We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

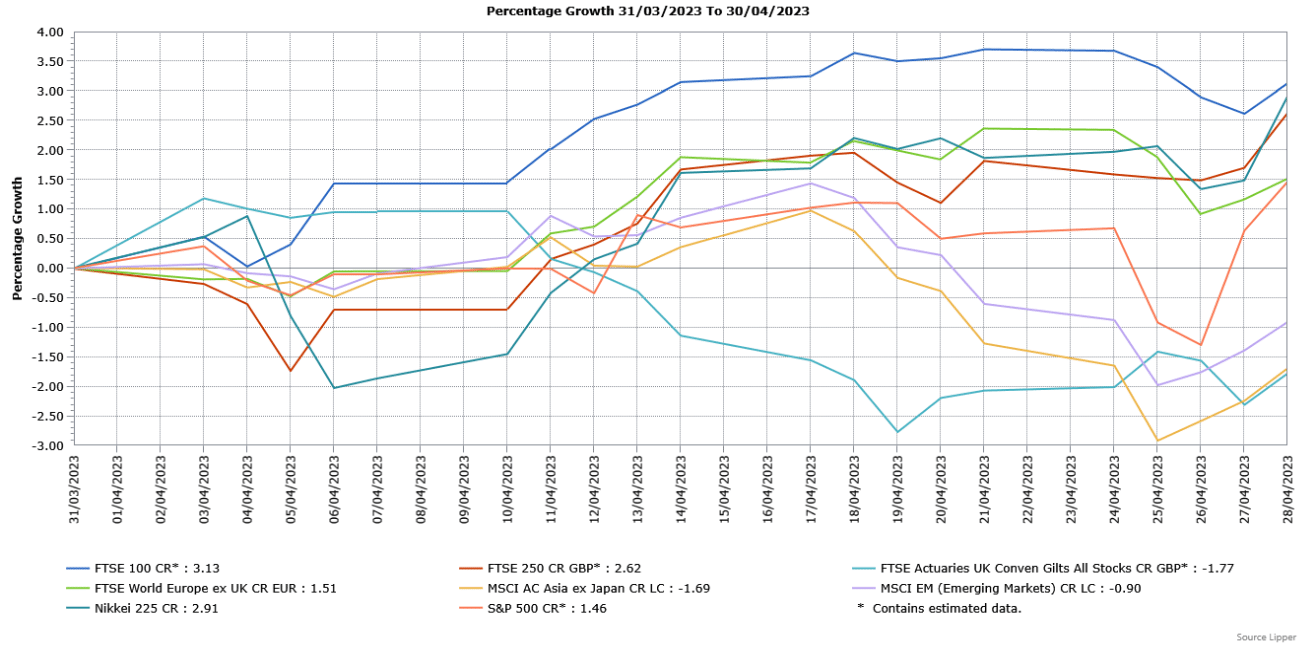

There was mixed performance in April from global equity markets, with developed markets producing gains as they benefited from positive earnings results, but there was underperformance from Emerging Markets amid weakness in Chinese stocks. Economic data was broadly resilient despite higher interest rates, whilst headline inflation continued to ease in the major developed countries. Fixed income markets were mixed, with corporate bonds broadly unchanged, but there was a loss for government bonds.

Economic Overview

UK

Economic Growth

The Office for National Statistics (ONS) said Britain’s economy stagnated in February, as strikes by public workers weighed on output. Economic output was flat in month-on-month terms in February, which was slightly lower than the forecasted 0.1% growth. However, a contraction in the first quarter overall looked less likely after January’s expansion was revised higher from 0.3% to 0.4%. The ONS said the dominant services sector contracted by 0.1% in February, as it was hit by strikes from teachers and other public sector workers, but this was offset by a jump in the much smaller construction sector. The data showed the 2.4% surge in construction output was the sole driver of growth in February, with the ONS attributing this to a recovery from the disruption caused by bad weather in January, as well as a jump in maintenance and repair work. The revisions to the previous data meant the ONS now estimates monthly GDP to be 0.3% above its pre-pandemic levels of February 2020.

Unemployment & Labour Market Statistics

British unemployment edged higher from 3.7% to 3.8% in the three-months to February, its highest rate since the second quarter of 2022 and slightly above the forecasted unchanged reading. Job vacancies fell for the ninth consecutive month, dropping by 47,000 to 1.105 million in the three months to March. The economic inactivity rate, which is the share of people not in work and not looking for it, fell to 21.1% in the three-months to February, broadly due to a jump in students seeking jobs.

