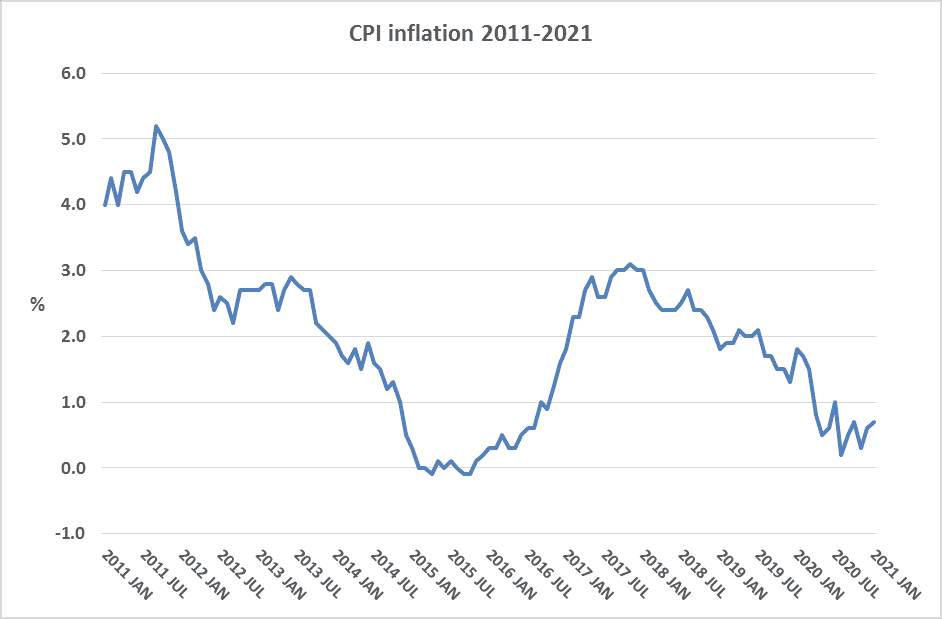

During the pandemic we have seen inflation at historically low levels. However, some analysts are now expecting inflation to rise during 2021.

Why does inflation matter?

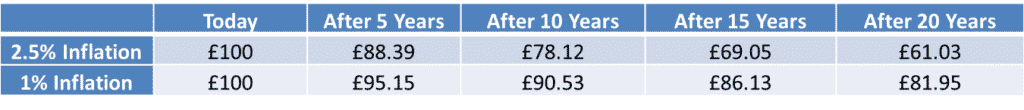

Inflation has the effect of eroding the purchasing power of your money over time. In practice it means that £100 today would be worth more to you now than it would in the future because of the impact of inflation.

Everyone should be aware of inflation, as it can have a deeply corrosive impact on your wealth and standard of living.

Unlike significant market events such as the financial crisis of 2008, which have seen the value of assets impacted over a short space of time, the impact of inflation is felt greatest over a period of years and can often be overlooked. Over time, it only takes a relatively small increase in the rate of inflation to have a substantial impact on the purchasing power of your money. As an example, £100 today would only be worth £78.12 in 10 years’ time with inflation at 2.5%.

A look back at inflation

Annual inflation over the last ten years to January 2021 has averaged 1.8%, as measured by the Consumer Prices Index (CPI), which means overall prices have increased by almost a fifth since 2011 due to the effect of year on year growth– which is potentially bad news for anyone with a fixed income.

Each month, CPI is announced which shows the rate at which the prices of goods and services bought by households rise or fall. It is important to note that if inflation falls, this means that prices are still rising but at a slower rate. Only when inflation is negative are prices falling.

How is inflation measured?

All inflation indices measure the prices based on a ‘basket’ of goods and services, which the Office for National Statistics (ONS) reviews and amends each year to reflect changing spending patterns. Additions to the basket for 2021 included electric and hybrid cars, hand hygiene gel, men’s loungewear bottoms and smartwatches, whereas staff restaurant sandwiches and gold chains are two items which have been removed. The Retail Prices Index (RPI) is another common measure of inflation which also includes housing costs in the index.

The pandemic has posed problems for the ONS when it comes to calculating the rate of inflation. Some items have not been available, such as restaurants and hotels, which in 2020 took up almost 12% of the CPI, and package holidays which had a 4.2% weighting in the index.

The new ‘basket’ for 2021 would normally have been based on expenditure in 2019. However, the ONS has created a special 2021 ‘basket’ that uses data from both 2019 and, where there have been significant changes, in 2020. As a result, the weighting for ‘restaurants and hotels’ and ‘recreation and culture’ have both fallen while those for ‘food and non-alcoholic beverages’ and ‘alcoholic beverages and tobacco’ have risen.

The ONS measure of inflation is used to aid economic decision making and helps to set prices and income levels across the economy. Whilst it is obviously an important economic measurement, it is only an average.

It is important to note that everyone has their own rate of inflation, which depends on what you spend your money on – your personal basket of goods and services – and how these prices change over time. For example, February’s CPI was only 0.4% which was driven by a 5.7% fall in the price of clothing and footwear, whilst alcoholic beverages and tobacco rose by 2.8%, meaning that the personal rate of inflation can vary significantly.

What to expect?

The Bank of England has a target inflation rate set at 2%. Although 2021 started with annual inflation of 0.7%, by May the figure is likely to be closer to 2% as a result of price rises that have already been locked in, including the 9.2% rise in capped gas and electricity bills, and council tax increases of up to 5%.

Richard Wallis, our Head of Research & Investment, shared his views on the outlook for inflation in our recent edition of Aspire on Page 42.

Ask your Origen adviser to review your financial plans and check that they are built to deal with the potential threat of rising inflation. Your financial planning and investment strategy need to reflect your own cost of living changes, so that your plans continue to meet the needs of you and your family. By taking the action required, your investments can help provide the income you need now and in the future, and maintain or improve your future purchasing power.

CA6425 Exp 04/2022