In the Budget in March 2021, a five-year freeze to the standard lifetime allowance was announced.

The lifetime allowance (LTA) sets the maximum tax efficient value of all your retirement benefits and is set by the government. Your pension benefits will be tested against the LTA when you start to take them, on death, or at age 75 if earlier. If the value of all your pension benefits exceeds the LTA, set at £1,073,100, a lifetime allowance tax charge is applied on the value of your benefits in excess of the allowance. A flat rate tax charge is applied on the excess at 25% if used to provide a taxable income or 55% if the excess is taken as a lump sum.

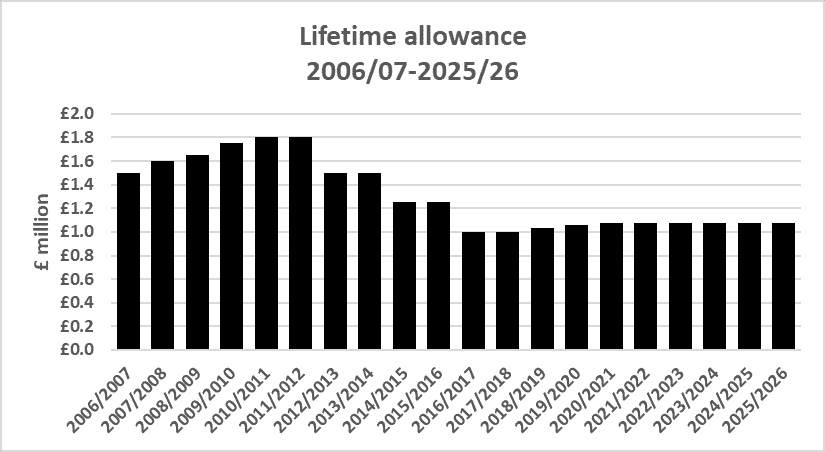

A brief history of the lifetime allowance

When the LTA was first introduced in 2006, it was set at £1.5 million, which equates to an annual pension income of £75,000, using a standard assumption of converting a fund into income using an annuity rate of 20:1. By the tax year 2010/11 it had increased to £1.8 million which proved to be the high water mark, frozen in the following tax year and then the first of three cuts were introduced. By 2016/17 the LTA was down to £1 million and thereafter it increased in line with Consumer Price Inflation (CPI).

However, from April 2021 until April 2026, the LTA will be frozen at £1,073,100. If the original £1.5 million allowance been increased in line with inflation, the LTA would now be £2,082,100 – almost double its current level!

What does this mean for pension savers?

Pension saving is still a valuable financial planning tool, with tax relief on pension contributions, access to a tax free lump sum and the potential of providing a guaranteed income for life using an annuity or income flexibility with drawdown.

However, the freezing of the LTA does require some additional consideration for financial planning:

• The LTA has previously been set at a level which meant that only a small number of pension savers were being impacted, but a freeze will inevitably bring this limit into financial planning consideration for more clients. Her Majesty Revenue & Customs (HMRC) figures show over 4,500 LTA charge payers in 2017/18 against 1,240 five years earlier.

• The freezing of the LTA means that the pension levels where charges apply become more likely – for pension income above £53,945 a year from a defined benefit (final salary) scheme or £31,000 (before tax) for defined contribution schemes buying an inflation-proofed income for a 65-year-old.

How to manage your retirement income?

Understanding and managing any potential lifetime allowance charge is an important part of retirement planning. As the lifetime allowance tax charge is only payable when you have used all of your available lifetime allowance, the timing of when and how you draw your pensions can have a significant impact on the amount of any tax due. It is therefore essential that this is factored into your strategy and you should seek financial advice to ensure you meet your retirement objectives whilst minimising any lifetime allowance tax charge where possible.

If you only access part of your pension fund before age 75, then you only need to pay a charge if the value of the benefits which you access exceeds the LTA. You can use funds up to the value of the lifetime allowance to provide pension benefits and designate them to drawdown, leaving the remainder – the excess – uncrystallised.

However, any remaining uncrystallised benefits will tested at age 75 or if you die before age 75 when a lifetime allowance charge may be payable. The growth on any crystallised fund will also be tested against the LTA at age 75

If you exceed the available lifetime allowance, you could enjoy full investment growth and resign yourself to paying a lifetime allowance charge. After all, you benefit from a larger fund value and paying a government charge may not be the worst outcome.

Can I protect my retirement savings?

Historically, when the lifetime allowance was introduced and subsequently reduced, the government allowed individuals who were impacted by these changes to protect their pension savings and lifetime allowance by applying for various different forms of lifetime allowance protection.

Protection from the most recent reduction in the lifetime allowance in 2016 is still available and you may be eligible for a higher lifetime allowance up to a maximum of £1.25 million, using Fixed Protection 2016 or Individual Protection 2016 which are becoming all the more valuable.

It can be very difficult to assess whether your pension savings may be impacted by the LTA in the future. Fixed Protection 2016 allows you to have a lifetime allowance of £1.25 million, but only if you have not made any pension contributions or accrued any other pension benefits since 5th April 2016.

Individual Protection 2016 allows you to have a lifetime allowance of the value of your pension savings on 5th April 2016, where the value exceeded £1 million, up to a maximum of £1.25 million.

You can apply for these protections online on the Government website but we would recommend that you seek financial advice before taking any action.

You can also consider other investments such as Individual Savings Accounts, Venture Capital Trusts or Enterprise Investment Schemes which could be used to provide income in retirement.

What should you do?

The freeze in the LTA has made it a wider consideration for retirement planning. If you are unsure whether your total pension benefits are likely to exceed the LTA, you should check the value of your pension funds.

Ask your Origen adviser whether the lifetime allowance may impact your pension savings. If so, we can provide recommendations on how to protect your pension savings, take your retirement benefits or recommend alternative actions to best suit your financial needs

The value of your investment and income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. The value of tax reliefs depends on your individual circumstances. Tax laws can change.

CA6426 Exp 04/2022