The Chancellor has confirmed that tax rises are extremely likely at the 30 October Budget, which may impact valuable tax allowances. With some of these changes potentially coming into effect immediately, here are the key financial planning actions to consider before any significant announcements.

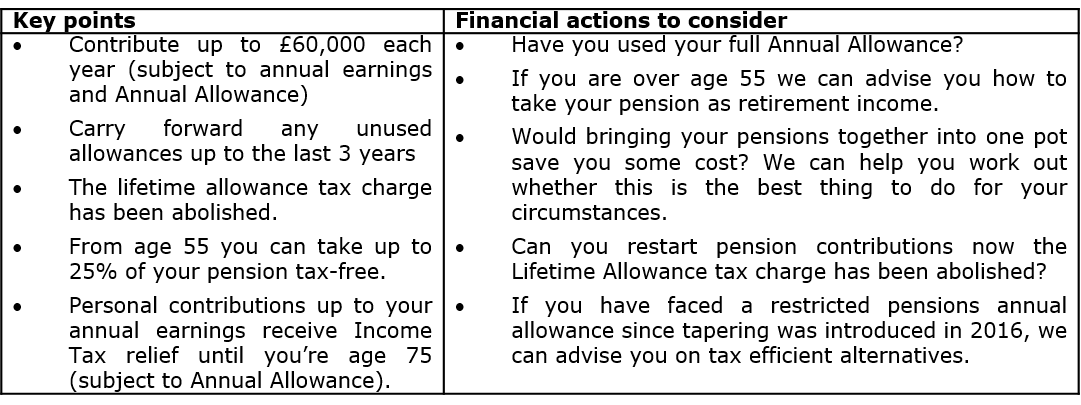

Maximise your pension contributions

Pensions can be complicated and any actions will depend on your personal circumstances and financial goals. It’s important to take expert advice based on your individual situation.

Pensions can be complicated and any actions will depend on your personal circumstances and financial goals. It’s important to take expert advice based on your individual situation.

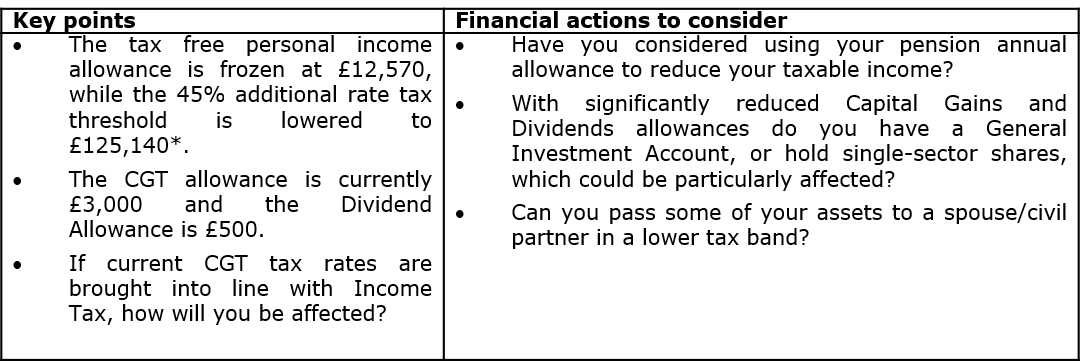

Income, Capital Gains Tax (CGT) and Dividend allowances

*Personal tax bands in Scotland are different. Please see our Guide to Tax Year Planning for details.

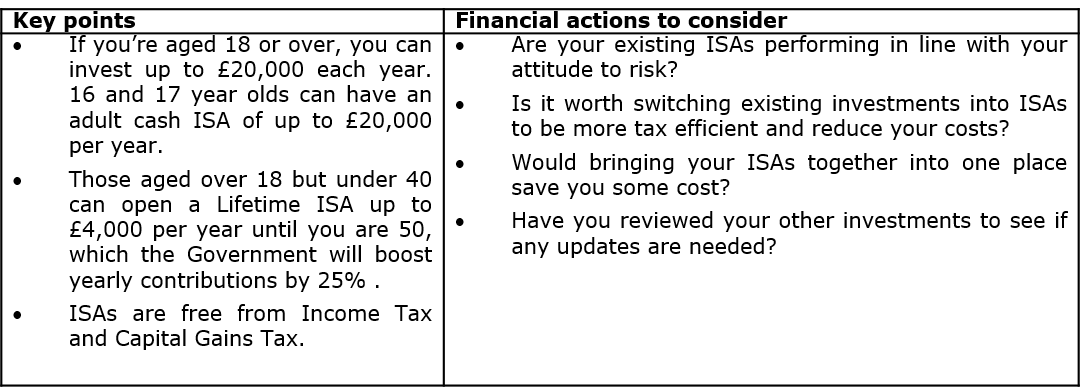

Use your ISA allowances

Making ISA contributions for others

You can also pay into an ISA for a spouse, civil partner or family member. Children under age 18 also have a £9,000 allowance.

You can also pay into an ISA for a spouse, civil partner or family member. Children under age 18 also have a £9,000 allowance.

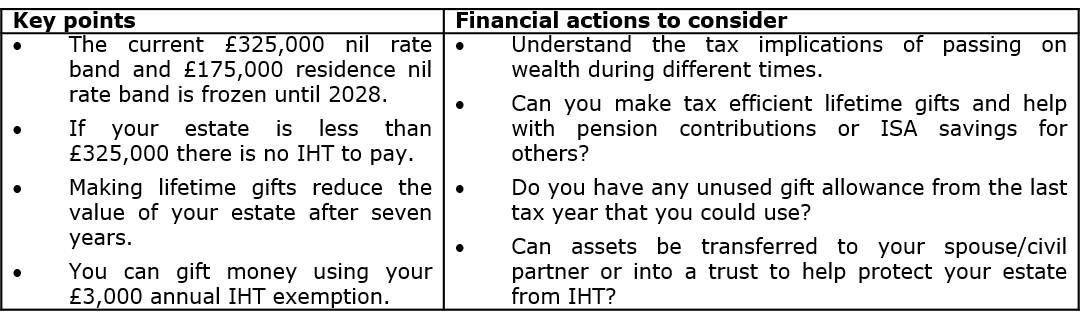

Review your Inheritance Tax (IHT) plans

Don’t miss out on valuable tax allowances

We have a wealth of experience in helping clients and their families to achieve their financial goals. Your Origen adviser can chat through how you can maximise your savings and suggest any actions to put in place before the 30 October Budget announcements.

Alternatively please contact our Client Services team on 0344 209 3925*, or by email at: clientservices@origenfs.co.uk

* Calls are charged at your phone company’s basic rate. All calls are recorded for business purposes.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The value of your investments can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

CA12390 Expiry:09/2025