Capital Gains Tax (CGT) is a tax on gains and profits and it applies on most investments, including property, art and shares. CGT only applies when you dispose of an asset either for consideration (money’s worth) or by making a gift. However, there are some notable exemptions, including ISAs, pensions, government gilts and your main family home which are not subject to CGT.

How can CGT help with financial planning?

If you do hold other investments and you need additional funds, then using your annual CGT allowance could be efficient financial planning. You can realise gains up to the allowance in any tax year without incurring any CGT. You may also wish to move some investments into a more tax efficient place, such as an ISA, and using your annual CGT allowance will enable you to do this gradually over several years if you have larger investments.

What are the CGT allowances and tax rates?

Each year, every UK resident has a CGT allowance and for the current tax year (2020/21) the allowance is £12,300. Most Trusts have a lower allowance of £6,150 (50% of the individual allowance). If you establish more than one Trust, the CGT allowance is divided between the trusts (up to a maximum of five) to give a minimum CGT allowance of £1,230 per trust if there are five or more Trusts.

The taxation rates for gains in excess of your allowance are as follows:

How does CGT impact investors?

In the tax year 2018/19, HM Revenue and Customs provisional figures show that just 256,000 people had a CGT bill, which was 9,000 fewer than in the previous tax year. This is less than 1% of all income taxpayers. However, over the 10 years since 2008/09 the number of CGT payers has nearly doubled. The total paid in 2018/19 was £8.8 billion, which is over £3.4 billion more than was collected in Inheritance Tax.

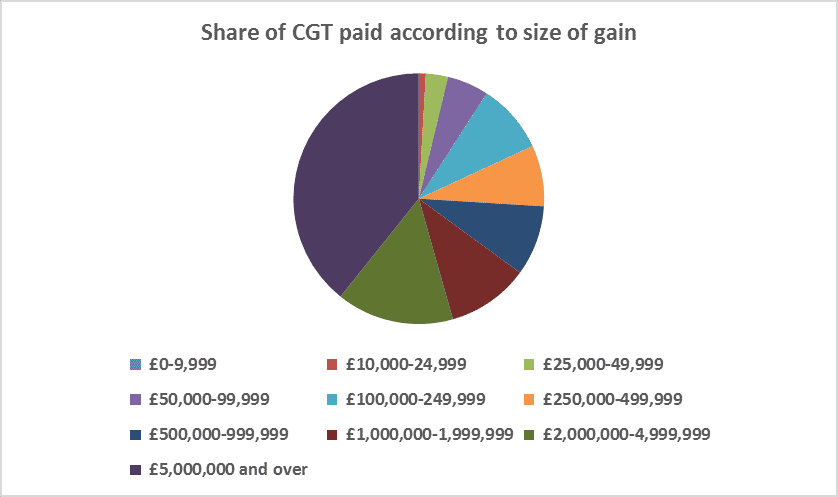

Clearly investors with larger gains are likely to contribute the most to CGT. The top 5,000, about 2% of all CGT payers, with gains of at least £2 million, contributed 54.4% (£4.7 million) of all CGT paid. The spread of gains and tax paid is shown in more detail in the pie chart below.

How can CGT allowances help my financial planning?

The Capital Gains Tax allowance offers a way, in addition to the Income Tax Personal Allowance, to access funds from your investments without having to pay tax. Even if your gains exceed the allowances, capital gains are usually taxed at a lower rate than they would be if they were income. This means that you will receive more from the same amount of a capital gain than from income after tax has been paid.

You can also ensure that you shelter investments from CGT by moving them into other tax efficient investments, such as ISAs. You should also remember that each person has a CGT allowance, so you may wish to transfer assets to a spouse or civil partner to utilise any unused allowances or if their total income means that their gains may be subject to a lower rate of CGT.

CGT is under government review, so it is important to check that your actions remain suitable for your own circumstances now and in the future and also to act before there are any changes in tax rules.

Our advisers can discuss your investment objectives and explain your options. Our advice recommendations can help you to generate funds from your investments and utilise the CGT allowances effectively, if this can help you towards your financial planning goals.

The value of tax reliefs depends on your individual circumstances. Tax laws can change.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

CA5881 exp04/2021