Holding cash is a key foundation for financial planning as it provides both an emergency fund and the ability to react to market conditions and purchase assets.

As a general rule, we recommend that you should hold an emergency cash fund of between 3-5 months’ worth of expenditure; this needs to be immediately accessible by the very nature of its purpose. Beyond this, cash deposits should be viewed as an asset class and need to be working for you even if it is there as a balancing asset to offset risks you are taking in the stock market for example.

“When people talk about cash being king, it’s not king if it just sits there and never does anything.”

Warren Buffett, CEO of Berkshire Hathaway, known as the ‘Oracle of Omaha”, w’dely considered to be one of the most successful investors of all time with a current net wealth, according to Forbes, of approximately $73.5 billion.

Is your cash hard at work?

In the current economic climate of low interest rates and with the Bank of England base rate at 0.1%, cash returns have been low for many years.

Many banks and building societies have announced savings rate cuts. In mid-February, NS&I announced that it would be cutting interest rates across a range of variable rate products from 1 May, only to drop these plans two months later, leaving NS&I with a range of league-topping interest rates. Backed by HM Treasury and guaranteeing 100% of your savings, NS&I provide a secure home for cash savings. Over a third of UK savers trust NS&I with their money. Between April and June, nearly £20 billion flowed into its coffers.

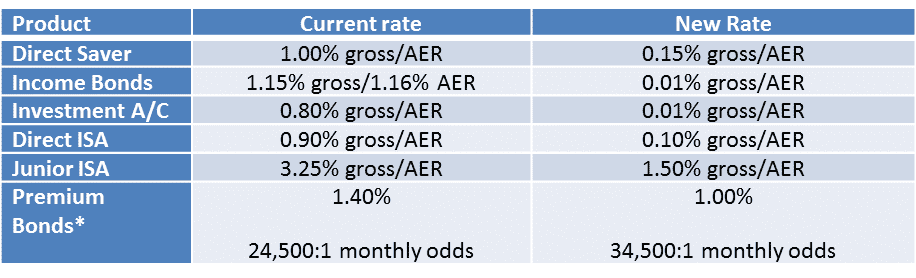

However, on 21 September, NS&I announced some significant reductions in interest rates so that they “are aligned appropriately against those of competitors”. The cuts, which generally take effect from 24 November, are dramatic, as the table shows.

* From December 2020 prize draw.

Put your cash to the test

By reviewing your financial objectives and assessing your investments, we can discuss the income or returns from your cash deposits.

If you have surplus cash savings, we can also help you to explore other investments which suit your attitude to risk and your financial objectives.

Speak to your Origen adviser or call 0344 209 3925 and see if we can help you put your cash to the test. All calls are recorded for business purposes and are charged at your phone company’s basic rate.

The value of your investment and income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

CA6009 Exp:04/2021