We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Richard Wallis

Richard Wallis

Head of Research and Investment

Introduction

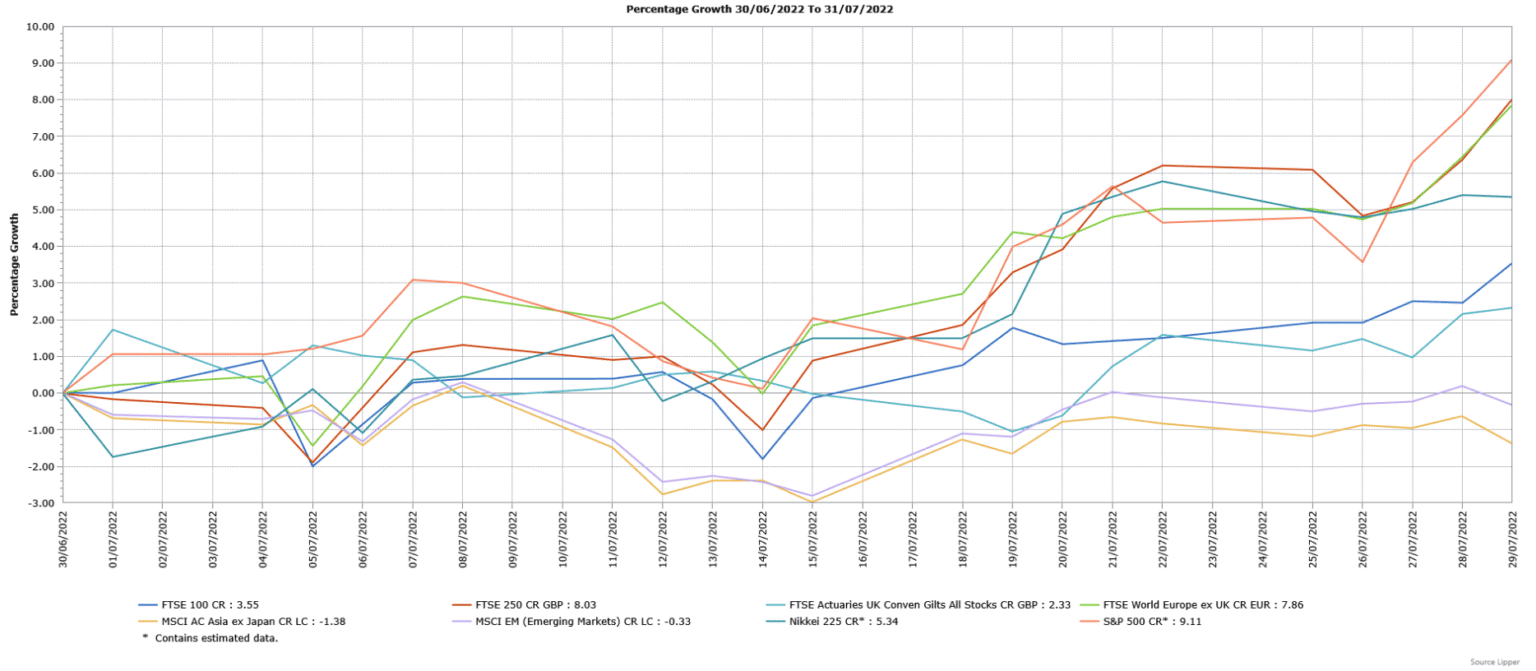

July was a much stronger month for developed market equities, with many regional indices posting their biggest monthly gains of 2022. Sentiment was boosted by optimism over a more gradual pace of interest rate rises in the US, as well as the prospect of reductions in 2023 due to slowing global economic growth. However, there were losses for Asian and Global Emerging Markets, with China a notable faller.

Economic Overview

UK

Britain’s economy unexpectedly expanded in May, driven by an increase in doctor appointments, which contributed to increased spending in the human health sector, and activity in the construction industry. There was also growing demand for services such as holidays. The economy expanded by 0.5% in May, which was ahead of the forecasted zero growth, whilst the Office for National Statistics (ONS) revised its estimate for April slightly higher from a fall of -0.3% to -0.2%. Whilst all the main sectors – manufacturing, services and construction – provided positive contributions, consumer-facing services fell by 0.1% from April, as inflation continued to rise and workers faced a tax (National Insurance) increase. This fall included a 0.5% decline in retail trade, which had risen 2.2% in April. The ONS noted that data can be volatile in periods when bank holidays are moved from their usual month, such as happened in May, but said it was confident that its adjustments captured the effects of the change.

