When we look at people who retire early, the natural instinct is envy and admiration. How did they do it? When can I retire too?

However, it may not all be as it seems. A recent survey carried out by financial services company, Just Group, of 1,000 retired and semi-retired people over age 55, nearly half of them had retired earlier than expected.

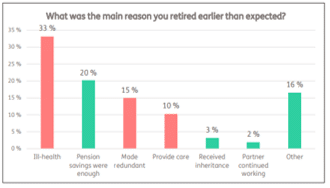

A further look into the reasons behind this showed that 58% of early retirees did so due to being forced out of work unexpectedly. The most common reason was ill health (33%) followed by redundancy (15%) and providing care (10%).

Another key finding was that only 20% of those retiring early did so because they had enough pension savings to live on. This highlights the importance of creating a financial plan as soon as possible to make sure that you are prepared for the transition into retirement, should this be expected, or in many cases, unexpected.

Origen’s View

Retiring early can have a big effect on your retirement – even retiring a year or two earlier than planned can have a impact later on in life if you start using your pension savings too early. It means stopping your contributions earlier than planned, which could also mean stopping employer contributions; it also means less potential growth from your pension investments. However most impactful is that you may need to start drawing from your pension pots or other savings to ensure you have an income prior to the State Pension kicking in. Here’s some things you can do to ensure you’re prepared for your retirement.

- Current Position: Your financial adviser can help you build a plan to understand your current financial position, income, expenses, savings, and investments and provides a starting point when considering retiring early.

- Your desired Retirement Income: We can help you gather information about your various income sources such as workplace pensions, State Pension, private pensions, and other investments. This will help you understand what contributions you need to make and other investments that are in place to support an early retirement. It also allows you to consider potential adjustments in lifestyle and spending habits that may be required.

- Tax Efficiency: Using tax-efficient savings and investment options, such as ISAs and pensions, can significantly impact the overall retirement savings and income, enabling you to have a more tax-efficient retirement lifestyle.

- Investment Strategy: an Origen’s adviser can help you to build an investment strategy that is designed to support an early retirement plan. Regularly reviewing and rebalancing your investment portfolio to align with retirement goals is crucial for long-term financial success.

- Healthcare costs: The biggest reason for early retirement is ill health. Long term health costs require extremely careful consideration, as you may need to budget for potential medical expenses or long-term care during your retirement.

Your Origen adviser can help you to address these point, enabling you to work towards a successful and fulfilling retirement.

CA10757 Exp 12/24.