The latest statistics on ISAs have emerged, showing nearly £270 billion is held in cash.

How are investors using ISAs?

Individual Savings Accounts (ISAs) reached their 20th birthday in April last year. HMRC has now issued ISA statistics up to April 2019 which reveal some surprising facts about ISAs.

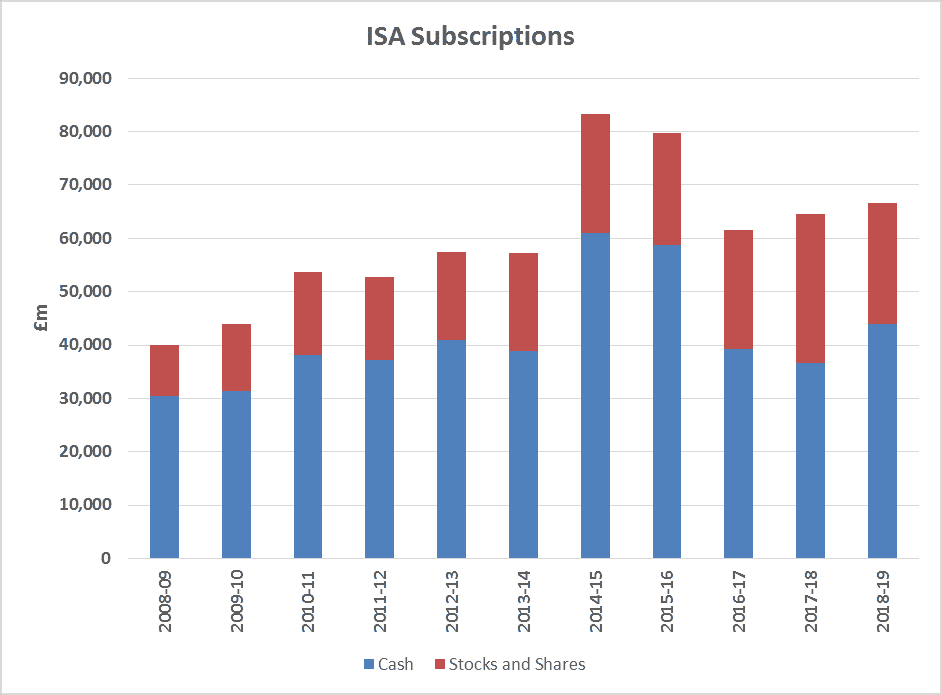

• Overall ISA subscriptions in 2018/19 were almost a fifth lower than in 2014/15.

• Cash ISAs accounted for 46% of all the value held in ISAs as at April 2019, despite the low interest rates on offer.

• In 2018/19, 65% of all new ISA subscriptions were made to cash ISAs.

• In the three years to April 2019, the amount of cash held in ISAs was virtually unchanged, suggesting that subscriptions and interest were just about matched by withdrawals.

• Similarly, in the two years to April 2019, the total value of stocks and shares ISAs was down by 0.3%, also pointing to withdrawals matching investment returns plus fresh subscriptions.

• Lifetime ISAs have not been a great success, accounting for less than 1% of all ISA subscriptions in 2018/19.

Why are people shunning ISAs?

There are two good reasons why ISAs have waned in popularity:

• The personal savings allowance of up to £1,000, introduced in April 2016, combined with low interest rates means that many savers do not need a cash ISA to avoid paying tax on interest.

• The dividend allowance, introduced alongside the personal savings allowance, exempts £2,000 of dividends from tax, so for many investors in share-based funds, an ISA offers no income tax savings.

How can ISAs help my financial planning?

An Individual Savings Account (ISA) is one of the most tax efficient ways to save, as your money is free from Income Tax and Capital Gains Tax. An ISA should be an essential part of your financial arrangements; allowing your savings more potential for tax-free income and growth.

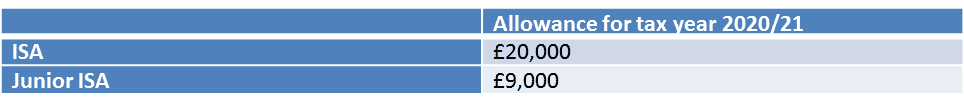

Every UK resident over 18 has an ISA allowance (age 16 for cash ISAs) for each tax year, which can be invested in a stocks and shares ISA, a cash ISA or an Innovative Finance ISA. If your spouse or civil partner dies, you can also inherit an additional permitted subscription to your ISA allowance up to the value they held in their ISA at the date of death, or the closing value for the purpose of the estate, whichever is the greater.

The Lifetime ISA (LISA) offers incentives for saving towards a first home purchase. In December 2019, the Help-to-Buy ISA was withdrawn for new investments. However, if you started a Help-to-Buy ISA before 1 December 2019, you can continue to contribute up to £200 a month and can claim the Help-to-Buy bonus until 1 December 2030.

ISAs still have an important role to play in financial planning, particularly if your investment income already exceeds your available allowances or you regularly use your capital gains tax (CGT) annual exemption (£12,300 in 2020/21).

Saving in a tax free environment can make a significant difference over time. For example, a lump sum £10,000 investment with a 5% return, after 10 years could be worth £16,288, but if basic rate tax reduced the annual return to 4%, the investment value could be almost £1,500 less. These benefits could be increased further if you make additional regular contributions or for higher rate or additional rate taxpayers.

How much can I contribute?

If you have used your own allowance, you may wish to make payments into an ISA for a spouse, civil partner or family member. Using the Junior ISA allowance can be an excellent way to help your children save for their future.

For many investors, the tax advantages of ISAs meant they were often regarded as buy-and-forget investments. If you have ISAs that fall into that category, blow the dust off them and take a look at how they are performing, or ask us to review them. It is also worth checking if you have a maturing Child Trust Fund which were set up by the government for children born between 1 September 2002 and 2 January 2011. James Stabler provided more detail on CTFs earlier this year.

ISAs can be valuable in financial planning helping you and your family towards your investment goals. Our advisers can help you to make the most of the opportunities which ISAs present.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The value of tax reliefs depends on your individual circumstances. Tax laws can change.

CA5710 exp:03/2021