In more timely data on the UK economy, a closely watched survey showed that activity in Britain’s private sector fell to its slowest pace in 17 months. The S&P Global flash composite Purchasing Managers’ Index (PMI) measures activity in the services sector and manufacturing and is an estimate for the full month as it is provided before the end of the period and as such, is not based on the entire range of survey responses. The flash composite PMI fell from 53.7 in June to 52.8 in July, its lowest level since February 2021. The reading therefore remained above the 50-mark separating expansion from contraction. S&P Global said that the reading was consistent with quarterly economic growth of 0.2%, whilst there were signs from order books that the slowdown could worsen. The slower pace of growth broadly reflected softer demand, alongside ongoing capacity constraints arising from shortages of materials and staff. However, the data also indicated that input cost inflation eased considerably since June and was the lowest for ten months, with respondents referring to lower commodity prices and stabilising fuel costs, but there were still widespread reports citing intense wages pressures, particularly by services providers. New order volumes increased moderately across the UK private sector as a whole, though this was driven by a sustained rise in new work across the service economy. A number of businesses attributed higher workloads to resilient spending on travel and leisure. This contrasts with manufacturing businesses, who signalled a further reduction in sales volumes, with the rate of decline the fastest in just over two years. The flash services PMI fell from 54.3 in June to 53.3 in July, a 17-month low, whilst the flash manufacturing PMI fell from 52.8 to 52.2, a 25-month low. Furthermore, manufacturing output contracted for the first time since May 2020, with respondents typically citing a lack of new work to replace completed orders, reflecting subdued client confidence and weaker global economic conditions.

British government borrowing, which is the difference between spending and tax income, was pushed higher in June by a surge in debt costs due to the rise in inflation. The British government borrowed £22.9 billion in June, which was £4.1 billion higher than a year earlier although slightly lower than the forecasted £23 billion. The government’s interest bill was £19.4 billion, more than double the previous record, pushing borrowing for the month up to the second-highest June level since records began in 1993. The ONS said the jump in debt costs reflected the big increase in April in the retail price index of inflation, which is the benchmark for index-linked government bonds. Borrowing in the first three months of the 2022/23 financial year (April to June) was £55.4 billion, £5.7 billion less than the same period last year but approximately £3.6 billion over forecasts made in March by the Office for Budget Responsibility.

British unemployment remained unchanged at 3.8% in the three months to May, despite a forecasted increase to 3.9%. The number of people in work rose by 296,000 in the three months to May, the most since mid-2021 and ahead of the forecasted 170,000 gain. For the three months to May, the ONS said growth in regular pay excluding bonuses rose 4.3%, slightly ahead of the 4.2% gain in the previous three-month period but when adjusted for inflation it was 2.8% lower, the biggest fall in records going back to 2001. Growth in employee’s average total pay, which includes bonuses, eased from 6.8% to 6.2%, with many employers looking to pay bonuses to attract or retain staff due to the shortage of workers, but this still represented a 0.9% fall when adjusted for inflation.

UK inflation, as measured by the Consumer Price Index (CPI), rose from 9.1% in May to 9.4% in June, the highest rate since February 1982 and above the slightly smaller forecasted rise to 9.3%. Britain has the highest rate of inflation seen in any of the Group of Seven countries (Canada, France, Germany, Italy, Japan, the UK and the US). The ONS said the main drivers of the rise in inflation in June was the 42% year-on-year increase in petrol prices and a near 10% gain in food prices. The cost of food is increasing at its fastest rate since March 2009, with notable rises in the prices of milk, cheese and eggs. The prices charged by restaurants and for accommodation also rose in the year to June 2022. In addition, the ONS said that the costs paid by factories for materials and energy, which is a key factor towards prices paid by consumers in shops, were 24% higher in June than a year earlier, the biggest increase since records began in 1985. Furthermore, the prices charged by factories increased 16.5%, the most since September 1977.

