Introduction

The opening three months of 2025 saw mixed performance from global equity markets, with the notable change from the previous year being the underperformance of US equities. The start of the year had seen investors expecting US equities to continue to outperform due to the new Republican administration enhancing the recent period of US economic exceptionalism. However, uncertainty over US trade policy weighed on sentiment, particularly as concerns grew over the severity of pending tariff announcements on 2 April. President Trump also announced separately tariffs on certain countries, notably Mexico and Canada, as well as on some goods such as cars, steel and aluminium.

Away from concerns over tariffs, the Federal Reserve left its interest rate unchanged at 4.25-4.50% during the first quarter, but the Bank of England reduced its interest rate by 0.25% to 4.5%, whilst the European Central Bank cut twice, each for 0.25%. The end of the period saw the Spring Statement announced in the UK, where spending cuts were announced but concerns persisted over the strength of the UK economy despite the Office of Budget Responsibility stating the fiscal outlook remained stabled, although it did highlight risks from the trade tariffs. In Europe, the German elections took place with the new Chancellor Friedrich Merz pushing through plans to loosen the strict borrowing limits to enable increased spending on defence and infrastructure ahead of forming a new government in April.

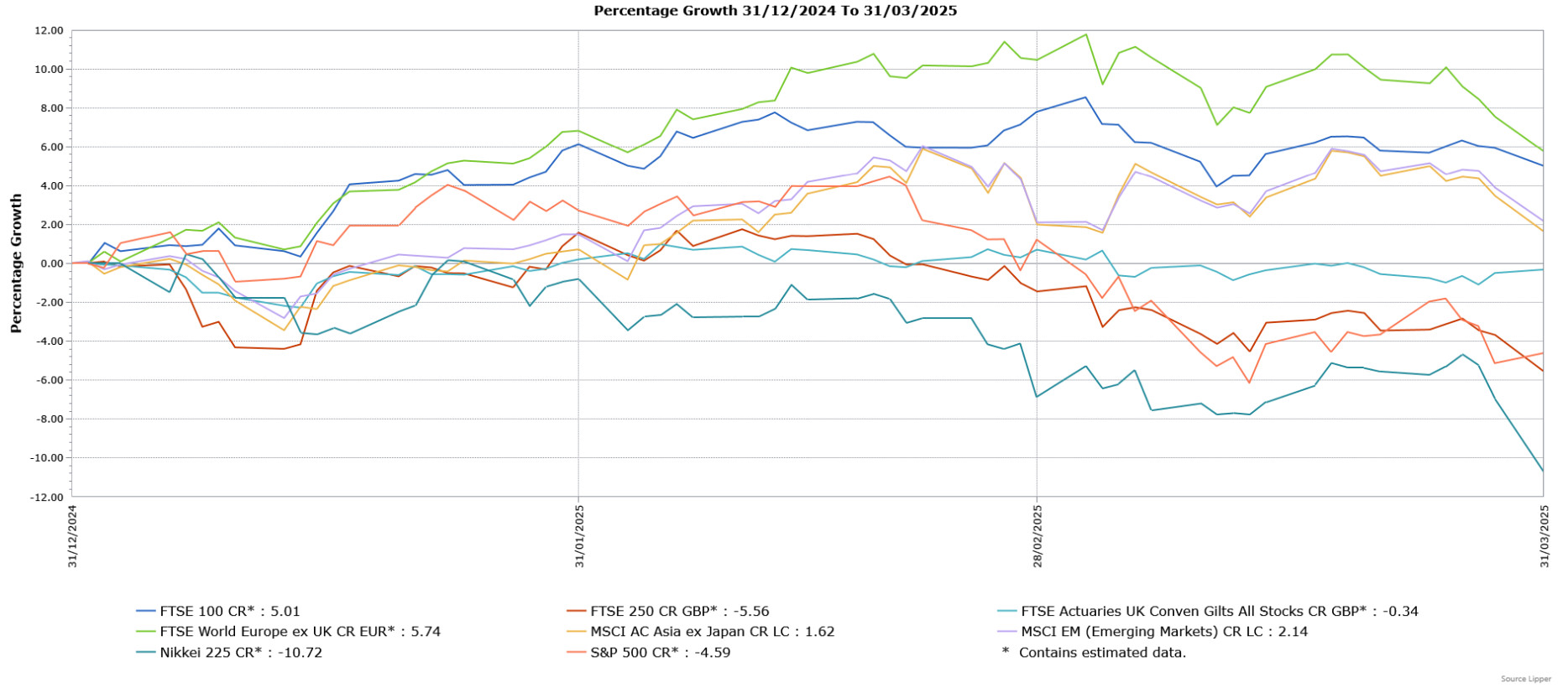

Market Performance

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK Equities

There was mixed performance from UK equity indices in the first quarter, with the FTSE 100 producing a strong gain, but the more domestically focussed mid-cap FTSE 250 (the 250 largest companies outside of the FTSE 100) suffered a loss. The FTSE 100 benefited from the rotation away from US equities, with notable gains in the financials, energy and healthcare sectors. However, the FTSE 250 suffered from the ongoing concerns over the UK economic outlook, with a number of consumer-facing sectors such as house builders and retailers finishing the period with losses.

Global Equities

The US S&P 500 (which measures 500 of the largest US companies) fell in the first quarter, with the losses driven by the previously strong performing “Magnificent Seven” group of mega cap stocks expected to benefit from US leadership in AI. The falls were partly driven by the news that Chinese AI company DeepSeek had developed a model comparable to the market leaders but at a much lower cost, whilst the concerns over trade tariffs also weighed on sentiment. However, European markets, as demonstrated by the FTSE World Europe ex UK Index (which measures large and mid cap stocks across Europe), posted strong gains as they were the key beneficiary of the rotation out of US large caps, whilst also benefiting from optimism over pro-growth policies from the new German administration. The Japanese Nikkei 225 Index (a measure of Japan’s top 225 companies) suffered a sharp loss due to underperformance in large cap companies, driven by uncertainty over US trade policies and the risk of a US recession.

