Income needs change in retirement and keeping track of your funds can be a hard task. Michael Spence shows how we use cash flow modelling to help you get the most out of your retirement funds and stay in control.

Managing your retirement

In retirement, you may have several different sources of income:

- From investments, which could also include any rental property

- Company pensions, from defined benefit or defined contribution type schemes

- Personal pensions from any pension savings you have made directly

- State Pension payments, which will also begin before your 66th birthday if you reach State Pension Age before October 2020.

There is now far greater flexibility regarding how and when you take your pension, but this also means that your total retirement income changes. For example, you may want to withdraw a large sum for a special purchase, or to repay a mortgage – but how will this affect your longer term income?

The value of cashflow modelling

Cash flow modelling, in its simplest form, is the process of assessing your current and forecasted wealth, along with inflows (income) and outflows (expenditure), to enable a picture to be created of your finances both now and in the future. By exploring your capital and income requirements, we are able to map out how that affects your retirement fund and future income levels using cash flow modelling:

- Reduce your tax liability by adjusting annual income to be within tax threshold allowances.

- Show how varying income to suit your needs may impact upon your future income. For example, when you start to receive State Pension you may be able to reduce any income you take from personal pensions.

- Show the impact of using tax free cash or additional lump sums to repay debts such as a mortgage or to fund larger capital outlays

The benefit of undertaking effective cash flow modelling is that it can help you to maintain a sustainable retirement income, taking account of all income sources, so that you can enjoy your retirement without financial worry.

As with any model, it will be based on assumptions such as annual investment growth, which we can amend to reflect your attitude to risk. This can also help to highlight how lower investment returns could also impact your retirement income.

Therefore it is important that you continue to review your retirement income with regular financial reviews. By using cashflow modelling, we can help you to get more out of your retirement fund and also plan ahead by highlighting the effects of larger withdrawals and avoid any nasty surprises of your income sources running out.

Case study

Trevor is currently 60. He’d like to start reducing his hours to work part time before he retires at 65 but he is unsure whether he can afford to.

If he worked part time his earnings would drop from £40,000 to £20,000 per annum.

He needs an income of £2,500 net per month, although £750 of this is going towards his mortgage which has a balance of £40,000.

In terms of his future retirement income:

- He will receive a State Pension of £200 p/w at age 66

- His local Government pension will provide £8,000 p.a. from age 65

- He has a personal pension pot worth £250,000

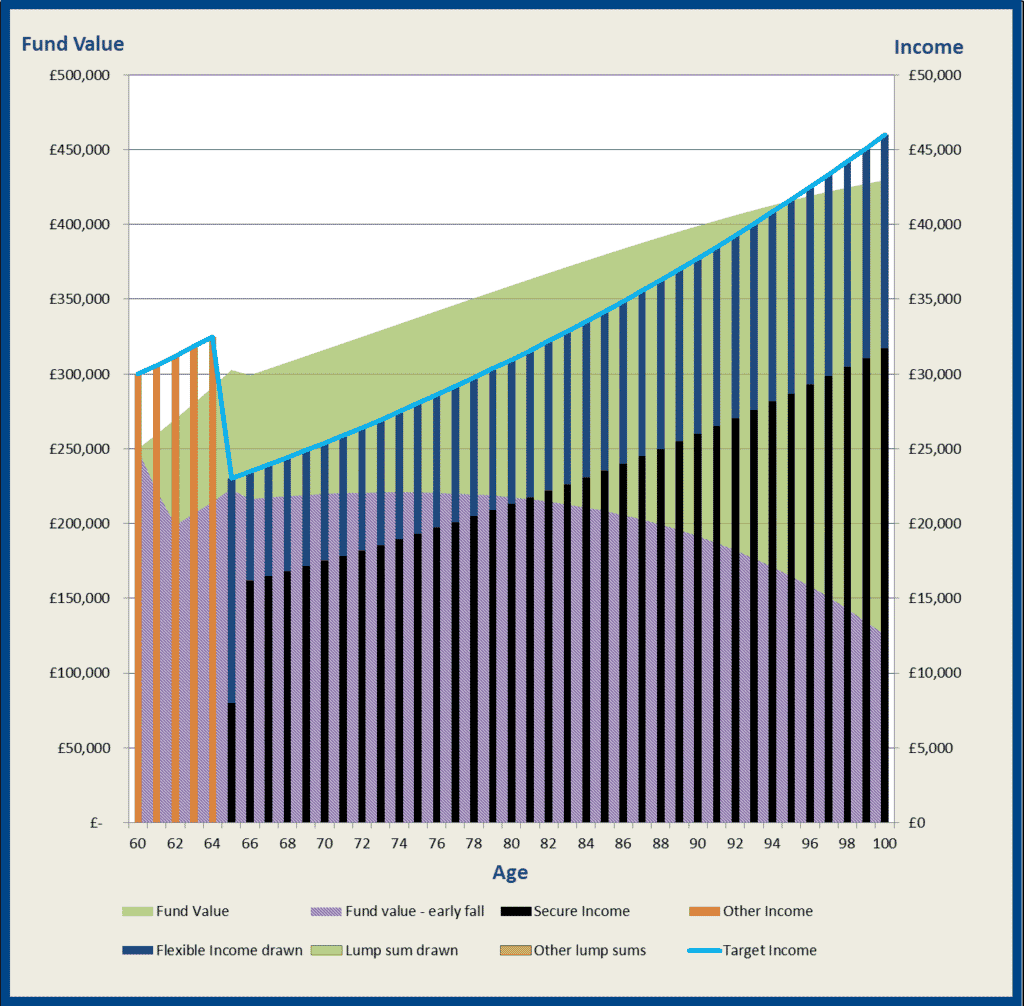

If we modelled Trevor’s current position and assume he works until 65 we can see that his retirement income needs will be comfortably met.