British retail sales fell slightly in June, as drivers reduced spending on record-price fuel, although consumers cut back on shopping less than expected. Retail sales volumes fell -0.1% in June, which was less than the forecasted -0.3% monthly fall. The fall in May’s volumes was worse than originally stated, with the initial decline of -0.5% revised lower to -0.8%. The ONS said that after considering rising prices, retail sales were lower and although they remain above their pre-pandemic level, the broader trend is one of decline. Automotive fuel sales fell by 4.3%, the largest fall since October 2021. Excluding fuel, sales volumes rose 0.4% in June, which was much higher than the forecasted fall of -0.4%. Clothing sales fell 4.7%, whilst retailers told the ONS that figures indicated people were reducing spending due to concerns over what they could afford. Food sales were the only the category to see a boost in June, the 3.1% rise being largely driven by the Queen’s Platinum Jubilee bank holiday celebrations.

Research firm GfK said British consumer confidence remained at a record low in July, as households continue to face surging inflation and higher interest rates. The GfK Consumer Confidence Index was unchanged at -41 in July, remaining at its 48-year low and below levels that previously preceded recessions, although the index was forecasted to fall slightly further to -42.

US

The US Federal Reserve (Fed) announced a second consecutive 0.75% increase in its benchmark interest rate as it continued its aggressive approach to combat soaring inflation. The Fed’s benchmark rate was increased to a target range of between 2.25% and 2.5%, whilst the accompanying statement said it “anticipates that ongoing increases in the target range will be appropriate”. The interest rate is now at the level that most Fed officials feel has a neutral economic impact, marking the end of the pandemic-related support aimed at encouraging business and household spending. Including the previous rate rises in the first half of 2022, this now represents the fastest tightening of monetary policy since the 1980s when there was double-digit inflation. There was little specific guidance about what to expect next, as there will be two months of data before the next meeting, including inflation readings in July and August that will show whether or not there is evidence of slowing price increases. Mr Powell highlighted that while another unusually large increase could be appropriate at the next meeting, it will be data-dependent and that there is “significantly” more uncertainty now than is normally the case. Nonetheless, Mr Powell also said to reporters that it will likely be appropriate to slow the pace of increases as rates get more restrictive and that the Fed wants to get to moderately restrictive by the year-end. The Fed Chair Jerome Powell was also asked about whether the US economy was in or on the cusp of a recession, which he rejected as he highlighted US firms continue to hire in excess of 350,000 additional workers each month. It was acknowledged though that the US economy was slowing and would likely need to slow more before the Fed would stop increasing interest rates.

Following the announcement of the interest rate increase, it was confirmed that the US economy had entered a technical recession (defined as two consecutive quarters of negative growth) after the Commerce Department said there was a contraction in the second quarter, having previously shrunk in the first three months of the year. The advance estimate for US economic growth in the second quarter showed a contraction at an annualised rate of -0.9%, sharply lower than the forecasted 0.5% expansion, although ahead of the -1.6% decline in the previous quarter. Consumer spending, which accounts for more than two-thirds of the US economy, rose 1%, the slowest pace since the second quarter of 2020 and a slowdown from the moderate 1.8% pace in the previous period. Due to record exports the trade deficit narrowed sharply meaning it added to growth, having been a drag in the previous seven quarters. Inventories were broadly responsible for the contraction, with the ongoing shortages of motor vehicles contributing to a significantly slower pace of accumulation compared with the previous two quarters. There was also a contraction in business spending, due to weak investment in equipment and non-residential structures. However, the National Bureau of Economic Research, which is the official arbiter of recessions in the US, defines a recession as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators. Job growth has averaged over 450,000 per month in the first half of the year, which has generated strong wage gains, meaning some of the criterion hasn’t yet been met although the risks have increased. This was in line with the Fed Chair’s earlier comments.

