During the pandemic, the restrictions in travel and socialising has seen many people increase their savings as they have been unable to go on holiday or have had no travel to work costs during the lockdown. As we begin new post lockdown living, it is a good opportunity to assess:-

• any spare cash which you may have built up, reflect on what you plan to do with these savings and make sure that they are working as hard as possible.

• Where pre pandemic spending habits can change to increase your ability to create wealth for the future

How has the pandemic changed global savings?

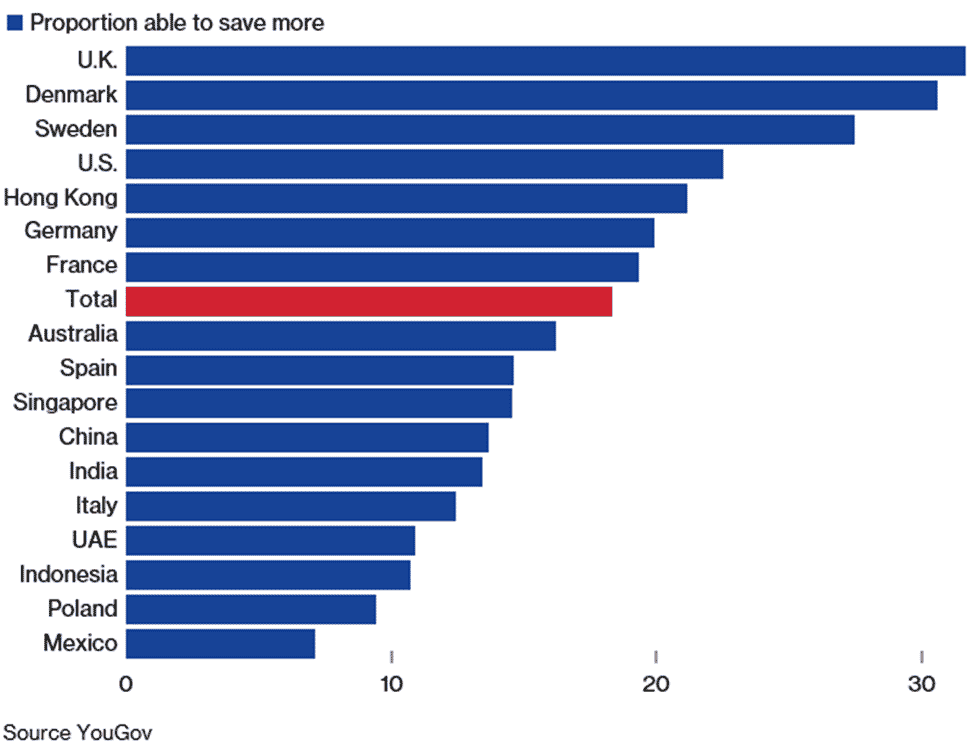

A YouGov survey shows that 31.6% of UK consumers have been able to increase savings during the pandemic lockdowns, compared with an average rate of 18.3% across the survey and more than any of the 17 nations surveyed. This compares with 22.5% in US, 19.4% in France and 13.7% in China.

According to the Bank of England, savers have added £110 billion to personal bank accounts in the last year, nearly three times the annual average of £41 billion.

The findings also revealed growing optimism, with households in most countries expecting to be better off 12 months from now than they are currently.

What is consumer sentiment?

On balance, people are upbeat about their near-term financial prospects. However, the obvious health concerns and economic uncertainty of the pandemic have led to cautious optimism. The UK reading of 3% was below the 8.5% total average, but still represents net optimism.

The survey of almost 19,000 people was conducted from May 14 to May 28. It included more than 1,000 people in each country, except in Hong Kong where the sample was about half that size. In the U.S. and U.K., more than 2,000 people were surveyed in each.

Don’t let good habits go to waste

With restrictions lifting, the temptation may be to spend, spend, spend – but if you have started to save during the pandemic, try to continue this habit. Here are some helpful tips to continue or start the savings habit:

• Make regular contributions – having savings automatically deducted from your monthly income removes the temptation to spend these funds. It can be hard initially, but over time you adapt to the disposable income available.

• Reduce debt – Making regular or lump sum overpayments on your debts, such as a mortgage, can also be a valuable saving, especially when savings rates are below the rates on any debt.

• Know your budget – It is important to be realistic, how much can you afford to save? You can review your outgoings and income and see what is affordable and achievable. This will also give you an opportunity to see if you really do get value from your outgoings, such as regular subscriptions, memberships etc.

• Understand your savings options – It is important that you have some rainy day funds easily available as cash, we recommend between 3-5 months of monthly income, but this will need to reflect your personal circumstances. However, it is important to recognise that inflation will increase the costs of living in the future, so if your returns are below inflation, your savings are falling in value in real terms. If you are saving for the long term, you can use pension or ISA allowances, which offer tax advantages for cash or stockmarket investments.

• Set your own target and objective – Having a plan or target, makes a savings plan easier to commit to and you can monitor your progress.

If you do hold savings in cash, in February 2021, the average UK instant access account pays just 0.12%, according to the Bank of England, while accounts that require you to lock your money away offer an average return of 0.51%, below the rate of inflation.

Our advisers use their expertise in helping you to budget, set financial objectives and invest your spare cash in the right way to help you achieve your financial goals. Our knowledge and experience can help you to use tax allowances and also assess your acceptable level of investment risk.

Beyond that, our regular reviews will help to assess your progress and take any action needed to reflect a change in circumstances or legislation.

The pandemic has changed everyone’s finances, so as we start to live in a new post-restrictions world, it is a good time to review your savings plans and objectives.

This update is intended to be for information only and should not be taken as financial advice.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. The value of tax reliefs depends on your individual circumstances. Tax laws can change. Origen is not authorised to provide advice on deposit accounts.

Origen Private Client Solutions is a trading name of Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority.

CA6936 Exp 07/2022