A major benefit of saving for retirement in a pension scheme is the generous tax relief given on your personal contributions. You automatically receive basic rate tax relief (presently 20%) which is paid directly into your pension fund. However, if you are a higher (40%) or additional rate (45%) taxpayer you can claim further tax relief.

In Scotland, you can also claim further tax relief for all bands above basic rate, i.e. intermediate rate at 21%, higher rate 41% and top rate 46%. If your rate of Income Tax in Scotland is 19%, your pension provider will claim tax relief for you at a rate of 20%. You do not need to pay the difference.

Are you entitled to more tax relief on your contributions?

Higher or additional rate tax relief is not paid into your pension fund and you will need to claim it back personally in one of two ways:

1) Contact your tax office

If you want to receive the higher rate tax relief regularly throughout the year in your salary, you will need a new tax code from your tax office.

You can write to your tax office and provide your personal contribution statement from your pension plan. This will show your gross and net personal contributions paid into your employer’s pension scheme and confirm your pension provider and policy number.

You should confirm that pension contributions are deducted from your payslip and the employer deducts relief at source and therefore your contributions are taken after tax.

This should enable the tax office to issue a refund of your higher rate tax relief entitlement and a revised PAYE Tax Coding, which they will provide to your payroll department within a few weeks, so that tax deductions from your salary will reflect the pension contributions that you make.

If this is the first time you have asked for a refund from HM Revenue & Customs (HMRC), you must inform them in writing. However, once you have made an initial request, you can contact HMRC by phone when your pension contributions change so that they can amend your tax records.

2) Self Assessment

Alternatively, you can complete a Self Assessment tax return to claim back your higher/additional tax relief after the end of each tax year. You will need to confirm the total gross contributions paid for the tax year to ensure the correct amount of tax relief is given. However, once you submit a Self Assessment tax return, you will be required to complete one every year.

If you are an additional rate taxpayer or a top rate taxpayer in Scotland, then you can only reclaim tax relief by completing a Self Assessment tax return.

How to claim tax relief for previous years

You can reclaim tax relief for the past four tax years. The earliest tax year that you can claim tax relief for is 2017/18 and you need to submit your claim by 5 April 2022, otherwise it will be lost.

You will need to contact your pension provider and request a statement of contributions for each tax year you wish to reclaim tax relief. You then need to send the statements to HMRC to claim back the tax relief.

How to check if you are entitled to reclaim tax relief

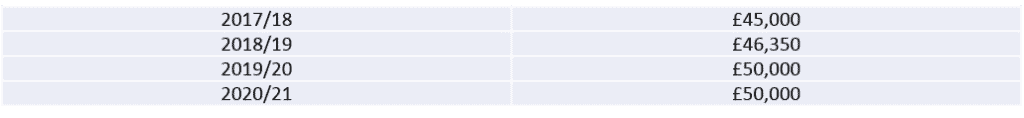

If your total income exceeds the higher rate tax threshold, then you should make a claim for higher rate tax relief. Your tax band and your marginal rate of Income Tax will be based on your income from all sources, not just earnings, and will include rental income, pension income and regular income from investments. To provide a guide for England and Wales, you should consider your total gross income in each tax year and see if the combined figure exceeds these higher rate tax thresholds:

Different tax rates apply in Scotland. For tax year 2021/22 the intermediate rate of Income Tax at 21% applies from £25,297, higher rate of 41% from £43,663 and the top rate of 46% applies to income over £150,000.

Our advisers can help you to review your retirement savings and check that you are on track to achieving your financial goals.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.

This article is intended to be for information only and should not be taken as financial advice.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA7123 Exp 09/2022