S&P Global said that activity in the US private sector contracted in July for the first time in two years, as a sharp slowdown in the service sector more than offset continued modest growth in manufacturing. The flash composite PMI fell from 52.3 in June to 47.5 in July, a 26-month low. The rate of decline was the sharpest since the initial stages of the pandemic in May 2020, with both manufacturers and services providers reporting subdued demand conditions. Whilst new orders returned to expansionary territory in July, the modest increase was still the weakest in the past two years except for the decline in June. Services businesses registered only a small upturn in new business, whilst manufacturers recorded a second consecutive monthly fall. Companies noted the weak demand conditions came as severe inflationary pressures and interest rate rises further weighed on domestic client spending, whilst foreign demand was also weaker. Respondents continued to highlight increases in input costs at suppliers, as fuel, transportation, raw material and wage expenses rose further, although the overall pace eased again from May’s peak. A substantial increase in selling prices was also noted, as firms highlighted the pass-through of higher costs to their clients as a driving factor. However, it was also stated that slower input cost inflation, greater competition and weaker demand led to some concessions being made to customers, helping ease the pace of charge inflation to its slowest since March 2021. The flash services PMI fell from 52.7 in June to 47.0 in July, a 26-month low, whilst the flash manufacturing PMI declined from 52.7 to 52.3, a 24-month low.

US employment growth rose by more than expected in June, whilst wages continued to increase at a decent pace. The Labor Department’s closely watched employment report showed nonfarm payrolls added 372,000 jobs, the fourth consecutive monthly gain in excess of 350,000 and ahead of the forecasted 268,000 increase. Employment is now 524,000 jobs below its pre-pandemic level. Overall, the private sector has now recouped all the jobs lost during the pandemic and employment is 140,000 higher than in February 2020. Government employment is 664,000 jobs lower than before the pandemic. There was a broad increase in employment in June, led by the professional and business services sector, which added 74,000 jobs. Whilst leisure and hospitality payrolls increased by 67,000 jobs, employment in this industry is still 1.3 million lower than in February 2020. There were strong gains across healthcare, information and the transportation and warehousing industries, whilst construction payrolls were also higher. Manufacturing added 29,000 jobs and has now recovered all its pandemic-related losses. The unemployment rate, which is obtained from the household survey, was unchanged at 3.6% for a fourth consecutive month. Average hourly earnings rose 0.3% in June, slightly lower than April’s revised 0.4% gain, with the annual rate easing from 5.3% to 5.1%, though this remains a robust increase.

US consumer prices rose by more than expected in June, reflecting not only higher gasoline and food costs, but also a range of other goods and services. The Labor Department said the Consumer Price Index (CPI) rose 1.3% in June, the biggest monthly increase since September 2005 and ahead of the forecasted 1.1% rise and the 1% gain in May. Energy prices jumped 7.5% and were responsible for nearly half the increase in CPI. Gasoline prices surged 11.2% higher, having jumped 4.1% in May, whilst natural gas prices rose 8.2%, the most since October 2005. The cost of food consumed at home rose 1%, its sixth consecutive monthly increase of at least 1%. For the 12 months through June, CPI rose 9.1%, the largest year-on-year increase since November 1981 as well as being above the forecasted 8.8% rise, whilst it follows the 8.6% gain in May. The so-called core CPI, which excludes volatile food and energy components, gained 0.7% in June, ahead of the 0.6% rise in May. The cost of rent drove core CPI higher, with a key measure of rents, owners’ equivalent rent of primary residence, jumping 0.8%, the largest monthly increase since April 1986. New vehicle prices continued to rise, as did the costs of used cars and trucks. Motor vehicle maintenance and repairs costs rose 2%, the most since September 1974. Healthcare costs rose 0.7%, whilst apparel prices increased 0.8%. However, prices for hotels, car rentals and airfares were lower. Overall, core goods prices rose 0.8%, whilst services were 0.7% higher. For the 12 months through June, core CPI rose 5.9%, slightly lower than the 6% increase in May and the third consecutive month it has slowed.

