The annual allowance sets your tax efficient limit for the total amount of pension contributions that you and your employer can make in a tax year. If the limit is exceeded, then you essentially repay tax relief on the excess by paying an annual allowance tax charge. So for example, a large employer contribution could land the employee with a tax bill.

The history of the annual allowance

The annual allowance was first introduced at £215,000 in 2006 and has then increased annually to £255,000 in 2010/11, before it was reduced to £50,000 in 2011/12.

This reduction was introduced to limit the cost of tax relief for the government and in 2014/15 a further cut was made to £40,000. Tapering was then introduced for high earners from 2016/17 which meant that for the highest earners (those with annual adjusted income levels exceeding £150,000) the annual allowance could be further reduced to as low as £10,000. Total adjusted income includes all earnings subject to Income Tax, such as salary, rental income etc. and also pension contributions paid by you and your employer.

How is the taper impacting clients?

These changes to the annual allowance have meant that more and more people have been adversely affected. In 2016/17 the number of people who reported through their self-assessment tax return that they breached the annual allowance doubled from the previous year (2015/16) to 18,930 and on average the excess was £29,635.

More recently, this issue became a topic for government discussion as many NHS consultants and GPs, with generous NHS pension scheme benefits, were being caught in the taper trap.

New changes to tackle the problem

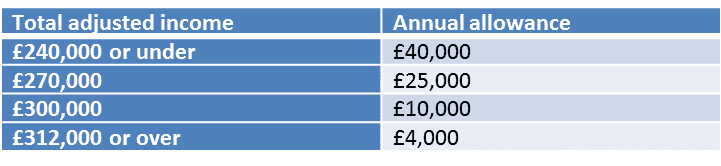

The Chancellor addressed concerns over the tapered annual allowance in this year’s Budget in March, by increasing both of the income thresholds relevant to the taper by £90,000. From 6 April 2020, nobody with total adjusted annual income below £240,000 will be subject to the tapering rules.

However, there are some losers from the Budget changes, as the tapered annual allowance has been cut from £10,000 to just £4,000 for those with adjusted income over £312,000.

If you have been affected previously by the tapered annual allowance, you may now be able to increase your pension contributions, but please ask your Origen adviser to check how the recent changes may affect you.

Pensions continue to offer valuable incentives for saving with tax relief on contributions and tax free cash entitlement at retirement – but they continue to be under the scrutiny of government policies and reviews. So it is important to regularly review your financial planning with your Origen adviser to ensure you make the most of any new opportunities that regulatory changes may offer.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

CA5275 exp05.2021