How much income do you need for a comfortable retirement?

One traditional way to answer this question is to base it on a percentage of pay. For example, when final salary pension schemes were more common, their target was often around two thirds of earnings, but this is very arbitrary and does not reflect your own circumstances or retirement aspirations.

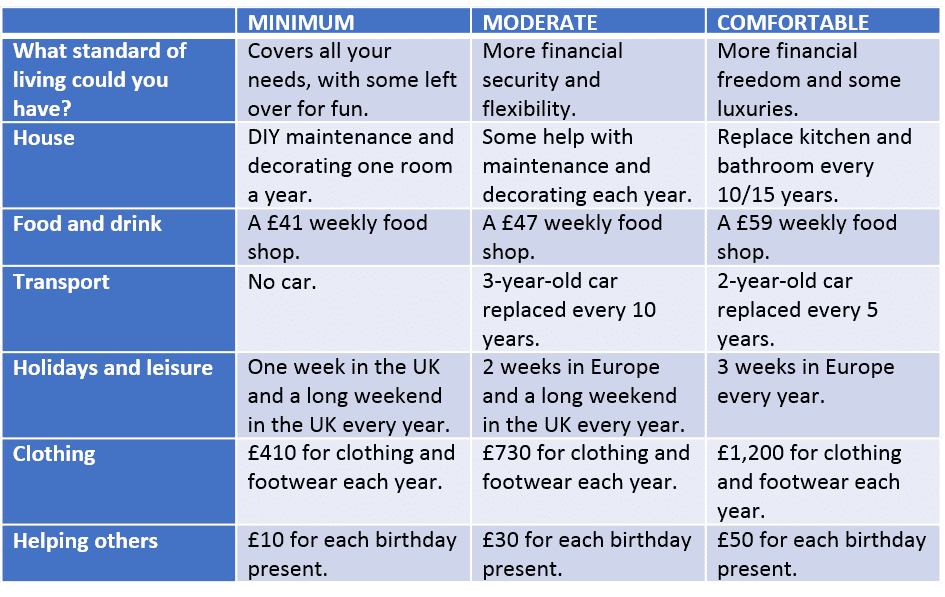

An alternative is to focus on retirement living standards, an option that has been supported in the UK by the Pension and Lifetime Savings Association (PLSA). Pitched at three different levels – minimum, moderate and comfortable – the retirement living standards are designed to help people picture the lifestyle they want when they retire, and understand the cost.

The minimum retirement living standard is based on the Joseph Rowntree Foundation’s Minimum Income Standard and covers all a retiree’s needs plus enough for some fun – including social and cultural participation. It includes a week’s holiday in the UK, eating out about once a month and some affordable leisure activities about twice a week. It does not include budget to run a car.

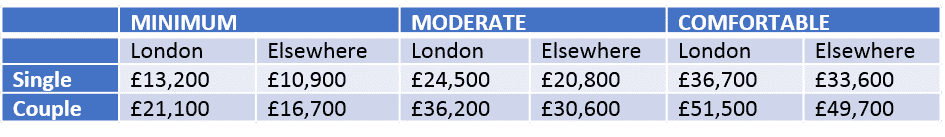

The PLSA sets these levels of post-pandemic retirement for a single person:

You can assess where you are or plan to be in retirement; many may wish to be in the comfortable category, but that requires more robust retirement planning.

These annual costs in retirement can provide you with a target retirement income after tax, in order to meet your preferred living standards in retirement.

How can our advice service help?

We can help you to check that your financial planning will meet the standard of living that you want in retirement. If you are already retired, we can also help you to manage your income effectively.

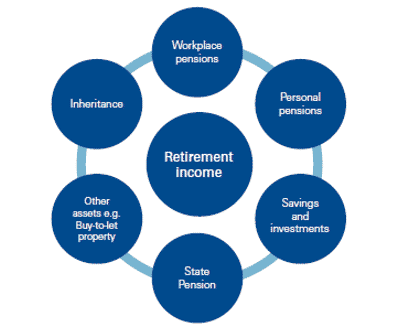

Retirement income may come from many different sources, but it is also important to recognise that some income sources cannot be guaranteed, such as an inheritance as you may not receive this until you are in retirement or you may not receive what you expected.

Your sources of retirement income

Building a full picture

You can gather information from your latest pension statements to estimate how much income you may have in retirement. You can also obtain a State Pension forecast, which will show you what you might receive and when these payments may start, online at www.yourpension.gov.uk or by phone on 0800 731 0175 (Monday to Friday 9.30 am to 3.30 pm).

We can help you to build a picture of how much and when you will receive your other retirement benefits. The State Pension Age is 66 and is gradually increasing for men and women and will reach age 67 by 2028.

By using cashflow modelling, we can also see how your income can adapt in retirement to suit your needs and test the resilience of your financial planning in different investment conditions, such as market volatility or rising inflation. This will help to give you confidence about what level of income you may have in retirement and reassurance that your plans can provide a sustainable income throughout your retirement.

Our advice service will identify actions you need to take to provide the retirement you want and to manage your income in retirement effectively, so that you make the most out of your financial plans.

Please contact your Origen adviser or our Client Services Team on 0344 209 3925 to talk to us about your retirement planning and we will be happy to help you.

Our lines are open 8.30am to 5.30pm, Monday to Friday. Calls are charged at your phone company’s basic rate. All calls are recorded for business purposes.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

CA7421 Exp 01/2023