Making pension contributions can be a great way of saving for your future. At the start of a new tax year, you have new pension allowances available which set the maximum amounts that you can contribute in a tax efficient way.

Tax treatment of pension contributions

Workplace pensions can be set up as net pay or salary sacrifice arrangements. For net pay arrangements, your contributions appear as a deduction on your payslip before any Income Tax is calculated. You then pay the rate of Income Tax that applies to your remaining earnings. This means that you immediately get full Income Tax relief on your pension contributions. Your employer will still deduct National Insurance (NI) contributions which are based on your pay before any pension contributions are made.

If your employer offers a salary sacrifice arrangement, your gross pay will be reduced and your employer will make a pension contribution instead of paying you that amount as salary. This way, the pension contributions will not be subject to Income Tax or employer or employee National Insurance Contributions.

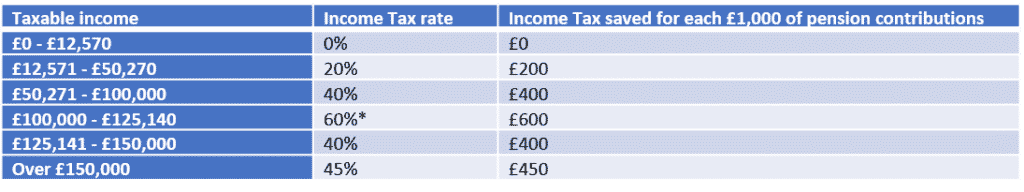

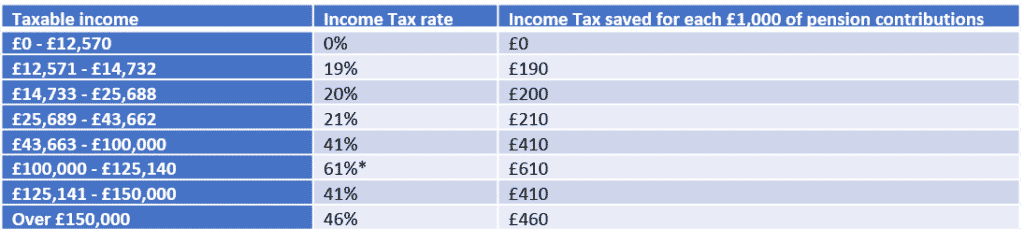

As your earnings are taxed after pension contributions have been deducted, you can use your pension to quickly and effectively reduce your tax bill. The rate of Income Tax you pay will depend on your earnings, and also your location, as tax rates differ between Scotland and the rest of the UK.

Remember that money you contribute into a pension cannot be accessed until you are at least age 55 (age 57 from 2028). Generally 25% of you pension fund can be taken as a tax free lump sum with any further withdrawals subject to Income Tax when it is drawn.

England, Wales and Northern Ireland tax rates

Scottish tax rates

*If you earn over £100,000, your personal allowance will be reduced by £1 for every £2 earned over the £100,000 threshold. This creates an effective tax rate of 60%/61% for earnings between £100,000 – £125,140 (assuming you have the standard £12,570 personal allowance). You may have a different tax-free allowance based on your personal tax code; your tax code will be quoted on your pay slip.

Some other thresholds to be aware of are:

• If you receive tax credits, an increase in earnings could reduce the level of means tested benefits you receive from the government, such as Universal Credit and Working Tax Credit.

• If you qualify for Child Benefit, this is tapered once your income exceeds £50,000 and is lost completely when your income exceeds £60,000.

If you receive a bonus, it could push your taxable pay into a higher tax band, but making a pension contribution could keep your income within a lower tax band.

If you do make your own personal pension contributions out of your income after tax, your pension provider will reclaim basic rate Income Tax relief on your behalf and any higher or additional rate Income Tax relief that is due can be reclaimed through your self-assessment tax return.

You can find more information about tax rates and a personal tax calculator at https://listentotaxman.com/.

How much can you save into your pension?

The annual allowance (AA) is the amount of pension savings you can make each year that benefit from tax relief. If your pension savings exceed the AA you may face a tax charge, and you will only receive tax relief on any personal contributions up to 100% of your 2022/23 earnings.

While there is nothing to stop you paying in more than your annual allowance, the additional tax charge could make alternatives options (such as ISAs) a better way to save money for the future.

For most savers, the annual allowance for the 2022/23 tax year is £40,000. This includes employer and employee contributions towards all of your pensions.

There are two main exceptions to this £40,000 threshold:

• If you have accessed any of your pensions flexibly (most commonly via flexi access drawdown or cashing in some or all of a pension as a lump sum) you may have triggered the Money Purchase Annual Allowance (MPAA). This permanently reduces your annual allowance to £4,000 .

• If you earn over £200,000, your annual allowance may be reduced. This can be a very complex area, so you should take professional advice.

Can you pay in more than your annual allowance?

The carry forward rules allow you to use up any annual allowance headroom you haven’t used during the three previous tax years. If you do not normally make contributions up to the annual allowance limit, this may allow you to pay more money in this year.

You can only carry forward previous allowances once you have fully used your 2022/23 annual allowance.

HMRC provides a calculator to check what the maximum contribution you can make in the current tax year are; please see the link below. If you are not sure how much you can pay without triggering a tax charge, you should seek professional advice.

Take control of your retirement planning

You can assess your own retirement plans by using our retirement modeller. Our advisers can then help you to review your objectives and provide advice to suit your own circumstances and keep you on track for your retirement.

This article provides general information on pensions and tax and should not be taken as personal financial advice.