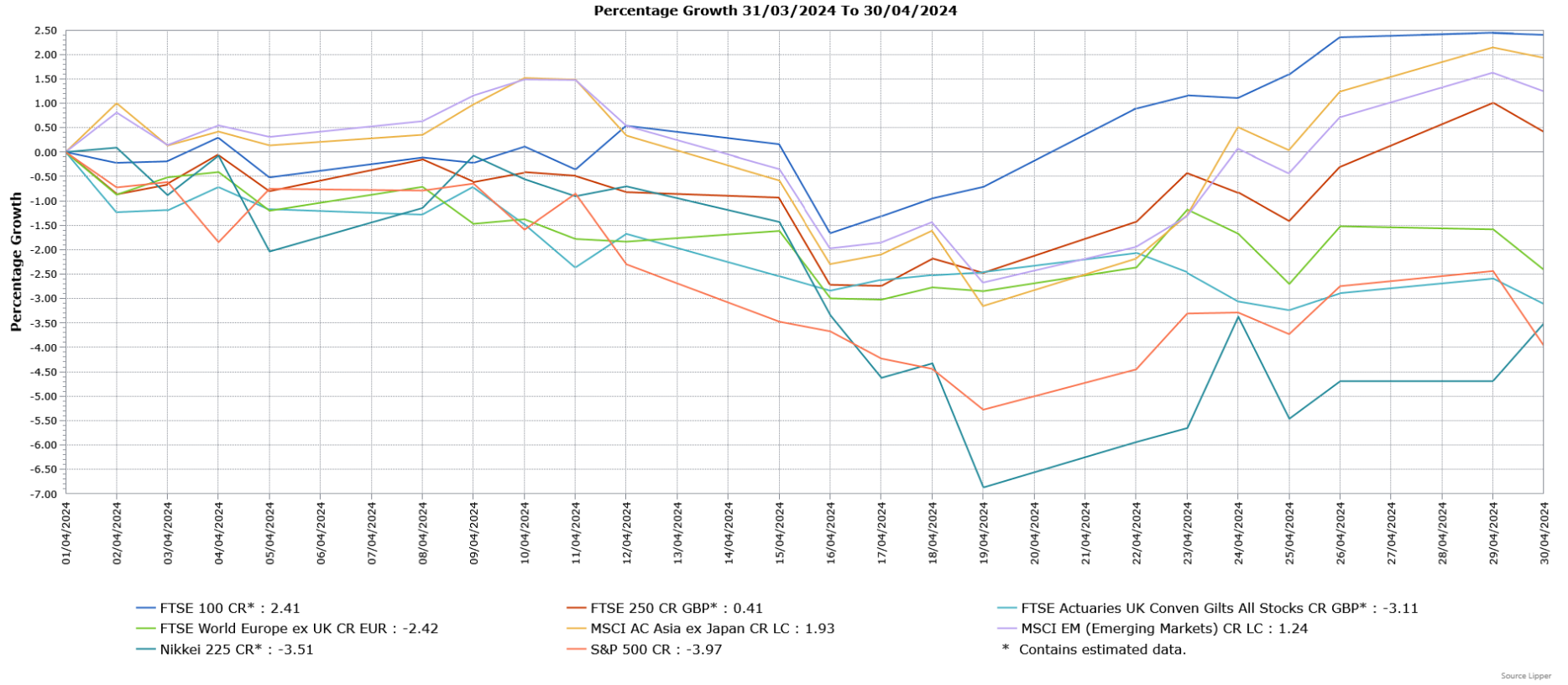

April was a difficult month for most developed market equities as the timing of US interest rate cuts was pushed back, which also weighed on fixed income markets. The UK was an outlier, with the FTSE 100 finishing higher as it recorded a record high during the month as non-technology sectors proved more resilient. Emerging markets outperformed developed markets, supported by stronger performance from China.

Economic Overview

UK

Economic Growth

The Office for National Statistics (ONS) said Britain’s economy grew in February, meaning it was on course to leave the shallow recession it had entered in the second half of last year. In line with expectations, the ONS said the economy grew 0.1% in February, whilst January’s reading was revised higher from growth of 0.2% to 0.3%. As expected, the service sector grew 0.1%, but manufacturing was ahead of forecasts as it rose 1.2% having declined 0.3% in January. However, construction dropped 1.9%, its biggest fall in just over a year, which was partly due to the wet weather. The data also showed the economy was 0.2% smaller than a year earlier, but this was above the forecasted 0.4% fall, whilst the three-month average rose from 0% in January to 0.2% in February, the highest rate since August 2023.

