For financial professionals only and not to be relied on by individual private customers.

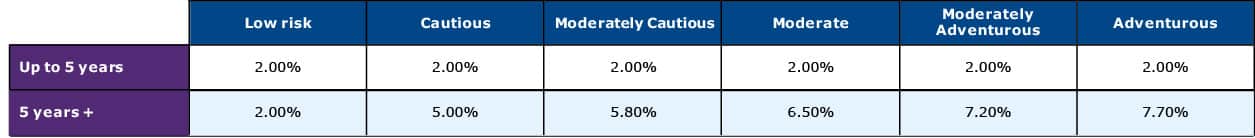

Origen has adopted Morningstar’s approach to annual investment returns as part of assessing a member’s attitude to investment risk when conducting PLM exercises. The figures below are based on Morningstar’s estimated returns for various asset classes, which they have calculated based on their 30+ years of investment and asset allocation experience. Although these are long-term assumptions, any significant falls or low levels of growth in the early years will have a significant impact on returns over the medium to longer term as they will have to make up for the shortfall in the earlier years.

For investment terms of five years or less, we believe there is insufficient time in the market to ride out volatility, so we base our returns on the pension fund being held in cash. We monitor these rates on a monthly basis and adjust our outlook based on any changes in the rates. They were last updated in September 2023. The next update is expected to be in Summer 2024.

Annual investment returns are gross of any initial and ongoing product, investment charges and adviser fees. All investment returns are assumptions and not guaranteed, the value of your investment can go down as well as up.

In practice, the advice provided to members will vary considerably depending on their personal circumstances and objectives. Members with longer to retirement can afford to take a greater level of risk.

CA10571 Exp:10/2024