US retail sales rebounded strongly in June following their unexpected decline in May, boosted by increased spending on gasoline and other goods despite surging inflation. The Commerce Department said retail sales rose 1% in June, ahead of the forecasted 0.8% gain, whilst the fall in May was revised upwards from 0.3% to 0.1%. Retail sales, which are mostly goods, rose 8.4% on a year-on-year basis. The increase in sales was led by receipts at auto dealerships, which rose 0.8% following a 3% decline in May amid shortages. Sales at service stations increased 3.6%, boosted by a surge in gasoline prices. Receipts at restaurants and bars, the only services category in the retail sales report, rose 1%, whilst there were strong gains in sales at furniture and electronics and appliance retailers. There was an increase in receipts at sporting goods, hobby, musical instrument and book stores. Online sales rebounded 2.2% having fallen in May. However, there was a fall in sales at building material, garden equipment and supplies stores, as well as at clothing retailers. The so-called core retail sales, which exclude automobiles, gasoline, building materials and food services and correspond most closely with the consumer spending component of GDP, rose 0.8% in June, but May’s unchanged reading was revised lower to show a fall of 0.3%.

The Commerce Department said consumer spending, which accounts for more than two-thirds of the US economy, rose by more than expected in June as Americans paid more for goods and services. Consumer spending rose 1.1% in June, ahead of the forecasted 0.9% gain, whilst May’s reading was revised higher from an increase of 0.2% to 0.3%. The increase was driven by higher prices for gasoline and other energy products, whilst there was a general rise in spending on a range of other goods and services due to higher costs, such as motor vehicles, healthcare and housing.

Europe

With concerns over surging inflation outweighing worries about growth, the European Central Bank (ECB) raised interest rates by more than expected, increasing its deposit rate by 0.5% to 0%, double the amount it had indicated at its previous meeting. This was the ECB’s first increase since 2011, whilst the deposit rate had been in negative territory since 2014. The ECB also raised the rate on its weekly and daily cash auction rates by 0.5% to 0.5% and 0.75% respectively, as well as signalling further rises in its three rates were likely to come this year. The ECB said that “At the Governing Council’s upcoming meetings, further normalisation of interest rates will be appropriate”. In addition, the ECB said “The frontloading today of the exit from negative interest rates allows the Governing Council to make a transition to a meeting-by-meeting approach to interest rate decisions”. However, the ECB also announced a new tool, the Transmission Protection Instrument (TPI), in an attempt to cushion the impact of the increase in borrowing costs. The TPI will allow the ECB to buy bonds when there are signs of financial fragmentation, which is the unwarranted divergence in borrowing costs among the Eurozone’s 19 countries, particularly in the bigger debtor nations such as Italy and Spain.

The European Union’s Statistics Office, Eurostat, said the Eurozone economy grew by more than expected in the second quarter. Eurostat said the economy expanded by 0.7% quarter-on-quarter, for a 4% year-on-year gain, well ahead of the forecasted growth of 0.2% and 3.4% respectively. The better than expected performance came despite stagnation in Germany, the largest economy in the bloc, which was more than offset by much stronger than forecasted expansions in France, Italy and Spain.

Eurostat’s preliminary estimate of inflation in the Eurozone showed that prices rose to another record high in July. Consumer price growth in the 19 countries sharing the euro rose from 8.6% in June to 8.9% in July, above the expected unchanged 8.6% reading. Prices for food, alcohol and tobacco continued to rise, as well as for non-energy industrial goods and services, but eased slightly for energy. Inflation excluding volatile food and energy prices, which is closely monitored by the European Central Bank, rose from 4.6% to 5%, whilst an even narrower measure that also excludes alcohol and tobacco rose from 3.7% to 4%.

The Federal Statistics Office said that the German economy stagnated in the second quarter, due to the impact of the war in Ukraine, the pandemic and supply disruptions. The preliminary estimates showed the economy stalled in the second quarter with no growth compared to the previous quarter, slightly lower than the forecasted 0.1% expansion, but the estimate for the first quarter was revised sharply higher from 0.2% to 0.8%. Economic activity in the second quarter was supported by household and government consumption, but net trade weighed on growth.