The ONS said regular pay excluding bonuses rose by an annual 6.6% in the three months to February, however when considering inflation regular pay fell by 2.3%. Average regular pay growth for the private sector was 6.9% and 5.3% for the public sector, with the difference between the two continuing to narrow. Employee’s total pay, which includes bonuses, increased by annual 5.9%, which was stronger than the expected fall to 5.1%. In real terms, total pay fell by 3%, which is still one of the largest falls in growth since comparable records began in 2001.

Inflation

The annual rate of UK inflation, as measured by the Consumer Price Index (CPI), fell by less than expected in March, leaving Britain as the only country in western Europe with double-digit inflation. The ONS said CPI rose by 10.1% in March, below the 10.4% rate in February but above the forecasted fall to 9.8%. The ONS said the price of food and non-alcoholic drinks surged 19.1%, the biggest increase since August 1977, with milk, sugar and olive oil prices around 40% higher than a year ago. Prices for bread, cereal and chocolate have also soared higher. Petrol prices eased and were among the largest downward contributor, whilst they are now sharply lower than their peak in July 2022.

Core CPI, which excludes volatile components such as food and energy prices, was unchanged at 6.2% despite being expected to fall. Services inflation, which is a gauge of mostly domestic price pressures, also failed to fall in March. However, prices charged by manufacturers dropped sharply from 11.9% in February to 8.7% in March, its lowest level since October 2021, broadly reflecting the fall in oil prices.

US

Economic Growth

The Commerce Department reported that US economic growth slowed in the first quarter of this year as higher consumer spending was offset by businesses liquidating inventories ahead in anticipation of weaker demand later this year amid rising borrowing costs. The advance estimate showed the economy expanded by an annualised 1.1% in the first quarter, below both the forecasted 2% rate and the 2.6% growth in the fourth quarter of 2022. Private inventory investment suffered its first fall since the third quarter of 2021, with the drop led by wholesalers and manufacturers. Inventories reduced economic growth by just over 2.2%, the most in two years. Residential investment suffered an eighth consecutive quarterly fall, though the pace of decline eased from the previous quarter. Government spending picked-up, whilst a smaller trade deficit contributed to economic growth for the fourth consecutive quarter. However, excluding inventories, trade and government spending, the economy expanded by 2.9% , the fastest since the second quarter of 2021. This measure of domestic demand benefited from a 3.7% jump in consumer spending, which had grown by only 1% in the fourth quarter of last year.

Inflation

US consumer prices were only marginally higher in March, but high rents maintained underlying inflation pressures. The Labor Department said the Consumer Price Index (CPI) rose 0.1% in March, which was below the forecasted 0.2% increase and followed a 0.4% gain in February. Higher rental costs offset a 4.6% fall in gasoline prices, whilst the cost of food consumed at home declined 0.3%, the first drop since September 2020. There was a sharp drop in egg prices, whilst meat, fruits and vegetables were also cheaper. However, the prices for cereals and bakery products rose, as did the cost of non-alcoholic beverages. It was also more expensive to eat out. For the twelve months through March, CPI rose by 5%, below the forecasted 5.2% gain and the smallest year-on-year increase since May 2021, as well as much lower than the 6% rise in February.

The so-called core CPI, which excludes volatile food and energy components, rose 0.4% in March having increased 0.5% in February. Owners’ equivalent rent, which is what a homeowner would receive from renting a home, rose 0.5%, the smallest gain since April 2022 and followed a 0.7% increase in the previous month. The easing in the pace of rent gains contributed to a moderation in the cost of services, which slowed from 0.5% in February to 0.3% in March. Airline fares rose 4% despite falling energy prices, which may have been due to the impact of higher wages and spring travel, whilst there were also strong gains in the cost of hotel and motel accommodation. Services costs excluding shelter were unchanged having risen 0.1% previously. Core services, which exclude energy, rose 0.4% in March having risen 0.6% in February. Core goods prices increased 0.2% having been unchanged in February, with prices of apparel and new motor vehicles rising, but used cars and trucks continued their downward trend. For the 12 months through March, core CPI rose 5.6%, a slightly quicker pace than the 5.5% gain in February, which ended five consecutive months of slower increases in the year-on-year figure.

Europe

Economic Growth

In its preliminary estimate, the EU’s Statistics Office, Eurostat, said the Eurozone economy grew by a marginal 0.1% in the first quarter, which was lower than the forecasted 0.2% expansion but ahead of the flat fourth quarter of last year. Amongst the Eurozone’s largest economies, Germany registered no growth, but there were expansions in France, Italy and Spain. On a yearly basis, the economy expanded 1.3%, just below the forecasted 1.4% as well as the 1.8% growth in the final three months of last year.