Unemployment & Labour Market Statistics

Unemployment rose by more than expected in the three months to February, although the ONS is continuing to overhaul its survey which produces the figures and stated that it was subject to volatility and should be treated with additional caution. The ONS said unemployment rose from 3.9% to 4.2%, above the forecasted smaller increase to 4%. The estimated number of job vacancies fell for the 21st consecutive time in the three months to March, falling by 13,000 to 916,000, although this was still 120,000 above the pre-pandemic level. The ONS also said economic inactivity rate rose to 22.2%, with the number of people registered as long-term sick reaching its highest level since records began in 1993 at 2.83 million.

The pace of wage growth eased slightly, but was still stronger than expected. In the three months to February, annual growth in regular pay excluding bonuses fell from 6.1% to 6% compared with the forecasted bigger decline to 5.8%. When adjusted for inflation, annual regular pay growth was 1.9%. Annual growth in employee’s total pay, which includes bonuses and can be volatile, was unchanged at 5.6% versus an expected small decline to 5.5%, whilst in real terms there was an increase of 1.6%.

Inflation

The headline annual rate of UK inflation, as measured by the Consumer Price Index (CPI), didn’t fall by as much as expected in March. The ONS said CPI eased lower from 3.4% in February to 3.2% in March, its lowest reading in two and a half years but slightly above the forecasted bigger fall to 3.1%. A slowdown in the pace of food price increases was the main contributor to the fall in CPI. Food and non-alcoholic beverage prices rose by 4%, the weakest pace since November 2021. In addition, prices for furniture and household goods such as cleaning products declined by 0.9%. However, fuel prices were higher amid the tensions in the Middle East.

Core inflation, which excludes food, energy, alcohol and tobacco prices, fell from 4.5% in February to 4.2% in March, also slightly above the forecasted decline to 4.1%. Service price inflation, which the Bank of England views as a key measure of domestically-generated inflation, fell only slightly from 6.1% to 6%.

US

Economic Growth

The Commerce Department’s advance estimate showed US economic growth was weaker than expected in the first quarter of this year, as imports jumped higher and there was a smaller increase in business inventories. The US economy grew at an annualised pace of 1.6% in the first quarter, the slowest rate since the second quarter of 2022, as well as below the 3.4% expansion seen in the fourth quarter of 2023 and the forecasted 2.4% rise. Consumer spending continued to grow at a solid pace, albeit slowing from the previous period due to lower spending on goods, with services expenditure rising at quicker pace. There was also further support from business investment. However, inventories reduced growth by 0.35% as they increased at a slower pace, whilst the rise in imports and a slowdown in exports meant there was a negative impact on net trade. However, it is worth highlighting that trade and inventories are the most volatile components of economic growth and are often subject to revision in future estimates. Government spending rose by 1.2%, slowing sharply from the 4.6% growth in the previous quarter. Excluding inventories, government spending and trade, the economy grew 3.1%, just below the 3.3% pace in the previous period.

Inflation

US consumer prices rose by more than expected in March, amid higher costs for gasoline and rental housing. The Labor Department said the Consumer Price Index (CPI) rose 0.4% in March, matching February’s gain as well as above the forecasted 0.3% increase. This was also the third consecutive month of stronger than expected CPI readings. Gasoline prices were 1.7% higher, having risen 3.8% in February, whilst shelter costs, which include rents, matched February’s gain of 0.4%. Gasoline and shelter were responsible for over half the increase in CPI. Food prices were 0.1% higher, but grocery food inflation was unchanged as the costs of butter, cereals and bakery products saw their largest monthly fall since 1989. However, the prices for meats and eggs rose, whilst there was a modest increase in the costs of fruits and vegetables. For the 12 months through March, CPI rose 3.5%, the highest rate since September 2023 and above the forecasted 3.4% as well as February’s 3.2% reading. The year-on-year CPI reading was also boosted by last year’s low reading falling out of the calculation.

The so-called core CPI, which excludes volatile food and energy components, rose 0.4% in March, matching the gain seen in both January and February. The increase was driven by rents, with owners’ equivalent rent, which is what a homeowner would receive from renting a home, gaining 0.4% and matching the increase in February. Motor vehicle insurance was also a key contributor as it jumped 2.6%, the largest increase since July 2020. The cost of motor vehicle repairs surged 3.1%, the biggest rise since August 2022, whilst healthcare costs were 0.5% higher. There were also increases in the cost of apparel and personal care. However, airline ticket prices declined, whilst the prices of hotel and motel rooms were unchanged. Goods prices were 0.1% higher, but fell 0.2% when excluding goods and energy. The cost of services rose 0.5%, but was 0.8% higher when excluding rents. For the 12 months through March, core CPI rose 3.8%, in line with February’s reading.

