There is no doubt that rising interest rates are having an impact on the UK economy and many peoples’ personal finances. The main question is how great that impact will be over the coming months and years.

In the last 12 months we have seen UK inflation accelerate to a 40-year high, whilst spiraling food costs and energy prices continue to intensify pressure on households. The Bank of England (BoE) has therefore maintained its plan to increase interest rates to cool down the economy and to try to bring inflation back down to its 2% target. If high inflation is allowed to continue, it can cause economic harm and reduce people’s living standards.

Economic impact

Some economists believe that rising interest rates are beneficial for the UK economy, helping to relieve inflationary pressures and create economic growth. However, others argue that higher interest rates lead to a sharp slowdown in economic activity by making borrowing more expensive, which can lead to less spending and investment by businesses and consumers.

The impact on younger adults

Rising interest rates are likely to have a significant impact on borrowing, be it on loans, credit cards or mortgages . It can also make it more difficult for first-time buyers to get on the property ladder. In addition, due to the current cost of living crisis, prices are rising faster than wages, which means that younger people may struggle to make ends meet whilst paying off debts.

If you have children or grandchildren currently applying for further education, they may be in the process of applying for student loans, not to mention overdrafts and credit cards to help fund themselves.

From 1 June 2023 to 31 August 2023 the maximum Plan 2 and Postgraduate interest rate is capped at the forecast prevailing market rate for the 2022/23 academic year. This is 7.3%, in line with the Government announcement dated 13 June 2022.

The mid-life ‘sandwich generation’

The ‘sandwich generation’ are typically middle aged and caught between their responsibilities for bringing up children as well as taking care of their ageing parents. They are also likely to be shouldering large mortgage debt, so higher interest rates mean higher monthly payments on mortgages and other loans. If you currently have a mortgage or other loans on a variable rate, you should consider whether it is appropriate based on your circumstances to move to a fixed rate to guard against further interest rate increases.

How it impacts your retirement income

Rising interest rates have multiple implications for retirement finances too. Rate rises tend to be triggered by rising inflation, which affects those living on a fixed annuity, because the real value of the income is eroded unless there is some inflation protection or escalation within the terms of your annuity contract.

Interest rate rises could, however, be a good thing for retirees with interest bearing savings accounts. You may have more money at this stage in your life, so any increase to your cash savings is a good thing. However, interest rates on cash savings are generally lower than the rate of inflation over the longer term which will mean they still decrease in value in real terms.

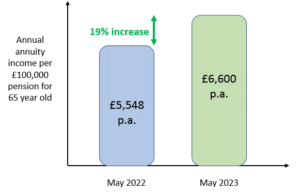

For those who are yet to retire there are a number of retirement income options to choose from depending on your circumstances. Following years of low annuity rates, current market trends are showing rising rates, which for clients wishing to have a regular, guaranteed retirement income is a positive.

For example, in May 2022 a £100,000 pension pot could have bought an annuity income of £5,548 a year. Whereas in May 2023 the same amount could have bought an annuity of £6,600 a year – equivalent to a near 19% increase year on year.

You should speak with your Origen adviser about the best option for you.

How can you achieve your financial goals?

We understand that you and your family will have different financial priorities at different stages in your life. But by regularly reviewing your finances, setting up a budget and making smart choices about spending, you can help to ensure that your retirement income doesn’t suffer, despite the current cost of living pressures and interest rate rises.

If you have questions about how higher interest rates may affect your financial plans, or you would like advice, please speak with your Origen adviser who will help you to keep your financial plans on track for the future.

CA10167 Exp 06/24.