Preliminary survey data indicated a contraction in German business activity in July, as companies were hit by inflationary pressures and supply chain disruptions. The S&P Global flash composite PMI fell from 51.3 in June to 48.0 in July, a 25-month low and the first contraction recorded so far this year. The survey showed declines in both domestic and export demand, as a combination of an uncertain business environment, supply shortages and stretched client budgets weighed on the sector. Both manufacturing and services registered contractions, with goods producers suffering the greatest fall as output slumped by the biggest amount since May 2020. The smaller fall in services activity reflected a combination of staff shortages and a reduction in new business, whilst manufacturers saw an even sharper fall in new orders. Firms across the private sector noted the difficult economic environment, including the squeeze on client budgets from rising inflation, whilst manufacturers highlighted the widespread uncertainty relating to the war in Ukraine, worries over energy security and ongoing difficulties in the supply-chain. Cost pressures remained elevated, as prices paid for energy and commodities, a weaker euro as well as rising interest rates and higher wages reported in services meant that overall input costs rose substantially. Nonetheless, inflation did maintain its recent downward trend. In addition, average prices charged for goods and services also rose at a slower rate, although remained at historically high levels. The flash services PMI fell from 52.4 in June to 49.2 in July, a seven-month low, whilst the flash manufacturing PMI declined from 52.0 to 49.2, a 25-month low.

France’s INSEE statistics body said its preliminary estimate for economic growth in the second quarter was stronger than expected, despite the headwind of rising inflation. The preliminary estimate showed growth of 0.5% in the second quarter, ahead of the forecasted 0.2% expansion and the 0.2% contraction in the first three months of the year. INSEE said the expansion in the French economy was driven by exports and a further increase in gross fixed capital formation (also called investment). However, final domestic demand provided no contribution to growth, with both household consumption and government spending falling. On an annual basis, the French economy grew by 4.2% in the second quarter, following the upwardly revised 4.8% expansion in the preceding three months.

Following the sharp slowdown in June, the French private sector suffered a further loss of momentum in July. The S&P Global flash composite PMI fell from 52.5 in June to 50.6 in July, a 16-month low. Weakening demand conditions weighed heavily on activity, with survey data highlighting the first decline in private sector new business since February 2021. There were differences between manufacturing output and services activity, as goods production fell at the sharpest rate since the first phase of the Covid-19 lockdown restrictions in May 2020 whilst services firms saw a slower downturn. However, businesses from both sectors noted weaker demand as being a key factor behind the worsening trends. There was a further easing in cost pressures in July, as the rate in input price inflation eased to a five-month low, although the increase was still among the steepest on record. Higher costs continue to be influenced by increasing wage bills, rising energy and fuel prices, as well as greater fees charged by suppliers. There was a rise in output prices and whilst the rate increased from June, it was will still below May’s peak. The flash services PMI fell from 53.9 in June to 52.1 in July, a 15-month low, whilst the flash manufacturing PMI dropped into contraction, declining from 51.4 to 49.6, a 20-month low. In addition, manufacturing output fell deeper into contractionary territory with its reading of 44.0, a 26-month low.

Asia and Emerging Markets

The Bank of Japan (BOJ) maintained its policy of ultra-low interest rates, despite forecasting that inflation would exceed its target this year. As widely expected, the BOJ maintained its -0.1% target for short-term interest rates and its pledge to guide the 10-year bond yield around 0%. In addition, the BOJ Governor Haruhiko dismissed any near-term policy tightening, stating he had “absolutely no plan” to raise interest rates or increase an implicit 0.25% cap set for the bank’s 10-year bond yield target. Although rising fuel and commodity costs have sent inflation above the 2% target, the BOJ has continuously said it was in no rush to tighten policy as slowing global growth means a highly uncertain outlook for the still-weak Japanese economy. The BOJ raised its projection for core consumer inflation for the current fiscal year ending in March 2023 from 1.9% to 2.3%, whilst cutting the growth forecast from 2.9% to 2.4% and warned of potential headwinds from supply constraints, rising commodity prices and the pandemic.

China’s economic growth slowed sharply in the second quarter of this year, with activity severely affected by the Covid-19 lockdowns. Official data showed China’s economy expanded 0.4% in the second quarter from a year earlier, the slowest pace since the data series began in 1992, excluding the pandemic-related -6.9% contraction in the first three months of 2020. The expansion was also slower than the forecasted 1% growth and well below the 4.8% gain in the first quarter. On a quarter-on-quarter basis, China’s economy fell -2.6% from the previous quarter, worse than the forecasted -1.5% fall and the revised 1.4% growth in the previous three-month period. A combination of full and partial lockdowns in major centres across China in March and April weighed heavily on the economy, particularly in the commercial capital Shanghai which saw a severe contraction in activity in the second quarter.

