We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

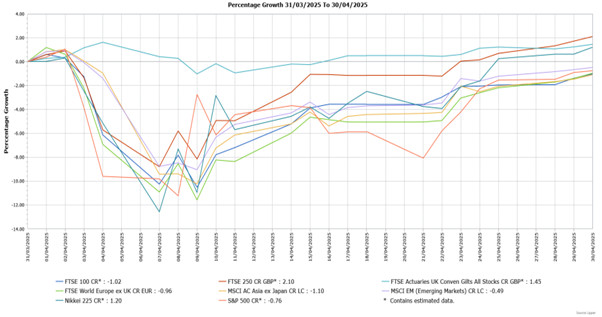

Global markets suffered significant volatility in April following President Trump’s announcement on 2 April, dubbed “Liberation Day”, of sweeping tariffs on imported goods. The tariffs were larger and broader than expected, causing sharp falls in markets. However, the new tariffs were suspended later in the month for 90 days for most countries whilst negotiations took place, contributing to a rebound in global markets. Most equity markets still finished the month slightly lower, but fixed income ended higher.

Economic Overview

UK

- Economic Growth: In February, the UK economy experienced stronger-than-expected growth, increasing by 0.5%, which was the highest monthly performance in 11 months. January’s 0.1% contraction was revised to zero growth. The service sector grew by 0.3%, industrial production jumped by 1.5%, driven by a 2.2% rise in manufacturing, and construction rose by 0.4%. The economy grew by 0.6% in the three months to February.

- Unemployment & Labour Market Statistics: The unemployment rate remained unchanged at 4.4%, but the ONS continued to highlight the increased volatility of the Labour Force Survey data due to smaller sample sizes and that it may not be an accurate measure. Job vacancies fell below pre-pandemic levels to 781,000 in the three months to February. Annual growth in regular pay rose by 5.9%, slightly above the previous period’s 5.8%. When adjusted for CPI inflation, annual regular pay growth was 3%. Private sector wages excluding bonuses, a measure closely watched by the Bank of England, rose by 5.9%, unchanged from the previous period. Both wage growth measures were slightly lower than expected.

- Inflation: The annual Consumer Price Index (CPI) fell from 2.8% in February to 2.6% in March, slightly below the forecasted decline to 2.7%. A fall in recreation and culture prices, notably in toys, games, and hobbies, as well as declining fuel prices, helped lower inflation. However, clothing prices rose strongly in March. Core inflation, which excludes food, energy, alcohol, and tobacco prices, fell slightly from 3.5% to 3.4%. Services inflation, a key measure of domestically-generated inflation, fell from 5% to 4.7%, a slightly bigger fall than the forecasted decline to 4.8%.

US

- Economic Growth: Advance data showed that the US economy contracted by an annualized 0.3% in the first quarter, well below the forecasted 0.3% expansion (although these projections were prior to the announcement of the surge in the goods trade deficit). This was the first contraction in three years and followed much stronger growth of 2.4% in the fourth quarter of the previous year. The decline was driven by a 41.3% surge in imports, with businesses and consumers stockpiling goods in anticipation of higher costs due to US tariffs. Despite seeing a slowdown compared with the previous quarter, consumer spending still rose by a healthy 1.8%, whilst business investment in equipment increased. Inventories added 2.25% to growth having produced a negative impact in the previous two quarters, with some of the imports ending up in warehouses. Federal government spending fell by 5.1%, the largest drop since the first quarter of 2022.

- Inflation: US consumer prices unexpectedly fell in March, with the Consumer Price Index (CPI) falling by 0.1%, the first monthly decline in nearly five years. Gasoline prices fell sharply by 6.3%, while food prices rose by 0.4%. For the 12 months through March, CPI rose 2.4%, well below the 2.8% increase in February. The core CPI, which excludes volatile food and energy components, rose by 0.1%, the smallest increase since June 2024. For the 12 months through March, core CPI rose by 2.8%, the smallest increase since March 2021.

Europe

- European Central Bank and Interest Rates: The European Central Bank (ECB) reduced its interest rate by 0.25% to 2.25%, the lowest level since late 2022. The ECB warned that economic growth would be significantly impacted by US tariffs. ECB President Christine Lagarde stated that downside risks to economic growth had increased due to global trade tensions, but no hints were given about future decisions, noting that policymakers would decide meeting-by-meeting.

- Economic Growth: Flash data showed that the Eurozone economy grew by 0.4% in the first quarter, ahead of the forecasted 0.2%. Spain grew at a robust pace, while Germany, France, and Italy experienced modest growth. On a year-on-year basis, the Eurozone economy grew by 1.2%, in line with the previous quarter.

- Inflation: Eurozone inflation slowed in March, falling from 2.3% in February to 2.2%. Energy costs fell, but inflation for non-energy industrial goods remained unchanged. Unprocessed food prices jumped higher to 4.1% from 3%. Annual core inflation, which excludes prices for energy, food, alcohol, and tobacco, fell from 2.6% to 2.4%, the lowest level since October 2021. Services inflation fell from 3.7% to 3.5%.

Asia and Emerging Markets

- China: China’s economy grew by 5.4% year-on-year in the first quarter, matching the pace of the previous period and beating the forecasted 5.1% . Economic growth was boosted by solid consumption and industrial output, supported by ongoing government stimulus. On a quarter-on-quarter basis, the economy expanded by 1.2%, slowing from the 1.6% pace in the previous period.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

- UK Equities: In April, UK equities were mixed, with the FTSE 100 suffering a loss due to the underperformance of the large energy sector and volatile market conditions following the announcement of US tariffs. However, the more domestically-focused mid-cap FTSE 250 outperformed, recording a gain as it was less impacted by tariff-related volatility.

- US Equities: The S&P 500 experienced significant volatility in April, including suffering its worst daily decline since 2020 at the beginning of the month, and although it did rebound the index still finished lower. The announcement of larger and broader-than-expected tariffs on 2 April weighed heavily on sentiment, though their later suspension helped shares recover.

- European Equities: European markets, as demonstrated by the FTSE World Europe ex UK Index, ended with a loss amid volatile conditions. However, there were regional differences, with Germany posting a gain, supported by expectations of higher fiscal spending.

- Japanese Equities: The Japanese Nikkei 225 Index outperformed many other developed markets, with sentiment helped by Japan securing priority tariff negotiations with the US, although no deal was concluded during the month. In addition, yen weakness supported export-orientated stocks.

- Asian Equities: Asian markets finished April lower, as shown by the loss in the MSCI Asia ex Japan Index. Trade tensions with the US contributed to China’s underperformance, although there were regional differences with other markets posting gains.

- Emerging Markets Equities: The MSCI Emerging Markets Index fell to a small loss, with China being one of the worst performers. However, Mexico performed well amid no new tariffs being announced, and Brazil benefited from local currency strength. Some countries also benefited from the weaker US dollar.

- UK Fixed Income Assets: UK fixed income assets rose in April, with government bonds outperforming amid expectations of an interest rate cut in May. Corporate bonds also finished higher but lagged behind the return from gilts. There was also divergence in government bond performance, with the US in particular seeing long duration bonds underperform due to concerns over the economic outlook and the independence of the Federal Reserve.

Origen Private Client Solutions is a trading name used by Origen Financial Services Limited which is authorised and regulated by the Financial Conduct Authority. Our FCA registration Number is 192666. Our Registered office is: Ascent 4, Gladiator Way, Farnborough, Hampshire GU14 6XN and registration number is: 03926629.

CA12901 Exp 05/2026