Inflation

In line with preliminary data, headline inflation fell by the most on record in March, but core prices rose. It was confirmed that headline consumer prices rose by 6.9% in March, below the forecasted smaller fall to 7.1% and sharply lower than the 8.5% increase in the previous month. In addition, this was the largest fall since Eurostat started collecting data in 1991. The fall in headline prices was driven almost solely by lower energy prices compared with the previous year when they had jumped higher due to the war in Ukraine. However, food, alcohol and tobacco saw prices accelerate in March. When excluding unprocessed food and fuel, inflation rose from 7.4% to 7.5%, whilst an even narrower measure, which also excludes alcohol and tobacco, rose from 5.6% to 5.7%, also in line with the preliminary data. Services inflation reached 5.1%, which could indicate wages are becoming a key issue as the main driver of services prices.

Asia and Emerging Markets

Japan

At Governor Kazuo Ueda’s first meeting, the Bank of Japan (BOJ) left monetary policy unchanged, but amended its guidance on the future path of policy changes. As expected, the BOJ kept its short-term interest rate at -0.1% and the target for the 10-year bond yield around 0%. Although the BOJ kept its commitment to “patiently” maintaining ultra-loose policy, it removed a pledge to keep interest rates at “current or lower levels”. Mr Ueda added “While trend inflation is gradually heightening, it will take some time to achieve our inflation target”. Mr Ueda stated that the risk of missing the price target with premature tightening was bigger than the risk of seeing higher inflation due to delayed tightening. In addition, Mr Ueda said a broad-based review of monetary policy, on which the BOJ will spend one to one-and-a-half years, will not be tied to near-term policy shifts and stressed the need to wait for more evidence to conclude inflation will sustainably achieve its 2% target.

China

China’s economic growth in the first quarter was stronger than expected, as the end of the strict zero-Covid policies lifted both business and consumer activity. The National Bureau of Statistics (NBS) said the economy expanded by 4.5% year-on-year in the first quarter, which was ahead of the 2.9% rate in the fourth quarter of last year as well as the forecasted 4% growth. The expansion was also the strongest in a year. A key driver of growth was a boost in household spending. The NBS said that while it was a good start to 2023 for the economy, “the international environment is still complex and ever-changing, constraints from insufficient domestic demand are obvious and the foundation for economic recovery is not solid”. The NBS added that second quarter growth could rise sharply due to the year-ago low base effect. On a quarter-on-quarter basis, the economy expanded 2.2% in the first three months of the year, in line with expectations and above the revised 0.6% rise in the fourth quarter of 2022.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK indices ended April with gains, with the large cap FTSE 100 outperforming the mid cap FTSE 250 as the market rebounded from March’s selloff. Financials were one of the biggest contributors, driven by a recovery in the banking sector. Saudi Arabia’s surprise decision to cut oil production helped globally diversified energy groups finish among the best performers. Domestically focused sectors were also resilient, despite inflation falling by less than expected and an increase in UK interest rate expectations.

Strong earnings updates helped US markets finish April higher, as shown by the S&P 500, with investor sentiment also supported by the anticipated moderation of the Federal Reserve’s tightening policy, although this was partly offset by a forecasted weakening in economic growth. Despite an easing in concerns over the wider banking sector, some regional US banks remained under pressure. European markets also rose, as demonstrated by the FTSE World Europe ex UK Index, with most sectors finishing higher supported by resilient corporate earnings. There was also a gain for the Japanese Nikkei 225 Index, with a boost from increased foreign investment.

The broad MSCI Asia ex Japan Index finished lower, as declines in China, Taiwan and Thailand weighed on performance. Sentiment towards China suffered from ongoing tensions with the US, despite economic growth being stronger than expected. Global Emerging Markets underperformed developed markets, as shown by the loss for the broad MSCI Emerging Markets Index, with losses in China again weighing on overall performance, although there was better performance in Latin America and Europe, Middle East and Africa (EMEA).

Government bonds (FTSE Actuaries UK Conventional Gilts Index) underperformed investment grade bonds in April as they suffered a loss, with resilient economic data and stronger than expected inflation leading to investors anticipating further interest rate rises in the UK. Corporate bonds were more resilient as they recovered following a volatile March.

This update is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA10084 Exp:05/2024