2020 has been a challenging year for investment markets and we have provided weekly updates during this period of uncertainty to provide you with reassurance and information about UK and global market performance as well as the economic impact of the pandemic.

In the case of equity investments, market prices are only part of the story as company dividends can provide valuable additional growth or a source for income. Dividends are paid out by companies to shareholders, which can benefit direct shareholders or contribute to investment returns from funds that invest all or part of their portfolios in equities.

2020 – A challenging year for dividends

In April, we highlighted that the short-term outlook for company dividends was looking bleak as many companies across a range of different sectors announced that they would cancel, suspend or cut dividends as a result of the unknown financial impact of coronavirus. In September, we reported that the bleak outlook had become a reality.

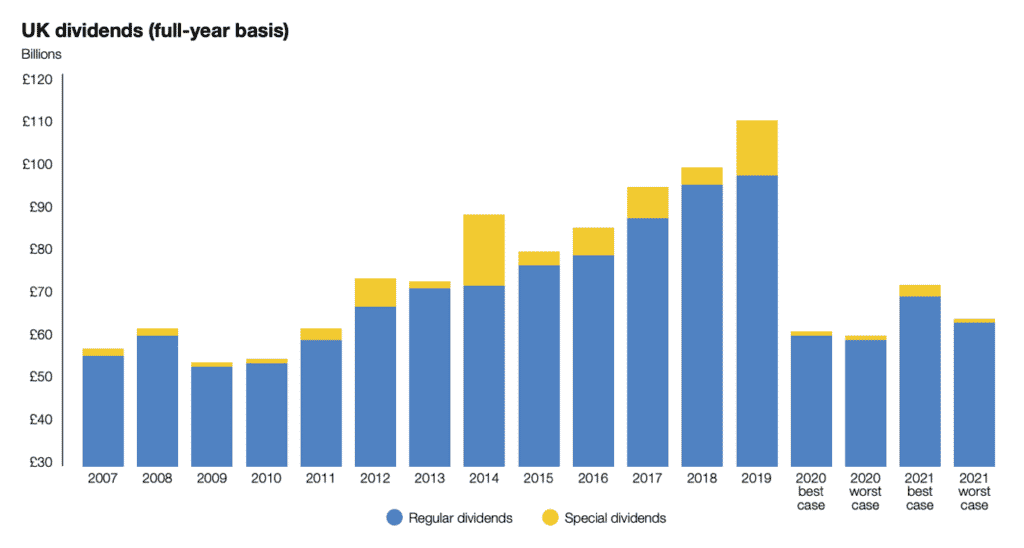

Companies will usually make regular dividends to shareholders, generally on a quarterly basis, but special dividends may be paid if the business has surplus cash.

Source: Link Asset Services

However, although there continue to be concerns over the coronavirus during the winter months which is likely to mean ongoing restrictions on social interaction in this period, we have seen more positive signs of late for the UK and global economy. Furthermore, the development of a number of vaccines to tackle the coronavirus means that there is optimism for a sustainable economic recovery in 2021.

Reflecting on 2020

• In the third quarter of 2020, (July to September), total (regular and special) dividend payments from UK companies were 49.1% lower than in the corresponding quarter in 2019.

• Two thirds of UK companies either cut or cancelled their dividends in this quarter.

• One-off special dividends fell by 90% from the third quarter of 2019.

• Across 2020 as a whole, the fall in total dividends will be around 45%, according to an estimate from Link Asset Services, who are one of the UK’s largest share registrars.

If you hold UK equity funds – particularly UK equity income funds – managed funds that invest in the UK or own shares directly, you will probably have felt the impact of such unprecedented dividend cuts. As the graph shows, the fall in payouts has been much greater this year than in the wake of the 2008 global financial crisis.

However, there are some positive signs:

• The fall in the third quarter at 49.1% was less than the fall in the second quarter, when the overall drop was 57.2%.

• Similarly, the proportion of companies cutting or cancelling dividends reduced in Q3, from 75% in Q2.

• Special dividends were unusually high in the third quarter of 2019 – nearly quadruple the amount of Q3 2018 – which distorts the latest comparison.

The pandemic has given the opportunity for companies that needed or wanted to cut or cull their dividends to do so. Some companies, such as BP and Royal Dutch Shell, have taken the opportunity to ‘rebase’ their dividends, setting lower level expectations for future payments. A growing number of companies that suspended dividends have already resumed payments or promised to do so.

Banks were told by the Bank of England in March to stop payouts, just before their final dividends for 2019 became payable. According to Link, almost 40% of the fall in Q3 regular dividends was accounted for by the banks’ dividend curfew. As the Bank of England has relaxed the coronavirus curbs, allowing the banks to take a cautious and prudent approach to restart paying dividends in 2021, there could be a significant jump in regular dividends across the year.

Link estimates that UK regular dividends could increase in 2021 by between 6% in its worst-case scenario, and 15% in the best case. If you are looking for income in a world of near-zero interest rates, both projections are attractive.

If you do have any concerns regarding the income which you receive from your investment funds, our advisers can review your income strategy and we can then make recommendations to help you receive the income you need most tax efficiently. Investments should always be viewed as long-term in nature and we would not recommend a knee-jerk reaction to any further downturns.

Please note that we do not provide advice on buying or selling individual shares. The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

CA6065 Exp 12/21