As we reported last month, savings in the UK during the pandemic have increased. Since 1999, when Individual Savings Accounts (ISAs) were introduced, the nation has adopted and widely invested in ISAs.

ISA returns are free from Income Tax and Capital Gains Tax, allowing your savings more potential for tax-free income and growth.

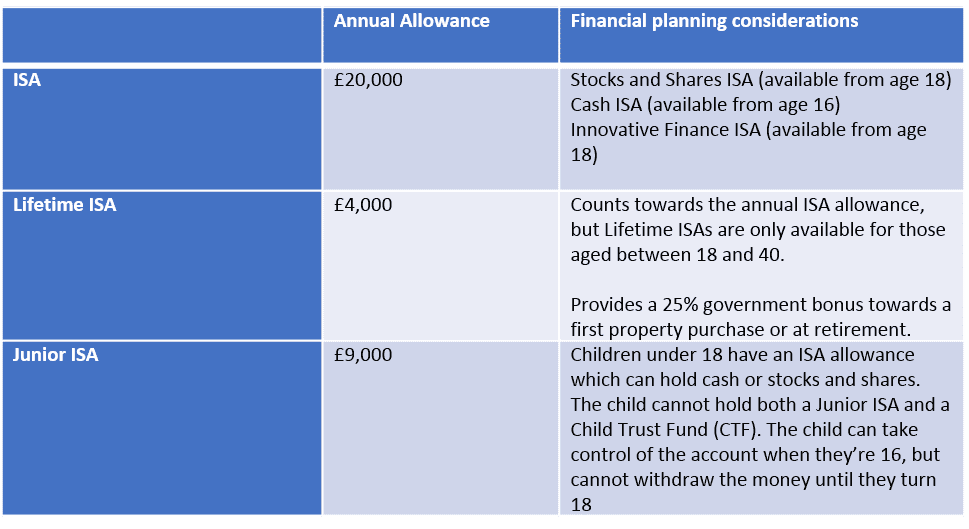

If you have used your own allowance, you can make payments into an ISA for a spouse, civil partner or other family members. The Junior ISA allowance has more than doubled from the last tax year and it can be an excellent way to save for your children’s future.

The ISA market

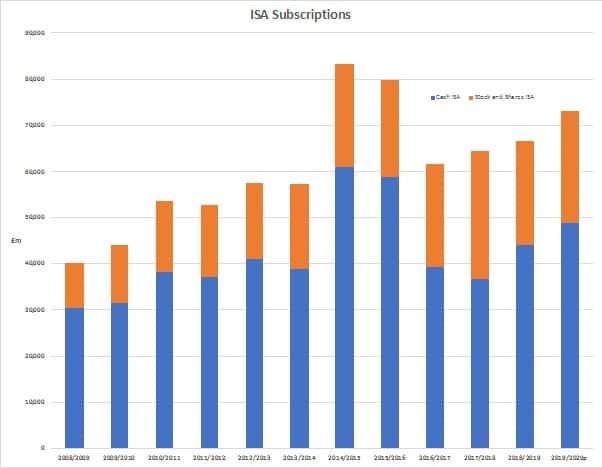

HM Revenue and Customs has recently issued details of ISA subscriptions and holdings for 2019/20 and this data shows:

• Despite ultra-low interest rates, the amount of money invested in cash ISAs has continued to grow. In 2019/20, £48.75 billion of subscriptions were received into Cash ISAs, more than double what was invested in stocks and shares ISAs.

• Despite the increase in the maximum overall ISA contribution to £20,000 in 2017/18 (from £15,240), total annual subscriptions have not exceeded their 2014/15 peak.

• Lifetime ISAs (LISAs), launched in 2017/18 have grown in popularity, with 2019/20 subscriptions more than double those of the previous year. This jump may have been partly due to the closure of the Help to Buy ISA to new investors in December 2019.

• For the first time, over one million subscriptions were made to Junior ISAs (JISAs) in 2019/20, with the total investment of £974 million.

• The total amount invested in ISAs (excluding JISAs) in April 2020 was just under £620 billion, of which just over half was held in cash ISAs.

Source: HMRC.

Are Cash ISAs good financial planning?

It is important that you have some short term, rainy day funds easily available. As part of our advice we generally recommend holding between 3-5 months of expenditure as cash savings for unforeseen emergencies. However, this is for guidance and clients will have their own views on the reserve you need to retain which will reflect your personal circumstances.

However, holding cash in ISAs may not be effective financial planning. In 2016/17 a personal savings allowance was introduced which means that basic rate taxpayers pay no tax on their first £1,000 of interest and, similarly, £500 of interest is tax free for higher rate taxpayers, which applies when total taxable earnings are over £50,000. Additional rate taxpayers, with total taxable earnings of £150,000 do not have a personal saving allowance.

For basic or higher rate taxpayers, a considerable amount of savings in an ordinary deposit account would be needed to exceed this personal savings allowance. For example, a higher rate taxpayer would need to have cash savings in excess of £50,000 assuming an interest rate of 1% before exceeding the personal savings allowance.

So, taking out a cash ISA could be of questionable value compared with an ordinary deposit, and it is important to regularly review the rates and the best option available.

If you have built up Cash ISAs, you can switch them to Stocks and Shares ISAs without using any of your annual ISA allowance, if you are willing to take on some investment risk. Our advisers can help you to review the options available and assess the level of risk that you are willing and able to take.

Don’t forget the kids

If you have a child or grandchild born between 1 September 2002 and 2 January 2011, they were almost certainly the beneficiary of a government payment – either £250 or £500 – into a Child Trust Fund (CTF). The CTF scheme was set up to ensure every child had some savings as they entered adulthood.

However, nearly a third of parents ignored the CTF vouchers they received, leaving HMRC to open default CTFs. The scheme survived until 2010 and it was closed entirely from the start of the following year. By then, there were over six million CTFs in existence.

HMRC have confirmed that in April 2020, shortly before the first CTFs started to mature, there was nearly £9.2 billion invested in CTFs, with the average CTF having a value of £1,500, with over 85% having a value of less than £2,500.

CTFs were not limited to receiving government payments and you can make top-ups to this day, with a current maximum of £9,000 in a tax year. However, in 2019/20, fewer than one in six plans were topped up, with the average addition being £430.

The government launched a find-a-CTF website www.gov.uk/child-trust-funds/find-a-child-trust-fund.

If your child or grandchild has a CTF, it makes sense to review it now to ensure they don’t miss out. Since April 2015, it has been possible to transfer a CTF to a Junior ISA (JISA) but not vice versa – a child can only have one or the other. Often, a new JISA will offer much wider investment choice than the old CTF and may have lower charges.

Savings advice for you and your family

There are a range of options available to you and your family. Our advisers will review your objectives and will also assess your attitude to risk, so that any recommendations match your risk profile.

Using our knowledge and experience, we can help you to make use of the allowance available most effectively, whether that be ISA allowances, personal savings allowances or CTFs.

Please contact your adviser or ask us to review your savings strategy or to help you get started. We will be happy to build and review plans to help you towards your financial goals.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.

This article is intended to be for information only and should not be taken as financial advice.

CA6994 Exp 08/2022