We generally recommend that you hold investments for the medium to long-term, which we would view as being for five years or more. The monthly market commentary provides an insight into the current factors that are affecting short-term global returns, but should not be viewed as a basis for making long-term investment decisions. You should consider your own investment goals and timeframes before making any such investment decisions. If you do have any concerns about where your money is invested, please contact your Origen adviser.

Introduction

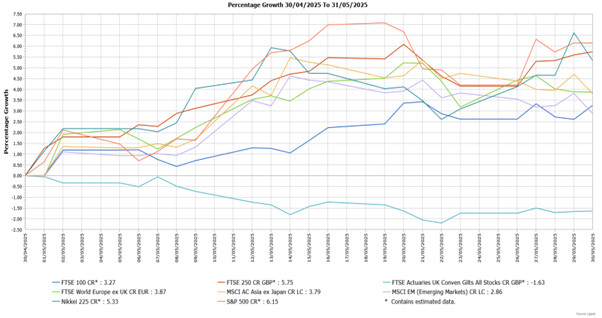

Global equity markets performed well in May, with investor sentiment supported by an easing in US-China tensions amid agreement over a 90-day pause on reciprocal tariffs, whilst there was a further boost came from positive economic data. Both developed and emerging markets posted gains, with the US market in particular rebounding from April’s losses. However, fixed income markets fell, driven by concerns over fiscal stability.

Economic Overview

UK

Bank of England & Interest Rates

The Bank of England (BoE) reduced its interest rate by 0.25% to 4.25%. The vote was split: five members supported the cut, two preferred a 0.5% reduction, and two wanted rates unchanged. BoE Governor Andrew Bailey noted the uncertain global economic outlook requires a cautious approach to future decisions, but he was “still of the view that the path, gradually and carefully, is downwards”.

BoE now projects inflation to peak at 3.5% in 2025 instead of 3.75%, returning to its 2% target by early 2027, nine months earlier than previously thought. Economic growth is expected to be 1% in 2025, revising up from 0.75%, but 2026 growth has been revised down to 1.25% from 1.5%.

Economic Growth

Preliminary data indicated the UK economy grew by 0.7% in Q1, exceeding forecasts of 0.6%. The dominant service sector and industrial production rose, while construction output was flat. Gross fixed capital formation increased, whilst there was also a positive contribution from net trade. Year-on-year growth was 1.3%, slightly below the previous quarter but above expectations.

For the month of March, the economy grew by 0.2%, ahead of the forecasted flat reading. Growth was driven by the service and construction sectors, but industrial production fell by 0.7%.

Unemployment & Labour Market Statistics

Labour market data showed a softening trend, amid higher employer NI contributions and the increased National Living Wage. The unemployment rate rose from 4.4% to 4.5%, its highest since mid-2021, but the Office for National Statistics (ONS) cautioned that these figures should be treated with caution. Job vacancies fell by 42,000 to 761,000 over the three months to April, marking the steepest decline in over a year, while payroll numbers also decreased.

Annual growth in regular pay rose by 5.6% in the three months to March, the slowest since late 2024 and below the forecasted 5.7%. Adjusted for CPI inflation, annual regular pay growth reached 2.6%. Private sector wages excluding bonuses, a measure closely watched by the Bank of England, increased by 5.6%, down from 5.9%. Total employee pay growth, which includes bonuses and can be volatile, was 5.5%, with a real-term rise of 2.6%.

Inflation

UK inflation, as measured by the Consumer Price Index (CPI), rose from 2.6% in March to 3.5% in April, surpassing forecasts of 3.3% and the Bank of England’s projection of 3.4%. This marks the largest month-on-month increase since 2022 and the highest reading since January 2024. The rise was primarily due to higher household bills and air fares, with Easter timing playing a role. Clothing and footwear prices declined.

Core inflation increased from 3.4% to 3.8%, exceeding forecasts of 3.6%. Services inflation surged from 4.7% to 5.4%, higher than the forecasted 4.8% and BoE’s 5%. Goods inflation also saw a notable rise.

US

Federal Reserve & Interest Rates

The Federal Reserve kept interest rates steady in the 4.25%-4.50% range and acknowledged growing uncertainty in the economic outlook as US tariff policy continues to evolve. Chair Jerome Powell emphasised the challenges in predicting inflation and unemployment trends, noting that the Fed is adopting a wait-and-see approach and remains ready to respond as conditions evolve.

Economic Growth

The revised estimate showed the US economy contracted by 0.2% in Q1, slightly better than the initial 0.3% decline, though still marking the first contraction in three years. Stronger fixed investment partially offset weaker consumer spending and a larger trade drag. Imports surged by 42.6%, up from 41.3%, as stockpiling occurred before tariffs. Consumer spending dropped to 1.2%, the weakest since Q2 2023. Government spending fell by 4.6%, better than previously estimated but still the sharpest drop since Q1 2022. Fixed investment grew by 7.8%, the highest since mid-2023, while exports rose by 2.4%.