This chart shows the amount of income he takes every year as a bar chart and this is overlaid over the value of his personal pension. If he works full time until age 65 he can pay off his mortgage, draw his local Government and state pensions, and use his personal pension to top up his income.

We have run two projections of his personal pension fund – the green shaded value assumes we have steady growth, and the purple shaded value assumes we see a sharp fall in the value of his funds. This is to give an indication how robust his plans are.

However, this doesn’t meet his objective to retire early.

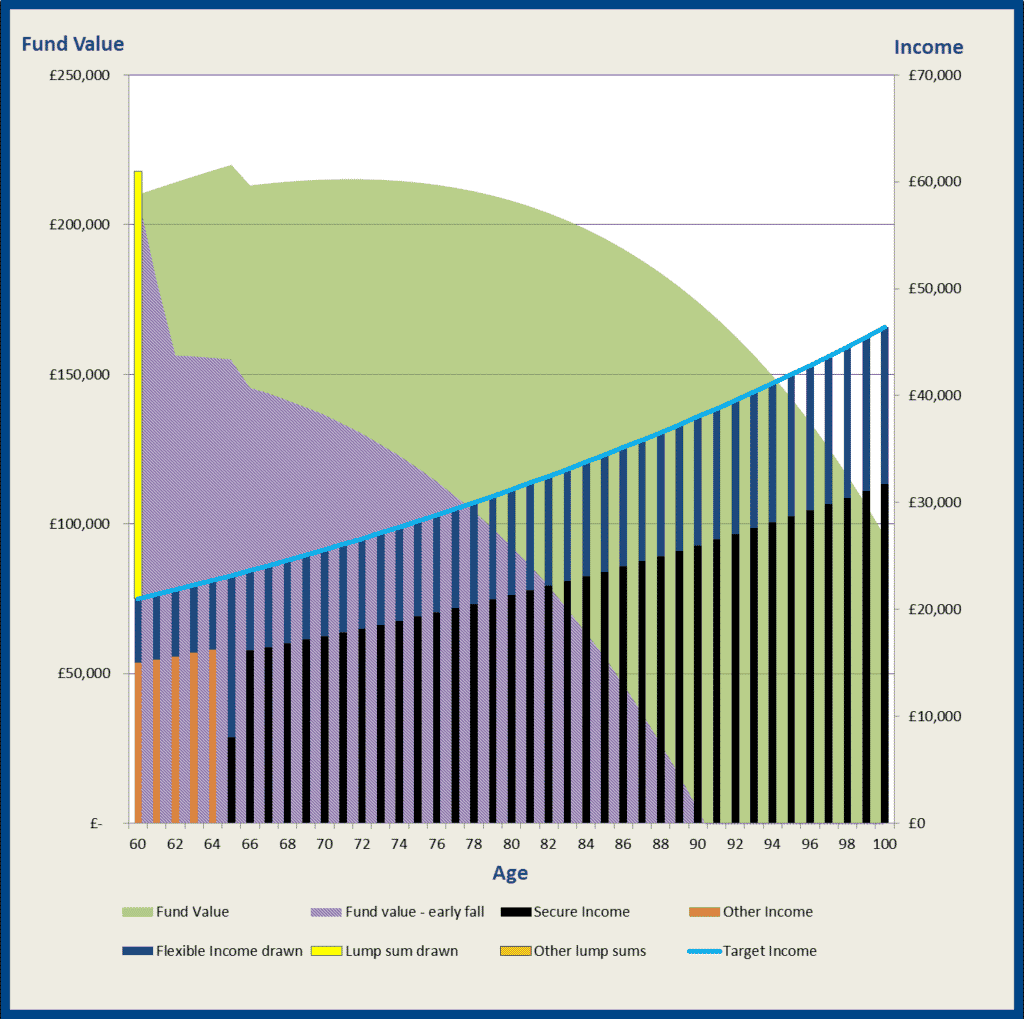

To allow Trevor to retire early, we recommend that he takes £40,000 of his tax free cash from his personal pension and repays his mortgage. This reduces his immediate income target from £2,500 per month to £1,750 per month.

If he chooses to work part time, he will need to top up his income from his personal pension. This is shown in the chart below.

This chart shows that he should still have enough money to work part time, but he is more exposed to a fall in the market – our model shows he could now potentially run out of money by age 90 if the markets do not perform well.

This analysis helps Trevor decide to pay off his mortgage and to start working part time. However, he appreciates the need to ensure that his personal pension is well managed as if it does not perform well in the future he could potentially run out of money.

This article is for information only and is not to be taken as Financial Advice.

CA2743 Exp.07/19