The coronavirus pandemic has caused falls in investment markets across the world. Although such falls are unnerving, we should remain focused on our financial goals and avoid taking actions which could adversely impact our ability to reach these goals.

Clients will be in different stages of retirement planning, from starting out on their savings, approaching retirement or in retirement – but in all cases these conditions prompt the need to reflect and review.

If you are retired, your annuity payments and State Pension benefits will not be affected by the investment markets performance. However if you are taking income from drawdown, then you need to be aware that the level of your withdrawals and the fall in markets will both be reducing the overall value of your investments. This will have an impact on how long your remaining pension fund can provide income in retirement.

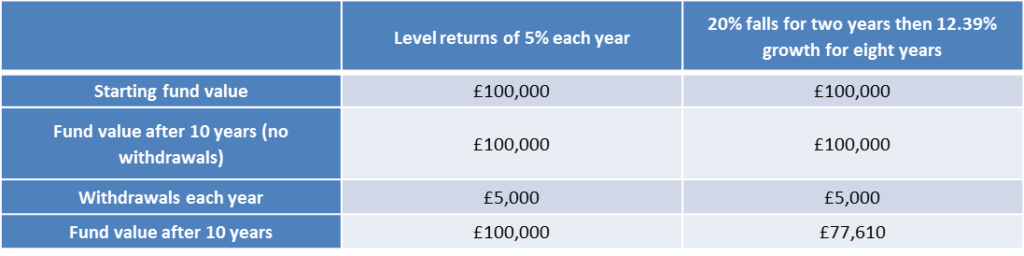

To demonstrate this impact, an investment which grows at 5% each year and another one which has two years of 20% falls followed by 12.39% growth each year for the next eight years will have the same value at the end of ten years. However, if you also make regular withdrawals the impact is significant.

The £22,390 difference is an illustration of an effect known as ‘sequencing risk’. To maintain withdrawals at their starting levels of £5,000 coupled with the falls at 20% means that at the end of two years, the fund is worth just £55,000 and the withdrawals are 9.1% of the remaining capital. Even growth of 12.39% a year thereafter cannot rescue the situation.

These calculations show that if you are taking regular withdrawals from your pension or are planning to do so, then the recent declines in investment values make it important that you review your level of withdrawals and consider other income options.

Some short-term strategies to consider include using cash reserves or other investments for income or only taking income generated from your pension savings or reduce your spending, which may not always be possible.

Our advisers will be able to review your portfolio and make recommendations which help you to adapt your financial plans to provide a sustainable income throughout retirement.

If you are approaching retirement, the downturn may change your outlook and impact your decisions about using your retirement funds which will often determine your level of income throughout retirement, so getting advice is highly recommended. Generally, you have the options of taking a tax free lump sum with the remainder being used to provide income either as an annuity, which will pay a guaranteed level of income for life, or through drawdown whereby you can choose the level of withdrawals as and when you wish. In drawdown, your fund will remain invested and is subject to market risk. You can of course choose a mixture of annuity and drawdown to provide the retirement income you need.

As a result of the coronavirus pandemic, you may choose to review your plans and some options include delaying retirement, not taking a tax free cash lump sum from your pension fund, paying additional pension contributions in the run up to retirement, or you may decide to phase your retirement by only taking part of your benefits. Phasing your retirement may be particularly suitable as the remaining fund has the opportunity to benefit from any market recovery.

If you are a long way from retirement, you should review your chosen funds to match the level of risk which you are willing to take. But equally, it is important that you do not overreact and move investments to more secure areas as a result of the downturn – you have time on your side and historically we have seen markets rebound from major investment market crashes in the past.

One way of combatting investment market risk is by drip-feeding investments, for example by making regular monthly contributions, so that you avoid buying at a market high and spread your purchasing prices more evenly, known as pound cost averaging.

Our advisers have experienced market volatility before and supported clients at different stages of retirement planning. The market downturn can be unsettling, but it is important that you consider your options and our advisers can make recommendations to get your retirement plans back on track and to overcome the challenges of recent market falls.

CA5451 Exp 04/2021