Inflation

In April, US consumer prices rose 0.2%, driven by higher rents despite falling food costs, the Labor Department reported. This increase was slightly below the forecast of 0.3%. Shelter costs grew by 0.3% and contributed to over half of the CPI rise. Food prices dropped 0.1%, contrasting with a 0.4% increase in March. Non-alcoholic beverage prices rose 0.7%, while gasoline costs fell 0.1%. Over the year ending in April, CPI increased 2.3%, the smallest gain since February 2021.

Excluding food and energy, the so-called core CPI rose 0.2%, mainly due to higher shelter costs. Owner’s equivalent rent increased, offsetting a slight decline in hotel and motel room costs. Core goods prices edged up 0.1%, reversing a previous drop. Despite another fall in airline fares, other service prices saw gains. Over the year, core CPI matched the previous period’s 2.8% increase.

Europe

Economic Growth

Eurostat’s revised estimate indicates that the Eurozone economy grew by 0.3% in Q1, slightly below the initial 0.4%. This marks the fifth consecutive quarter of growth, driven by stronger domestic demand, easing inflation, lower borrowing costs, and the relaxing of some fiscal constraints in Germany. Ireland’s growth was boosted by foreign companies’ tax-related activities. Germany grew by 0.2%, Spain by 0.6%, Italy by 0.3%, and France by 0.1%. Year-on-year growth was 1.2%, consistent with earlier estimates.

Inflation

Eurozone inflation remained at 2.2% in April, slightly above the 2.1% forecast. Energy prices fell, but services, food, alcohol, and tobacco inflation rose at a stronger pace. Non-energy goods prices increased by 0.6%, matching the prior month. Core inflation, excluding energy, food, alcohol, and tobacco, rose from 2.4% to 2.7%, surpassing the expected 2.5% amid higher services inflation.

Asia and Emerging Markets

Japan

The Bank of Japan (BOJ) voted unanimously to maintain its interest rate at 0.5%. BOJ Governor Kazuo Ueda noted that hitting the target for 2% inflation has been delayed due to uncertain trade impacts. The BOJ expects future rate hike conditions to eventually be met, with a positive cycle of rising wages and inflation continuing amid a labour shortage. Inflation is now projected to reach 2% by the latter half of fiscal year 2026, around a year later than previously expected. Economic growth forecast for fiscal year ending March 2026 was reduced from 1.1% to 0.5% due to tariff developments.

Preliminary data showed Japan’s economy contracted by 0.2% in Q1, underperforming the forecasted 0.1% decrease. Capital expenditure grew by 1.4%, but private consumption, which accounts for over half of Japan’s economic output, remained flat. Net trade contributed a 0.8% reduction in GDP amid falling exports and rising imports. Year-on-year, the economy shrank by 0.7%, missing the forecasted 0.2% decline and well below the upwardly revised 2.4% expansion in the previous period.

Market Overview

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK equities rose in May, with the mid cap FTSE 250 recording a particularly strong gain as it outperformed the FTSE 100. Positive economic data boosted the more domestically focused FTSE 250, whilst the announcement of a number of trade deals, including with the US covering certain goods, supported broader investor sentiment.

US equities, represented by the S&P 500, saw their largest monthly gain in 18 months in May due to easing trade tensions with China and strong corporate earnings. European markets, shown by the FTSE World Europe ex UK Index, also rose despite US tariff volatility, helped by reduced global recession fears. The Japanese Nikkei 225 Index increased too, benefiting from trade tension relief, strong large-cap stocks, and a weaker yen.

Asian markets ended May higher, as shown by the gain in the MSCI Asia ex Japan Index. Investor sentiment was again boosted by easing trade tensions with gains across most of the region, whilst further Chinese stimulus was also supportive. The broad MSCI Emerging Markets Index also rose amid the de-escalation in trade tensions, although it lagged the gains in developed markets. Emerging Asia led the gains, whilst Latin American markets also rose as did Eastern European equities.

UK fixed income assets fell in May, with government bonds (FTSE Actuaries UK Conventional Gilts Index) suffering a bigger loss than corporate bonds. Government bonds were under pressure from concerns over fiscal sustainability, notably in the US following the House of Representatives’ approval of the Reconciliation Bill that is expected to worsen the US debt position, although it does still need to be passed by the Senate. UK gilts were similarly affected by concerns about the country’s fiscal outlook.

This update is intended to be for information only and should not be taken as financial advice.

CA12979 Exp:06/2026