The clock continues to tick towards the end of the tax year on 5 April, so now is the time to look at maximising ISA allowances, making pension contributions, using Capital Gains Tax or gifting allowances. Many of your allowances are lost if they are not used before the end of the tax year.

Take a look at The Origen Guide to Tax Year Planning which shows some of the financial planning opportunities available.

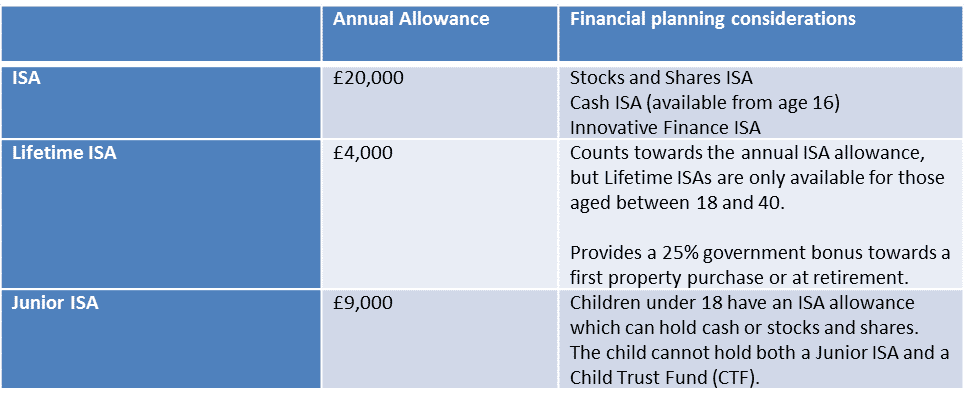

ISAs – Saving for your future

An Individual Savings Account (ISA) is free from Income Tax and Capital Gains Tax, allowing your savings more potential for tax-free income and growth.

If you have used your own allowance, you can make payments into an ISA for a spouse, civil partner or family member or make contributions into their pension plans. The Junior ISA allowance has more than doubled from the last tax year and it can be an excellent way to save for their future through a stocks and shares ISA or a cash ISA.

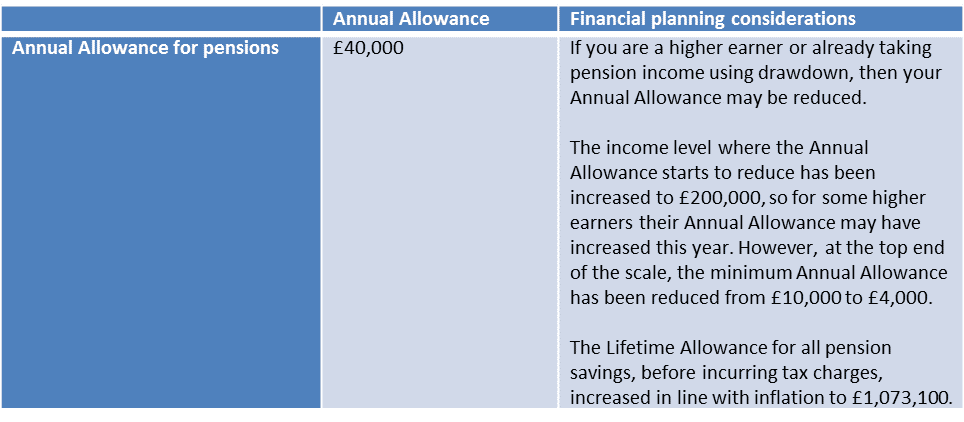

Don’t miss out on pension savings but watch the limits

You can save up to 100% of your income in a pension and earn tax relief so long as you don’t exceed your annual allowance.

You can make pension contributions through your employer’s workplace pension scheme or into your own pension plan both of which benefit from tax relief on your contributions. If you haven’t used all of your annual allowance, it is possible to ‘carry forward’ any unused annual allowances from the three previous tax years so long as you were a member of a pension scheme for those years.

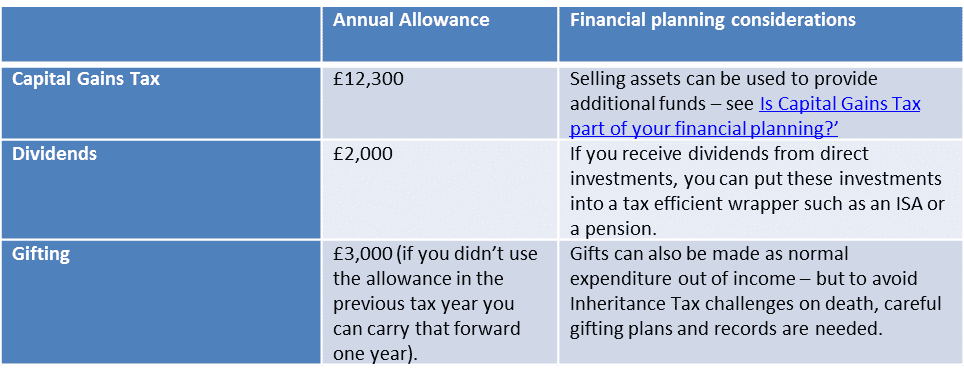

Generating income from your investments

If you sell certain investments, including shares, your gains will be subject to Capital Gains Tax (CGT) at either 10% or 20% if you exceed your CGT allowance (with an additional 8% on the sale of properties, other than your main residence, which is generally CGT exempt). If you receive dividends from shares, above the annual allowance, you may want to consider holding these assets in tax efficient options, like ISAs or pensions.

We can guide you on how to release funds from your portfolio to retain the correct level of risk and reduce your tax payments. If you are planning to make a sale which will have a gain in excess of the CGT allowance, you may consider splitting the sale over tax years, so that you use this year’s and next year’s CGT allowance, thereby reducing the taxable gain.

Key Allowances to consider

Looking ahead

We know that 2020 was a challenging year and tax changes may be announced in the Budget. The Budget date has been set as 3 March, but you should get financial advice and act now to ensure that we can set up your plans before the end of the tax year.

Please contact your Origen adviser or our Client Liaison team on 0344 209 3925 if you would like to talk to us about tax year end actions…and please act soon before some allowances are lost at the end of this tax year.

Our lines are open 8.30am to 5.30pm, Monday to Friday. Calls are charged at your phone company’s basic rate. All calls are recorded for business purposes.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

CA6132 exp 05/2021