Asia and Global Emerging Markets Equities

Despite the uncertainty over US trade policies, the broad MSCI Asia ex Japan Index (which captures the performance of over 1,000 companies across Asia), rose in the first quarter, supported by positive returns in China, Singapore and South Korea. The Chinese market was supported by government stimulus measures, as well as optimism over the the country’s AI capabilities. Global Emerging Markets, as demonstrated by the broad MSCI Emerging Markets Index (which covers over 1,200 stocks from across 24 emerging markets countries), also produced a positive return as it was similarly supported by gains in China. In addition, Brazil performed well as did emerging European markets, which were boosted by the improved outlook for the Eurozone.

Fixed Income

UK gilts fell to a small loss in the first quarter, as shown by the performance of the FTSE Actuaries UK Conventional Gilts Index. The weak UK economic outlook and inflation concerns, as well as the vulnerable fiscal position, were the main drivers of performance. In the US, there was outperformance from Treasuries in response to weaker economic data, but there was a sell-off in the Eurozone that was led by German Bunds following the announcement of increased spending in Germany.

AFP126 Exp:04/2026

Home > Market Commentary – Quarter 1, 2025

Market Commentary – Quarter 1, 2025

Introduction

The opening three months of 2025 saw mixed performance from global equity markets, with the notable change from the previous year being the underperformance of US equities. The start of the year had seen investors expecting US equities to continue to outperform due to the new Republican administration enhancing the recent period of US economic exceptionalism. However, uncertainty over US trade policy weighed on sentiment, particularly as concerns grew over the severity of pending tariff announcements on 2 April. President Trump also announced separately tariffs on certain countries, notably Mexico and Canada, as well as on some goods such as cars, steel and aluminium.

Away from concerns over tariffs, the Federal Reserve left its interest rate unchanged at 4.25-4.50% during the first quarter, but the Bank of England reduced its interest rate by 0.25% to 4.5%, whilst the European Central Bank cut twice, each for 0.25%. The end of the period saw the Spring Statement announced in the UK, where spending cuts were announced but concerns persisted over the strength of the UK economy despite the Office of Budget Responsibility stating the fiscal outlook remained stabled, although it did highlight risks from the trade tariffs. In Europe, the German elections took place with the new Chancellor Friedrich Merz pushing through plans to loosen the strict borrowing limits to enable increased spending on defence and infrastructure ahead of forming a new government in April.

Market Performance

CR = Capital return; LC = Local currency

Source: Lipper for Investment Management

Past performance is not a reliable indicator of future performance

UK Equities

There was mixed performance from UK equity indices in the first quarter, with the FTSE 100 producing a strong gain, but the more domestically focussed mid-cap FTSE 250 (the 250 largest companies outside of the FTSE 100) suffered a loss. The FTSE 100 benefited from the rotation away from US equities, with notable gains in the financials, energy and healthcare sectors. However, the FTSE 250 suffered from the ongoing concerns over the UK economic outlook, with a number of consumer-facing sectors such as house builders and retailers finishing the period with losses.

Global Equities

The US S&P 500 (which measures 500 of the largest US companies) fell in the first quarter, with the losses driven by the previously strong performing “Magnificent Seven” group of mega cap stocks expected to benefit from US leadership in AI. The falls were partly driven by the news that Chinese AI company DeepSeek had developed a model comparable to the market leaders but at a much lower cost, whilst the concerns over trade tariffs also weighed on sentiment. However, European markets, as demonstrated by the FTSE World Europe ex UK Index (which measures large and mid cap stocks across Europe), posted strong gains as they were the key beneficiary of the rotation out of US large caps, whilst also benefiting from optimism over pro-growth policies from the new German administration. The Japanese Nikkei 225 Index (a measure of Japan’s top 225 companies) suffered a sharp loss due to underperformance in large cap companies, driven by uncertainty over US trade policies and the risk of a US recession.

Asia and Global Emerging Markets Equities

Despite the uncertainty over US trade policies, the broad MSCI Asia ex Japan Index (which captures the performance of over 1,000 companies across Asia), rose in the first quarter, supported by positive returns in China, Singapore and South Korea. The Chinese market was supported by government stimulus measures, as well as optimism over the the country’s AI capabilities. Global Emerging Markets, as demonstrated by the broad MSCI Emerging Markets Index (which covers over 1,200 stocks from across 24 emerging markets countries), also produced a positive return as it was similarly supported by gains in China. In addition, Brazil performed well as did emerging European markets, which were boosted by the improved outlook for the Eurozone.

Fixed Income

UK gilts fell to a small loss in the first quarter, as shown by the performance of the FTSE Actuaries UK Conventional Gilts Index. The weak UK economic outlook and inflation concerns, as well as the vulnerable fiscal position, were the main drivers of performance. In the US, there was outperformance from Treasuries in response to weaker economic data, but there was a sell-off in the Eurozone that was led by German Bunds following the announcement of increased spending in Germany.

AFP126 Exp:04/2026

Related News & Insights

Planning for a secure retirement: Insights and Tips

Make the most of your new tax year allowances

Market volatility – how long-term financial planning helps

Market Commentary – Quarter 4, 2024

Is cash really still king?

Ways to maximise your ISA savings before tax year end

Market Commentary – Quarter 3, 2024

October Budget – reduce the impact of any tax increase