Prior to Parliament’s summer break, several newspapers reported that Downing Street might be considering getting rid of Inheritance Tax (IHT). The discussion was short-lived as the media debate shifted towards environmental issues surrounding the results of the Uxbridge by-election. However, the topic of IHT may come up again as we move closer to the next general election.

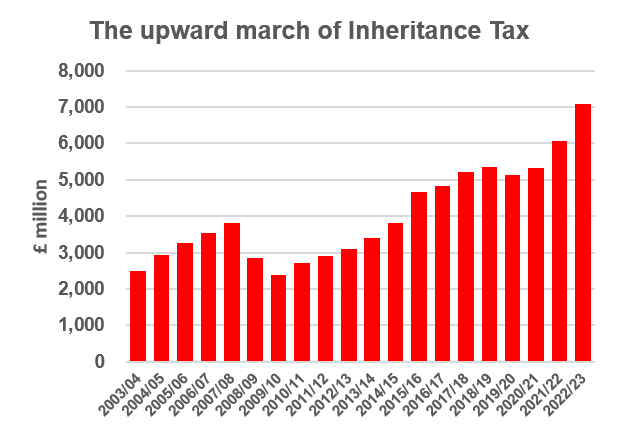

Record IHT receipts

HMRC has recently reported record IHT receipts of £7.1 billion in its annual figures, up nearly £1 billion from the previous year and close to £4 billion from ten years ago. Often branded as Britain’s ‘most hated tax’, many people feel that their assets have, in one way or another, already been subject to all manner of taxations (Income Tax, Stamp Duty, Capital Gains Tax etc) during their lifetime. In addition, as house prices have risen over recent decades (outstripping the nil rate band, unchanged for over ten years), more people have been drawn into the IHT net.

Source: HMRC, supplied by TaxBriefs

Currently, IHT is generally payable at 40% on the value of an estate on death. However, everyone has an IHT-free nil rate band and an additional residence nil rate band provided their qualifying residence is left to a direct descendant. The nil rate band of £325,000 and the residence nil rate band of £175,000 are frozen until 2028.

What if it was abolished?

The Treasury considers IHT to be a highly effective tax, much like its predecessors, however, according to HMRC’s latest statistics for 2020/21, only 27,000 estates paid IHT, with an average tax liability of £214,000.

If IHT was to be abolished, the government would need to find a way to make up for the lost revenue. This could involve increasing the basic rate of Income Tax. Another option could be to raise the standard VAT rate. However, when considering the large number of people who would be impacted by these changes, the decision may not make for popular politics. So, it seems likely that IHT may continue for the foreseeable future.

What can you do to reduce your IHT bill?

There’s plenty you can do to ensure more of your wealth is passed on in the future.

- Transferring assets – can assets be transferred to your spouse/civil partner or into a trust to help protect your estate from IHT?

- Small gifts – you can give away a total of £3,000 worth of gifts each tax year without them being added to the value of your estate (known as your ‘annual exemption’). You can also give as many gifts of up to £250 per person as you want each tax year, as long as you have not used another allowance on the same person.

- Larger gifts – have you considered tax-efficient ‘lifetime gifts’ to help your family members? Larger gifts can be made and will not be part of your estate for IHT as long as you survive for seven years

- Unused allowance – do you have any unused gift allowance from the last tax year that you could use?

- Regular gifts our of surplus income – do you have surplus income that you can make regular gifts from? Gifts made as part of your normal expenditure from income are wholly exempt from IHT.

- Financial planning – have you considered other actions to help reduce your IHT bill? Your Origen adviser can recommend tax-efficient options depending on your circumstances.

Let’s find ways to maximise your tax allowances

We can help you make the most of your tax allowances and check that your financial plans are on track for the future. Your Origen adviser can recommend any actions you need to put in place.

Please contact your Origen adviser, or call our Client Services Team on 0344 209 3925* or email clientservices@origenfs.co.uk to arrange a call at a time to suit you.

* Calls are charged at your phone company’s basic rate. All calls are recorded for business purposes.

CA10528 Exp:10/2024