The Scottish Budget proposals announced on the 28th January 2021 have been delivered against the backdrop of the impact of Covid-19 on Scotland and the Scottish economy. The main tax proposals are as follows:

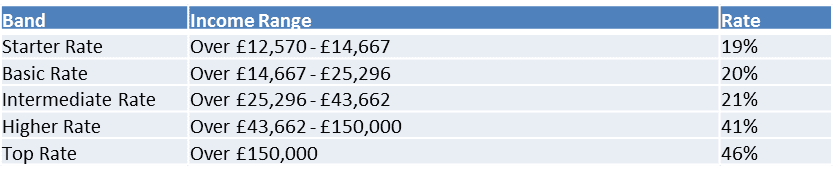

Income Tax Proposals

Income tax rates will remain unchanged, with the starter, basic and higher rate thresholds increasing in line with Consumer Price Index (CPI) inflation of 0.5%. The top rate of income tax remains at the 2020/21 level.

The rate and thresholds proposed for 2021/22 are:

Those earning more than £100,000 will see their Personal Allowance reduced by £1 for every £2 earned over £100,000.

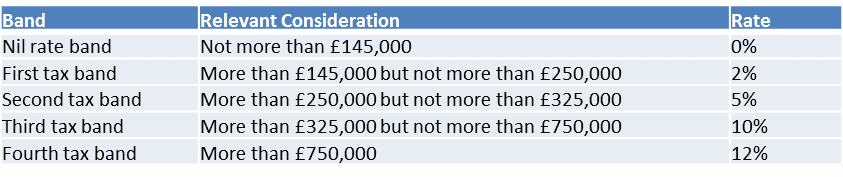

Land and Buildings Transaction Tax

The temporary increase to the ceiling of the nil rate band to £250,000 for residential Land and Buildings Transaction Tax (LBTT) will return to £145,000 from 1 April 2021.

Rates and bands for 2021/22:

First time buyers will continue to be eligible for first time buyer relief, which has the effect of raising the nil rate band to £175,000, resulting in a saving of up to £600.

Council Tax

An additional £90 million will be provided to councils that choose to freeze their Council Tax at 2020 21 levels in order to support low income households.

These announcements are the first stage in getting them implemented for the new tax year. Whilst they still need to gain UK parliamentary approval it is expected that this will not be a problem.

If you would like to discuss any of these changes with an adviser then please get in touch.

CA6163 Exp:04/2021