The National Bureau of Statistics (NBS) said that China’s factory activity unexpectedly contracted in July, due to the impact of fresh Covid-19 flare-ups and demand being hit by a deteriorating global outlook. The official manufacturing PMI fell from 50.2 in June to 49.0 in July, below the 50-mark separating expansion from contraction and the forecasted increase to 50.4. The NBS said the level of economic prosperity in China had fallen, whilst the foundation for recovery still needs consolidation. Continued contraction in energy-intensive industries, such as petrol, coking coal and ferrous metals, were the main negative contributors to the manufacturing PMI. The sub-indexes for output and new orders both declined in July, with both falling into contraction. The official non-manufacturing PMI fell from 54.7 in June to 53.8 in July, also impacted by rising Covid-19 infections and renewed restrictions in some cities. In addition, the sub-indexes for new orders and export sales both fell into contraction. The official composite PMI, which includes both manufacturing and services activity, fell from 54.1 in June to 52.5 in July. The official PMI surveys focus on the largest sample of companies, although the majority are big and state-owned enterprises.

China’s exports rose at their strongest pace in five months in June, benefiting from factory activity rebounding from the Covid-19 restrictions. Exports rose 17.9% in June compared with a year earlier, the fastest pace since January 2022, well ahead of the forecasted 12% increase as well as above the 16.9% gain in May. Exports of computers, steel products and autos contributed to the growth, with the number of vehicles exported 30.5% higher than a year earlier. However, import growth slowed by more than expected, rising 1% in June compared with the previous year, which was lower than May’s 4.1% gain and the forecasted 3.9% increase. Subdued domestic consumption weighed on imports, whilst almost all of China’s commodity imports were notably weaker, including crude oil, coal and soybeans.

Chinese industrial production picked up pace in June, with output rising 3.9% from a year earlier compared with the 0.7% rise in May. However, the expansion was weaker than the forecasted 4.1% gain. Activity continued to recover in June from the months of Covid-19 lockdowns. Retail sales were better than expected following the easing in restrictions and the drop in Covid-19 infections, rising 3.1% in June, which was higher than the forecasted no increase and the 6.7% fall in May. This was also the quickest pace of growth in four months.

Elsewhere in Asia, Singapore’s economy expanded by less than expected in the second quarter. Preliminary data from the Ministry of Trade and Industry showed the Asian financial hub grew 4.8% year-on-year in the second quarter, faster than the 4% expansion in the first three months of this year, but lower than the forecasted 5.2% gain. In addition, Singapore’s central bank unexpectedly tightened monetary policy as inflation rose in May to 3.6%, its fastest pace in more than a decade.

In line with expectations, South Korea’s central bank raised its interest rate by 0.5% to 2.25%, as it looked to combat inflation at 24-year highs. This was the biggest increase in interest rates since the bank adopted the current policy system in 1999. The central bank highlighted the downside risks to the economy, but felt it was important to curb the spread of inflation expectations through a 0.5% increase. In response to a question about whether there would be another 0.5% rise, the central bank Governor told a news conference that “If the inflation and growth trends do not change significantly, a return to 25-basis-point hikes looks appropriate for the time being”. South Korea’s economic growth was stronger than expected in the second quarter of this year, boosted by consumption as easing Covid-19 restrictions offset poor export data. The Bank of Korea estimated that the economy expanded by 0.7% quarter-on-quarter, ahead of both the 0.6% growth in the first quarter and the forecasted 0.4% gain.

The Hong Kong Monetary Authority raised its base interest rate by 0.75% to 2.75%, matching the US Federal Reserve’s increase announced hours earlier on the same day. Hong Kong’s monetary policy moves in line with that of the US, given the tight band of the Hong Kong dollar’s peg to the US dollar.

Taiwan’s economy expanded at its slowest pace in two years in the second quarter, broadly due to the impact of supply chain issues and a surge in domestic Covid-19 cases. Preliminary data showed annualised growth of 3.08% in the second quarter, slightly lower than the 3.14% in the preceding quarter and the forecasted 3.1% gain. This was the slowest pace of growth since the second quarter of 2020, which was impacted by the pandemic. Taiwan is a key hub in the global technology supply chain and benefited during the pandemic from strong demand for tech exports. However, the second quarter was impacted by supply chain issues caused by Covid-19 lockdowns in its largest trading partner China, whilst domestic outbreaks of the virus also weighed on overall growth.

