It is fair to say that the gilt market has been more volatile than usual over the course of 2022. At the start of January this year the average yield on a UK 15 year gilt was 1.144%. This now sits at 3.465% (early December) having peaked at over 5% in the turmoil following the mini-Budget in October.

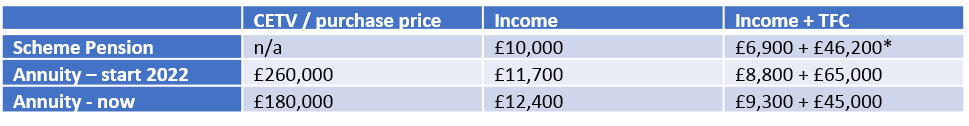

This increase in gilt yields has materially affected the transfer values on offer to those with defined benefit pensions. At the start of the year, according to XPS Transfer Value Tracker, a 64-year-old male with a pension of £10,000 a year could expect an average transfer value of around £260,000. At the end of October, this value had fallen to around £180,000 – a reduction of 30%.

However, this sharp rise in gilt yields has led to a similarly sharp rise in annuity rates. At the start of the year, a healthy 65-year-old would get a single life level annuity rate of around 4.50%, meaning a £100,000 pot would secure an annuity of £4,500 per year. The current rate has jumped by over 50% to 6.90% over the course of the year. Please see the example in the table below:

*This assumes a cash commutation factor of 15:1

Origen view

Based on these rates, those clients who transfer now and secure a single life level annuity are potentially seeing a significant increase in income, and this is before any medical underwriting takes place. Of course, this is comparing a scheme pension with inflation linking to a level annuity – over time the scheme pension will do a better job of maintaining its purchasing power.

We generally see clients purchasing an annuity as the defined benefits don’t really suit their needs; they may be single and not require a spouse’s pension, or perhaps in poor health but looking for a guaranteed income.

For those in ill health annuity rates can be significantly higher and you can also ensure any unused pension fund is passed to the client’s next of kin. For many clients, this is a conversation they really must have before deciding to take a scheme pension.

CA8732 Exp:12/2023