We will share the highlights of the Budget on 3 March, but in advance of changes to tax allowances and rates, the State Pension increases have been confirmed. The positive news is that the increase is above the rate of inflation due to the protection provided by the triple lock.

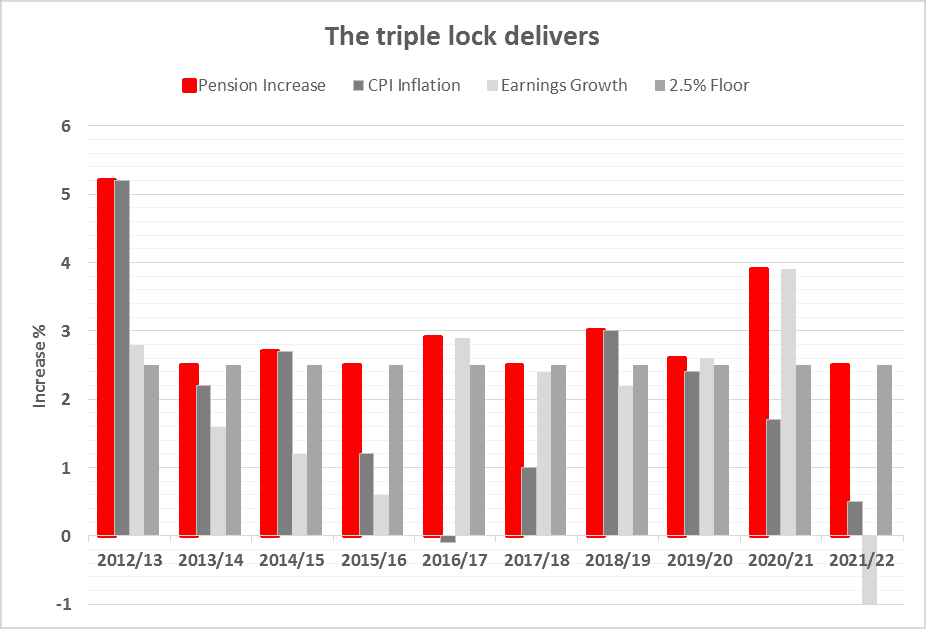

The triple lock was introduced to the UK State Pension in 2010. It was a guarantee that the State Pension would increase by the greater of Average Earnings, inflation as measured by the Consumer Price Index (CPI) or 2.5%. For the new tax year, 6 April 2021, the main State Pension will rise by 2.5% as both Average earnings and CPI were below 2.5% on the calculation date.

The State Pension changes are usually announced in an Autumn Budget, but due to the pandemic, no Autumn Budget took place. However, the changes have since been announced by the Department for Work and Pensions:

• The new State pension, which applies if you reach(ed) State Pension Age (SPA) after 5 April 2016 rises to £179.60 a week, an increase of 2.5%. If you are nearing your SPA (now 66), you are most unlikely to receive that figure as your State Pension will be subject to transitional rules introduced in 2016, when the old State Pension was replaced by the current version.

• The old State Pension, which applies if you reached SPA before 6 April 2016, also rises by 2.5% to £137.60 a week.

• Payments under other State Pensions, such the State Second Pension (S2P), will increase by 0.5%.

• The SPA is gradually increasing for men and women and will reach 67 by 2028.

Request a State Pension forecast

You can obtain a State Pension forecast online at www.yourpension.gov.uk or by phone:

0800 731 0175 (Monday to Friday 9.30 am to 3.30 pm)

Your State Pension forecast will show you what you might receive and when these payments may start, but values or dates are subject to change.

The outlook for the UK State Pension

The SPA is being kept under review which means that it could change in the future, so it is important to get advice for your pensions as this may change your overall retirement plans.

The lower increases outside the two main State Pensions are because only the new and old State Pensions benefit from the triple lock. Where the triple lock does not apply, CPI inflation is used.

As the graph shows, the triple lock has delivered above inflation increases in seven of the last ten years. Over that period the gap between a CPI-linked pension and a triple locked pension has grown to nearly 11%.

Both the cost and intergenerational fairness of providing the triple lock have regularly been called into question. Although the Conservatives’ 2019 manifesto promised to protect the lock, the pandemic expenditure and this year’s inflation-busting increase have once again brought a spotlight on the triple lock’s affordability.

Whether or not the triple lock survives, UK State Pensions remain among the least generous in the developed world. The latest survey from the OECD showed the UK at the bottom of the organisation’s league table for replacement income, providing less than half the OECD average.

Thus, while the State Pension has been outpacing inflation, it is still far from being sufficient to fund a comfortable retirement. Ask your Origen adviser or contact us and we can discuss your retirement goals and map out your income needs and build a plan for your retirement savings.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

CA6247 Exp 08/2021