The national statistics agency INEGI said the Mexican economy expanded for the third consecutive quarter in the April to June period. The preliminary estimate showed growth of 1% in the second quarter, ahead of the forecasted gain of 0.8%. There was a 1% increase in the tertiary sector, which covers services, with tourism contributing to the recovery. Secondary activities, which includes manufacturing, also rose whilst there was an increase in agricultural output.

Russia’s central bank sharply lowered its key interest rate by 1.5% to 8%, which followed a similar move in June and was much bigger than the forecasted 0.5% cut. The Bank of Russia has forecast, given the monetary policy stance, that annual inflation will ease down to 12-15% in 2022 and then to 5-7% next year. This is due to both the influence of a set of one-off factors and subdued consumer demand.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK markets rose in July, with the FTSE 250 strongly outperforming the FTSE 100. Both indices produced their strongest monthly gains so far in 2022, with the mid cap FTSE 250 seeing its biggest increase since November 2020. The gains were driven by a rebound in the consumer discretionary and industrial sectors, both of which endured a very difficult first half of the year, with the mid FTSE 250 benefiting from their rally to a greater extent.

Optimism over an easing in the pace of interest rate rises and broadly well received corporate earnings updates, despite some notable profit warnings including from retail giant Walmart, helped US markets record strong gains, with the S&P 500 registering its biggest month gain since 2020. European markets, as shown by the broad FTSE World Europe ex UK Index, similarly produced strong gains, also supported by a number of strong corporate earnings updates. The Japanese Nikkei 225 Index also posted a decent monthly gain.

As shown by the fall in the broad MSCI Asia ex Japan Index, it was a tougher month for Asian markets. In particular, China and Hong Kong underperformed, with the former’s zero-Covid policy and associated ongoing lockdown measures, slowing economic growth and regulatory issues weighing on sentiment. Global Emerging Markets, as demonstrated by the broad MSCI Emerging Market Index, also suffered a loss, broadly due to the weakness in China, and despite better performance from Latin America and EMEA (Emerging Europe, the Middle East and Africa).

Following a difficult period, fixed income markets had a much better month as investors weighed slowing economic growth and potentially more moderate interest rate rises. Corporate bonds outperformed gilts (FTSE Actuaries UK Conventional Gilts Index) as yields finished the month lower (fixed income prices and yields have an inverse relationship).

This update is intended to be for information only and should not be taken as financial advice.

Short-term Key Dates

• 4th August – Bank of England Interest Rate Decision

• 5th August – US Non-Farm Payrolls for July

• 10th August – US Inflation for July

• 12th August – UK GDP 2nd Quarter Preliminary Estimate

• 12th August – UK Monthly GDP for June

• 15th August – Japan GDP 2nd Quarter Preliminary Estimate

• 16th August – UK Labour Market Statistics

• 17th August – UK Consumer Price Indices (Inflation) for July

• 17th August – Eurozone GDP 2nd Quarter Second Estimate

• 19th August – UK Gfk Consumer Confidence for August

• 19th August – UK Public Sector Finances for July

• 19th August – UK Retail Sales Data for July

• 23rd August – UK Flash PMIs for August

• 25th August – Germany GDP 2nd Quarter Final Estimate

• 25th August – US GDP 2nd Quarter Second Estimate

• 31st August – France GDP 2nd Quarter Final Estimate

• 2nd September – US Non-Farm Payrolls for August

• 7th September – Eurozone GDP 2nd Quarter Final Estimate

• 8th September – Japan GDP 2nd Quarter Final Estimate

• 8th September – European Central Bank Interest Rate Decision

• 12th September – UK Monthly GDP for July

• 13th September – UK Labour Market Statistics

• 13th September – US Inflation for August

• 14th September – UK Consumer Price Indices (Inflation) for August

• 15th September – Bank of England Interest Rate Decision

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA8466 Exp 08/2023