Europe

European Central Bank and Interest Rates

In line with expectations, the European Central Bank (ECB) held its interest rate unchanged at its record high of 4%, but signalled it could start cutting as soon as June. The ECB President Christine Lagarde said a strong majority preferred keeping rates unchanged, but a few policymakers had pushed for a rate cut before eventually joining the consensus. Ms Lagarde said that if a fresh assessment increased policymakers’ confidence that inflation was returning to target, then it “would be appropriate” to cut interest rates. Ms Lagarde also acknowledged the relevance of developments in the US economy and the recent stronger than expected US inflation data, but stressed the Eurozone’s differing economic conditions. Ms Lagarde added that “We are data-dependent, not Fed-dependent”.

Economic Growth

In its flash estimate, Eurostat said the Eurozone economy grew 0.3% quarter-on-quarter in the first three months of this year, the fastest pace since the third quarter of 2022. In addition, growth was ahead of the forecasted 0.1% expansion. The fourth quarter figure was though revised lower from no growth to a 0.1% contraction, meaning the Eurozone had been in a technical recession. Among the Eurozone’s largest economies, both Germany and France grew by 0.2%, whilst there was a 0.3% expansion in Italy and 0.7% growth in Spain, all of which were ahead of expectations. On a year-on-year basis, the Eurozone economy grew 0.4%, above the forecasted 0.2% expansion and the 0.1% pace in the previous two quarters.

Inflation

Eurostat’s flash estimate showed inflation unexpectedly declined in March. The Consumer Price Inflation rate fell from 2.6% year-on-year in February to 2.4% in March, below the estimated unchanged reading and matching the 28-month low reached in November 2023. Energy prices declined 1.8%, whilst the pace of price rises eased for food, alcohol & tobacco, and non-energy industrial goods. Core inflation, which excludes prices for energy, food, alcohol and tobacco, fell from 3.1% to 2.9%, below the forecasted smaller decline to 3%. However, service price inflation remained unchanged at 4%. The preliminary estimates were confirmed later in the month in the final data released by Eurostat.

Asia and Emerging Markets

Japan

Having ended its negative interest rate policy in the previous month, the Bank of Japan (BOJ) kept interest rates unchanged at around 0% to 0.1% at its latest meeting, whilst highlighting a growing conviction that inflation was on track to sustainably hit its target of 2% in coming years, indicating further increases in rates could come later in 2024. The BOJ Governor Kazuo Ueda said the central bank would raise interest rates if future data supported its latest price forecasts or if inflation should overshoot the projections. However, there was no indication over the timing of the next interest rate increase, whilst a shift to a full-fledged reduction in the BOJ’s bond purchases was ruled out. The BOJ said in its quarterly outlook report that trend inflation was expected to rise gradually as wages and prices rise in tandem. Core consumer inflation is projected to hit 2.8% in the year starting in April, before slowing to 1.9% in the 2025 and 2026 fiscal years.

China

The National Bureau of Statistics (NBS) said China’s economy grew by more than expected in the first quarter, although other data was less positive and may weigh on overall momentum. The NBS said the world’s second largest economy grew 5.3% in the first quarter compared with a year earlier, well above the forecasted 4.6% pace and just above the 5.2% reading in the previous period. On a quarterly basis, the economy expanded 1.6%, above the 1.4% growth in the previous period. Economic growth was boosted by further support measures from Beijing, as well as spending related to the Lunar New Year festival. In addition, fixed investment rose 4.5%, the strongest pace in nearly a year.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK equities finished April higher, with the FTSE 100 outperforming the mid cap FTSE 250. The FTSE 100 reached a new record high, with the large overseas earners supported by the weaker sterling. UK markets were also boosted by a broadening of the performance drivers away from technology-heavy indices, benefiting the large weightings in sectors such as financial and resources. There was further support from bid activity and positive corporate updates.

The US S&P 500 declined in April following five consecutive monthly gains, with almost all sectors suffering losses. Investor sentiment was negatively impacted by higher than expected inflation readings, which pushed back the timing of interest rate cuts. European markets, as demonstrated by the FTSE World Europe ex UK Index, also finished lower amid sticky inflation readings and the uncertain interest rate outlook, as well as tensions in the Middle East. The Japanese Nikkei 225 Index also suffered a loss, driven by falls in large cap and sem-conductor-related stocks, partly due to profit-taking.

Asian markets rose in April, as shown by the performance of the broad MSCI Asia ex Japan Index. The gains were led by China, Hong Kong and Singapore, with the former producing the strongest performance amid improving sentiment towards its market despite ongoing concerns over the strength of the economic recovery. Global Emerging Markets, as demonstrated by the broad MSCI Emerging Markets Index, outperformed developed markets as they finished the month higher, with the gains again driven by China and emerging Asian markets, but there was weakness in Latin America.

UK fixed income markets fell in April as disappointing inflation data led to the timing of interest rate cuts being pushed back to later in the year. Government bonds (FTSE Actuaries UK Conventional Gilts Index) suffered a bigger loss than investment grade bonds.

This update is intended to be for information only and should not be taken as financial advice.